Category Archive: 5) Global Macro

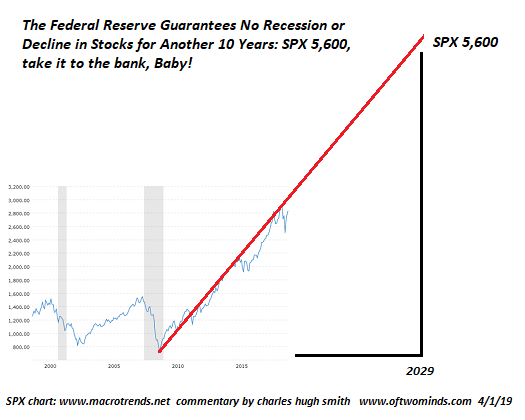

The Fed Guarantees No Recession for 10 Years, Permanent Uptrend for Stocks and Housing

A classified Federal Reserve memo sheds new light on the Fed's confidence in its control of the economy and the stock and housing markets. In effect, the Fed is guaranteeing that there will be no recession for another 10 years, and that stocks and housing will remain in a permanent uptrend.

Read More »

Read More »

Monthly Macro Monitor – March 2019 (VIDEO)

Alhambra CEO discusses all the talk about the recent yield curve inversion and how he views it.

Read More »

Read More »

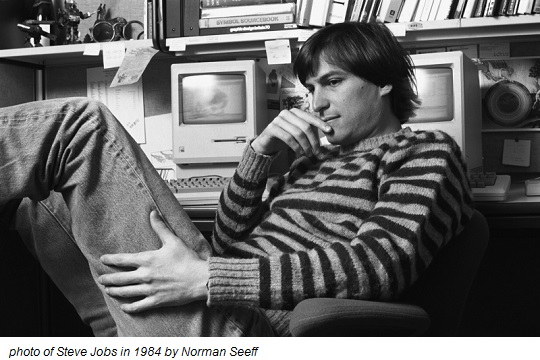

Apple’s Rotten Core

Entering commoditized, fiercely competitive low-margin services cannot substitute for the high-margin profits that will be lost as global recession and saturation erode iPhone sales. Apple has always been equally an enterprise and a secular religion. The Apple Faithful do not tolerate heretics or critics, and non-believers "just don't get it."

Read More »

Read More »

Trump’s post-Mueller victory spin | The Economist

The summary of Robert Mueller’s report appears to have cleared President Trump of collusion with Russia in the 2016 election campaign—though it did not exonerate him of obstructing justice. Kal, our cartoonist, contemplates “spinmeister” Trump’s joyous vindication. https://econ.st/2HNleQ8 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit:...

Read More »

Read More »

Is the World Becoming Wealthier or Poorer?

There is nothing intrinsically profitable about either robotics or AI. At the request of colleague/author Douglas Rushkoff (his latest book is Team Human), I'm publishing last week's Musings Report, which was distributed only to subscribers and patrons of the site.) The core assumption of Universal Basic Income (UBI) and other plans to redistribute wealth and income more broadly is that the world is becoming wealthier, and so the pool of income and...

Read More »

Read More »

Why is chicken so cheap? | The Economist

People eat 65 billion chickens every year. It is the fastest-growing meat product. Yet pound for pound the price of chicken has fallen sharply. How has this happened? Read more about Chickenomics here: https://econ.st/2Wtp04o Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Chickens are the most populous bird on the planet. There are …

Read More »

Read More »

Monthly Macro Monitor: Well Worried

Don’t waste your time worrying about things that are well worried. Well worried. One of the best turns of phrase I’ve ever heard in this business that has more than its fair share of adages and idioms. It is also one of the first – and best – lessons I learned from my original mentor in this business. The things you see in the headlines, the things everyone is already worried about, aren’t usually worth fretting over.

Read More »

Read More »

How happy is your country? | The Economist

Money doesn’t buy happiness—or does it? In both India and China people have become richer in the past decade, but global data reveal that greater wealth does not necessarily lead to greater happiness Economic growth does not guarantee rising happiness. Read more here: https://econ.st/2HIlxLT Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy The …

Read More »

Read More »

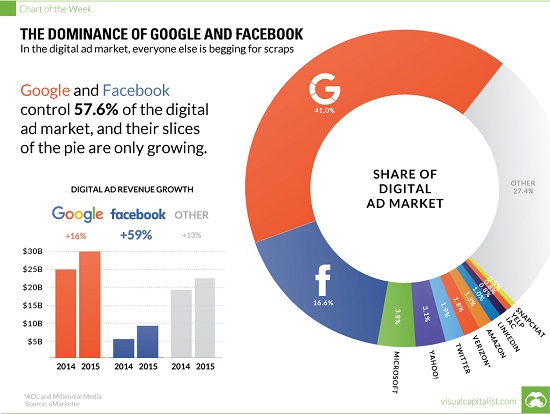

When Are We Going to Tackle the For-Profit Monopolies Which Censored RussiaGate Skeptics?

We either take down Facebook and Google and turn them into tightly regulated transparent public utilities available to all or they will destroy what little is left of American democracy. The RussiaGate Narrative has been revealed as a Big Con (a.k.a. Nothing-Burger), but what's dangerously real is the censorship that's being carried out by the for-profit monopolies Facebook and Google on behalf of the status quo's Big Con.

Read More »

Read More »

The Media, Mueller, the Big Con and the Democratization of Narrative

Falling for a con is painful. The first reaction is to deny being conned, of course. The second is to blame skeptics for being correct in their skepticism. Here's the fundamental "story" of the Mueller Investigation: elites don't like "the little people" democratizing public narratives.

Read More »

Read More »

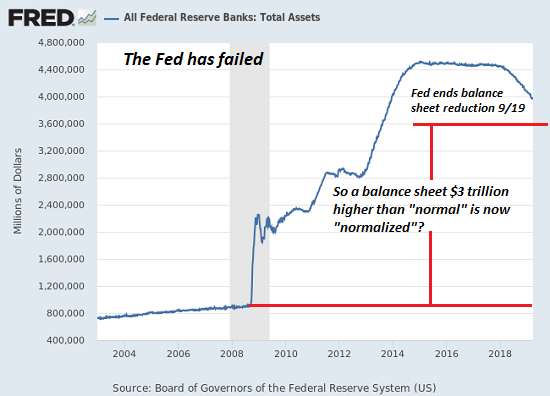

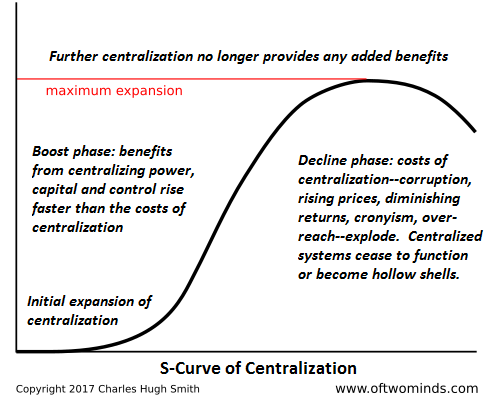

Politics Has Failed, Now Central Banks Are Failing

With each passing day, we get closer to the shift in the tide that will sweep away this self-serving delusion of the ruling elites like a crumbling sand castle. Those living in revolutionary times are rarely aware of the tumult ahead: in 1766, a mere decade before the Declaration of Independence, virtually no one was calling for American independence.

Read More »

Read More »

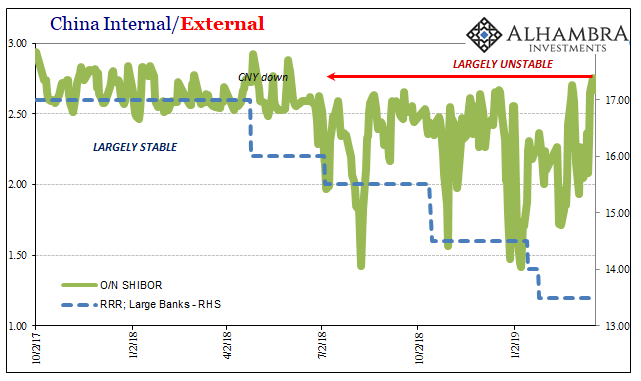

February 2019 PBOC/RMB Update

This will serve mostly as an update to what is going on inside the Chinese monetary system. The PBOC’s balance sheet numbers for February 2019 are exactly what we’ve come to expect, ironically confirmed today on the domestic end by the FOMC’s dreaded dovishness. Therefore, rather than rewrite the same commentary for why this continues to happen I’ll just link to prior discussions.

Read More »

Read More »

Which Nations Will Crumble and Which Few Will Prosper in the Next 25 Years?

Adaptability and flexibility will be the core survival traits going forward. What will separate the many nations that will crumble in the next 25 years and those few that will survive and even prosper while the status quo dissolves around them? As I explain in my recent book Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic, the factors that will matter are not necessarily cultural or financial; being hard-working and...

Read More »

Read More »

Slump, Downturn, Recession; All Add Up To Sideways

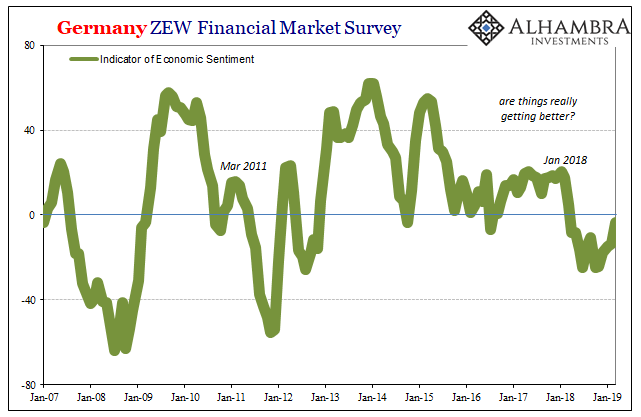

According to Germany’s Zentrum für Europäische Wirtschaftsforschung, or ZEW, the slump in the country’s economy has now reached its fourteenth month. The institute’s sentiment index has improved in the last two, but only slightly. As of the latest calculation released today, it stands at -3.6.

Read More »

Read More »

The Real End of the Bond Market

These things are actually quite related, though I understand how it might not appear to be that way at first. As noted earlier today, the Fed (yet again) proves it has no idea how global money markets work. They can’t even get federal funds right after two technical adjustments to IOER (the joke).

Read More »

Read More »

Why calories are a con | The Economist

Calorie-counting has been central to people’s understanding of weight loss for over a century. Given that the great majority of diets fail—could the calorie be one of the biggest delusions in dietary history? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For decades people who want to control their weight have been told …

Read More »

Read More »

While the Nation Fragments Socially, the Financial Aristocracy Rules Unimpeded

If there is one central irony in American history, it is this: the citizenry that broke free of the chains of British Monarchy, the citizenry that reckoned everyone was equal before the law, the citizenry that vowed never to be ruled by an aristocracy that controlled the government and finance as a means of self-enrichment, is now so distracted by social fragmentation that the citizenry is blind to their servitude to a new and formidably informal...

Read More »

Read More »

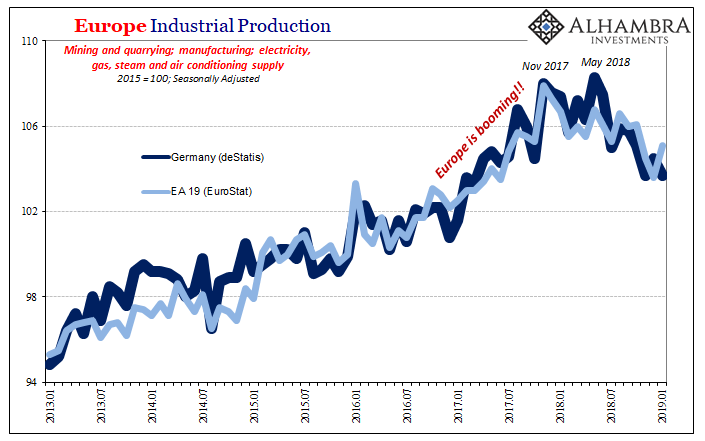

The World Economy’s Industrial Downswing

As economic data for 2019 comes in, the numbers continue to suggest more slowing especially in the goods economy. Perhaps what happened during that October-December window was a soft patch. Even if that was the case, we should still expect second and third order effects to follow along from it.

Read More »

Read More »

Are lab-grown diamonds the future? | The Economist

Scientists now have the technology to make synthetic diamonds in a laboratory. They are far cheaper than mined stones, but can they replace the real thing? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy It’s the biggest disrupter the diamond industry has faced. Machines are now growing diamonds in a matter of weeks …

Read More »

Read More »

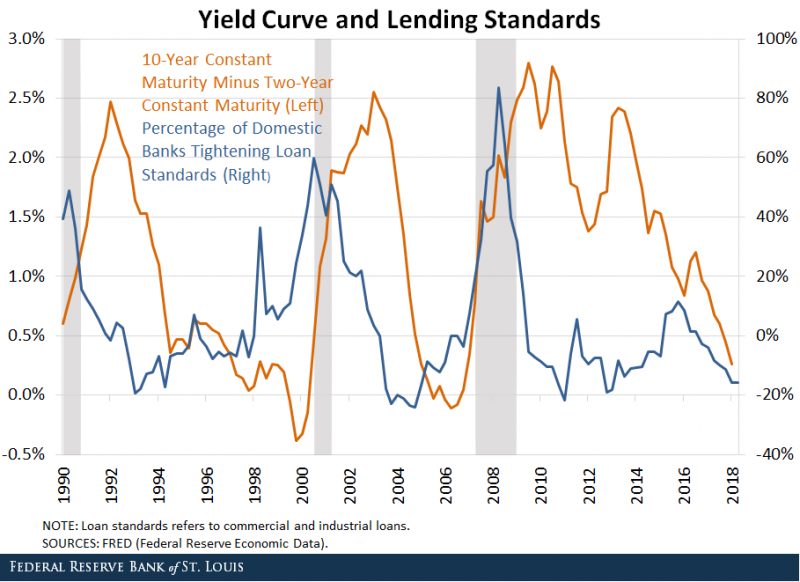

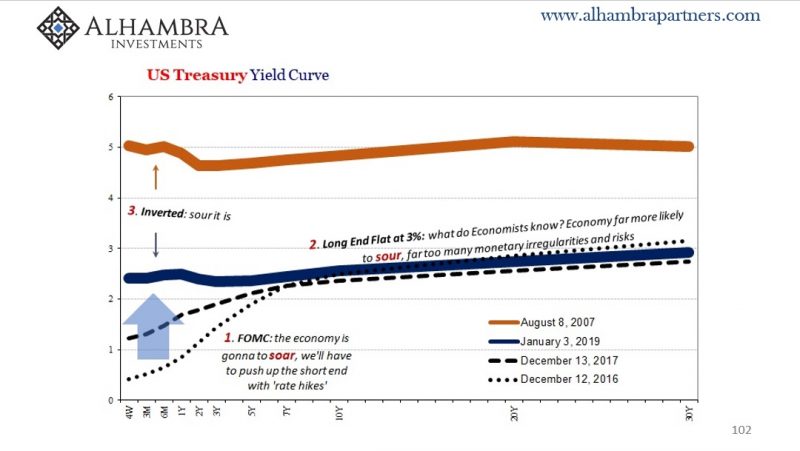

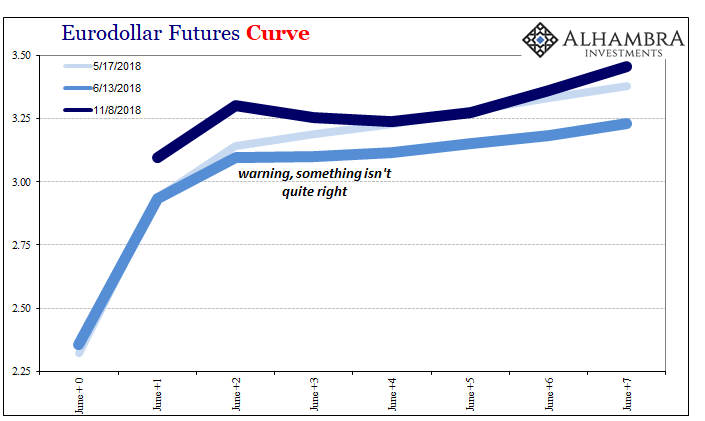

Chart(s) of the Week: Reviewing Curve Warnings

Quick review: stocks hit a bit of a rough patch right during the height of inflation hysteria. At the end of January 2018, just as the US unemployment rate had finally achieved the very center of attention, global markets were rocked by instability. Unexpectedly, of course.

Read More »

Read More »