Category Archive: 1) SNB and CHF

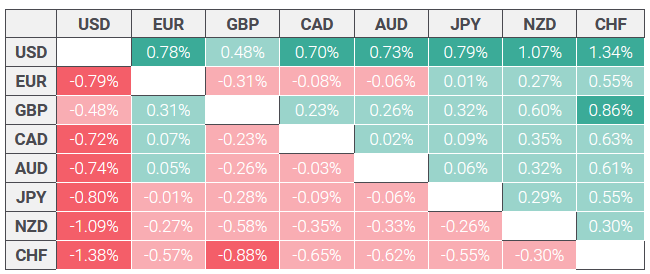

GBP to CHF weakness after no majority for alternative Brexit

The pound to Swiss franc exchange rate still struggles to push higher amidst global uncertainty and the pressing issue of Brexit. The Swiss franc maintains the higher ground with its safe haven status amidst concerns of a global slowdown, the effects of which are already being seen across China and the EU.

Read More »

Read More »

Dépossession. Des politiques monétaires mortifères…

L’économie du pays est promise à un effondrement. Il suffit pour s’en convaincre de voir la quantité de surfaces commerciales disponibles. En Suisse, près de 1200 entreprises ont fait faillite entre janvier et février! L’information du jour est un non-évènement, puisque annoncé de longue date sur ce site. Par ailleurs, elle ne semble intéresser personne à Berne, dans les « agglomérations », ou autres »Régions ».

Read More »

Read More »

Pound to Swiss Franc Forecast – Will GBP/CHF rates rise or fall on Brexit?

The Brexit date of 29th March has been delayed to the 12th April or the 22nd May as the EU provide a lifeline to the UK to help them avoid a no-deal scenario. This has helped the pound to rise and has provided some of the best rates to buy Swiss Francs in many months.

Read More »

Read More »

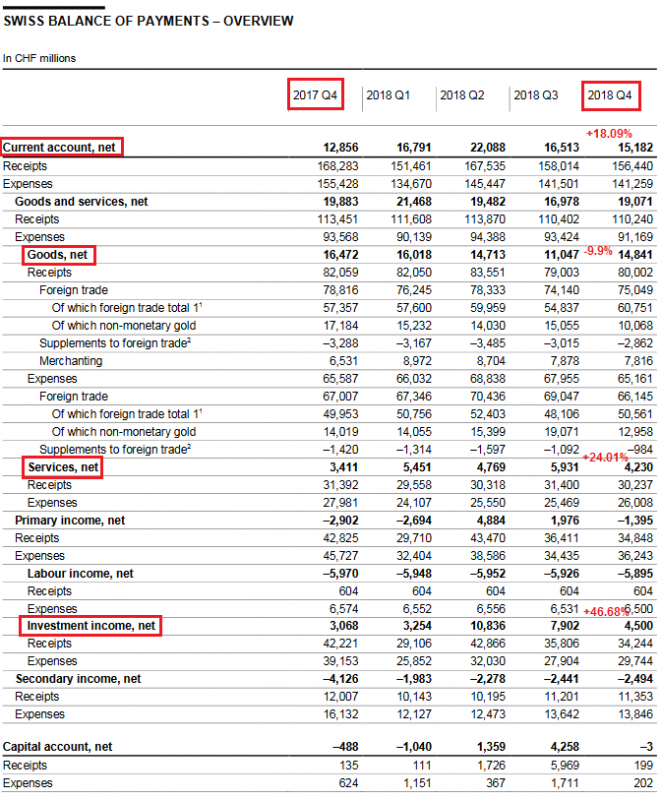

Swiss Balance of Payments and International Investment Position: Q4 2018 and whole 2018

The current account surplus for 2018 was CHF 71 billion, CHF 26 billion more than in the previous year, an increase by over 50%.

Read More »

Read More »

Pound falls against the Swiss franc owing to third meaningful vote uncertainty

The pound has once again felt the impact of the uncertainty caused by Brexit and the pound has fallen against the Swiss franc during yesterday afternoon’s trading session. We are now just over a week away from when the UK is due to leave the European Union and the latest update is that the EU will allow an extension until the end of June if Theresa May can get her deal backed in the next few days.

Read More »

Read More »

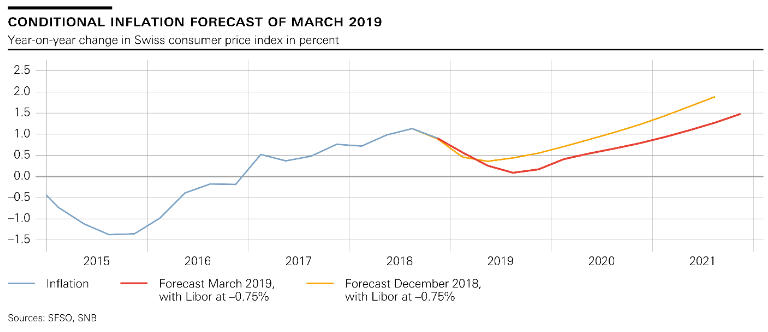

Monetary policy assessment of 21 March 2019

The Swiss National Bank is maintaining its expansionary monetary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

2019-03-21 – Publication of the 2018 Annual Report

The 2018 Annual Report of the Swiss National Bank is published on the SNB website (www.snb.ch).

Read More »

Read More »

Rothschilds To Take Swiss Bank Private In 100 Million Francs Bid

Benjamin de Rothschild’s family plans to take Swiss Bank Edmond de Rothschild (Suisse) S.A. private as it consolidates and simplifies the bank's legal structure. According to Bloomberg, Edmond de Rothschild Holding SA will acquire all publicly held Edmond de Rothschild (Suisse) bearer shares at 17,945 francs per share, a 6.7% premium to Tuesday’s closing price, in a deal worth about $100 million.

Read More »

Read More »

Pound to Swiss Franc Forecast: GBP/CHF rate hits near 1-year high

It is now very close to the best time to buy Swiss Francs with pounds since May 2018. The stronger pound and a reduced global risk appetite has seen the move on the GBP/CHF pairing. This is presenting a much improved opportunity to buy Swiss Francs with pounds. Any client wishing to buy or sell on this pairing might benefit from a quick review with our team to best understand what is next, and the potential outcomes.

Read More »

Read More »

1000-Franc Note Enters Circulation Today

Issuance of the new 1000-franc note presented a week ago begins today, 13 March. The Swiss National Bank’s ‘Swiss Banknotes’ app has now been updated to include the new note. The app, which has been downloaded some 110,000 times, can be obtained free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com) app stores.

Read More »

Read More »

Swiss National Bank releases new 1000-franc note

The Swiss National Bank (SNB) will begin issuing the new 1000-franc note on 13 March 2019. Following the 50, 20, 10 and 200-franc notes, this is the fifth of six denominations in the new banknote series to be released. The current eighth-series banknotes remain legal tender until further notice.

Read More »

Read More »

Die neue 1000-Franken-Note: Präsentation – Le nouveau billet de 1000 francs: présentation

Dieser Film zeigt Impressionen von der Präsentation der neuen Schweizer 1000-Franken-Note am 5. März 2019 in Zürich. Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank, stellt die wichtigsten Gestaltungsmerkmale und Sicherheitselemente der neuen Banknote vor. - Ce film donne quelques impressions de la présentation du nouveau billet de 1000 francs qui a eu lieu le 5 mars 2019. Fritz Zurbrügg, vice-président de la...

Read More »

Read More »

Die neue 1000-Franken-Note: Präsentation – Le nouveau billet de 1000 francs: présentation

Dieser Film zeigt Impressionen von der Präsentation der neuen Schweizer 1000-Franken-Note am 5. März 2019 in Zürich. Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank, stellt die wichtigsten Gestaltungsmerkmale und Sicherheitselemente der neuen Banknote vor. – Ce film donne quelques impressions de la présentation du nouveau billet de 1000 francs qui a eu lieu le …

Read More »

Read More »

GBP/CHF exchange rates: A good start to the year, but what next for Brexit?

Since the start of the year GBP/CHF exchange rates have increased from 1.2377 to 1.3212 at the time of writing this report. To put this into monetary value, a client that converts £200,000 into CHF could now achieve an additional 16,700 Swiss Francs.

Read More »

Read More »

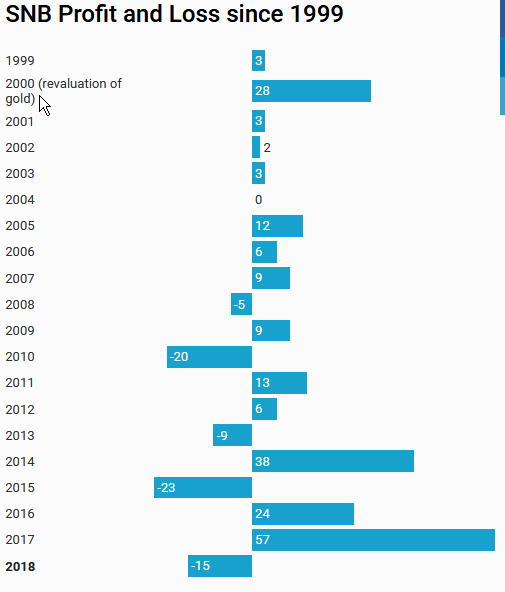

SNB loses 15 billion in 2018

The SNB earned 2 billion on negative interest rates (Swiss franc positions below), but lost nearly 17 billion CHF on FX investments, of which 5 bn on bonds and 12 bn on stocks. Gold was nearly unchanged.

Read More »

Read More »

Mit Negativzinsen die Wirtschaft ankurbeln? Nächste Irrlehre der SNB

Seit Jahrzehnten geistert die Illusion in den Köpfen der Oekonomen herum, man könne mit Zinssenkungen eine Wirtschaft ankurbeln. Den Vogel schiesst der vermeintliche „Starökonom“ von der Harvard University, Kenneth Rogoff, ab. Er prophezeit, dass künftige Wirtschaftskrisen mit Negativzinsen von bis zu minus 6 Prozent bekämpft würden.

Read More »

Read More »

GBP to CHF rate hovers over 1.32 awaiting new Brexit Developments

The pound has rallied higher against the Swiss Franc with rates for the GBP/CHF pair now sitting over 1.32. Pound to Swiss Franc exchange rates have been lifted on the back of some optimism over Brexit, that a deal will be reached between Britain and the EU. The markets are awaiting developments over the contentious Irish backstop which could pave the way forward for a deal.

Read More »

Read More »

XXIX. Atelier de la Concurrence: Strafrechtliche Verfahrensgarantien vor WEKO und FINMA

Im klassischen Verwaltungsverfahren sind Parteien zu Mitwirkung und Auskunft verpflichtet. Im Strafverfahren hat demgegenüber der Beschuldigte das Recht, Aussage und Mitwirkung zu verweigern. Das Recht, sich selbst nicht belasten zu müssen, kollidiert somit mit der Mitwirkungspflicht im WEKO- und FINMA-Verfahren. Es stellt sich deshalb die Frage nach sachgerechten Lösungen. Zu diesem Thema fand Anfangs Oktober …

Read More »

Read More »

Strong Trade Balance Data Supports the Franc

The Swiss Franc has been boosted during early morning trading as investors find the latest Trade Balance data supportive of the economy, with the Trade Balance data coming in showing a surplus of CHF3bn. The strength of the Swiss economy is its exports; in watches, chocolate and specialized industrial engineering.

Read More »

Read More »

La Dépossession façon BNS. Entretien ORBIS TERRAE

L’ouvrage de Vincent Held aborde une série de sujets brûlants : la politique d’affaiblissement du francs suisse menée par la Banque nationale suisse (BNS), l’imbrication de cette politique avec celles des banques privées suisses, la politique d’acquisition d’obligations d’Etat en dollars et en euros au détriment de la constitution d’un véritable fonds souverain… Le livre de M. Held touche au cœur nucléaire de la prospérité helvétique. Et ce qu’il...

Read More »

Read More »

-638453232816314704.png)