Category Archive: 4) FX Trends

Sterling: Has the Breaking Point been Reached?

Sterling's decline is not longer coinciding with lower rates. Sterling's decline is boosting inflation expectations. If the inflation expectations are realized (Sept CPI next week), it will quickly erode what ever competitive gains there may have been.

Read More »

Read More »

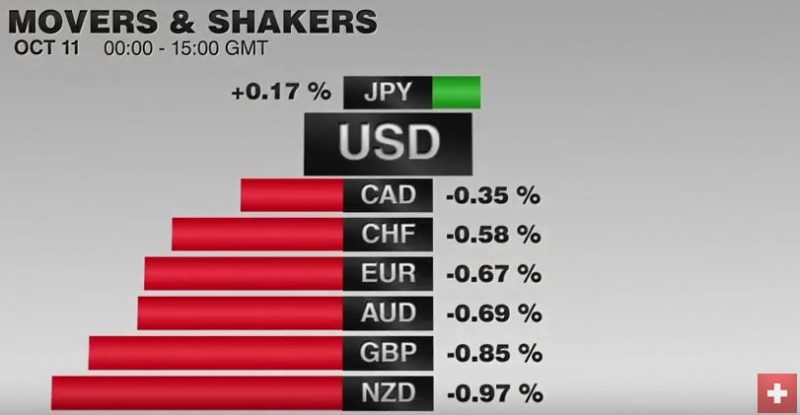

FX Daily, October 11: The Dollar Remains Bid

The US dollar is bid against all the major and most emerging market curerncies. An important driver is the backing up of US rates. The two-year yield, which is particularly sensitive to Fed policy is at it highest levbel since early June (~86 bp). The US 10-year yield is five basis points hihger today at 1.77%, which is the highest in four months.

Read More »

Read More »

Great Graphic: Euro is Approaching Year-Long Uptrend

The year-long euro uptrend comes in near $1.1035, just below the August lows. The technical are fragile, but the euro is below its lower Bollinger Band. The fundamental driver seems to be the backing up of US rates, and widening premium over Germany.

Read More »

Read More »

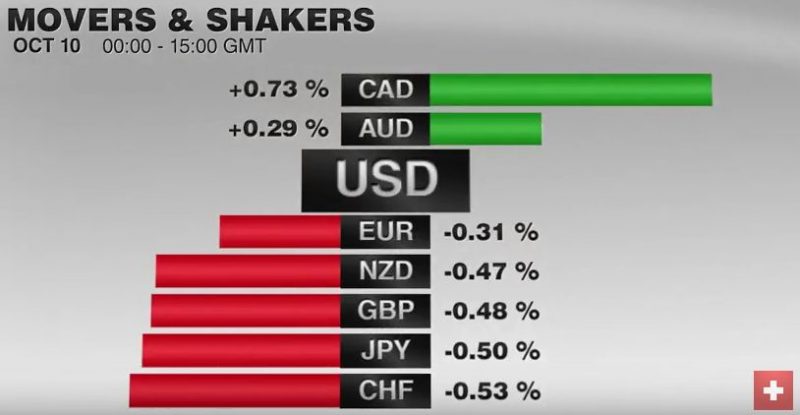

FX Daily, October 10: Dollar after the Second Debate

The US dollar has started the new week on a firm note. The light news stream and holidays in Japan, Canada and the United States make for a subdued session. Notable exceptions to the dollar's gains are the Canadian dollar and Mexican peso. Both currencies appear to have been. underpinned by US political developments, the main feature of which is the implosion of the Trump campaign.

Read More »

Read More »

FX Weekly Preview: The Week Ahead: It’s Not about the Data

High frequency economic reports will be not be among the key drivers of the capital markets in the week ahead.The light schedule, consisting mostly of industrial production in Europe, inflation for Scandinavia, and US retail sales, will have minimal impact on rate expectations.

Read More »

Read More »

Great Graphic: US-German 2-Yr Differential and the Euro

The US premium over Germany is at its widest since 2006. This is despite a small reduction in odds of a hike in December. There are many forces are work, but over time, the widening differential will likely give the dollar better traction.

Read More »

Read More »

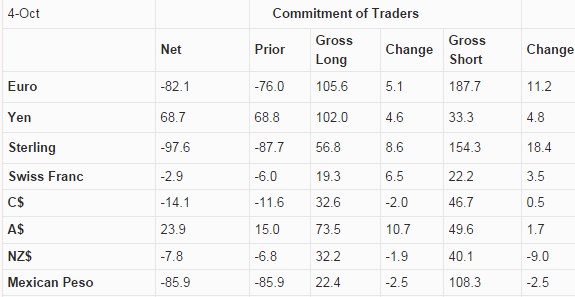

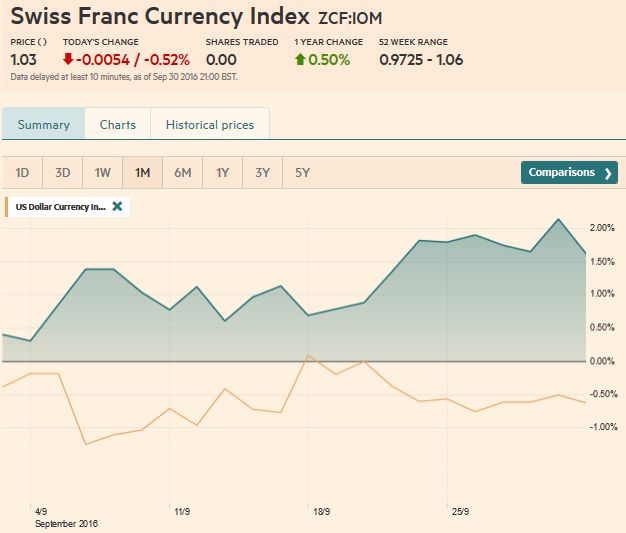

Swiss Franc Net Shorts Getting Reduced

Last week SNB Q3 window cleaning that led to a big CHF net short position. This week this changed again. Both longs and shorts on CHF increased, but the net short position fell.

Read More »

Read More »

British Pounding

Flash-Crashed. Earlier this morning the British Pound suddenly found itself on the receiving end of a 6% flash crash during Asian trading hours. Some of the losses have been recouped since then, but that will be of little consolation to anyone who may have been long the GBP overnight.

Read More »

Read More »

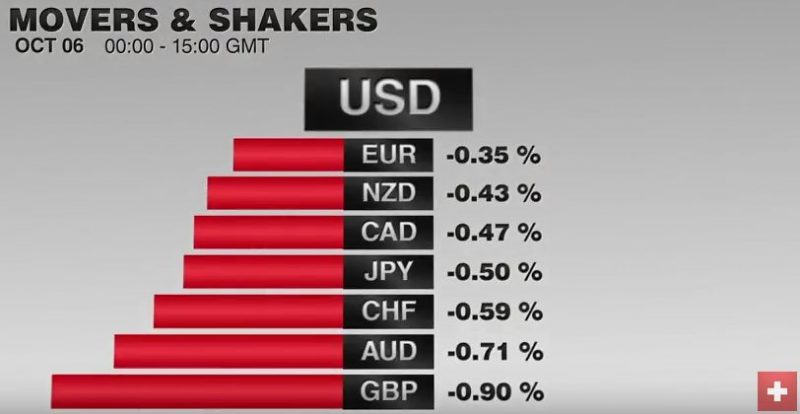

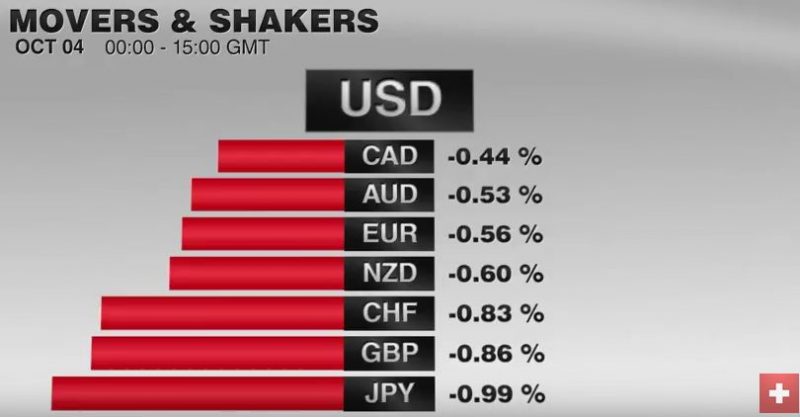

FX Weekly Review, October 03-07: Dollar Profits on Strong ISM Index

The Franc index lost considerably in the last week, in particularly in comparison to the dollar index. Reason was the exceptionally strong U.S. ISM Non-Manufacturing Index.

Read More »

Read More »

FX Daily, October 07: Sterling Stabilizes After Harrowing Drop, Now Jobs

Sterling again steals the limelight. In early Asia, sterling inexplicably dropped nearly eight cents in minutes (to ~$1840), and on some platforms, may have traded below $1.1380. It almost immediately rebounded but has not resurfaced above $1.2480.

Read More »

Read More »

US and Canada Jobs: Sill Strong Enough for a Rate Hike

The US grew 156k jobs in August, missing the median estimate by about 16k. The July series was revised up by 16k. The unemployment and participate rate ticked up 0.1% to 5.0% and 62.9% respectively. Hourly earnings rose 0.2% to lift the year-over-year rate to 2.6% from 2.4%. The average work week increased to 34.4 hours from 34.3.

Read More »

Read More »

Algos, Barriers, Rumors: Some Theories On What Caused The Pound Flash Crash

As reported moments ago, just around 7:07pm ET, cable snapped and plunged by what some say may have been as much as 1200 pips, dropping from 1.26 to as low as 1.14 according to some brokers, before snapping back up.

Read More »

Read More »

FX Daily, October 06: The Dollar is Firm in Quiet Market

The US dollar is advancing against the major and most emerging market currencies. Activity is subdued and ranges are narrow. We share four observations about the price action. First, the euro has been unable to sustain upticks even after Germany reported a jump in industrial orders three-times more than the median estimate (1.0% vs. 0.3%).

Read More »

Read More »

Canadian Dollar: A Little Less About Oil, a Little More about Rates

The Canadian dollar's link to oil has loosened. Its sensitivity to interest rates has increased. Lumber issue is coming to a head shortly.

Read More »

Read More »

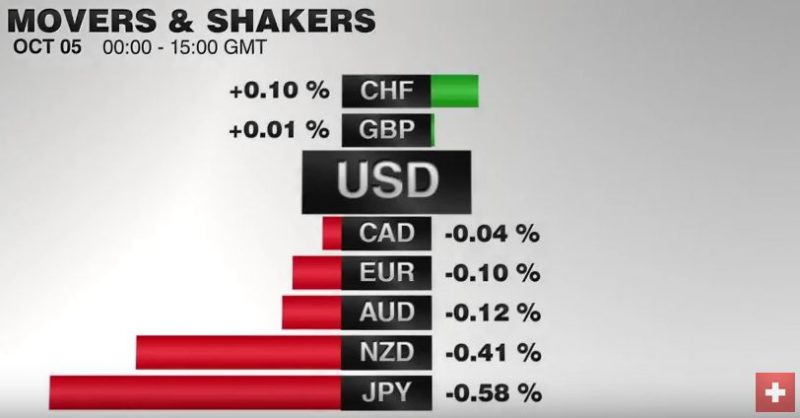

FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

After the sudden rise to 1.0973 the EUR/CHF is falling again. The volatiliy is related to the CHF speculative postion, that suddenly was Short CHF. Traders that moved with the SNB Window Dressing for Q3 are closing their shorts again.

Read More »

Read More »

Why Portugal Matters

DBRS reviews its investment grade rating of Portugal on Oct 21. A cut in its rating would have far reaching implications. A cut in the outlook is more likely than a cut the rating.

Read More »

Read More »

FX Daily, October 04: Sterling’s Slide Continues, EUR/CHF Soars Again

UK Prime Minister May's comments at the Tory Party Conference over the weekend played up the risk of what has been dubbed a hard Brexit and triggered a slide in sterling saw it fall to new 30-year+ low against the dollar just below $1.2760. The EUR/CHF has soared again. Later during the day, it has even achieved 1.0970.

Read More »

Read More »

Cool Video: Bloomberg TV-Dollar Supercycle and Brexit

I reiterated my long-standing view that the euro is going to retest its record lows before the Obama Dollar Rally is over. I warn that the UK's quest to regain sovereignty is an illusion. I announce that my new book will be published in early December or early January.

Read More »

Read More »

The Yen in Three Charts

The dollar is taking out a several month downtrend against the yen. The correlation between the yen and the S&P 500 has broken down. The US 2-year premium over Japan has steadily risen.

Read More »

Read More »

FX Daily, October 03: May’s Confirmation Sends Sterling Lower

Sterling has a bad case of the Monday blues. Even the moon looks distraught. Prime Minister May has confirmed earlier suggestions that she will trigger Article 50 to formally begin its divorce proceedings from the EU at the end of Q1 17. Several officials have already hinted this time frame, though many have been skeptical that Article 50 would be triggered at all, given the complexities of the issues.

Read More »

Read More »