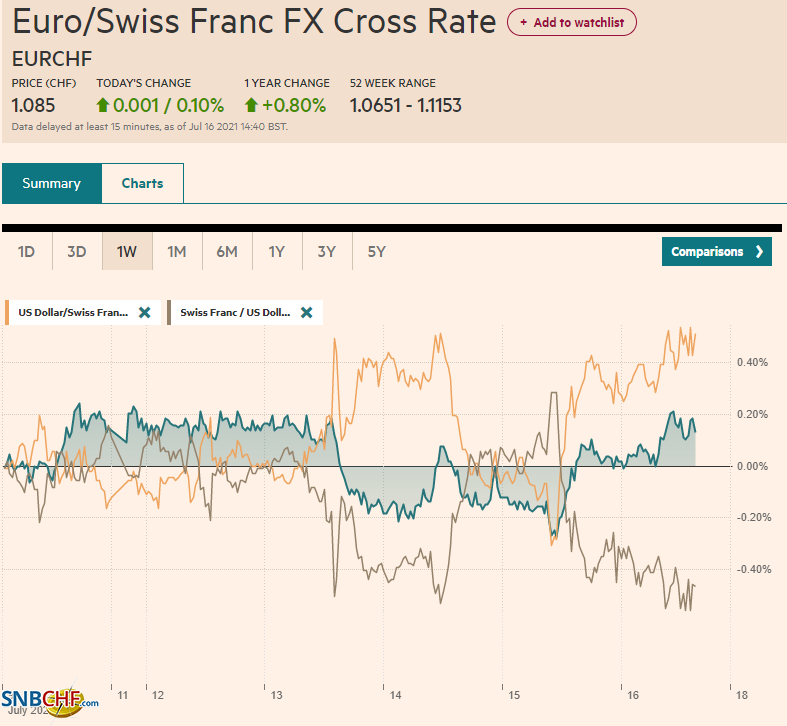

Swiss FrancThe Euro has risen by 0.10% to 1.085 |

EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The markets head into the weekend with little fanfare. Most large equity markets in the Asia Pacific region slipped earlier today. Hong Kong, which will be exempt from the need to secure mainland’s cybersecurity approval for foreign IPOs, and Australia were notable exceptions. European bourses are edging higher, while US futures are oscillating around unchanged levels. After closing below 1.30%, the US 10-year yield is around 1.33%. European yields are little changed, but German, Dutch, Spanish and Greek benchmarks recorded new three-month lows today. The US dollar is narrowly mixed. Dollar-bloc currencies and the Scandis are posting modest gains, while the yen and Swiss franc are sporting a softer profile. The euro is in about a 20-tick range through late European morning turnover. The freely accessible and liquid emerging market currencies are faring best today, led by the South African rand and Turkish lira. The JP Morgan Emerging Market Currency Index was nearly flat on the week coming into today. September WTI is stabilizing after falling nearly 4.5% over the past two sessions. It is off over 3% this week, the most since March, and the first back-to-back weekly loss since then as well. Gold is trimming yesterday’s gains, but barring a deeper sell-off in North America, it is set to close higher for the fourth consecutive week. Iron ore extended its rally for a fifth consecutive session and is up a little more than 6% this week. |

FX Performance, July 16 |

Asia Pacific

BOJ Governor Kuroda’s name refers to “black rice field.” His predecessor, Shirakawa’s name, means “white river.” China’s Deng Xiaoping observed that it doesn’t matter if the cat is black or white, as long as it catches mice. Shirakawa was old-school and unimaginative. Kuroda has been bolder, bigger, and more activist. Yer neither has been able to generate sufficient price pressures to defeat the threat of deflation. Kuroda appears to have given up. Quietly and without much fanfare, he has scaled back JGB and ETF purchases. The BOJ tweaked its macro forecasts at today’s meeting and provided more details about its green initiative. With the formal emergency extended until August 22 in Tokyo and social restrictions to continue elsewhere, the BOJ shaved this year’s GDP forecast to 3.8% from 4.0%, but boosted next year’s forecast to 2.7% from 2.4%. Its inflation forecast was lifted to 0.6% this year from 0.1% and next year from 0.8% to 0.9%.

There appeared to be three elements of the BOJ’s green initiative. First, it will make loans at zero interest rates to fund green loans by banks. There had been some talk about offering negative rates, but reports suggest Japanese banks pushed back against such ideas, seeing interest rate margins squeezed further. Second, the BOJ will exclude related reserve requirements from negative rates. Thirdly, and most provocatively, the BOJ said it will buy foreign currency-denominated green bonds issued by Japanese names. In the past, the BOJ has rejected buying foreign currency bonds because it was difficult to distinguish it from intervention.

After the Reserve Bank of New Zealand announced the end of its bond-buying program and spurred speculation of a hike this year, it reported a larger than expected jump in Q2 CPI. On the quarter, CPI rose 1.3%, almost twice the median forecast in the Bloomberg survey, after a 0.8% increase in Q1. The year-over-year pace surged to 3.3% from 1.5%. The net result is the market now looks to be pricing in about a 90% chance of a hike at the August 17 RBNZ meeting. The New Zealand dollar, which saw its central bank-inspiring gains trimmed yesterday, is the strongest of the major currencies today, gaining around 0.55% near midday in Europe.

The dollar recovered from about JPY109.70 to slightly above JPY110.20 but has lost momentum in the European morning. The almost $500 mln option at JPY110 that expires today has likely been neutralized. Net-net the dollars little changed on the week, having settled a week ago near JPY110.15.

The Australian dollar is finding a base just ahead of $0.7400. Still, the extended lockdown in Sydney and the fact that the RBNZ is pulling ahead of the RBA in adjusting monetary policy have kept it on the defensive. Around $0.7440, it is off nearly 0.66% this week and on track for the third consecutive weekly loss.

The US dollar edged slightly higher against the Chinese yuan, and it is snapping a six-week advance with around a 0.2% loss. The PBOC set the dollar’s reference rate at CNY6.4705 compared with Bloomberg’s survey median projection of CNY6.4686. The reference rate has deviated a bit more than “normal” from expectations in recent days. Separately, as we suggested, the PBOC confirmed that the digital yuan will mainly be used for domestic retail payment. That use reached CNY34.5 bln (~$5 bln) in June (70.7 mln transactions by almost 21 mln personal wallets and 3.5 mln business wallets).

EurozoneA combination of strong CPI and labor market reports and comments from two BOE officials have seen the market re-think the outlook for UK monetary policy. Consider that a week ago, the December 2022 short-sterling futures contract (three-month deposit) implied a yield of about 37 bp. Yesterday, the implied yield reached 68 bp. |

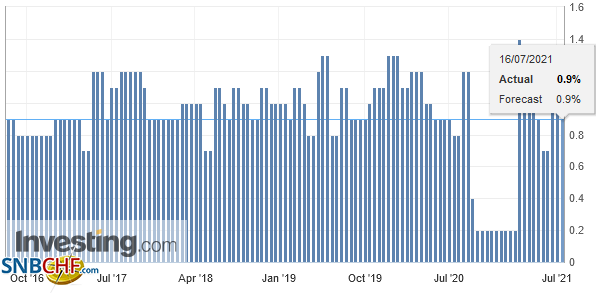

Eurozone Consumer Price Index (CPI) YoY, June 2021(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| It is consolidating today. Deputy Governor Ramsden acknowledged that the conditions for considering less accommodative monetary policy were coming sooner than he previously thought. However, the activist external MPC member Saunders suggested an adjustment might be necessary in the next month or two. |

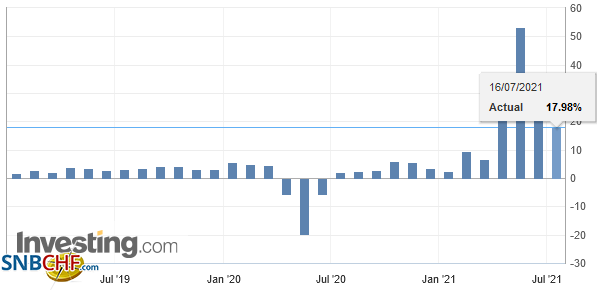

Eurozone Core Consumer Price Index (CPI) YoY, June 2021(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Today, the House of Lords Economic Affairs Committee argued that the BOE was risking stoking inflation and that its asset purchases have widened inequality and done little to boost growth. Yet, with the furlough labor program ending in September, it may be difficult to forge a majority that wants to change the policy setting seeing the impact. Still, a dissent at the August 5 meeting cannot be ruled out.

The ECB’s meeting next week is drawing attention. After adjusting the inflation target to 2% symmetrically and accepting that an overshoot is possible while it seeks to achieve the target, the ECB’s forward guidance will be adjusted. Ideas, however, that it will take another initiative, such as announcing post-PEPP plans, seems premature. The latest Bloomberg poll found that 52% expect the full 1.85 trillion PEPP “envelope” to be used up from 40% last month.

For the fourth consecutive session, the euro is straddling the $1.18-handle. So far, today’s high of about $1.1820 is the lowest high since April. It needs to rise above $1.1850 to be anything noteworthy from a technical perspective and $1.1870 to be significant. It is the fifth weekly decline in the past seven weeks.

Unless sterling resurfaces above $1.39, it will also record a losing week; its fifth in the past seven weeks too. It seems to be forging a base just below $1.3800. The British economy is set to fully reopen on Monday, though some mask-wearing requirements will remain. Next week’s data highlights include house prices, government finances, retail sales, and the preliminary Markit PMI.

United StatesThe US Department of Energy estimates that US coal production is likely to rise by 15% this year, twice the projection made in May. The drought has cut the output of hydropower, and high natural gas prices have seen utilities boost demand for coal. Key exporters, like Australia and Colombia, have supply challenges. The coal exports are forecast to rise by 21% this year and 19% next year. Meanwhile, China indicated it will release a quarter of its strategic reserves (or 10 mln metric tons) in the face of rising prices to help meet power shortages. Parts of China are reportedly experiencing the worst power shortages in a decade, exacerbated by the ban on Australia’s coal. |

U.S. Retail Sales YoY, June 2021(see more posts on U.S. Retail Sales, ) Source: Investing.com - Click to enlarge |

The Child Tax Credit expansion began yesterday. Some 60 mln children will be eligible in 36 million families. The average monthly payout is estimated at around $423 per household per month for the rest of the year. Half will be distributed now, and half with the tax returns next year. Many Democrats want this to be a permanent expansion of the program, while the Biden administration is seeking to extend it until at least 2025.

Treasury Secretary Yellen weighed in on how long transitory in terms of price pressures means. In an interview, she said that she sees several more months of rising inflation before easing. This dovetails well with our back-of-the-envelope estimate. With the pace of growth peaking around now, prices likely will follow with a lag. The headline-core split now may not be the most helpful way to break down the data. These sectors, like airfare, hotel accommodation, apparel, and the like, reflect the re-opening of the economy and adjustment from last year. Used vehicles are a different story and partly related to the re-opening and partly due to the chip shortage slowing or delaying new car production. We note that shipping costs from Asia to Europe and the US are at new highs, reflecting the large trade imbalance (shortage of empty containers in Asia). The boost in oil prices is also partly a function of a strong recovery in demand, but also of production restraint by OPEC+ and US shale producers, though for different reasons.

The US reports June retail sales today. The headline will likely be depressed by the larger than expected drop in auto sales, which has already been reported. The core retail sales, which excludes food services, autos, building materials, and gasoline, fell by 0.7% in May and likely recovered last month. May business inventory will also help economists fine-tune Q2 GDP forecasts. The University of Michigan’s preliminary July consumer confidence report will draw attention. The long-term inflation expectations (2.8% in June) will be watched closely. The US May TIC data is reported as the markets close for the week, but Canada’s report on portfolio flows will be released at the start of the session, as will housing starts and wholesale sales.

Despite the Bank of Canada extending tapering and shrugging off some recent weakness in full-time job creation, the Canadian dollar has underperformed this week, losing about 1% against the US dollar and is the weakest of the dollar-bloc currencies. It is the third consecutive weekly US dollar advance and the seventh in the past eight weeks. The US dollar is bumping against CAD1.26, and the 200-day moving average is found slightly above CAD1.2625. It has not traded above the 200-day moving average since last July. Note that the upper Bollinger Band (two standard deviations above the 20-day moving average) comes in now a little above CAD1.26.

The greenback spent yesterday below MXN20.00 and has been unable to resurface that today. It remains within the range set on Tuesday (~MXN19.8150-MXN20.0820). It is virtually flat on the week near MXN19.88. The Brazilian real is the strongest in the region this week coming into today, up almost 1.2%. The Chilean peso, where the central bank hiked rates and signaled the start of a tightening cycle, is off the most in the region, about 1.85% so far this week.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Bank of England,Bank of Japan,Currency Movement,Digital currency,ECB,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,Japan,newsletter,U.K.,U.S. Retail Sales,USD/CHF