Category Archive: 5) Global Macro

Are monarchies a thing of the past? | The Economist

Prince Harry and Meghan Markle are celebrating the birth of their baby boy. A new emperor has ascended to the throne in Japan. And Thailand is crowning its new king. Around the world monarchies are holding up surprisingly well. What is the secret to their success? Read more here: https://econ.st/2LoxqcC Click here to subscribe to …

Read More »

Read More »

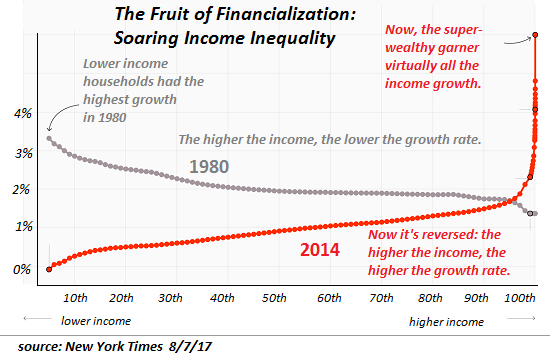

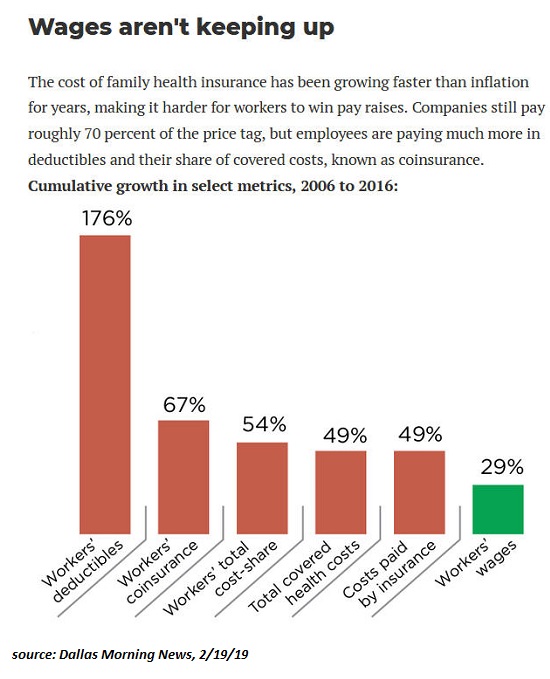

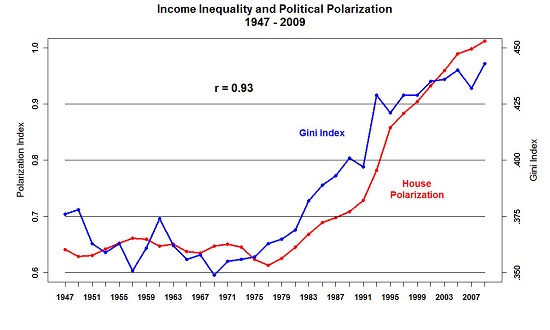

The Accelerating Decay of the Middle Class

Ironically, their ample compensation allows them to avoid the poor-quality services they've designed for everyone below them. If we define middle class by the security of household income and what that income can buy rather than by an income level, what do we conclude?

Read More »

Read More »

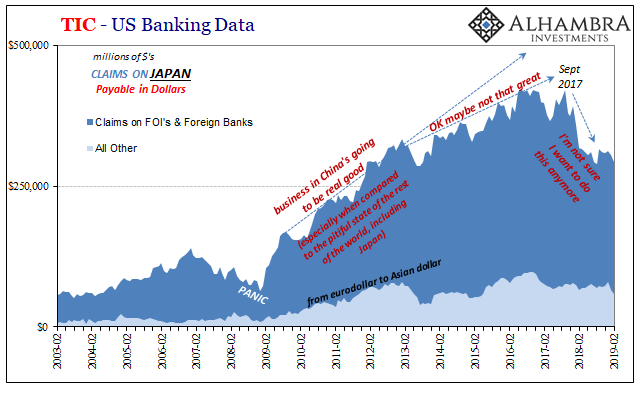

What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective.

Read More »

Read More »

The Erosion of Everyday Life

Working hard and doing what you're told is no longer yielding the promised American Dream of security, agency and liberty. Volume One of Fernand Braudel's oft-recommended (by me) trilogy Civilization & Capitalism, 15th to 18th Century is titled The Structures of Everyday Life. The book describes how life slowly became better and freer as the roots of modern capitalism and liberty spread in western Europe, slowly destabilizing and obsoleting the...

Read More »

Read More »

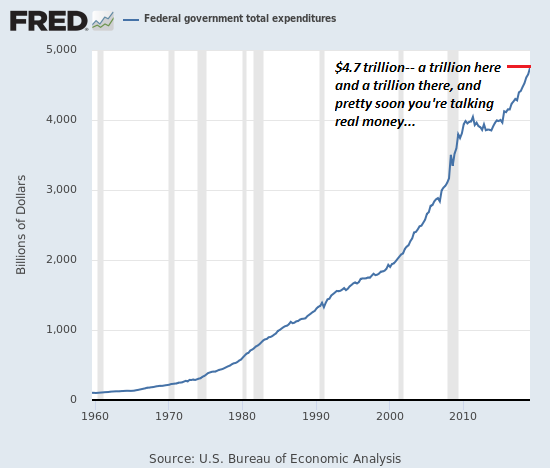

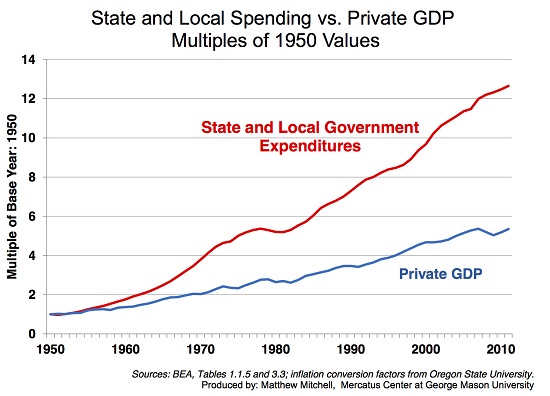

There Are Two Little Problems with “Taxing the Rich” to Pay for “Free Everything”

No super-wealthy individual or household is going to pay billions in additional taxes when $10 to $20 million will purchase political adjustments. The 2020 election cycle has begun, and a popular campaign promise is "free everything" paid for by new taxes on the super-wealthy. Who doesn't like free stuff? Who will vote for whomever offers them free stuff? No wonder it's a popular campaign promise.

Read More »

Read More »

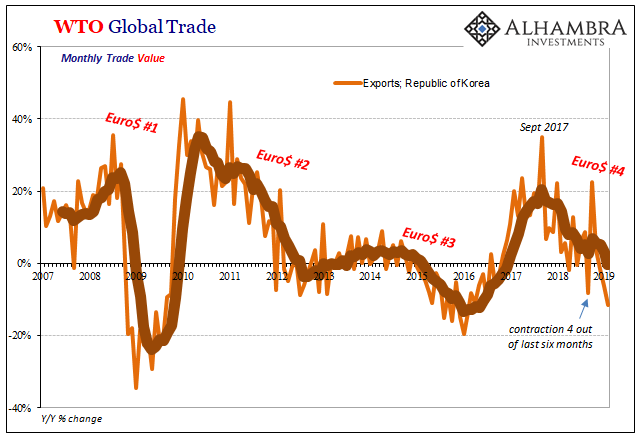

Globally Synchronized…

The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death.

Read More »

Read More »

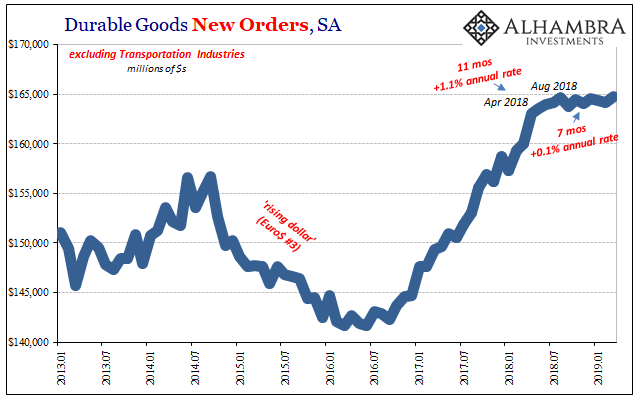

Durably Sideways

Next month, in the durable goods series, the Census Bureau will release the results of its annual benchmark changes. In May 2019, the agency will revise the seasonal adjustments going back to January 2002. Unadjusted data will not be, well, further adjusted.

Read More »

Read More »

Mandela’s legacy: 25 years on | The Economist

Nelson Mandela is one of the great icons of the 20th century. Yet many of South Africa’s “born free” generation—those born after the end of apartheid—are conflicted about his legacy. https://econ.st/2GJ7OCX Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: …

Read More »

Read More »

Push Them Hard Enough and the Productive Class Will Opt Out of Servitude

People love their big paychecks, but they also value their sanity. One of the most astonishing manifestations of disconnected-from-reality hubris is public authorities' sublime confidence that employers and entrepreneurs will continue starting and operating enterprises no matter how difficult and costly it becomes to keep the doors open, much less net a profit.

Read More »

Read More »

This is the most over-fished sea in the world | The Economist

The Mediterranean supports countries in Europe, the Middle East and North Africa—but its fish stocks are almost completely collapsed. Meet the man who is leading attempts to revive its marine habitats. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy This is the extraordinary story of one man’s dream to save the most over-fished …

Read More »

Read More »

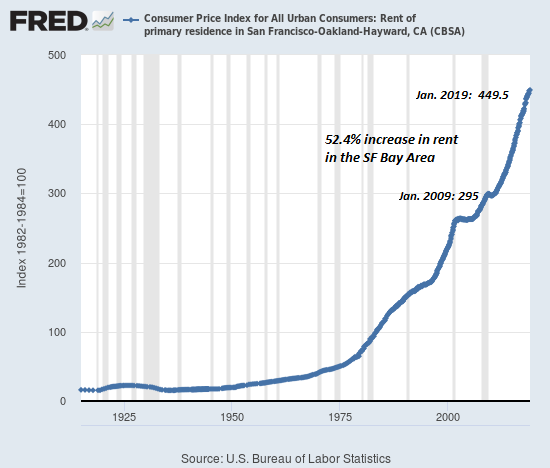

The Feedback Loop of Doom: When Mobile Creatives and Capital Abandon Unaffordable, Dysfunctional Cities

When the 4% who generate the jobs and tax revenues have had enough and leave, the effects quickly impact the 64%. At the end of any trend, everyone's a true believer: this trend is so enduring, so broad-based, so based on unchanging fundamentals that it will never ever reverse.

Read More »

Read More »

How to defeat malaria | The Economist

Malaria still kills around 400,000 people a year. Efforts to eradicate the disease have stalled because of drug resistance—but pioneering gene-editing technology might offer a new solution Read more here: https://econ.st/2XHVIiY Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: …

Read More »

Read More »

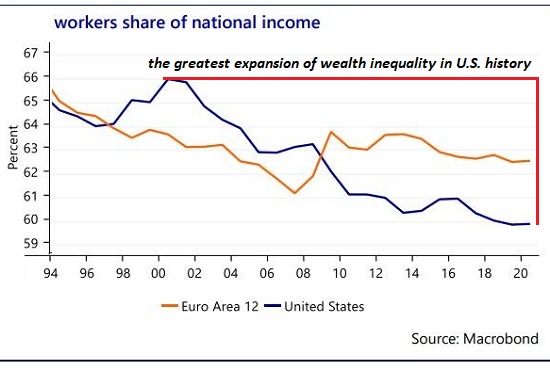

If “Getting Ahead” Depends on Asset Bubbles, It’s Not “Getting Ahead,” It’s Gambling

Given that the economy is now totally and completely dependent on inflating asset bubbles, it makes no sense to invest for the long-term. Beneath the endlessly hyped expansion in gross domestic product (GDP) of the past two decades, the economy has changed dramatically. The American Dream boils down to social and economic mobility, a.k.a. getting ahead through hard work, merit and wise investments in oneself and one's family.

Read More »

Read More »

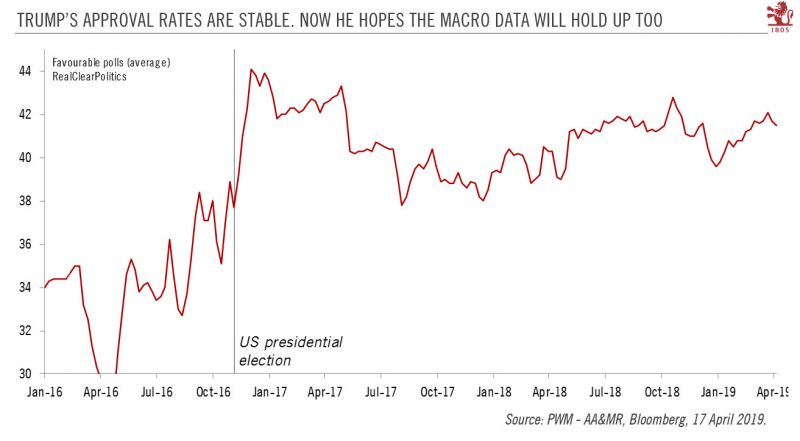

Charles Hugh Smith – Debt Rising Faster Than Income

Can team Trump keep the economy going until after the 2020 election? Journalist and book author Charles Hugh Smith says, “I think you are pushing a little bit on a string to get a 10 year long expansion to stretch out to 12 years. It’s like you are pushing sand uphill at some point. . … Continue reading »

Read More »

Read More »

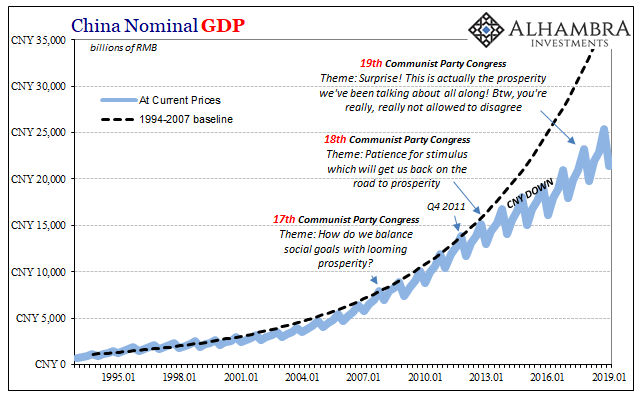

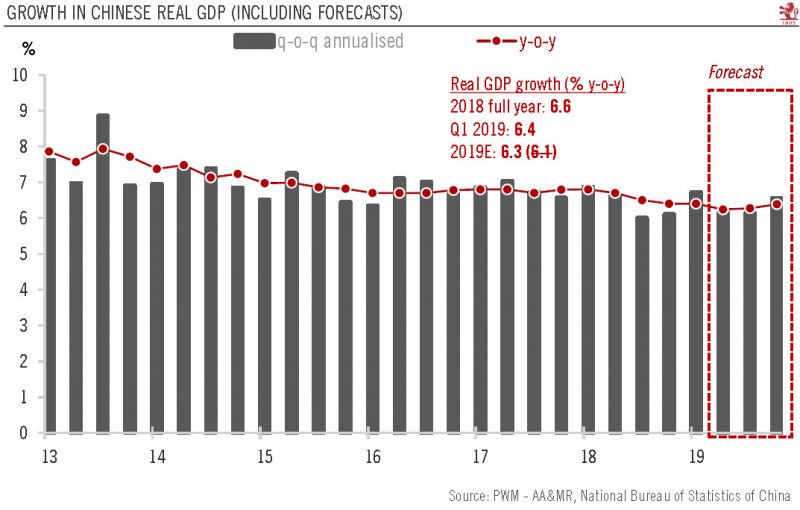

The Eurodollar, Unfortunately, Is What Is Rebalancing China’s Services Economy

If the “equation” CNY DOWN = BAD is valid, and it is, then what drives CNY downward in the first place? In conventional Economics, authorities command the currency to affect the level of exports. In reality, that’s not at all how it works. The eurodollar system of shadow money is almost purely calculated risk versus return.

Read More »

Read More »

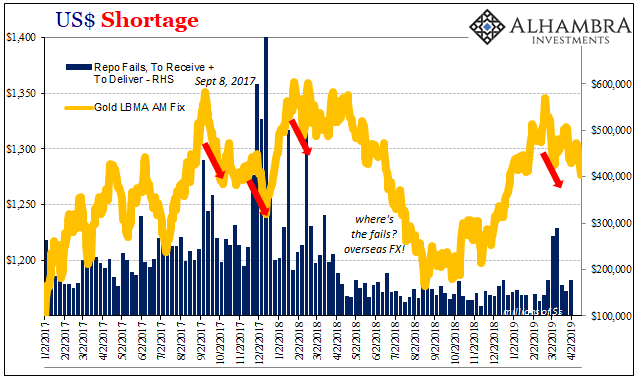

COT Blue: Distinct Lack of Green But A Lot That’s Gold

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge.

Read More »

Read More »

How Empires Fall: Moral Decay

There is a name for this institutionalized, commoditized fraud: moral decay. Moral decay is an interesting phenomenon: we spot it easily in our partisan-politics opponents and BAU (business as usual) government/private-sector dealings (are those $3,000 Pentagon hammers now $5,000 each or $10,000 each? It's hard to keep current...), and we're suitably indignant when non-partisan corruption is discovered in supposed meritocracies such as the college...

Read More »

Read More »

America’s Forced Financial Flight: Fleeing Unaffordable and Dysfunctional Cities

The forced flight from unaffordable and dysfunctional urban regions is as yet a trickle, but watch what happens when a recession causes widespread layoffs in high-wage sectors. For hundreds of years, rural poverty has driven people to urban areas: cities offer paying work and abundant opportunities to get ahead, and these financial incentives have transformed the human populace from largely rural to largely urban in the developed world.

Read More »

Read More »

China: Q1 growth beats expectations

The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in.The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest data releases still surprised to...

Read More »

Read More »

Business cycle could define Trump’s re-election chances

President Trump’s focus on getting re-elected in November 2020 may have implications for his economic policy choices.As we move closer to the 2020 presidential election, Trump has been blatantly leaning on the Federal Reserve to be more accommodative and has been trying to appoint nominees who share his preference for loose monetary policy to the Fed board.

Read More »

Read More »