Category Archive: 4) FX Trends

FX Daily, August 22: Tick Up in EMU PMI Does Little, Waiting for Powell

Overview: Soft data in Asia and the continued decline in the yuan (six days and counting) prevented Asian equities from following the US lead from yesterday when the S&P 500 advanced by 0.8%. European shares are paring yesterday's 1.2% advance despite an unexpected gain in the EMU flash PMI. US shares are little changed in the European morning.

Read More »

Read More »

FX Daily, August 21: European Stocks Snap Back, Market Hopeful Italian Election can be Delayed

The end of the US equity three-day advance yesterday weighed on Asia Pacific shares today. Most benchmarks fell. Better than expected trade data helped Thailand buck the trend. A firmer tone emerged in the European morning, and the Dow Jones Stoxx 600 has recouped yesterday's losses and more. It was led higher by consumer discretionary, energy, and industrials.

Read More »

Read More »

FX Daily, August 20: Marking Time Ahead of PMI and Powell

Overview: Global equities and bonds are firmer in quiet turnover, and the dollar is narrowing mixed in narrow ranges. The big events of the week, the eurozone flash PMI and Powell's speech at Jackson Hole still lie ahead. The MSCI Asia Pacific Index rose for the third consecutive session, led by Korea and Australia's 1%+ gains.

Read More »

Read More »

FX Daily, August 19: China’s Rate Reform Helps Markets Extend End of Last Week Recovery

Overview: China announced some changes in its interest rate framework that is expected to lead to lower rates. This helped lift equity markets, which were already recovering at the end of last week from the earlier drubbing. Chinese and Hong Kong shares led the regional rally with 2-3% gains. The Nikkei gapped higher for the third time in six sessions, and the first two were followed by lower gaps.

Read More »

Read More »

FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends.

Read More »

Read More »

First a European recession, then everywhere else

Adam Button from ForexLive outlines about how a drop in the euro will lead to cascading consequences for the global economy.

LET'S CONNECT!

Facebook ► http://facebook.com/forexlive

Twitter ► https://twitter.com/ForexLive

Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

First a European recession, then everywhere else

Adam Button from ForexLive outlines about how a drop in the euro will lead to cascading consequences for the global economy. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

FX Daily, August 16: Markets Take Collective Breath Ahead of the Weekend

Overview: The global capital markets are ending the tumultuous week calmly, but it is far from clear that is will hold long. Next week's flash PMIs have potential to disappoint, and there is risk of new escalation in the US-China trade conflict as the PRC threatens to take action to countermeasures to the new US tariffs.

Read More »

Read More »

FX Daily, August 15: Animal Spirits Lick Wounds

Overview: It took some time for investors to recognize that the scaling back of US tariff plans was not part of a de-escalation agreement. There was an explicit acknowledgment by US Commerce Secretary Ross that there was no quid pro quo. The US tariff split was more about the US than an overture to China.

Read More »

Read More »

FX Daily, August 14: Markets Paring Exaggerated Response to US Blink

The US cut its list of Chinese goods that will be hit with a 10% tariff at the start of next month by a little roe than half, delaying the others until the mid-December. This spurred a near-euphoric response by market participants throughout the capital markets. However, as the news was digested, it did not seem as much of a game-changer as it may have initially.

Read More »

Read More »

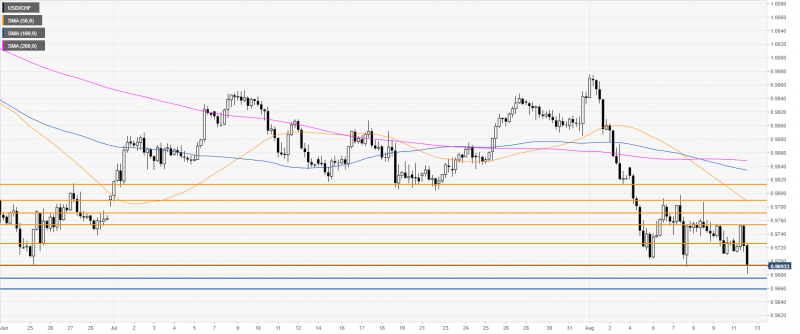

USD/CHF technical analysis: Greenback jumps and settles above 0.9726 as tariffs gets delayed

USD/CHF is trading off 2-month lows below the main daily simple moving averages (DSMAs). US equity markets are rising sharply as US tariffs are to be delayed to December 15. The news was perceived as risk-on, sending safe-haven CHF, JPY and gold down.

Read More »

Read More »

FX Daily, August 13: Investors Remain on Edge

Overview: The confrontation in Hong Kong and the fallout from the Argentine primary over the weekend join concerns the conflict between the two largest economies and slower growth to force the animal spirits into hibernation. Global equities remain under pressure. Japan's Topix joined several other markets in the region to have given up its year-to-date gain.

Read More »

Read More »

USD/CHF technical analysis: Greenback under pressure below 0.9700 as sellers challenge June lows

CHF is up as Wall Street indices start the week in the red. The level to beat for bears are at the 0.9675 and 0.9660 levels.

Read More »

Read More »

FX Daily, August 12: Yen Remains Bid, While Macri’s Loss in Argentina Weighs on Struggling Mexican Peso

Overview: China again tried to temper the downside pressure on the yuan, and this appears to be helping the risk-taking attitude. Many centers in Asia were closed today, including Japan and India, though most of the other equity markets advanced modestly, including China, Korea, and Australia. Europe's Dow Jones Stoxx 600 opened firmer but is staddling little changed levels unable to stain any upside momentum.

Read More »

Read More »

FX Weekly Preview: Macro Deterioration

The US-China tensions remain the dominant driver of investor risk appetites. President Trump has repeatedly accused China of manipulating its currency on twitter, and finally Treasury Secretary Mnuchiin acquiesced after China failed to prevent the dollar from rising above CNY7.0.

Read More »

Read More »

USD/CHF technical analysis: Greenback stable near 0.9755 as US stocks recover

The demand for the Swiss franc decreases as Wall Street indices are gaining strength. The level to beat for bulls are at 0.9790 and 0.9815 level.

Read More »

Read More »

FX Daily, August 8: PBOC Helps Stabilize CNY, while US Equity Recovery Lifts Sentiment

Overview: The challenges for investors have not gone away, but a combination of factors has helped stabilize the capital markets. The PBOC set the dollar's reference rate above CNY7.0, but not as high as anticipated, and this has seen the yuan strengthen modestly today. Meanwhile, the strong recovery in the S&P 500 has spilled over and helped lift global equities.

Read More »

Read More »

Yes, the Dollar is Above CNY7.0, but No, the Sky is Not Falling

The world's two great powers are at loggerheads. Chinese nationalism meet your sister, US nationalism. Import substitution strategy of Made in China 2025 meet your cousin Make America Great Again. Paradoxically, or dialectically, the similarities are producing divergent interests that extend well beyond economics and trade policy.

Read More »

Read More »

FX Daily, August 7: Three Asian Central Banks Surprise Investors

While investors keep a watchful eye on the dollar fix in China (a little firmer than projected) and tensions with the US, two other developments compete for attention. The Reserve Bank of New Zealand and the central banks of India and Thailand surprised the market with lower rates. The RBNZ cut by 50 bp, India by 35 bp, and the fact that Thailand cut at all was unexpected.

Read More »

Read More »

FX Daily, August 6: Markets Stabilize with Help of CNY Fix in Muted Turnaround Tuesday

Overview: The escalation of the economic conflict between the world's two largest economies is dominating the capital markets. The US cited China as a currency manipulator after the North American markets closed, ensuring the troubled start to Asian trading after the US equities and yields plummeted on Monday. The VIX surged to 25%, doubling in the past week.

Read More »

Read More »