|

With the ECB and the Fed both signalling their readiness to provide further stimulus, the Swiss National Bank is unlikely to have smooth sailing over the coming months. How the Swiss National Bank (SNB) reacts to further stimulus by its US and European counterparts will be the key focus of the coming months for investors. We believe that the Swiss central bank will be reluctant to cut rates in direct response to the ECB, especially in the case of a small 10 basis point deposit rate cut by the latter, as we expect. The SNB’s first line of defence is more likely to be FX market interventions to counter any appreciation of the CHF. If FX interventions prove ineffective, the SNB would resort to a rate cut. Our best guess would be a cut of 25 basis points in the SNB’s policy rate (bringing it to -1.0%) so as to widen the interest differential to the euro even further. In this scenario, the chances of a change in the exemption thresholds (currently at 20 times the minimum reserve requirement) for the SNB sight deposits would rise. |

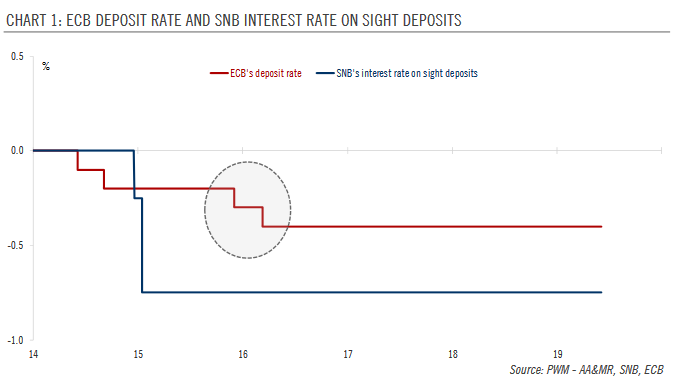

ECB Deposit Rate and SNB Interest Rate on Sight Deposits, 2014-2019 Source: perspectives.pictet.com - Click to enlarge |

Tags: Macroview,newsletter,Swiss Franc,Swiss monetary policy,Swiss National Bank