Category Archive: 6b.) Acting Man

Real High Crimes and Misdemeanors

World Class Entertainer in the Cross-Hairs. Christmas is no time to be given the old heave-ho. This is a time of celebration, redemption, and excess libation. A time to shop ‘til you drop; the economy depends on it. Don’t get us wrong. There really is no best time to receive the dreaded pink slip. But Christmas is the absolute worst. Has this ever happened to you?

Read More »

Read More »

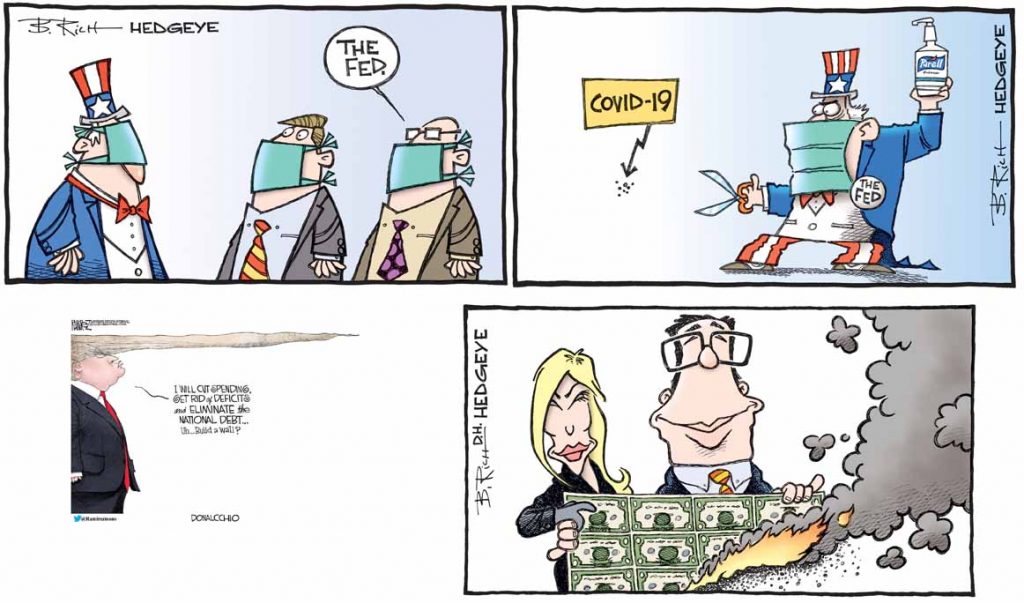

Banana Republic Money Debasement In America

Addicted to Spending. There are many falsehoods being perpetuated these days when it comes to money, financial markets, and the economy. But when you cut the chaff, three related facts remain: Uncle Sam needs your money. He needs a lot of your money. And he needs it bad!

Read More »

Read More »

Jayant Bhandari Gives His View on The Markets for The New Year

Jayant Bhandari, who travels the world to look for investment opportunities, particularly in the natural resource sector, gives his views for the markets in the new year.

Read More »

Read More »

Jayant Bhandari: Blood in the Streets Means the Best Value and Least Risk

The past year has been interesting for investors and the resources industry, but according to Jayant Bhandari of Anarcho Capital, it’s been a good one. #MinesAndMoneyLondon #Gold #China

“When blood is running in the streets, when people are not interested in buying any of these companies, that’s where the best value emerges, that’s when you can invest with the least amount of risk and for the highest amount of upside,” he said....

Read More »

Read More »

Goldpreis kann auf 15.000 Dollar steigen! (Dimitri Speck im Interview)

Geheime Goldpolitik (Buch): https://amzn.to/2XNnXy2 ?Gold kaufen: https://www.kettner-edelmetalle.de/gold/ ?Silber kaufen: https://www.kettner-edelmetalle.de/silber/ ?Gratis Beratung und Bestellhotline: 07930-2699 ✅NEU! Masterplan Edelmetalle: https://goo.gl/DDfPu2 ?Unser Online-Shop: https://www.kettner-edelmetalle.de ?5 € Gutschein für Neukunden: http://www.kettner-edelmetalle.de/newsletter Seit vielen Jahren ist Kettner-Edelmetalle Ihr...

Read More »

Read More »

Dimitri Speck ueber Gold, Silber, Rohstoffe und moegliche Rezession

https://responsa-liberta.de/ Auf der Internationalen Edelmetall- und Rohstoffmesse 2019 in München hat Dimitri Speck (SEASONAX) eine Einschätzung zu den Edelmetallen Gold und Silber, aber auch zu Platin und weiteren Rohstoffen wie u.a. Öl gegeben.

Read More »

Read More »

Riding the Type 3 Mega Market Melt Up Train

Beta-driven Fantasy. The decade long bull market run, aside from making everyone ridiculously rich, has opened up a new array of competencies. The proliferation of ETFs, for instance, has precipitated a heyday for the ETF Analyst. So, too, blind faith in data has prompted the rise of Psychic Quants… who see the future by modeling the past.

Read More »

Read More »

Maurice Jackson Interviews Brien Lundin and Jayant Bhandari

Our friend Maurice Jackson of Proven and Probable has recently conducted two interviews which we believe will be of interest to our readers. The first interview is with Brien Lundin, the president of Jefferson Financial, host of the famed New Orleans Investment Conference and publisher & editor of the Gold Newsletter – an investment newsletter that has been around for almost five decades, which actually makes it the longest-running US-based...

Read More »

Read More »

Global Protests, Gold, Stock Picks – Jayant Bhandari and Maurice Jackson

Proven and Probable

Where we deliver Mining Insights & Bullion Sales, in form of physical delivery, offshore depositories, and private blockchain distributed ledger technology you may reach us at [email protected]

Proven and Probable provides insights on mining companies, junior miners, gold mining stocks, uranium, silver, platinum, zinc & copper mining stocks, silver and gold bullion in Canada, the US, Australia and beyond....

Read More »

Read More »

The Golden Autumn Season – One of the Most Reliable Seasonal Patterns Begins

The Strongest Seasonal Stock Market Trend. Readers may already have guessed: when the vibrant colors of the autumn leaves are revealed in all their splendor, the strongest seasonal period of the year begins in the stock market – namely the year-end rally. Stocks typically rise in this time period. However, there are questions, such as: how often does a rally take place, how strong is it, and when is the best time for investors to enter the market?

Read More »

Read More »

Excellent Gold Stock Opportunities Now | Jayant Bhandari

Jayant is constantly traveling the world to look for investment opportunities, particularly in the natural resource sector. He advises institutional investors about his finds. He was a Director on the board of Gold Canyon, a publicly-listed Canadian company, until its merger with another entity. Earlier, he worked for six years with US Global Investors (San Antonio, Texas), a boutique natural resource investment firm, and for one year with Casey...

Read More »

Read More »

America’s Road Map to $40 Trillion National Debt by 2028

Planning on Your Behalf. Watch out! At this very moment, professional economists of all stripes are making plans on your behalf. They are dreaming and scheming new and innovative ways to spend your money long before you have earned it. While you are busy at the gristmill, grinding away for clients and customers, claims are being laid upon your life.

Read More »

Read More »

A Gain of 1,080 percent Annualized – One of the Strongest Seasonal Rallies is Starting Right Now

Bitcoin – An Exceptional Asset. When I first heard about Bitcoin (BTC) in May 2011, it was trading at 8 US dollars. Today, more than eight years later, BTC trades at around 8,000 dollars. A thousandfold increase! An investment of 1,000 dollars at the time would have resulted in a gain of more than a million – a dream result.

Read More »

Read More »

US Money Supply Growth – Bouncing From a 12-Year Low

True Money Supply Growth Rebounds in September. In August 2019 year-on-year growth of the broad true US money supply (TMS-2) fell to a fresh 12-year low of 1.87%. The 12-month moving average of the growth rate hit a new low for the move as well. The main driver of the slowdown in money supply growth over the past year was the Fed’s decision to decrease its holdings of MBS and treasuries purchased in previous “QE” operations.

Read More »

Read More »

Fed Chair Powell’s Inescapable Contradiction

Conflict and contradiction. These were two of the main themes reverberating around the world of centralized monetary planning this week. On Tuesday, for instance, a novel and contradictory central banker parlance – “reserve management purposes” – was birthed into existence by Fed Chair Jay Powell. We will have more on this later on. But first, to best appreciate the contradiction, we must present the conflict.

Read More »

Read More »

Present and Future of the Indian Economy With Mr. Jayant Bhandari

In our second episode we sit down with Mr. Jayant Bhandari to discuss Indian economy, society and culture. Mr. Bhandari throws light on the underlying cultural factors that are necessary prerequisite for the progress of India. He also analyzes the economic policies of Modi and all other past governments.

Jayant's Website: http://jayantbhandari.com

Read More »

Read More »

Repo Quake – A Primer

Chaos in Overnight Funding Markets. Most of our readers are probably aware that there were recently quite large spikes in repo rates. The events were inter alia chronicled at Zerohedge here and here. The issue is fairly complex, as there are many different drivers at play, but we will try to provide a brief explanation.

Read More »

Read More »