I’ve found the word “dissonance” has become more common in regular usage beyond just my own. Whether that’s a function of my limited observational capacities or something more meaningful than personal bias isn’t at all clear. Still, the word does seem to fit in economic terms more and more as we carry on uncorrected by meaningful context.

The Buffalo News reported this week the results of M&T Bank’s survey of business owners at small and mid-sized firms. This is a regular feature of the bank’s economic department, and just as regular has been optimism spread throughout this group. For several years now, these important pieces to missing growth have voiced increasing positivity as to their assessments of the overall economy.

And yet, dissonance:

Fifty percent of the respondents to the survey said they expected the economy to improve in the next six months, and 55 percent expected the recent tax overhaul to have a positive impact on business performance. But only 34 percent planned to increase their capital expenditures over the next six months, which was lower than the 38 percent who responded that way to a survey in the second quarter.

Things are good but a business owner isn’t willing to bet his/her capital on it? How good can things really be? There is even dissonance among other dissonance:

Seventy percent of the respondents said they planned to increase wages and salaries this year. But only 26 percent planned to hire more workers in the next six months, compared to 34 percent in the second quarter survey. Sixty-two percent of respondents said they were having trouble finding qualified candidates for jobs.

The economy is good so they plan to raise wages and salaries, but not hire more people. They would hire more people, but they can’t find qualified labor. This “labor shortage”, I guess, means they won’t add to their own business capacity. Something’s obviously missing here.

What owner would ever pass up profit opportunity? It sounds more like business owners, as consumers, keep saying the economy is good because that’s what everyone else is saying.

| Basic economics dictates the owner would absorb whatever additional costs, whether increased wages to directly address the shortage or those that come with hiring less qualified fill-in candidates, rather than forego the opportunity. Econometrics, for all its big faults, uses a profit maximization function because that’s how the world works. If the economy is truly good, and this is the central part, that’s the only consideration; what follows are mere details of how the business will do whatever it takes to cash in on it.

If, however, the economy seems just OK, which counts as “good” these days, then apprehension and caution are more fitting (even then I have to wonder). This idea of a “labor shortage” is one that has been perpetuated for years now. It almost has to have been given the further depths of the unemployment rate. It starts right from the top, and by that I mean where all mainstream economic narratives come from. |

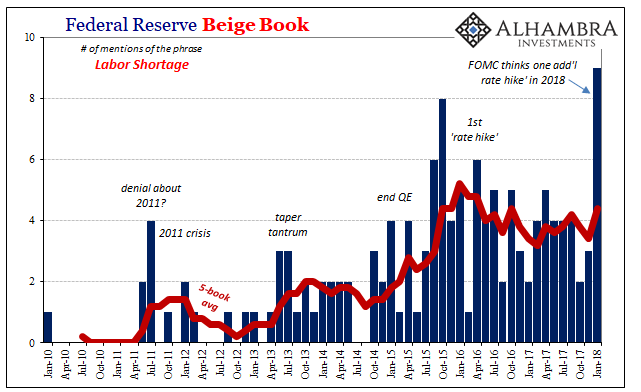

US Federal Reserve, Jan 2010 - 2018 |

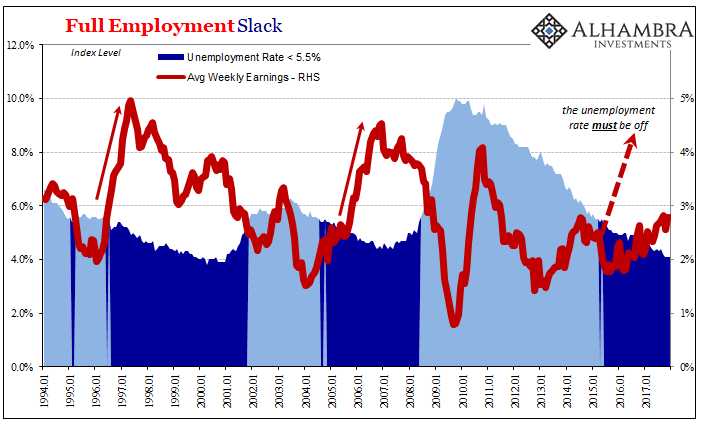

US Full Employment Slack, Jan 1994 - 2018 |

|

| The Federal Reserve’s Beige Book, its collection of hand-picked anecdotes that serve to further harden its echo chamber-like nature, for the just-released January 2018 version saw a spike in mentions of “labor shortage.” It appeared in the compendium a record nine times, exceeding by one the prior peak registered just before the first of the Fed’s “rate hikes.”

As noted on prior occasions, that appears to be the exact relationship and nature of using the term in this fashion. The FOMC recently upped its dots, expecting four “rate hikes” in 2018 versus the three the market had priced because that’s how many they got around to last year. Should we be surprised that the Beige Book now is back to finding a “labor shortage?” I believe it simply a case of officials trying to convince themselves of their own expectations. It’s especially predictable given how that works out in relation to other factors, meaning again dissonance. The Kansas City Fed, for example, highlighted perfectly in one sentence what I mean:

|

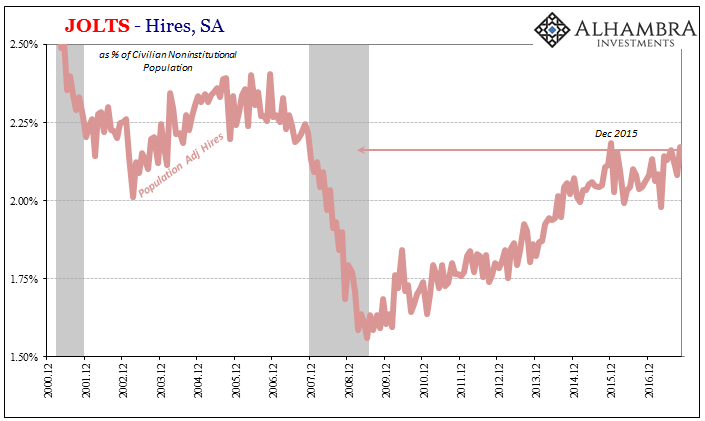

JOLTS Hires Beveridge Curve, 2002 - 2009 |

| It just doesn’t work that way. In a real labor shortage, wage gains wouldn’t be modest because they couldn’t be modest. If they are modest, then the shortage is a kinda, sorta shortage rather than true to the meaning of the word in this context.

The only way those two really different parts could ever come together is if businesses don’t really care that there is a shortage because its not based on economic growth perceptions so much as regular churn. As I wrote last year:

|

US JOLTS Hires, Dec 2000 - Jan 2018 |

| This view is far more consistent with the level of hiring actually taking place (recalling the various angles of the Beveridge Curve).

And, of course, all that still assumes that this “labor shortage” might be any different than at any time in the past. There are always firms who can claim they are having trouble finding qualified candidates. What might be different now is those particular businesses are being given a wider public voice because they fit the preferred idea of the economy – no matter what incongruity it might produce with other data (including Economists “finding” labor shortages wherever they happen to look). |

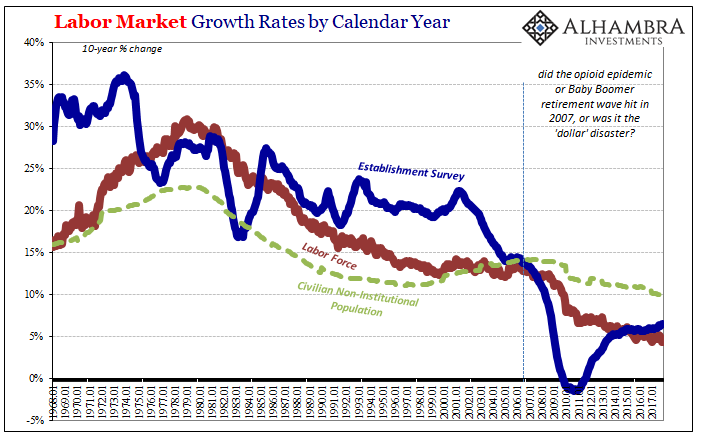

Labor Market Growth Rates, Jan 1968 - 2018 |

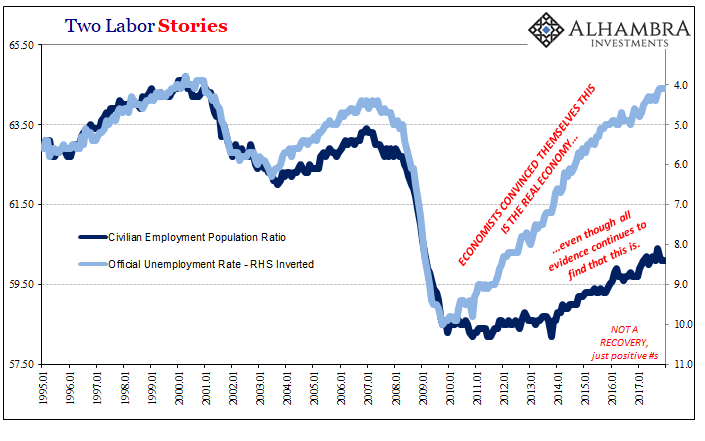

| In other words, the level of hiring is not likely the anomaly here. A truly booming economy and therefore labor market isn’t plagued by so many inconsistencies. The constant dissonance is more than the unemployment rate’s problem with its own denominator. It’s just not suited for the real economy of the last ten years, top as well as bottom. There’s no way to realistic assess what you see at the bottom right on the chart below as anything other than tremendous, lasting caution on the part of domestic business.

In other words, saying the economy is good simply because it isn’t 2009 isn’t a meaningful assessment of the economy. |

Two Labor Stories, Jan 1995 - 2018 |

Tags: currencies,economy,Federal Reserve/Monetary Policy,income,inflation,Labor Market,labor shortage,Markets,newslettersent,unemployment rate,wages