Category Archive: 4) FX Trends

Great Graphic: Selected GDP Performance since 2008 and Policy

This Great Graphic was tweeted by Martin Beck, and it comes from Oxford Economics, using Haver Analytics database. It shows the relative economic growth since 2008 for the US, UK, Japan, and EMU.

Read More »

Read More »

FX Daily, June 21: Heavy Oil Weighs on Yields and Lifts Yen

The US dollar is narrowly mixed against the major currencies. The drop in oil prices (3.3% this week) is seen as one of the factors that may be underpinning the appetite for fixed income, and this, in turn, is lifting the yen. The greenback had approached JPY112 yesterday, but with the drop in oil prices and yields has seen it retreat toward JPY111.00.

Read More »

Read More »

FX Daily, June 20: Officials Fill Vacuum of Data to Drive FX Market

The light economic calendar has cleared the field to allow officials to clarify their positions. Yesterday it was NY Fed President Dudley and Chicago Fed Evans who argued that economic conditions continued to require a gradual removal of accommodation. The Fed's Vice Chairman Fischer did not address US monetary policy directly but did note that housing prices were elevated and that low interest rates

contributed.

Read More »

Read More »

FX Daily, June 19: Dollar Mixed while Equities Recover to Start Eventful Week

The US dollar is mixed against the major currencies, and while it is firmer against the euro and yen, it is within last week's ranges. The success of Macron's new party in France, and the majority is secured, was well anticipated by investors and is having little effect on today's activity in the capital markets.

Read More »

Read More »

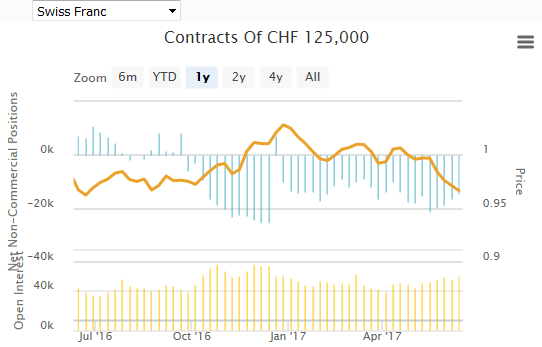

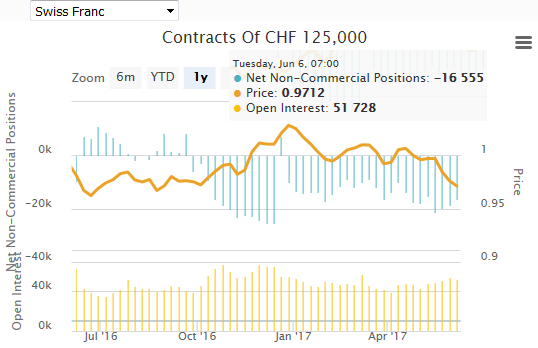

Weekly Speculative Positions (as of June 13): Specs Cut Euro, Yen, and Aussie Exposure and Do Little Else

The net short CHF position has fallen from 16.5 short to 14.5K contracts short (against USD). We wonder how long this will be the case, given that we expect Euro zone inflation to fall under 1% from December 2017 onward.

Read More »

Read More »

FX Weekly Preview: Events Not Data Key in Week Ahead

Light economic data calendar, but look for downtick in eurozone flash PMI. Soft Canadian retail sales (volume) and softer CPI (base effect) could take some of the sting from the recent BoC official comments. MSCI decision on China, Argentina, Saudi Arabia, and South Korea may have the broadest and long-lasting impact of the five key events we highlight.

Read More »

Read More »

FX Weekly Review, June 12 – June 17: Greenback Still Trying To Turn

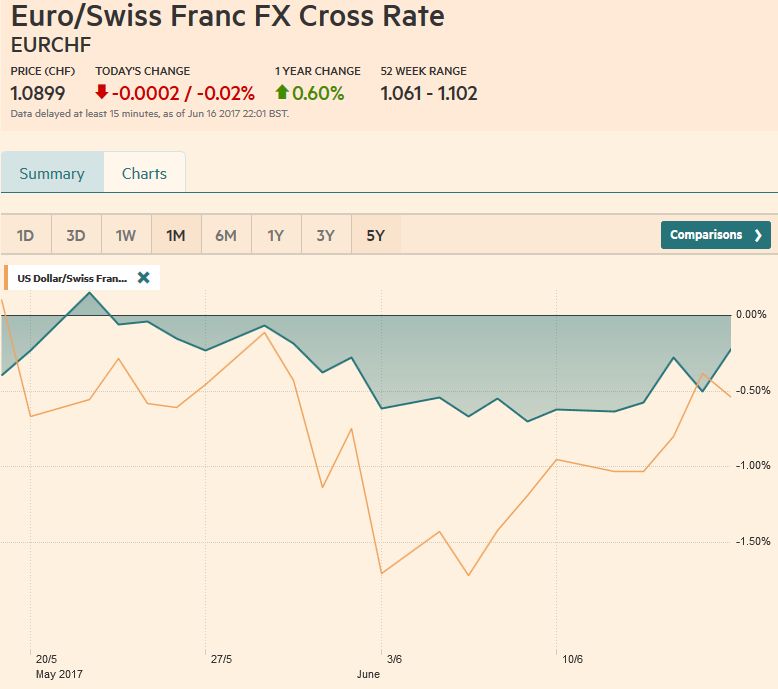

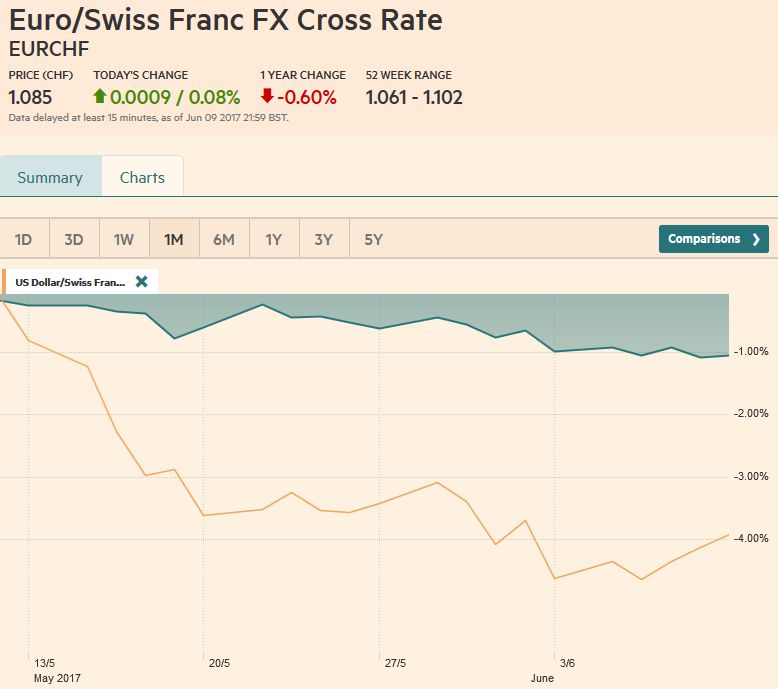

Swiss Franc vs USD and EUR Rarely in the foreign exchange market is there a V-shaped extreme. Most of the time, the high or low is a process that is carved over time. Although the explanation of the dollar’s weakness here in H1 vary, we continue to believe that the longer-term cyclical rally, the third since … Continue reading »

Read More »

Read More »

Great Graphic: Value vs Growth

This Great Graphic, created on Bloomberg show the performance of growth and value stocks since the start of December 2016. The yellow line is the Russell 1000 Growth Index. The white line is the Russell 1000 Value Index. The outperformance of the former is clear.

Read More »

Read More »

FX Daily, June 16: Dollar Slips In Consolidation, but Extends Recovery Against the Yen

As the market heads into the weekend, the US dollar is trading softer as it consolidates. It is within yesterday's ranges against the major currencies but the Japanese yen. The dollar has made a dramatic recovery against the yen. It traded near JPY108.80 in the middle of the week and pushed through JPY111 in late in the Tokyo morning. The greenback is above its 20-day moving average against the yen for the first time in a month.

Read More »

Read More »

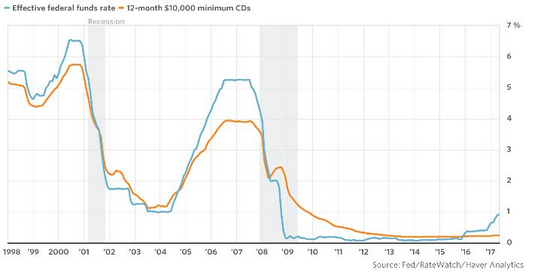

Great Graphic: Sticky Pass Through

This Great Graphic was posted by Steve Goldstein at MarketWatch. The blue line shows the effective Fed funds rate. The orange line depicts the average interest rate on a $10,000 one-year CD.

Read More »

Read More »

FX Daily, June 15: Dollar Trades Higher in Wake of the FOMC

The US dollar gains scored yesterday in response to what appeared to be a more hawkish FOMC than expected have been extended today. The euro and the Swiss franc have recorded new lows for the month.

Read More »

Read More »

FX Daily, June 14: FOMC and upcoming SNB

The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow.

This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen.

It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates.

Read More »

Read More »

FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected.

Read More »

Read More »

FX Daily, June 12: Ahead of Central Bank Meetings, Politics Dominates

The US dollar is trading within its pre-weekend range against the major currencies as participants await the central bank meeting starting in the middle of the week. The Federal Reserve, Bank of England, and the Bank of Japan meet.

Read More »

Read More »

Weekly Speculative Positions (as of June 06): Speculators Trimmed Exposure Ahead of Super Thursday

The net short CHF position has fallen from 18.5 short to 16.5K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. In the CFTC reporting week that covered the US employment data and the run-up to Super Thursday that featured an ECB meeting, former FBI Director Comey's testimony before the Senate Intelligence...

Read More »

Read More »

FX Weekly Preview: Politics and Economics in the Week Ahead

FOMC, BoE, and BOJ meet next week; only the Fed is expected to change policy. High frequency data may be less important than the central bank meetings and politics in the week ahead. UK political situation is far from resolved, and US drama continues, while several hot spots in the EMU are emerging.

Read More »

Read More »

FX Weekly Review, June 05 – June 10: Sterling Leads Dollar Recovery

The US Dollar has lost 4% against the franc since the beginning of May, while the euro is down only 1%. Most important events in this week were the ECB meeting and the UK elections. The inability of the Tory Party to secure a parliamentary majority spurred a sharp decline in sterling.

Read More »

Read More »

FX Daily, June 09: Sterling Shocked, Dollar Broadly Firmer

What looked like a savvy move in late April has turned into a nightmare. Collectively, voters have denied the governing Conservative party a parliamentary majority. The uncertainty today does not lie yesterday with the known unknown, but with the shape of the next government and what it means for Brexit.

Read More »

Read More »

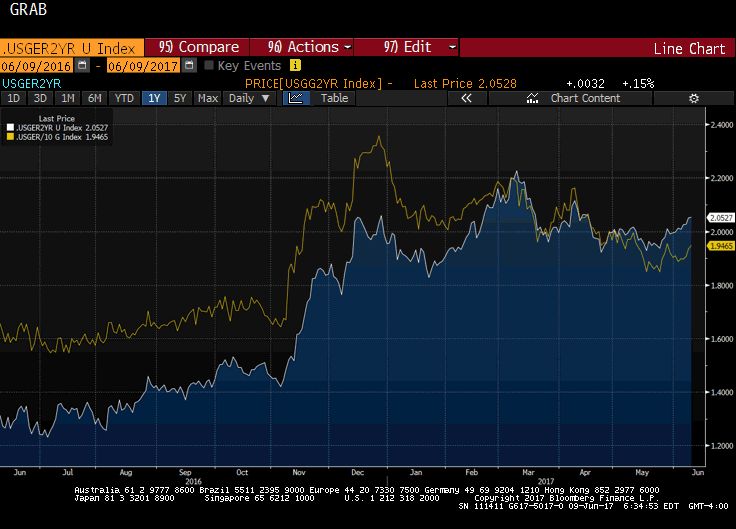

Great Graphic: Another Look at US-German Rate Differentials

This Great Graphic, created on Bloomberg, depicts the interest rate differential between the US and Germany. The euro-dollar exchange rate often seems sensitive to the rate differential. The white line is the two-year differential and the yellow line is the 10-year differential.

Read More »

Read More »

7 Things to Watch on UK Election Night

How to trade on the UK election. Adam Button talks about the UK election night and the finer points of trading the results as they roll out. Visit ForexLive for real-time news, analysis and technical analysis of the forex market. http://www.forexlive.com/ LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Google+ ► https://plus.google.com/+Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »