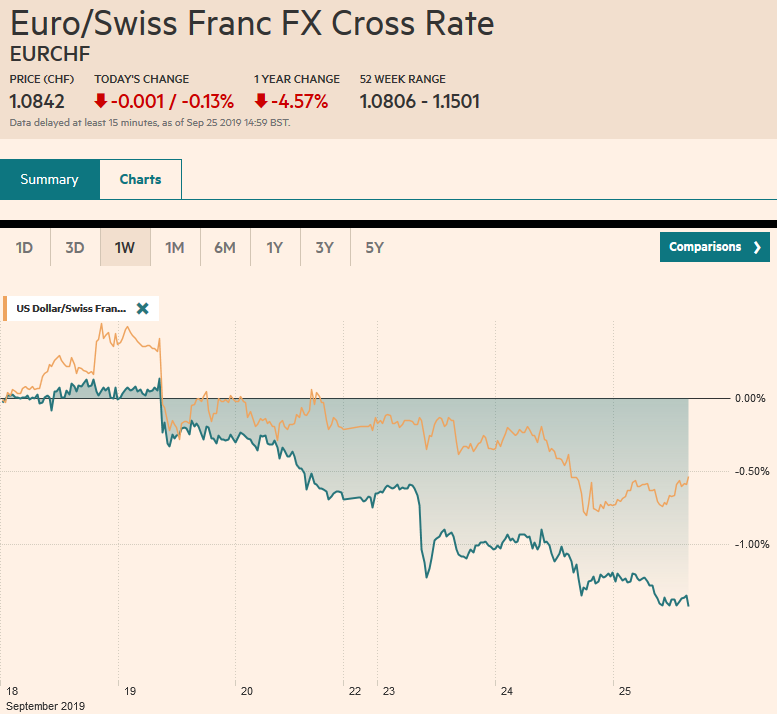

Swiss FrancThe Euro has fallen by 0.13% to 1.0842 |

EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Global equities and fixed income reacted to the large moves yesterday in the US when the 10-year note yield fell eight basis points, and the S&P 500 fell by 0.85%. Investors have focused on three separate developments and two of which came from President Trump’s speech at the UN. He dismissed the likelihood of a short-term trade deal with China and was critical of the large social media platforms. The other consideration was the movement toward an impeachment inquiry against Trump in the US House of Representatives. Nearly all the markets in Asia Pacific were lower. Of note, Chinese shares ended on their lows, while the Nikkei, which gapped lower at the open, closed on its highs, though still outside of yesterday’s range. Europe’s Dow Jones Stoxx 600 is off nearly 1.5% through the morning. Most benchmark 10-year yields are off 1-3 bp today. The dollar is firm against all the major currencies. Most emerging market currencies are also trading lower. |

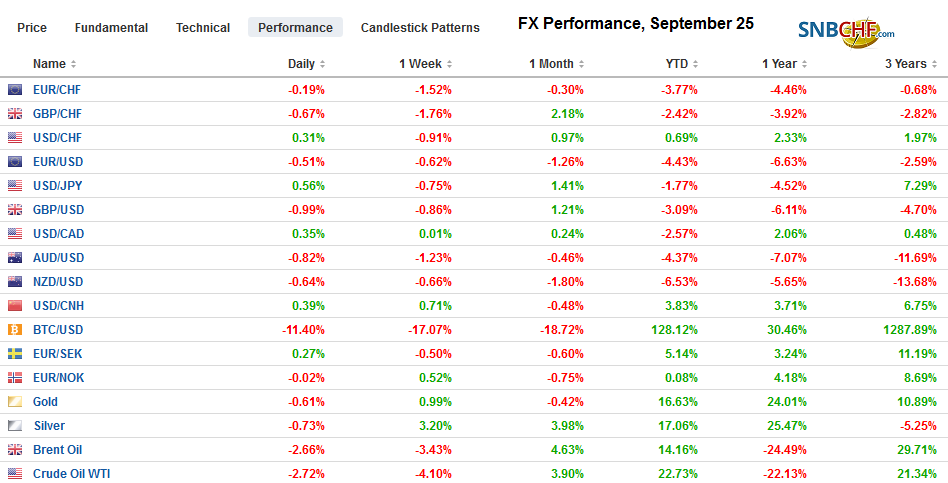

FX Performance, September 25 |

Asia Pacific

The pattern has been stocks and bond yields to fall on signs that the US-China trade conflict is not going away any time soon. The trade conflict a significant economic headwind. Although we suspect that given Trump’s focus on the stock market as a reflection of his presidency, we suspect his denials of interest in a small agreement while a more comprehensive deal is negotiated, could very well be part of his negotiating strategy. A limited deal could be packaged as a downpayment. Moreover, this is precisely what the US pursued with Japan, and there are reports about a similar approach to India. The White House expects a small near-term agreement with India that can potentially be part of a more significant deal later.

Many continue to talk about China’s purchases of US soy and pork as goodwill gestures. That may be naive. China’s purchases are driven by necessity. A shortage is evident and fueling a surge in food prices. Reports suggest China may buy 100k tons of US pork. Meanwhile, it will hold its second pork auction (from inventories) tomorrow for 10k tons. Last week was the first such auction.

Japan’s five-year yield fell to a record low today of minus 40 basis points. At the same time, the 40-year bond auction saw light demand (bid-cover was lowest in four years). The BOJ wants a steeper yield curve, but it continues to be frustrated in its attempts. It is raising questions about the effectiveness of its yield curve control (YCC) strategy. However, under YCC, the BOJ has been reducing the amount of bonds it buys and has succeeded in distinguishing this from tapering.

After surprising investors last month with a 50 bp rate cut, it was no surprise that the Reserve Bank of New Zealand left rates steady. Separately, New Zealand reported a larger than expected trade deficit in August of almost NZ$1.6 bln. Exports slipped, and imports edged higher. Still, the 12-month gap was flat at NZ$5.48 bln.

The dollar was sold briefly through JPY107 yesterday after having tested Monday’s high of JPY107.80. There was no follow-through selling in Tokyo, forcing some momentum traders to cover short dollar positions. This saw the greenback rebound to around JPY107.40 before dollar selling reemerged. Initial support now is seen near JPY107.20. The Australian dollar stopped shy of the $0.6810 cap we noted yesterday and is retracing its gains today. The three-day shelf near $0.6760 may be challenged, and a break may be worth another 20 pips or so today. The sawtooth pattern of the dollar alternating between gains and losses against the Chinese yuan continued with a small dollar gain earlier today.

Europe

Members of the UK Parliament return today after the Supreme Court ruled against the government’s prorogation. There is pressure to dismiss some of the Prime Minister’s political advisers as calls for Johnson to resign will be ignored. Reports suggest that the UK has submitted new proposals to the EC. While Johnson says he is “cautiously optimistic,” the Irish Prime Minister said the gap between the UK and EC remained “very wide.” Sterling, which traded to almost $1.26 before the weekend is challenging support near $1.24.

There is a Sword of Damocles hanging over US-European trade. The WTO will allow the US to sanction European goods due to improper subsidies of Airbus. An initial decision enables the US to hit $5-$7 bln of European exports. The findings will be made finalized and made public shortly. Reports suggest the US may use a particularly disruptive way to do it, which is to rotate the goods that will be levied. Twice before the US threatened this tactic, which the EU claims violate WTO rules. Both times (over bananas and hormone-treated beef issues) the issue was resolved before the implementation of this “carousel” tactic. Separately, but related, the EU’s case against US subsidies for Boeing is expected to come to a head by the middle of next year.

For a third session, offers near $1.1025 have capped the euro. Support in the European morning was seen near $1.0990. Yesterday’s low was near $1.0985, and Monday’s low was closer to $1.0965. It remains uninspiring. Sterling remains in a $1.24-$1.25 range. We expect a break lower out of this range and the first target is near $1.2345, which is a (38,2%) retracement of this month’s rally. It also houses the 20-day moving average.

America

Reports that around 70% of the Democrats in the House of Representatives support an impeachment inquiry into the President’s actions proved too much for Speaker Pelosi who capitulated to the pressure she had been resisting. Still, Pelosi did not (yet) propose a floor vote to endorse and inquiry, and it is not clear what has really changed by Pelosi’s comments. Specifically, the Judiciary Committee and several other committees had already scheduled hearings. That said, the prospects of success are poor insofar as there is little support in the Senate. While the Chief Justice (Roberts) would be the judge in an impeachment trial if it came to that, the Senate is the jury. The impeachment is the trial. Clinton was acquitted by the Senate. The S&P 500 fell 0.85%, the most in a month. It has initially gapped higher at the open and saw a little follow-through buying, but then reversed course. However, rather than the threat of impeachment, it was Trump’s speech at the UN where again he spoke against a short-term partial trade agreement with China that got the ball rolling. By the time that the news leaked out around midday that Pelosi was going to initiate an impeachment inquiry, the S&P 500 had already shed 1% from the highs. Trump also was critical of the power of the social media platforms and the FAANG stocks were hit, sending the NASDAQ down 1.45%.

The Federal Reserve has the tools to control the short-end of the market. However, it still seems to be struggling to provide enough cash. The overnight repo operation and the first 14-day repo were oversubscribed. The banks wanted $62 bln of the 14-day repo, but the Fed provided less than half ($30 bln). The overnight repo for $75 bln saw bids for a little more than $80 bln. To re-establish control and credibility, the Fed may need to increase the size of the operations. If, as Powell said at the press conference after the FOMC meeting, the reserve needs will be clearer in six weeks, the signal so far is that the needs are greater than are currently being met.

The US report new home sales for August. After the outsized 12.8% plunge in July, a recovery is widely expected. The median forecast in the Bloomberg survey calls for a 3.6% bounce. Such a rise would lift the new single-family home sales to 658k, which is a little above the three-month average. Last year they averaged about 615k. Another look through the volatility, consider that the average through July this year is about 661k. Last year’s average of the Jan-July period was near 633k. Three Fed presidents speak: Evans, George, and Kaplan. The first two are voters, and they come from different wings, with Evans more dovish and George having dissented against the two rate cuts. Kaplan is seen as a centrist, which often seems to mean going with the Board of Governors. Governor Brainard speaks before the House panel on Financial Stability.

The US dollar slipped to a five-day low against the Canadian dollar yesterday near CAD1.3230. No follow-through selling emerged, and the greenback is firmed toward near CAD1.3270 in Asia, just shy of yesterday’s high was around CAD1.3275. The US dollar’s upside momentum faded in the European morning. The 200-day moving average found just above CAD1.33 frustrated the US dollar bulls last week and on Monday this week. Falling oil prices (new lows since the attack on Saudi Arabia) and the risk-off sentiment reflected in the pullback in US shares are often negative influences on the Canadian dollar. The US dollar is at two-week highs against the Mexican peso (~MXN19.5450). The next target is a little above MXN19.60 and then MXN19.68. Economists are mostly looking for a 25 bp rate cut tomorrow to bring the overnight rate to 7.75%. Of the two dozen economists surveyed by Bloomberg, only one expects the central bank to stand pat and two forecast a 50 bp cut.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,China,Currency Movement,EUR/CHF,FX Daily,newsletter,SPX,Trade,USD/CHF