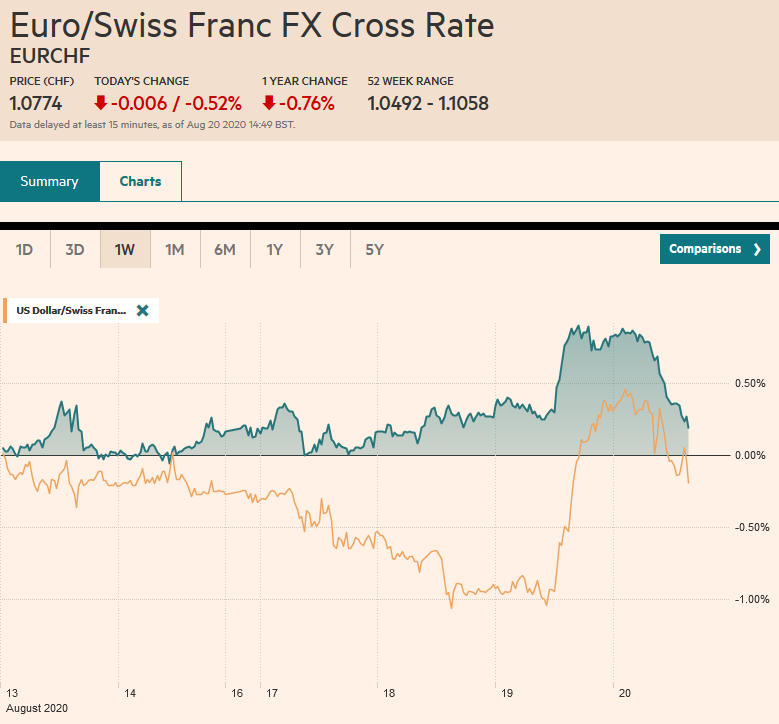

Swiss FrancThe Euro has fallen by 0.52% to 1.0774 |

EUR/CHF and USD/CHF, August 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The FOMC minutes depicted a Federal Reserve that appeared to be not quite ready to take fresh initiatives, whether it is yield curve control or changing the composition or quantities of its bond purchases. This unleashed profit-taking on some of the large moves in equities, the dollar, and gold. The move has carried into today. Most bourses in the Asia Pacific region were off at least 1%, and Taiwan and Korea markets were off more than 3%. Europe’s Dow Jones Stoxx 600 is off around 1.0% near midday in Europe, and the S&P 500 is poised to gap lower at the opening today. Bond markets are on the sidelines, though yields mostly softer. The US benchmark is near 65 bp, having topped out last week a little above 70 bp. The dollar, which has been under pressure, is extending yesterday’s gains before steadying in the European morning. The yen and Swiss franc are among the most resilient to the dollar, while the Antipodeans and Scandis are the weakest. Emerging market currencies are also heavier. Gold held yesterday’s lows near $1925, but the early bounce to $1962 seemed to spur new sales. September WTI remains within its well-worn range of $41.80-$43.00. |

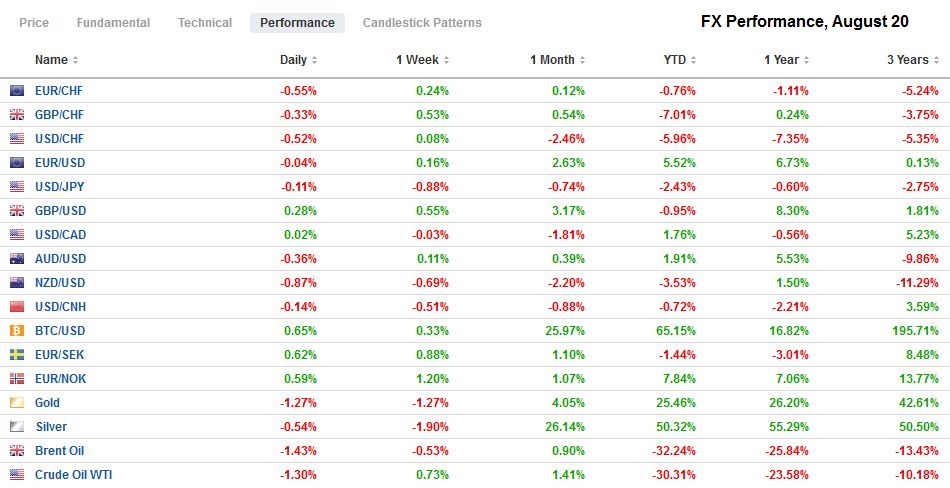

FX Performance, August 20 |

Asia Pacific

As widely anticipated, China’s one-year and five-year Loan Prime Rates were unchanged at 3.85% and 4.65%, respectively. Chinese officials seem broadly content with the pace of the recovery and continue to be reluctant to take fresh initiatives. Separately, SWIFT reported the yuan’s settlement increased at it accounted for 1.8% of the turnover on its platform, the most since February.

The US formally ended three pacts with Hong Kong over extraditions and tax exemptions. More actions are threatened that could take the form of additional sanctions against individuals and institutions. On a different front, Chinese officials indicated that the postponed review of the Phase 1 trade deal, which US President Trump claimed responsibility for, is expected to be rescheduled soon, though at least three top US officials (Lighthizer, Navarro, and Kudlow) have all indicated it on track (defying most private-sector assessments)

Taiwan reported a 12.4% year-over-year surge in export orders. It is the most since early 2018. It is the fifth month of rising orders, and there is much demand for semiconductor fabrication equipment. Orders from the US rose 22%. Orders from HK and the mainland rose 16.8% and from Europe 18.2%.

Japanese investors had stepped up their foreign bond purchases in recent weeks, but last week took a little profit. On the other hand, Japanese investors continue to sell foreign equities. Last week’s JPY1.8 trillion was the sixth consecutive week of liquidation. Over the run, Japanese investors have sold about JPY5.1 trillion of foreign equities, nearly offsetting in full the year’s purchases up until then (~JPY5.5 trillion).

The dollar posted an outside up day against the yen yesterday by first selling off through the previous day’s low and then rallying to close above the previous day’s high. However, follow-through dollar buying has been minimal and limited to about JPY106.20. A move above JPY106.30 would re-target last week’s high near JPY107.00, where an option for $1.2 bln is set to expire today. Support now is seen near JPY105.80. The Australian dollar had a key reversal yesterday, making new highs for the year before selling off and settling below the previous day’s low. It made a new low for the week today near $0.7145. Last week’s low was near $0.7110, and an option for about A$565 mln at $0.7120 may be in play. The PBOC set the dollar’s reference rate at CNY6.9274, a little weaker than the bank models suggested, but the greenback rose in the mainland session for the first time this week.

Europe

The US and Europe are on opposite sides of the Iran issue at the UN that may come to a head today. Essentially, the US withdrew from the 2015 agreement and now appears to insist on the triggering of a clause in it that would allow full sanctions to be applied again to Iran. The US may still be able to force its will as it can threaten to sanction any party that does not respect its moves against Iran.

Norway’s central bank kept policy steady, which includes a deposit rate of zero. Norway has been able to tap its large sovereign wealth fund instead of issuing much more debt as other countries have done. The thinness of Norway’s asset markets (bonds and stocks) removes a large market segment from actively trading the krone, which contributes to its high-beta profile.

Turkey’s central bank meeting outcome is awaited. The CBRT has tightened lending conditions to force up funding costs as a way to stabilize the currency. Prime Minister Erdogan seemed to suggest some surprise move ahead of the weekend. The one-week repo rate (8.25%), which had been its chief operating tool, was suspended last week. The dollar held TRY7.20 yesterday after running into resistance near TRY7.40. Some observers have suggested the TRY7.40 is the new cap, but we are suspicious that Turkey does not have the wherewithal to defend it for long. Investors lack confidence in both the substance and process of Turkey’s economic and financial policies.

The euro set two-year highs on Tuesday near $1.1965, but this did not represent a breakout, and instead, the euro remains in the range that has dominated this month that is mostly $1.17-$1.19. Today it approached the middle of that range (~$1.1810), and the 20-day moving average is closer to $1.1800. It has not closed below the 20-day moving average since July 3. On the upside, there are options for 1.4 bln euros at $1.1840-$1.1850 that will be cut today. Adjusting for the 1.3 bln euro-option $1.19 that also expires today may have played a role in yesterday’s sell-off. Sterling reversed lower yesterday after reaching its best level in seven months (~$1.3265). Yesterday’s low, just below $1.31, was extended to $1.3065 today. There are GBP445 mln in options struck between $1.3100 and $1.3110 that expire today. Although sterling has risen above these in the European morning, the intraday technicals are stretched, and a pullback in the North American morning should not surprise.

America

Rarely have the FOMC minutes created such a market reaction. While officials remain concerned about the economy, they do not appear prepared to take new steps as early as next month, that many, including ourselves, thought likely. Yield curve control seems somewhat less likely in the near-term, though the staff concern that it could lead to more bond-buying that the Fed prepared to do is a bit mysterious. The two central banks (BOJ and RBA) that have implemented such a strategy have actually bought fewer bonds. Nevertheless, yields did back up, the dollar rallied, and equities fell in response. That said, its call for more efforts by Congress is thus far falling on deaf ears, and not coincidentally, Walmart reported that the drop in supplemental unemployment insurance is already impacting their sales figures.

The US reports the August Philadelphia Fed manufacturing survey, weekly jobless claims, and the July Leading Economic Indicators Index. The Empire State survey released at the start of the week was softer than expected, and there may be downside risk to the Philly survey, for which the median forecast in the Bloomberg survey projects a decline to 20.8 from 24.1. Tomorrow, Markit publishes its preliminary August PMI, and the manufacturing reading is expected to tick higher. Weekly jobless claims surprised on the downside last week, and a further decline toward 920k is expected. The LEI jumped to a record high in May (3.2%) and moderated in June (2.0%) is expected to ease to 1% in July. It is not typically a market-mover. Canada, Mexico, and Brazil’s economic diaries are light.

The US dollar reversed higher against the Canadian dollar after falling to seven-month lows yesterday near CAD1.3135. It traded as high as CAD1.3235 in late Asia before coming off again. Initial support is seen in the CAD1.3180-CAD1.3200 area. The risk-off mood today may limit the scope for the Canadian dollar’s recovery. The greenback is trading in the upper end of this week’s range against the Mexican peso (~MXN22.25), which is also near the 20-day moving average. The next cap for the US dollar is seen near MXN22.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,Featured,federal-reserve,newsletter,Norges Bank,Taiwan,Turkey