Category Archive: 5) Global Macro

Tara Westover: Mormons, Harry Potter and the future of education | The Economist Podcast

Tara Westover grew up in a strict Mormon family—she was 17 when she first stepped into a classroom. Now she is a best-selling author. She spoke to Anne McElvoy about her life and the future of education for “The Economist asks” podcast. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching …

Read More »

Read More »

No Such Thing As An 80 percent Boom

Many attribute the saying “a rising tide lifts all boats” to President John Kennedy. He may have been the man who brought it into the mainstream but as his former speechwriter Ted Sorenson long ago admitted it didn’t originate from his or the President’s imagination. Instead, according to Sorenson, it was a phrase borrowed from the New England Chamber of Commerce or some such.

Read More »

Read More »

Saudi Arabia’s crown prince: who is Muhammad bin Salman? | The Economist

Muhammad bin Salman has come under international scrutiny following the brutal murder of Jamal Khashoggi, a prominent Saudi journalist. Here’s what you need to know about Saudi Arabia’s crown prince. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy He is one of the most powerful people in the middle east. Just 33 years …

Read More »

Read More »

China: facial recognition and state control | The Economist

China is the world leader in facial recognition technology. Discover how the country is using it to develop a vast hyper-surveillance system able to monitor and target its ethnic minorities, including the Muslim Uighur population. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Improving lives, increasing connectivity across the world, that’s the great …

Read More »

Read More »

Monthly Macro Monitor – October 2018

Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly.

Read More »

Read More »

#MeToo: is it destined to fail? | The Economist

When Tarana Burke founded MeToo she had no idea it would become a global movement. A year after it swept around the globe, she considers why it’s at a critical moment. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films …

Read More »

Read More »

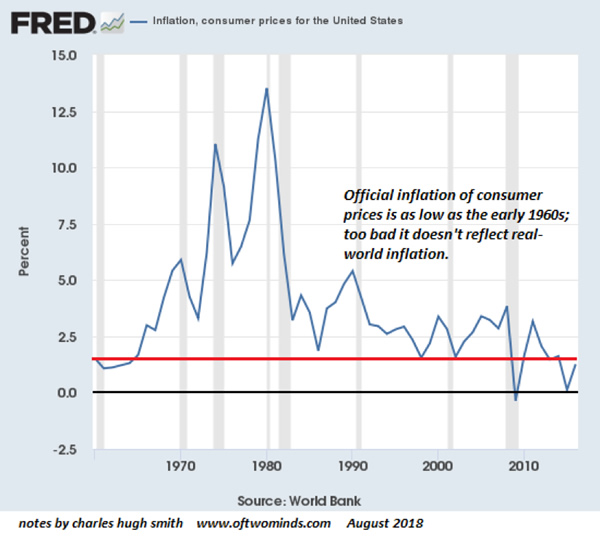

The Coming Inflation Threat

Falling asset inflation plus rising cost inflation equals stagflation. Inflation is a funny thing: we feel it virtually every day, but we’re told it doesn’t exist—the official inflation rate is around 2.5% over the past few years, a little higher when energy prices are going up and a little lower when energy prices are going down.

Read More »

Read More »

Mutiny, Class, Authority and Respect

Humiliation and fear of a catastrophic decline in status foment mutiny and rebellion. I recently finished The Bounty: The True Story of the Mutiny on the Bounty, a painstakingly researched history of the mutiny, but with a focus on how the story was shaped by influential families after the fact to save the life of one mutineer, Peter Haywood, and salvage the reputation of the leader, Fletcher Christian, via a carefully orchestrated character...

Read More »

Read More »

Charles Hugh Smith – Independence Questioned

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

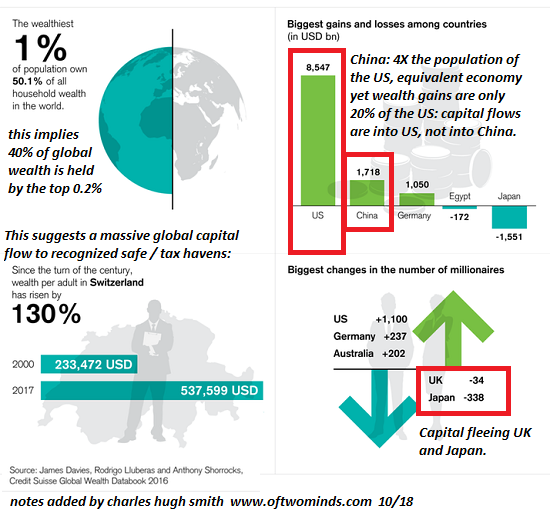

Is the Greatest Bull Market Ever Finally Ending? (Hint: Follow the Money)

The key here is the gains generated by owning US-denominated assets as the USD appreciates. Is the Greatest Bull Market Ever finally ending? One straightforward approach to is to follow the money, i.e. global capital flows: assets that attract positive global capital flows will continue rising if demand for the assets exceeds supply, and assets that are being liquidated as capital flees the asset class (i.e. negative capital flows) will decline in...

Read More »

Read More »

How to prepare for the next global recession | The Economist

A decade after the global recession, the world’s economy is vulnerable again. Ryan Avent, our economics columnist, considers how the next recession might happen—and what governments can do about it Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: …

Read More »

Read More »

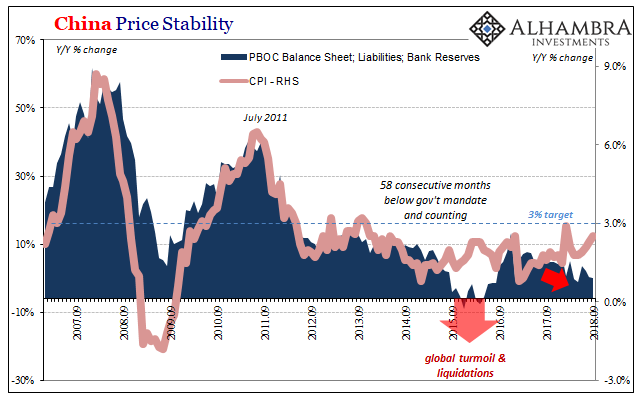

Raining On Chinese Prices

It was for a time a somewhat curious dilemma. When it rains it pours, they always say, and for China toward the end of 2015 it was a real cloudburst. The Chinese economy was slowing, dangerous deflation developing around an economy captured by an unseen anchor intent on causing havoc and destruction. At the same time, consumer prices were jumping where they could do the most harm.

Read More »

Read More »

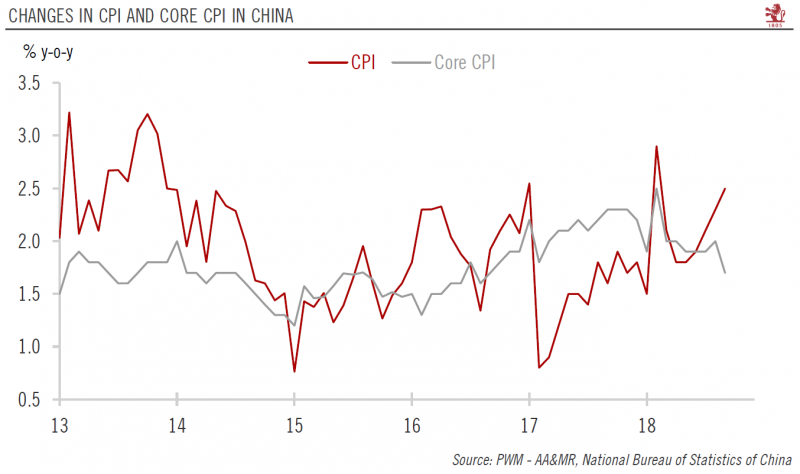

Inflation Environment remains Benign in China

The headline consumer price index (CPI) in China picked up slightly in September, rising by 2.5% year-over-year (y-o-y) compared with 2.3% in August, driven by higher food price and fuel prices. Excluding food and energy, core inflation in China actually eased to 1.7% y-o-y in September from 2.0% in August.

Read More »

Read More »

What’s so funny about #MeToo? | The Economist

The #MeToo movement is a year old. To mark the anniversary Tiff Stevenson, a British comedian, talks about inequality between the sexes and the laughable facts. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Tiff Stevenson is a British comedian who uses inequality between the sexes as material in her stand-up routine. The …

Read More »

Read More »

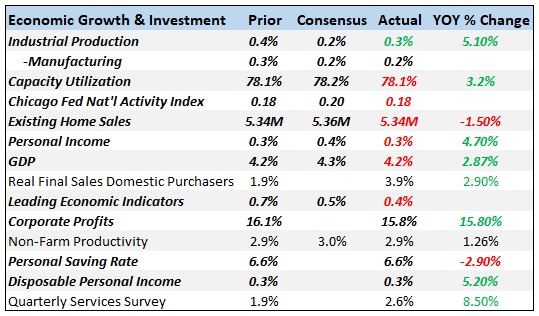

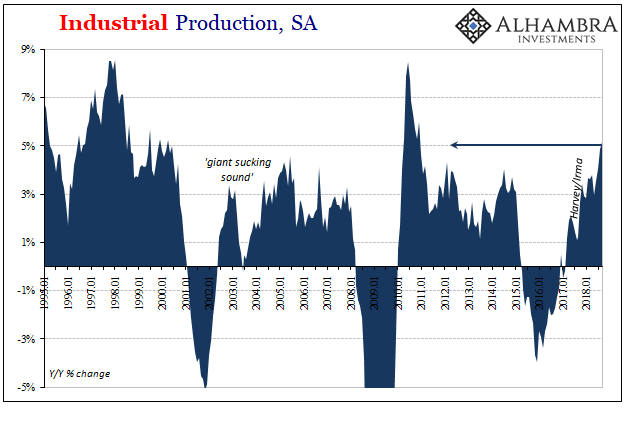

Just The One More Boom Month For IP

The calendar last month hadn’t yet run out on US Industrial Production as it had for US Retail Sales. The hurricane interruption of 2017 for industry unlike consumer spending extended into last September. Therefore, the base comparison for 2018 is against that artificial low. As such, US IP rose by 5.1% year-over-year last month. That’s the largest gain since 2010.

Read More »

Read More »

Now Back To Our Regularly Scheduled Economy

The clock really was ticking on this so-called economic boom. A product in many economic accounts of Keynesian-type fantasy, the destructive effects of last year’s hurricanes in sharp contrast to this year’s (which haven’t yet registered a direct hit on a major metropolitan area or areas, as was the case with Harvey and Irma) meant both a temporary rebound birthed by rebuilding as well as an expiration date for those efforts.

Read More »

Read More »

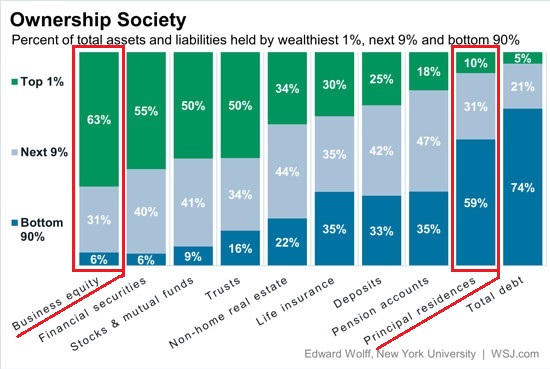

Mapping poverty in America | The Economist

America is the richest country in the world, but it also has one of the biggest divides between rich and poor. What can a zip code reveal about inequality? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy The United States is the world’s richest country. It is also one of the most unequal. …

Read More »

Read More »

Here’s Why the Next Recession Will Spiral Into a Depression

Here's the difference between a recession and a depression: you can't get blood from a stone, or make an insolvent entity solvent with more debt. There are two basic differences between a recession and a depression: 1. Duration: a recession typically lasts between 6 and 18 months, while a depression drags on for years or even decades, often masked by official propaganda as "slow growth" or "stagnation."

Read More »

Read More »

How Many Households Qualify as Middle Class?

By the standards of previous generations, the middle class has been stripmined of income, assets and purchasing power. What does it take to be middle class nowadays? Defining the middle class is a parlor game, with most of the punditry referring to income brackets as the defining factor.

Read More »

Read More »

Special Edition: Markets Under Pressure (VIDEO)

What does Alhambra Investments think about the 1300 point drop in the Dow Jones Average this week? Alhambra CEO Joe Calhoun has some thoughts.

Read More »

Read More »