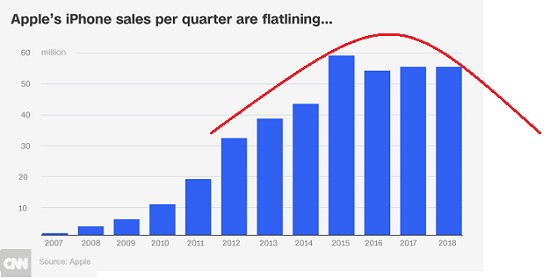

| As the second chart illustrates, the market for costly mobile phones is saturated: everyone on the planet who could afford one and wants one has already bought one. As we all know, the “fix” for saturation is to speed up the product cycle so the existing owners are forced to buy a newer and much more costly model every year or two.

But this strategy also has diminishing returns: people get tired of getting ripped off by accelerating replacement cycles and eventually some percentage step off the merry-go-round and switch to a much cheaper and less demanding (product-cycle-wise) alternative. |

|

| Then there’s the other problem: without Steve Jobs, there is no “next big thing” at Apple. As I’ve explained many times here and in my books, value flows to scarcity, and Apple’s enormous profits are based on the artificial scarcity Apple has been able to impose on the market by closely guarding its proprietary mix of hardware and software.

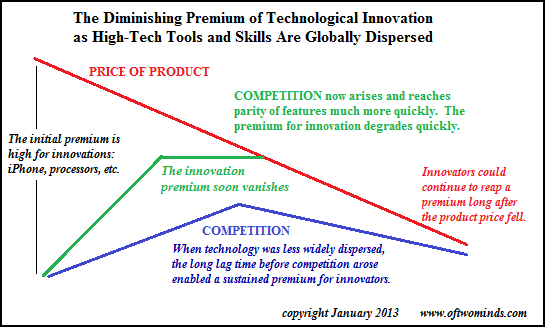

But as this chart attempts to explain, the price innovators can charge as competition increases diminishes as the innovations lose their scarcity value. The faster the advances and product cycles, the faster the erosion of pricing power. Why the Innovation Premium Is Diminishing (January 16,2013) |

Diminished premium |

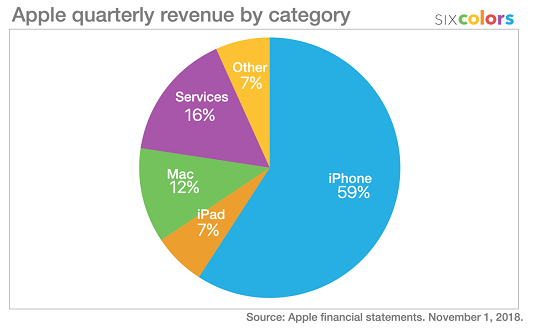

| The innovations of late-cycle iPhones are out of synch with the price increases.Apple is moving from selling innovations worth an extra couple hundred dollars to resting on its status-symbol laurels as a “luxury brand.”

That may work well in a global expansion, i.e. the past 10 years, but as the world economy contracts (don’t dare call it recession), that strategy will not yield the same results it did in the expansionary cycle. Lastly, the “services” Apple is entering are commoditized and extremely competitive, markets in which it has very little proprietary territory to defend.Payment systems and credit cards are commoditized markets: there is very little differentiating the options and the host of competitors is expanding rapidly. |

Apple's iPhone sales per quarter are flatlining... 2007-2018 |

| Many competitors are well-funded and experienced in maintaining customer loyalty. Payment systems and credit cards aren’t a sideline as they are for Apple; these are the banks’ bread and butter and they will not make it easy for Apple to carve off a proprietary territory.

As I’ve also noted, commoditized products and services have low profit margins.Apple generated its tens of billions of dollars in profits by reaping extraordinary margins; those margins cannot be transferred to commoditized services. The content creation and delivery sector is also commoditized and fiercely competitive. There is very little to differentiate the services and generate scarcity value, and as the global recession deepens, consumers will be paring back their subscriptions, not adding them. There is quite a lot of free content out there and those on a budget have many options. What happens to Apple’s “growth story” once iPhone sales decline and the much-hyped services generate a mere trickle of net profit? |

Apple quarterly revenue by category |

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the book's website.

Full story here Are you the author? Previous post See more for Next post

Tags: newsletter