The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in.

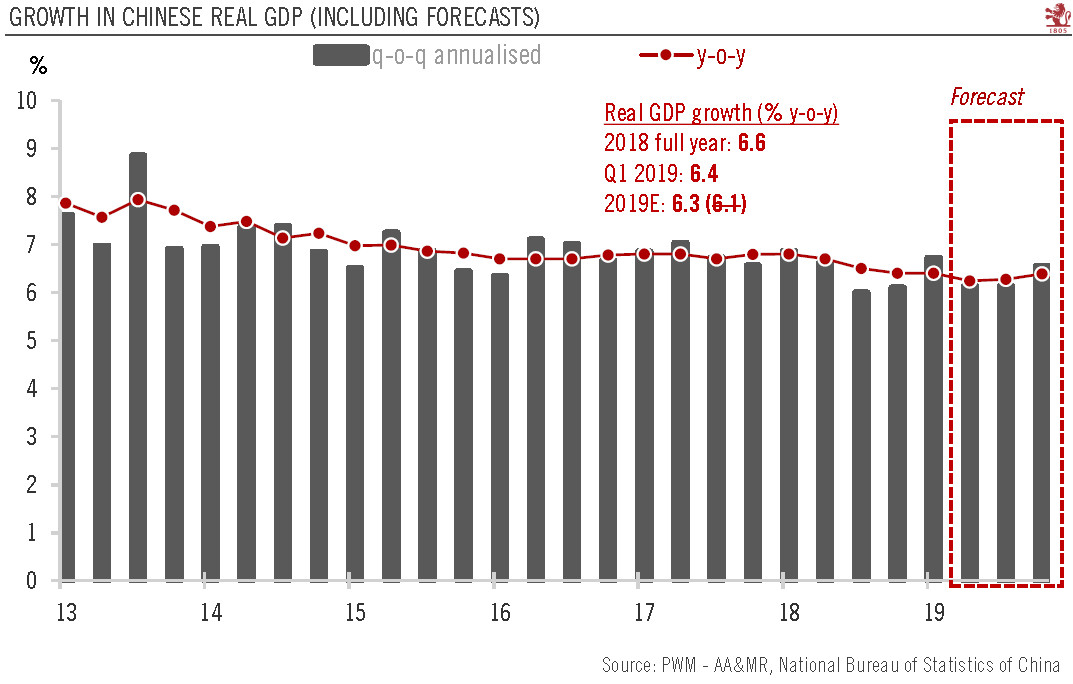

The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest data releases still surprised to the upside. In light of the strong Q1 results and the likely trade agreement between the US and China, we have decided to revise up our Chinese GDP forecast for 2019 to 6.3%, from 6.1% previously.

The better-than-expected Q1 results suggest that the effect of the government’s stimulus may have materialised earlier than we had expected (at least in part of the economy). Looking forward, we expect the People’s Bank of China (PBoC) to continue to be supportive, although the magnitude of liquidity injection may be less aggressive given the strong credit figures in Q1. Meanwhile, fiscal policy will continue to play a greater role in driving growth. In addition, new measures will likely be announced in the near term to stimulate consumption growth.

| As we turn more bullish on China’s growth outlook, we also recognise that inflation could be a potential risk to the more positive macro picture. Due to the spread of African swine fever, pork production has dropped sharply in China (down by 5.2% y-oy in Q1) and the negative trend could last much longer and run deeper. The shortage in supply has already made itself visible on food prices in March, which rose 4.1% y-o-y, compared to an average of 1.3% in the first two months of the year. Given that China is the world’s largest producer and consumer of pork (consuming about half of global pork production), this could add some significant inflation pressure ahead and the impact will likely not be limited to China. While we do not expect the PBoC to overreact to this one-time supply-side shock, the potential surge in headline inflation could have an impact on market sentiment and thus put some restrictions on monetary policy in the second half of this year. |

Growth in Chinese Real GDP 2013-2019(see more posts on China Gross Domestic Product, ) |

Tags: China Gross Domestic Product,Macroview,newsletter,People's Bank of China