Category Archive: 5) Global Macro

CHARLES HUGH SMITH: What We Want To Do Is Make Society Rich | Global Economic

☀☀☀☀ Please Click Below to SUBSCRIBE for More “Global Economic” Videos https://www.youtube.com/channel/UCV-UIza2EiL0s3Pd5GmawDw Thanks for watching!!! ******************************************* Please help me to reach 1k subscribers. Thanks you very much!!!

Read More »

Read More »

2019 Outlook

A discussion of the outlook for 2019 in the markets and the economy by Alhambra CEO Joe Calhoun and the Head of Alhambra Global Investment Research Jeff Snider.

Read More »

Read More »

Will China dominate science? | The Economist

China is fast becoming a world leader in science, but should the world worry? Our deputy editor, Ed Carr, examines the impact of China’s scientific expansion. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: https://econ.st/2o8kfOB Check out The …

Read More »

Read More »

…And Get Bigger

Just as there is gradation for positive numbers, there is color to negative ones, too. On the plus side, consistently small increments marked by the infrequent jump is never to be associated with a healthy economy let alone one that is booming. A truly booming economy is one in which the small positive numbers are rare. The recovery phase preceding the boom takes that to an extreme.

Read More »

Read More »

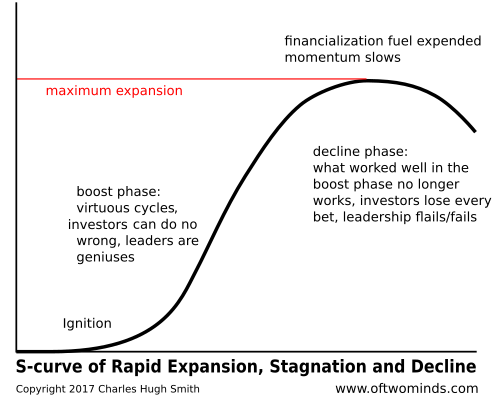

The Recession Will Be Unevenly Distributed

Those households, enterprises and organizations that have no debt, a very low cost basis and a highly flexible, adaptable structure will survive and even prosper. The coming recession will be unevenly distributed, meaning that it will devastate many while leaving others relatively untouched. A few will actually do better in the recession than they did in the so-called "recovery."

Read More »

Read More »

What will people wear in the future? | The Economist

Innovation in fashion is sparking radical change. In the future clothes could be computers, made with materials designed and grown in a lab. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy A new wave of innovation is fuelling a radical change in fashion. Wearable technology, data, automation and lab-grown materials will have a …

Read More »

Read More »

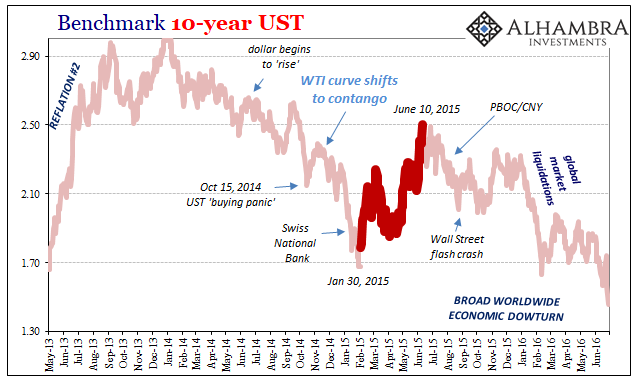

You Know It’s Coming

After a horrible December and a rough start to the year, as if manna from Heaven the clouds parted and everything seemed good again. Not 2019 this was early February 2015. If there was a birth date for Janet Yellen’s “transitory” canard it surely came within this window. It didn’t matter that currencies had crashed and oil, too, or that central banks had been drawn into the fray in very unexpected ways.

Read More »

Read More »

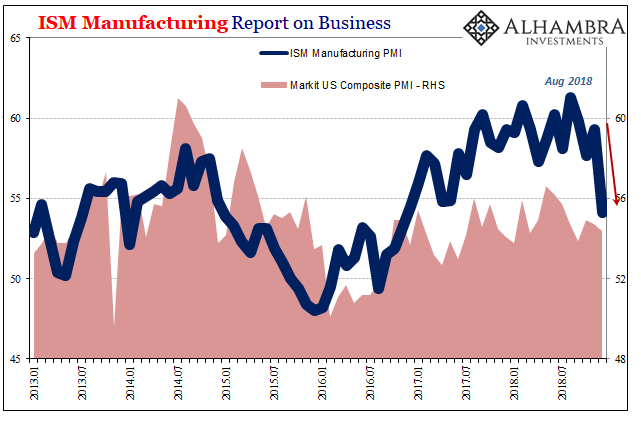

If You’ve Lost The ISM…

These transition periods are often just this sort of whirlwind. One day the economy looks awful, the next impervious to any downside. Today, it has been the latter with the BLS providing the warm comfort of headline payrolls. For now, it won’t matter how hollow.

Read More »

Read More »

How democratic is your country? | The Economist

Democracy is in danger around the world. Perhaps for this reason, political engagement is at an all-time high. Robert Guest, our foreign editor, examines this year’s Democracy Index, compiled by the Economist Intelligence Unit. Find out where your country ranks on the Democracy Index: http://www.eiu.com/topic/democracy-index https://www.economist.com/graphic-detail/2019/01/08/the-retreat-of-global-democracy-stopped-in-2018 Click here to...

Read More »

Read More »

Living In The Present

It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable health care or Miami Dolphin playoff games? Will China’s economy succumb to the pressure of US tariffs and make a deal?

Read More »

Read More »

Could Stocks Rally Even as Parts of the Economy Are Recessionary?

It's not yet clear that the stock market swoon is predictive or merely a panic attack triggered by a loss of meds. We contrarians can't help it: when the herd is bullish, we start looking for a reversal. When the herd turns bearish, we also start looking for a reversal.

Read More »

Read More »

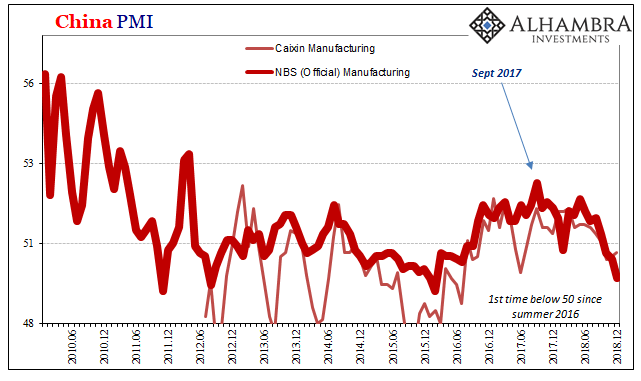

More Unmixed Signals

China’s National Bureau of Statistics (NBS) reports that the country’s official manufacturing PMI in December 2018 dropped below 50 for the first time since the summer of 2016. Many if not most associate a number in the 40’s with contraction. While that may or not be the case, what’s more important is the quite well-established direction.

Read More »

Read More »

Mispriced Delusion

Recency bias is one thing. Back in late 2006/early 2007 when the eurodollar futures curve inverted, for example, it was a textbook case of mass delusion. All the schoolbooks and Economics classes had said that it couldn’t happen; not that it wasn’t likely, it wasn’t even a possibility. A full-scale financial meltdown was at the time literally inconceivable in orthodox thinking.

Read More »

Read More »

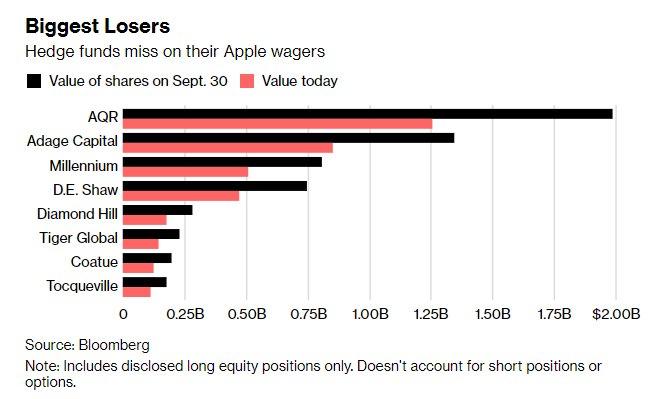

Hedge Funds, ETFs, Central Banks Suffer Billions In Losses On Apple

It wasn't that long ago that Apple was the most beloved stock by the hedge fund community, and although in recent months the company's popularity faded somewhat among the 2 and 20 crowd it is still one of the most popular names among the professional investing community. Which on a day that saw AAPL stock tumble as much as 10% is clearly bad news.

Read More »

Read More »

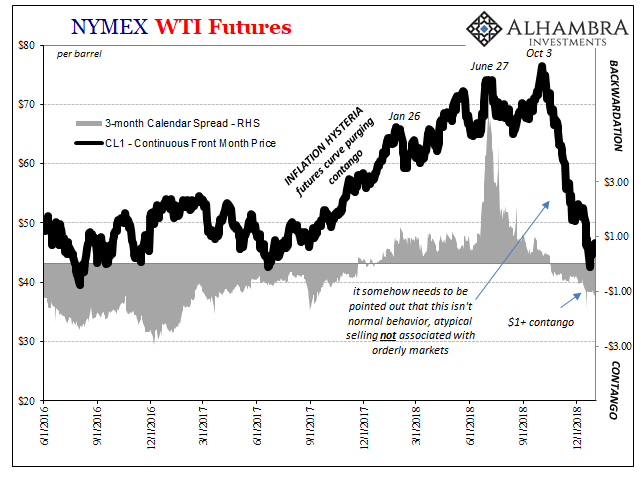

Nothing To See Here, It’s Just Everything

The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal.

Read More »

Read More »

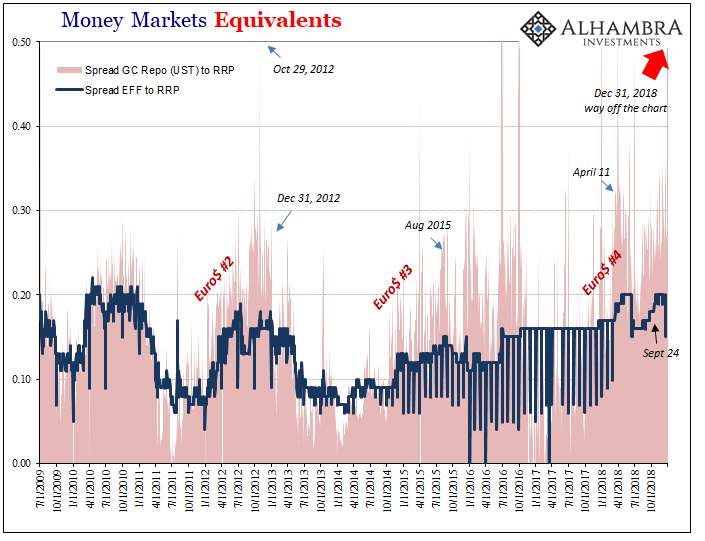

Insane Repo Reminds Us

It was only near the quarter end, that’s what made it so unnerving. We may have become used to these calendar bottlenecks over the years, but they still remind us what they are. Late October 2012 was a little different, though. On October 29, the GC repo rate for UST collateral (DTCC) surged to 52.6 bps. The money market floor, so to speak, was zero at the time and IOER (the joke) 25 bps. We also have to keep in mind the circumstances of that...

Read More »

Read More »

Where to invest in 2019? | The Economist

Where should you look to invest in 2019? Our capital-markets editor John O’Sullivan suggests the best strategy for the year ahead. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on Facebook: https://www.facebook.com/TheEconomist/ Follow The Economist …...

Read More »

Read More »

The Crisis of 2025

This is the predictable path because it's the only one that's politically expedient and doesn't cause much financial pain until it's too late to stave off collapse. While many fear a war between the nuclear powers or the breakdown of civil order, I tend to think the Crisis of 2023-26 is more likely to be financial in nature.

Read More »

Read More »

What will be the biggest stories of 2019? | Part Two | The Economist

Augmented-reality surgery, moon landings and a battle for the soul of Europe will be major talking points in the year ahead. But what else will make our countdown for the top ten stories for 2019? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy What will be the biggest stories of the year ahead? …

Read More »

Read More »

A Couple of Thoughts on 2019

The story of the 21st century is debt is soaring while earned income is stagnating for the bottom 95%. Best wishes to all my readers and correspondents for a safe, healthy and productive 2019. Thank you, longstanding supporters, for renewing your financial support at the new year without any pathetic begging on my part. (The pathetic begging will commence shortly.)

Read More »

Read More »