| With such low levels of self-awareness, it isn’t surprising that the FOMC’s members continue to pour gasoline on the already-blazing curve fire. March Madness is supposed to be on the courts of college basketball, instead it is playing out more vividly across all financial markets. One reason why is that policymakers at the Fed really still believe, even after so many recent historical episodes have gone against them, markets will rethink their current reluctance and end up following the official view at some point.

Those at the Fed absolutely fear inflation pressures. Markets increasingly and more decisively bet anticipating their opposite. Officials believe bonds are wrong, or, as most have been led to think, muddied by other factors such that there can be no fundamental message in their results. Just ignore all those upside-down contracts and yields. |

|

| The more that mainstream gets talked into more rate hikes in the short run, the uglier the curves get. The Treasury yield curve after today’s verbal assaults now stands inverted from the 3-year note on down to the 10-year; the entire middle is rather alarmingly upside-down.As I keep pointing out, if that was all there was to it, then alone it would still be a highly compelling counterargument to all this short run inflation. How many more times does the FOMC need to be embarrassed in this same fashion?

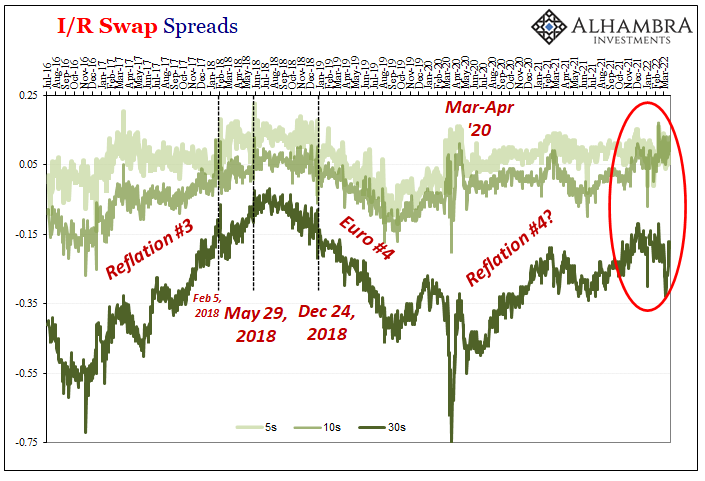

It’s not just the one thing or the other, though, since the whole bond market is rejecting the rate hikes and doing so with more conviction. Just look at swap spreads, for example, which is right where rate hikes would go…if the market thought there was any realistic chance they’d stick around for more than a, forgive me, transitory period. |

|

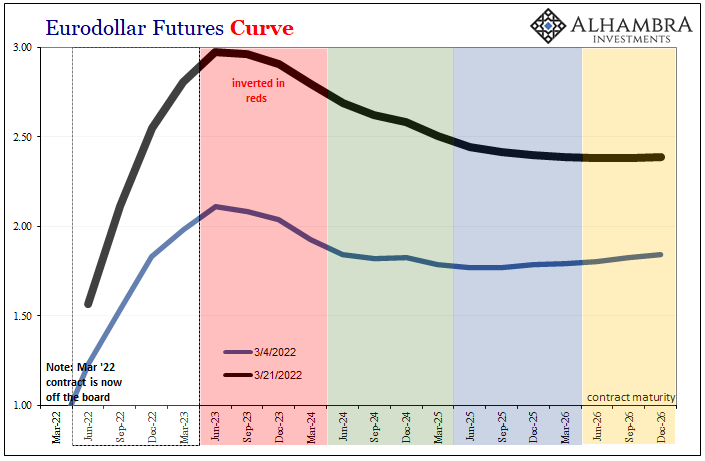

And we can’t forget that this all began in eurodollar futures more than three and a half months ago. Why is this so important? Because the trend in eurodollar futures has only been in the one direction, and a contradictory direction which has been since joined by other markets including the Big One, the Treasury curve. |

|

| No matter how many rate hikes are piled into near-term speeches and media interviews, nothing changes the market mind. As of today, eurodollar futures are just shy of 60 bps inverted, beginning near the front of the reds and heading out the whole rest of the way.

There might be those (few) who look at this and think Jay Powell’s got more than enough time before recession or something down the road in the second half of 2023. As if the FOMC has almost two years to calibrate its intentions and then fine-tune its actions. But that’s not what the curves are indicating; you never take them literally. |

|

| If we did, then we’d have thought all the way back on December 1, 2021, when the eurodollar curve first inverted, that the market was expecting economic and financial trouble all the way out in 2025! It had been, after all, the December 2024 contract where all this inversion stuff got its start.Ever since then, though, it has continued to spread in depth and breadth, inching closer and closer toward the front.

It began all the way out at the December 2024 since it was a small but “vocal” minority which began hedging for some non-specific possibility that could maybe happen at some unknown point. The market didn’t change its mind about the arrival date, rethinking to the latter half of 2023 as the inversion has moved up to the reds, rather that movement up the curve is a minority of the market converting the majority which is today more and more certain something not inflation will happen. And not in the way-out far-distant future, but closer and closer and closer to tomorrow. |

|

The more the curve inverts and is joined by other curves, the higher those probabilities are raised and the more likely that formerly non-specific something happens right out in the open of the near-term.

If – or when – the inversion in eurodollar futures spreads into the whites, then we will be able to take the contracts literally (like 2019).

Bonds vs. Economists yet again, for the championship of March Madness. Only in this “game”, rather than a highly competitive tournament made up of equally-balanced teams fighting it out over razor-thin margins for error and producing all kinds of unpredictable last-second upsets, this financial contest is like the Harlem Globetrotters about to beat down the Washington Generals for the nth time in a row.

That is the real madness here.

The market doesn’t fear rate hikes creating a recession, rather these curves all indicate a recession is too much of a probability regardless of rate hikes and how many times some policymaker says to just ignore yields and curves. They’ve been ignored for months already, and they just keep coming.

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,currencies,Deflation,economy,eurodollar futures,Featured,Federal Reserve/Monetary Policy,FOMC,inflation,interest rate swaps,Markets,newsletter,rate hikes,swap spreads,U.S. Treasuries,Yield Curve