Category Archive: 5) Global Macro

Coloring One Green Shoot

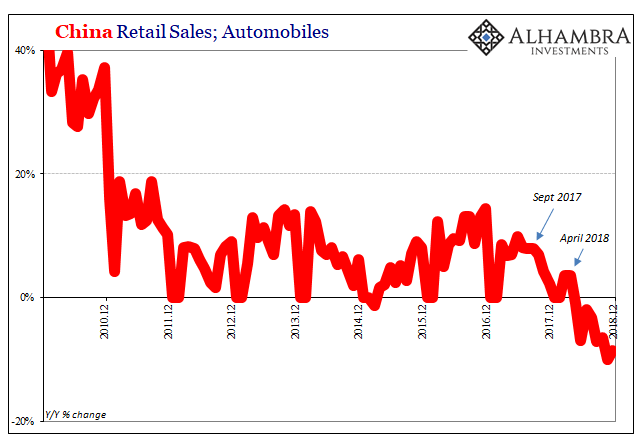

China’s Passenger Car Association reported last week that retail sales of various vehicles totaled 1.78 million units in March 2019. The total was 12% less than the number of automobiles sold in March 2018. This matches the government’s data, both sets very clear as to when Chinese economic struggles accelerated: May 2018.

Read More »

Read More »

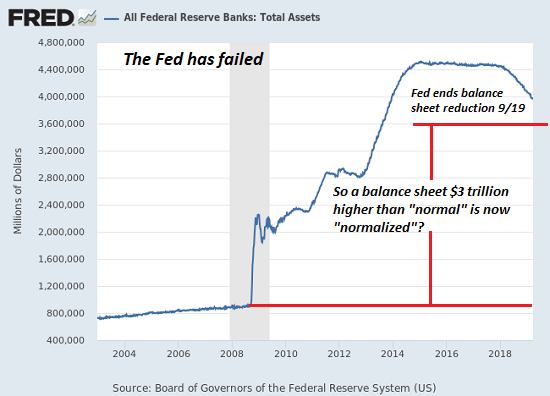

No Fix for Recession: Without a Financial Crisis, There’s No Central Bank Policy Fix

There are no extreme "fixes" to secular declines in sales, profits, employment, tax revenues and asset prices. The saying "never let a crisis go to waste" embodies several truths worth pondering as the stock market nears new highs. One truth is that extreme policies that would raise objections in typical times can be swept into law in the "we have to do something" panic of a crisis.

Read More »

Read More »

Assange and the Unforgivable Sin of Disemboweling Official Narratives

There is really only one unforgivable sin in the political realm, and that's destroying the official narrative by revealing the facts of the matter. This is why whistleblowers who make public the secret machinery of the elaborately artful lies underpinning all official narratives are hounded to the ends of the Earth.

Read More »

Read More »

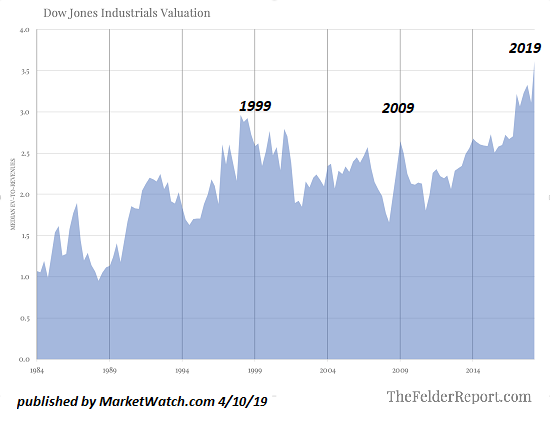

Blind Faith vs. the Bottom Line

There is more than a little "let them eat brioche" in the blind faith that the masses' patience for pillage is infinite. We've reached an interesting moment in history where we each have a simple choice: we either go with blind faith or we go with the bottom line, i.e. the facts of the matter. So far, 2019 is the year of Blind Faith, as the charts below illustrate: the bottom line no longer matters.

Read More »

Read More »

Monthly Macro Chart Review – April 2019 (VIDEO)

Alhambra CEO Joe Calhoun discusses the charts from the past month and what they indicate.

Read More »

Read More »

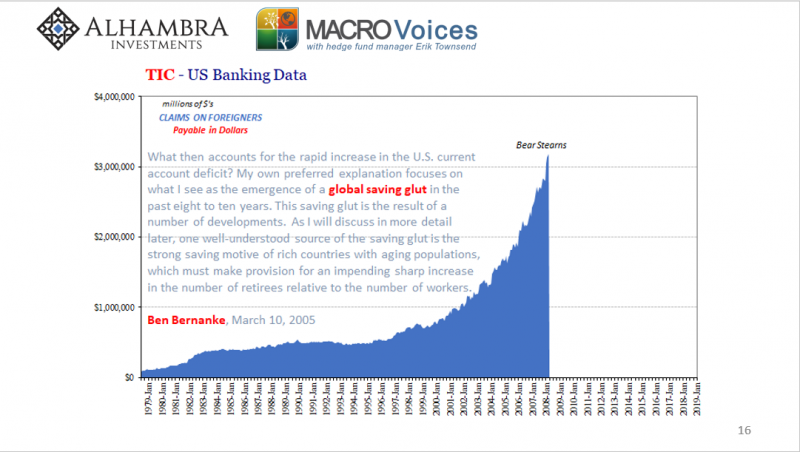

Why 2011

The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing.

Read More »

Read More »

Is private education good for society? | The Economist

Across the world private education is booming. Though private schools and tuition promote inequality, Emma Duncan, our social policy editor, explains why governments should embrace the private sector’s rise Read more here: https://econ.st/2X4ODsm Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy There is a big boom in private education all over the world. …

Read More »

Read More »

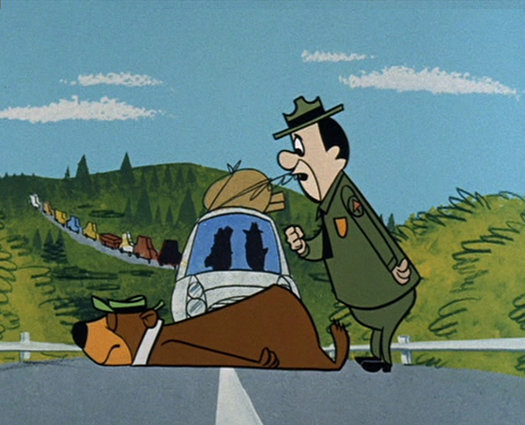

Here’s What It’s Like To Be a Bear in a Rigged Market

Central bankers and media handlers must be laughing at how easy it is to slaughter the Bears and doubters with another fake-news round of trade-deal rumors and another Fed parrot being prompted to repeat some dovish mumbo-jumbo. It's not just tough being a Bear in a market rigged by trade deal rumors, Federal Reserve dovishness, a tsunami of Chinese liquidity and $270 billion in stock buy-backs in the first quarter--it's impossible.

Read More »

Read More »

Trade Deal Follies: The U.S. Has Embraced the World’s Worst Negotiating Tactics

The world's worst negotiating strategy is to make a crazy tulip-bubble stock market rally dependent on a trade deal that harms the interests of the U.S. The world's worst negotiating tactics, the equivalent of handing the other side a loaded gun while waving a squirt gun around, are: 1. Declare a de facto political deadline for a deal. Constantly tweet that a deal is imminent.

Read More »

Read More »

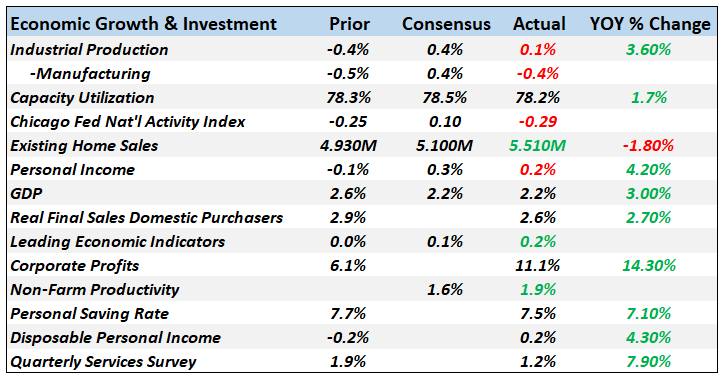

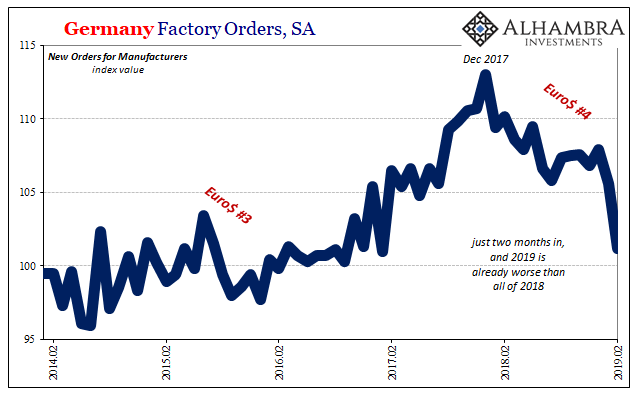

Monthly Macro Chart Review: April 2019

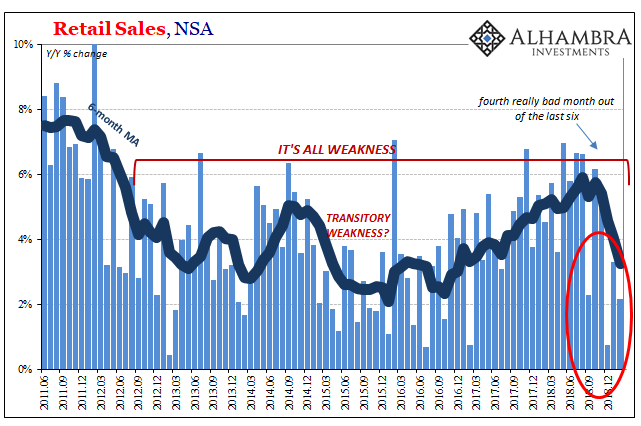

The economic data reported over the last month managed to confirm both that the economy is slowing and that there seems little reason to fear recession at this point. The slowdown is mostly a manufacturing affair – and some of that is actually a fracking slowdown – but consumption has also slowed.

Read More »

Read More »

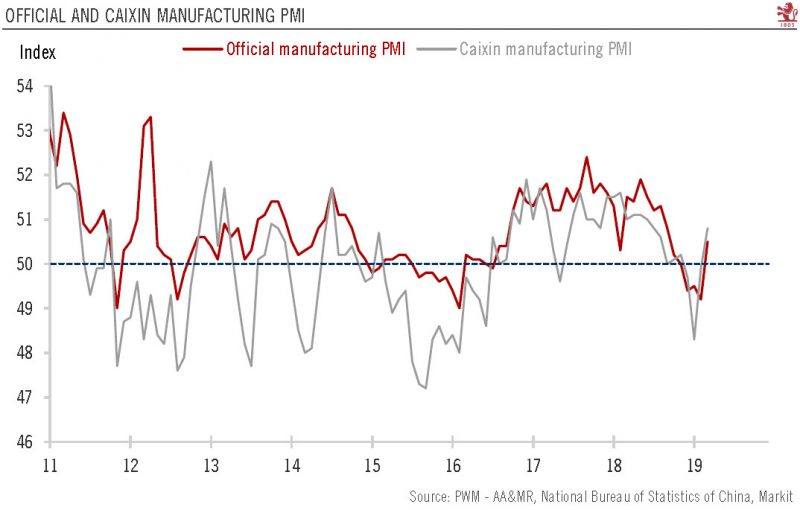

China PMIs jump in March

Industrial gauges rebound on seansonality as well as policy easing.Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0.

Read More »

Read More »

External Demand, Global Means Global

The Reserve Bank of India (RBI) cut its benchmark money rate for the second straight meeting. Reducing its repo rate by 25 bps, down to 6%, the central bank once gripped by political turmoil has certainly shifted gears. Former Governor Urjit Patel was essentially removed (he resigned) in December after feuding with the federal government over his perceived hawkish stance.

Read More »

Read More »

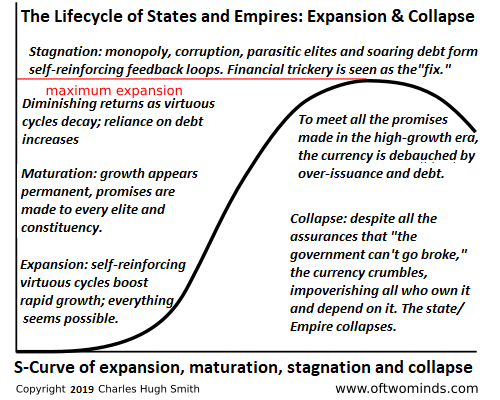

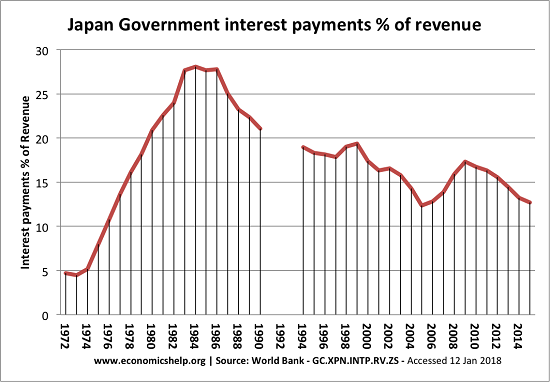

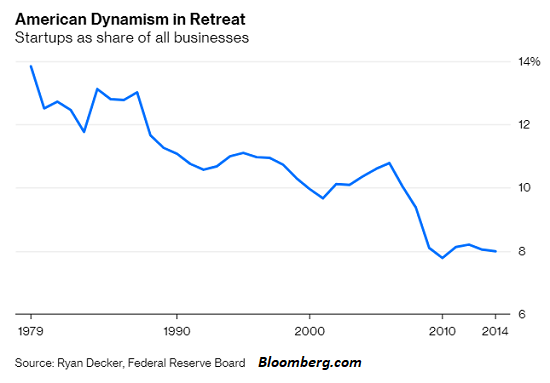

The Japanification of the World

Zombification / Japanification is not success; it is only the last desperate defense of a failing, brittle status quo by doing more of what's failed. A recent theme in the financial media is the Japanification of Europe. Japanification refers to a set of economic and financial conditions that have come to characterize Japan's economy over the past 28 years: persistent stagnation and deflation, a low-growth and low-inflation economy, very loose...

Read More »

Read More »

Are the Rise of Social Media and the Decline of Social Mobility Related?

Social media offers hope of achieving higher online social status without having to succeed financially in a winner-take-most economy. I've often addressed the decline of social mobility and the addictive nature of social media, and recently I've entertained the crazy notion that the two dynamics are related. Why Is Social Media So Toxic?

Read More »

Read More »

The truth about lies | The Economist

From little fibs to big fat whoppers, lying is part of human nature. Lane Greene, our language guru, examines the difference between lies, falsehoods and plain nonsense. To read more about why the press should call out politicians when they lie click here: https://econ.st/2FRdmJS Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For …

Read More »

Read More »

Retail Sales In Bad Company, Decouple from Decoupling

In a way, the government shutdown couldn’t have come at a more opportune moment. As workers all throughout the sprawling bureaucracy were furloughed, markets had run into chaos. Even the seemingly invincible stock market was pummeled, a technical bear market emerged on Wall Street as people began to really consider increasingly loud economic risks.

Read More »

Read More »

Phugoid Dollar Funding

On August 12, 1985, Japan Airways flight 123 left Tokyo’s Haneda Airport on its way to a scheduled arrival in Osaka. Twelve minutes into the flight, the aircraft, a Boeing 747, suffered catastrophic failure when an aft pressure bulkhead burst.

Read More »

Read More »

The Hidden Cost of Losing Local Mom and Pop Businesses

What cannot be replaced by corporate chains is neighborhood character and variety. There is much more to this article than first meets the eye: In a Tokyo neighborhood's last sushi restaurant, a sense of loss "Eiraku is the last surviving sushi bar in this cluttered neighborhood of steep cobblestoned hills and cherry trees unseen on most tourist maps of Tokyo.

Read More »

Read More »

The hunt for oceans in space | The Economist

Scientists believe there are oceans buried under thick crusts of ice on the moons of Saturn and Jupiter. Sampling them would raise hope of life beyond Earth https://econ.st/2WDdEe5 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The …

Read More »

Read More »

Charles Hugh Smith on the End Game for Monetary and Fiscal Policies

Click here for the full transcript: http://financialrepressionauthority.com/2019/04/01/the-roundtable-insight-charles-hugh-smith-on-the-end-game-for-monetary-and-fiscal-policies/

Read More »

Read More »