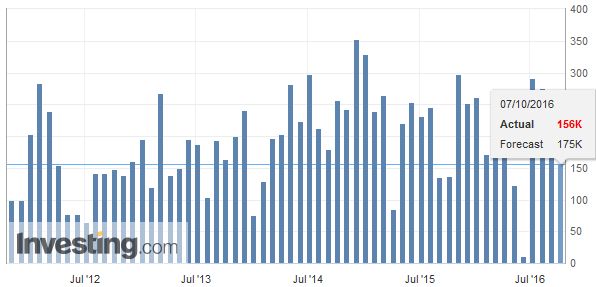

United StatesThe US grew 156k jobs in August, missing the median estimate by about 16k. |

U.S. Nonfarm Payrolls, September 7(see more posts on U.S. Nonfarm Payrolls, ) |

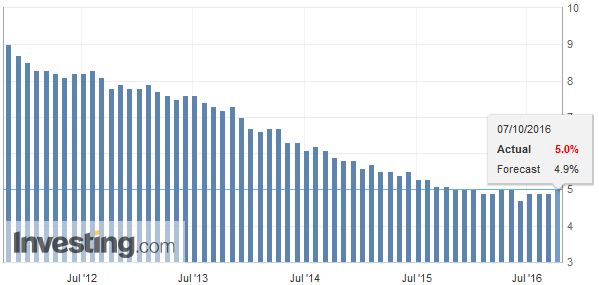

Unemployment RateThe July series was revised up by 16k. The unemployment and participate rate ticked up 0.1% to 5.0%… |

U.S. Unemployment Rate, September 2016(see more posts on U.S. Unemployment Rate, ) . Source: Investing.com - Click to enlarge |

Participation Rate… and 62.9% respectively. |

U.S. Participation Rate, September 2016(see more posts on U.S. Participation Rate, ) . Source: Investing.com - Click to enlarge |

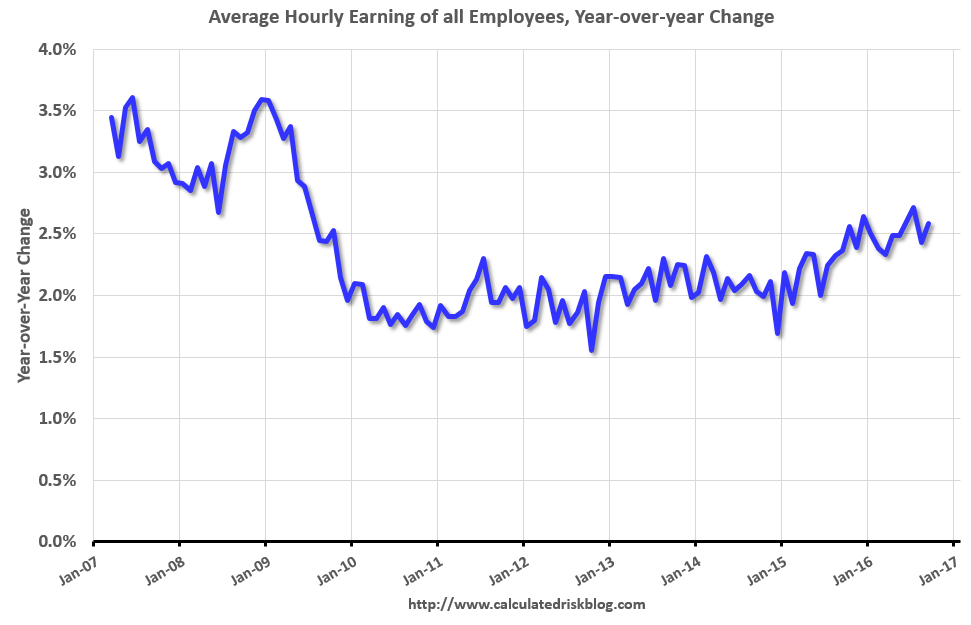

Average Hourly EarningsHourly earnings rose 0.2% to lift the year-over-year rate to 2.6% from 2.4%. The average work week increased to 34.4 hours from 34.3. |

U.S. Average Hourly Earnings(see more posts on U.S. Average Earnings, ) |

As we noted the initial estimate in September has typically disappointed since the financial crisis. However, we had thought this time could be different because of a number of other reports, including weekly jobless claims, jobs availability, payroll withholding, payback due to weather in August, and the monster rise in the employment component of the service ISM.

Nevertheless, those expecting a Fed hike in December will likely be unswayed by today’s report. We have argued the market was exaggerating the risk of a November hike. The FOMC meeting is a week before the election and a rate move then would be unprecedented, and the meeting does not include update forecasts or a press conference. We expect market will reduce the chance of a November hike.

The government shed 11k jobs. This is the most in a year. It appears that the loss of teaching-related jobs fell more than the job gain related to the election. The 13k drop in manufacturing jobs, following a 16k loss in July warns of knock-on impact on output. Construction added 23k jobs, which is a little more than retailers (22k). Employment growth in leisure and hospitality was the slowest in four months (15k). The underemployment rate remained at 9.7% where it has been for six of the past eight months.

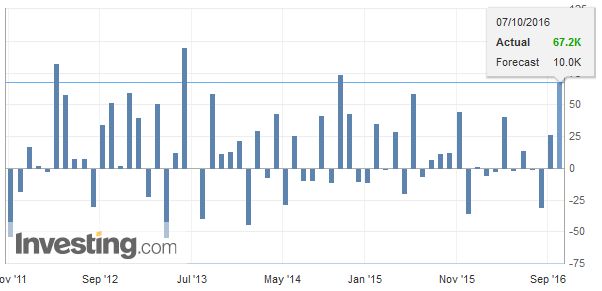

CanadaSeparately, Canada also reported September employment. Canada created 23k full-time jobs after 52.2k in July. Overall it grew 67.2k jobs, 44.1k of which were part-time. |

Canada Employment Change, September 2016(see more posts on Canada Employment Change, ) . Source: Investing.com - Click to enlarge |

| The participation rate rose to 65.7% form 65.5%, so the fact that the unemployment rate remained at 7.0% was a constructive development. |

Canada Unemployment Rate September 2016(see more posts on Canada Unemployment Rate, ) Source: Investing.com - Click to enlarge |

Canada Participation RateThe Canadian participation is nearly three percent higher than the American one. On the other side, Canadian unemployment is two percent higher. |

Canada Participation Rate September 2016(see more posts on Canada Participation Rate, ) Source: Investing.com - Click to enlarge |

The US dollar had approached CAD1.33, and in response to the diverging reports fell below CAD1.32. It is stabilizing above CAD1.32. The price action reaffirms the $1.1100 area as the lower end of the euro’s trading range. Resistance is seen near $1.1180. The dollar approach the early September high near JPY104.30 but has been turned back. However, found a bid near JPY103.30. Sterling remains choppy between $1.23-$1.24. US 10-year yields remain slightly higher, while the two-year yield remains flat near four-month highs.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CAD,$EUR,$JPY,Canada Participation Rate,Canada Unemployment Rate,jobs,newslettersent