Category Archive: 4) FX Trends

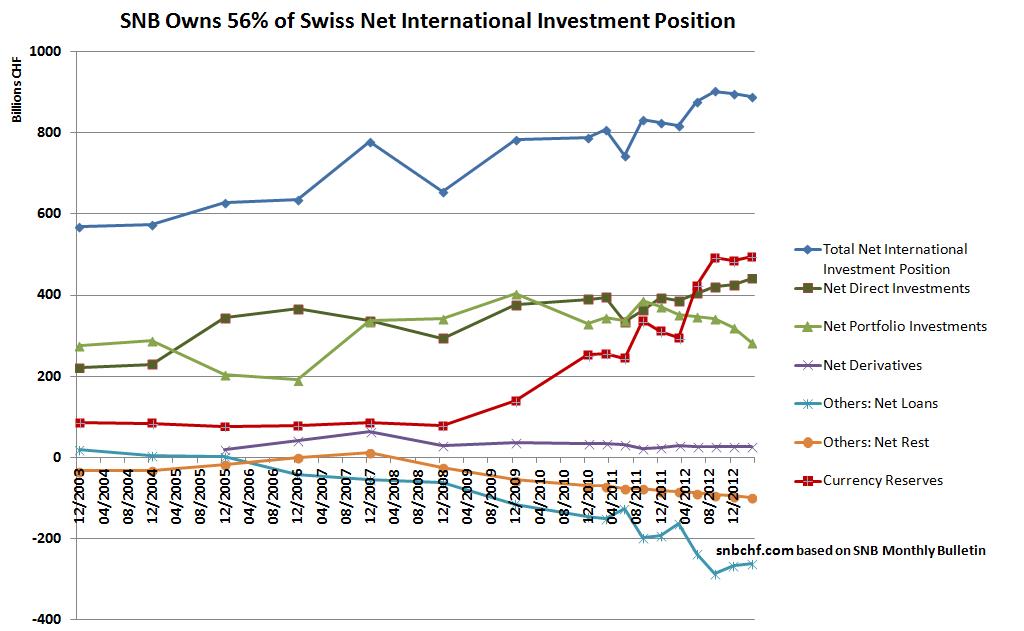

(10.1.2) Net International Investment Position Switzerland and Italy

We compare aspects of the Net International Investment Positions for Italy and Switzerland

Read More »

Read More »

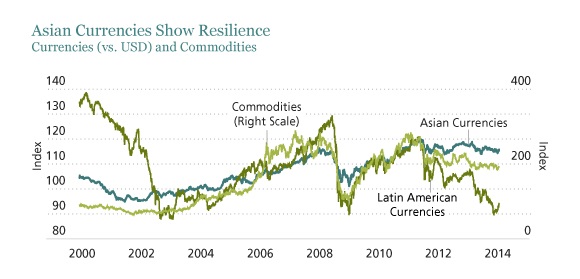

(1) What Determines FX Rates?

The effects of so-called “currency wars” and other central bank actions are small compared to the long-term impact made by these five catalysts, which include credit cycles, trade balance, differences in economic growth, and more.

Read More »

Read More »

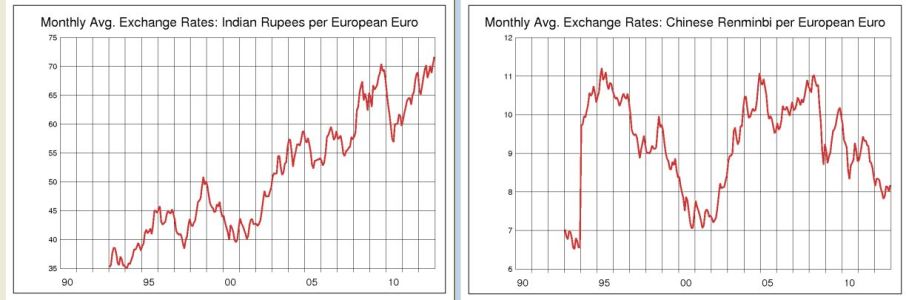

(1.2) Explaining price movements in FX rates

We indicate the main factors that influence FX rates in the longer term. We explain the movements of currencies based on these factors.

Read More »

Read More »

(2) FX Theory: Purchasing Power Parity

An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency's purchasing power.

Read More »

Read More »

Trading a Non trending market. A look at the GBPAUD

In this video, Greg Michalowski of ForexLive.com will discuss how to trade Non trending markets using the GBPAUD. SUBSCRIBE TO OUR EMAIL LIST! http://forexlive.us7.list-manage.com/… LET’S CONNECT! Google+ ► https://plus.google.com/1026488501294… Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Linkedin ► https://www.linkedin.com/company/fore… High Risk Warning: All news, opinions, research,...

Read More »

Read More »

Forex technical trading: Is the GBPUSD basing for a move higher?

The GBPUSD found support buyers against the 200 hour MA after Yellen’s initial comments on Capitol Hill. The rally higher has run into topside resistance but the gains are being maintained. Is the price action a suggestion of further gains to come? There is room to roam if the support can hold and the ceiling …

Read More »

Read More »

Preview: Fed Chair Yellen Senate Testimony Feb 24 2015

In this hangout, Adam Button and Greg Michalowski from ForexLive.com will preview Fed Chair Yellens Senate testimony and how to trade the event.

Read More »

Read More »

(2.2) Purchasing Power Parity: Big Mac and Starbucks Tall Latte

The following table compares the Big Mac and the Starbucks Tall Latte index among different countries. It explains the issues with these measurements.

Read More »

Read More »

(2.3) Differences in global CPI baskets

Typically poorer countries have a basket with a higher weight for food and other consumption goods, but richer states give them a smaller weight. Here the full details over different countries

Read More »

Read More »

A technical look at the GBPUSD for the week starting February 23, 2015

The GBPUSD has been in a corrective mode since bottoming in January. Last week the pair made a new corrective high but ran into a cluster of resistance that slowed the rise. Will the new trading week, break above that resistance or is the upside correction over for now? SUBSCRIBE TO OUR EMAIL LIST! http://forexlive.us7.list-manage.com/… …

Read More »

Read More »

A technical look at the USDJPY for the week starting February 23rd

The USDJPY remains contained and non trending with defined high and low levels. These levels traders should use as clues to their trading in the week starting January 23rd. Greg Michalowski, director of technical analysis and trader education will outline his technical focused views on this currency pair and how best to trade it. SUBSCRIBE …

Read More »

Read More »

A technical look at the EURUSD for the week starting Feb 23rd

The EURUSD is trading in an up and down trading range. How can traders take advantage of the trading environment. Greg Michalowski of ForexLive.com gives an overview of the non trending environment and outlines how he would trade the market. SUBSCRIBE TO OUR EMAIL LIST! http://forexlive.us7.list-manage.com/… LET’S CONNECT! Google+ ► https://plus.google.com/1026488501294… Facebook ► http://facebook.com/forexlive Twitter …...

Read More »

Read More »

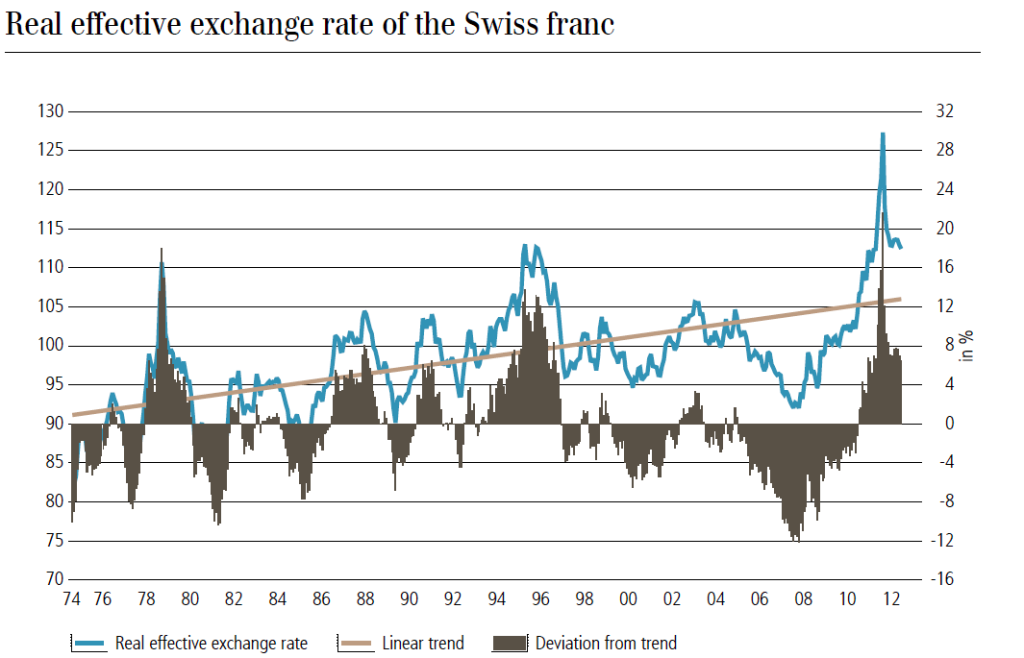

(2.5) Real Effective Exchange Rate, Swiss Franc, Yen and Renminbi

The weighted average of country's currency relative to index or basket of other major currencies adjusted for inflation. We explain the Real Effective Exchange Rate for the Franc, the Yen and Renmimbi

Read More »

Read More »

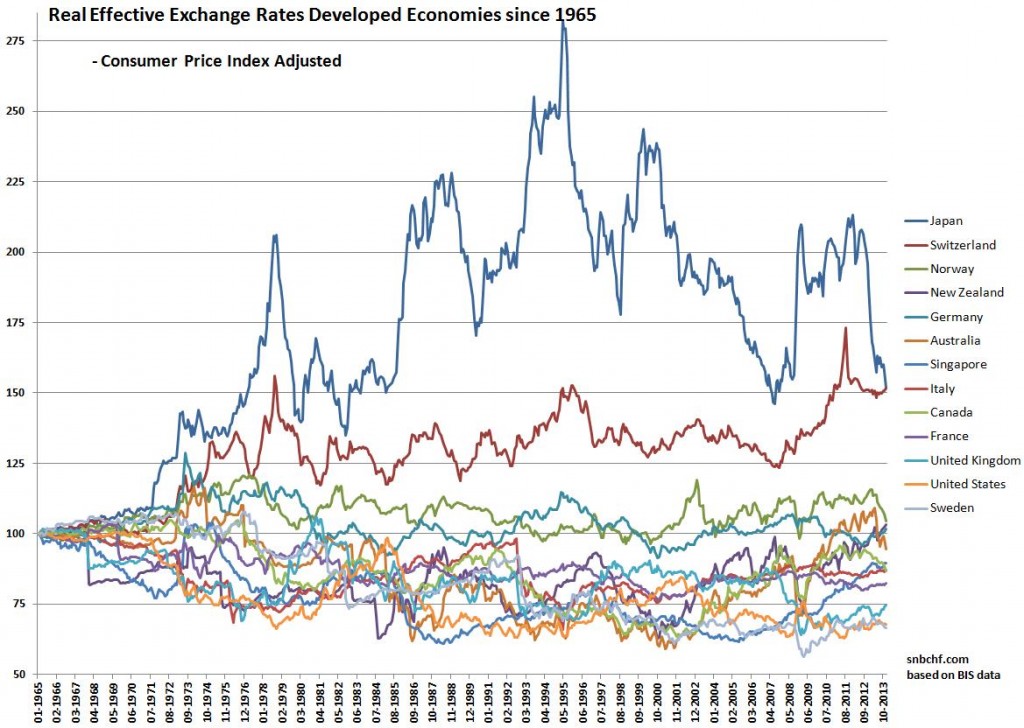

(2.6) CPI-based Real Effective Exchange Rate Since 1965: Yen Still Most Overvalued Currency

If we calculate Real Effective Exchange rates on the base year 1965, the Japanese yen remains the most overvalued currency.

This analysis is based on the real effective exchange rate (REER) provided by the Bank of International Settlement (BIS) and a consumer price-index adjusted exchange rate.

The real value of the yen is around 50% higher than 1965, the same applies to the Swiss franc.

Read More »

Read More »

Marc Chandler on the Negative Interest Rate Trend in Europe

Feb 20 – Cris Sheridan welcomes Marc Chandler, author and Global Head of Currency Strategy at Brown Brothers Harriman. Marc discusses the reasons behind the negative interest rate trend in many European countries. http://www.financialsense.com/subscribe

Read More »

Read More »