Category Archive: 1) SNB and CHF

Pressure returns on Swiss franc amid global uncertainty

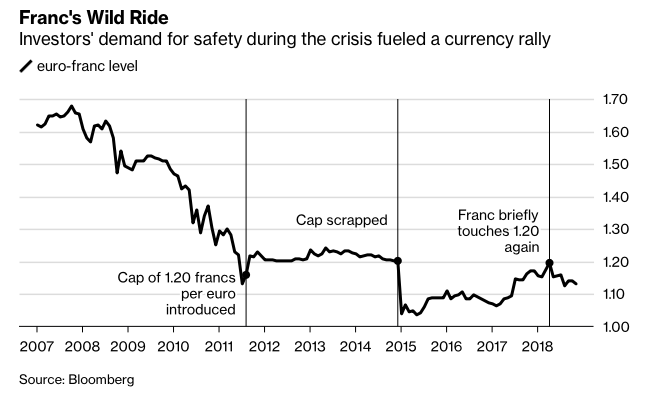

One knock-on effect of the escalating trade war between the United States and China is that the Swiss franc is becoming more attractive for investors – putting pressure on the Swiss National Bank (SNB) to come to the defence of the safe haven currency. For much of July a euro bought at least CHF1.10.

Read More »

Read More »

Quant Network Token Utilities / Are they FINMA Compliant? / Binance X Quant / Overleder Gateways

Hello, My name is Amos Thomas, Owner of Chill Zone International. Please LIKE, SHARE, & Subscribe for more videos! Support The Chill Zone (ELA ONLY ADDRESS) – EexWCtt77AH97wd9kaFCFU1SpnAueLtsqp Join my Chill Zone Telegram to chat with me directly at – https://t.me/ChillZoneInt Follow me on Chill Zone Twitter at – https://twitter.com/ChillZoneInt Quant Telegram – https://t.me/QuantOverledger Quant …

Read More »

Read More »

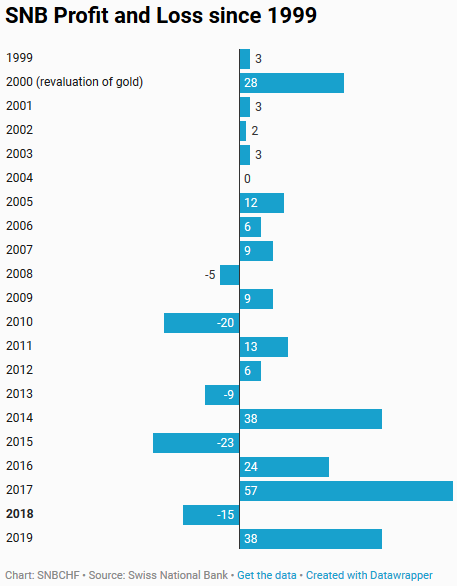

SNB reports a profit of CHF 38.5 billion for the first half of 2019.

The Swiss National Bank reports a profit of CHF 38.5 billion for the first half of 2019. The profit on foreign currency positions amounted to CHF 33.8 billion. A valuation gain of CHF 3.8 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.1 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets.

Read More »

Read More »

Uptick in site deposits puts the spotlight on SNB intervention in the franc

Has the SNB started to intervene. The weekly site deposit data from the Swiss National Bank showed a small uptick but with some perspective, it's a notable turn. Bloomberg highlights the bump and what looks like a bid to keep EUR/CHF above 1.10.

Read More »

Read More »

Swiss Central Bank under Pressure as Franc Rises

Yesterday, the Swiss franc reached its highest level against the euro in two years. The EUR/CHF exchange rate reached 1.097 on 24 July 2019, a rate not seen since early 2017. Upward pressure on the franc is partly being driven by expectations of interest rate cuts by eurozone and US central banks. In addition, the franc is considered a safe haven currency and typically rises when global risk perceptions rise.

Read More »

Read More »

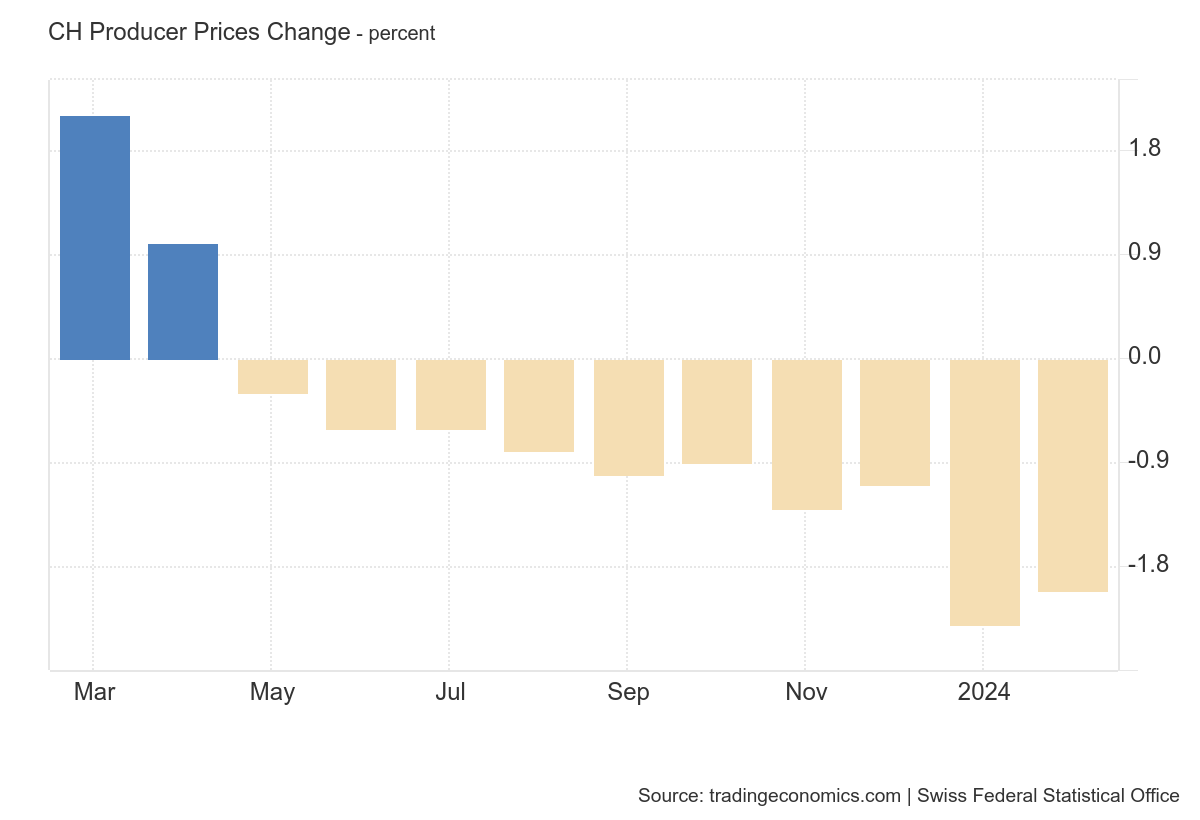

BNS, les taux vont encore être baissés

De son bilan démesuré supérieur au PIB suisse. De ne pas avoir vendu les euros achetés quand elle le pouvait. D’avoir dû abandonner le taux plancher de 1.2 CHF pour 1 EUR sous la pression du marché (je l’avais prévu, mais la BNS a quand même tenu 3 ans et demi). Qu’avec les taux négatifs, les caisses de pensions (donc les retraites) subissent des ponctions anormales.

Read More »

Read More »

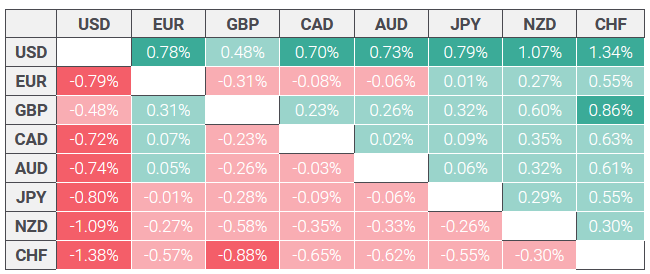

Pound to Swiss Franc exchange rates remain docile despite yesterday’s UK political developments

Movement for the Pound to Swiss Franc pair limited. Pound to Swiss franc exchange rates have remained relatively rangebound this week, despite yesterday’s political developments inside the UK. Whilst the GBP/CHF pair is historically less volatile than GBP/EUR for an example, a range of only two cents movement over the past month is testament to the current market uncertainty.

Read More »

Read More »

Hildebrand hatte SNB nicht verstanden: Sie muss zugunsten eigener Wirtschaft investieren

Bilderberg, Gerzensee und „Franken-Rütli“ – das sind alles Geschwister im Geiste: undurchschaubar, informell, nicht greifbar, gegen aussen, eine Versammlung der Macht, mit dem Vorspuren von Entscheiden grösster wirtschaftlicher und politischer Tragweite.

Read More »

Read More »

Pound to Swiss Franc forecast: Will GBP/CHF rates fall below 1.20?

The pound to Swiss Franc exchange rate has been on steady decline since May when it peaked at 1.3397. Since then, it has fallen to 1.2245 as Brexit uncertainties continue to weigh on sterling, with the market feeling the prospect of a no-deal Brexit has increased. The franc has also risen in value owing to its status as a safe haven currency, and the continued fears over the global economy.

Read More »

Read More »

eicker.TV – Google AdSense ohne Apps, Fake News, Libra will Finma, Galileo – Frisch aus dem Netz.

eicker.TV – Google AdSense ohne Apps, Fake News, Libra mit Finma, Galileo – Frisch aus dem Netz. Google AdSense ohne Apps: “Nearly 70% of AdSense audiences experience the web on mobile devices. With new mobile web technologies such as responsive mobile sites, Accelerated Mobile Pages (AMP) and Progressive Web Apps (PWA) the mobile web works …

Read More »

Read More »

Future of Money Part 13 Dirk Niepelt

Public Versus Private Digital Money: Macroeconomic (ir)relevance, Dirk Niepelt is Director of the Study Center Gerzensee and Professor at the University of Bern. A research fellow at the Center for Economic Policy Research (CEPR, London), CESifo (Munich) research network member and member of the macroeconomic committee of the Verein für Socialpolitik, he served on the …

Read More »

Read More »

La BNS aspire l’épargne des Suisses. Entretien avec Vincent Held

Depuis une année, il ne se passe pas un jour sans que Donald Trump critique violemment la politique monétaire de la banque centrale américaine, pas un jour sans que le fantasque locataire de la Maison-Blanche crache son fiel au visage de Jerome Powell, le président de cette Réserve fédérale amarrée à une ligne beaucoup trop rigoureuse à ses yeux.

Read More »

Read More »

Hypothekarkredite: Selbstregulierung soll Risikoappetit bremsen

Die grössten Risiken für die Finanzstabilität gehen für die inlandorientierten Banken unverändert vom Hypothekar- und Immobilienmarkt aus, warnt die Schweizerische Nationalbank (SNB) im diesjährigen Bericht zur Finanzstabilität vom 13. Juni. Obwohl die Preise 2018 bei den Wohnrenditeliegenschaften leicht sanken, bleibe die Gefahr einer Preiskorrektur in diesem Segment besonders hoch.

Read More »

Read More »

Alumni Top Tips: Jonathan Watson

In this video, alumnus Jonathan Watson - Business Economics class of 2016 - shares his top tips for students and recent graduates.

Find out about the alumni community here: mmu.ac.uk/alumni

Read More »

Read More »

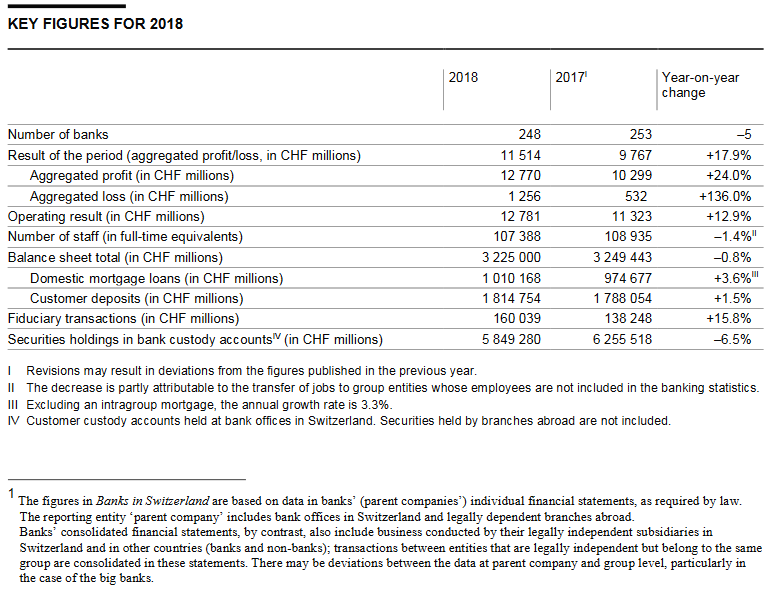

Swiss mortgages and bank profits rise as jobs scale down

Swiss commercial banks achieved higher profits last year, mortgage loans tipped the CHF1 trillion ($1.02 trillion) mark and costs were saved by reducing headcounts. These are the findings of an annual report from the Swiss National bank (SNB).

Read More »

Read More »

Banks in Switzerland 2018

The Swiss National Bank has today published its report Banks in Switzerland 2018 and the corresponding data for its annual banking statistics. The most significant events are summarised below.

Read More »

Read More »

Swiss central bank asked to issue stock exchange digital currency

The Swiss stock exchange wants the country’s central bank to issue a form of cryptocurrency to settle payments on its new digital securities trading platform. If the Swiss National Bank (SNB) agrees, it would represent a departure from its cautious policy on digital currencies. Stock exchange operator SIX Group revealed at the Crypto Valley Association conference that traders on its forthcoming SDX platform would be able to swap cash for a new...

Read More »

Read More »

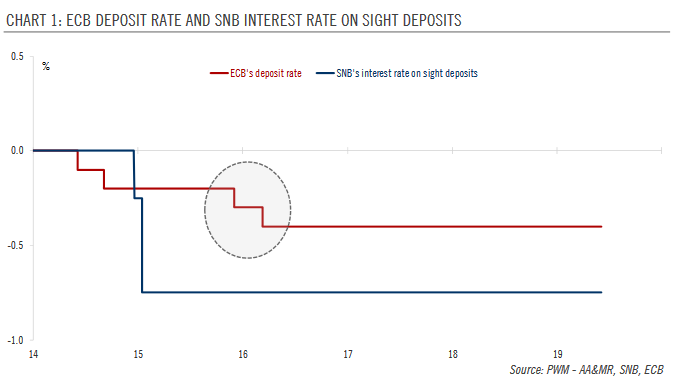

Swiss monetary policy – it’s (almost) all about the Swiss franc

With the ECB and the Fed both signalling their readiness to provide further stimulus, the Swiss National Bank is unlikely to have smooth sailing over the coming months.How the Swiss National Bank (SNB) reacts to further stimulus by its US and European counterparts will be the key focus of the coming months for investors.

Read More »

Read More »

Swiss Franc at 5 month highs vs the Pound

Tory leadership debate does little to help the pound. Sterling has remained under a lot of pressure against a number of currencies including vs the Swiss franc. The Tory leadership race is now down to 5 candidates after former Brexit secretary Dominic Raab only managed to get 30 votes. This was short of the required 33 to progress to the next round.

Read More »

Read More »

Das Einmaleins des neuen Leitzinses

Die Schweizerische Nationalbank (SNB) führt neu einen Leitzins ein. Hatte sie denn bis jetzt gar keinen? Doch, hatte sie, aber der hiess anders. Nutzen wir doch die Gelegenheit, um zu klären, was eigentlich ein Leitzins ist. Und was sich nun geändert hat. Eine Notenbank benutzt einen Leitzins, um das gesamte Zinsniveau in einem Land zu beeinflussen – und damit indirekt den Gang der Wirtschaft.

Read More »

Read More »

-638453232816314704.png)