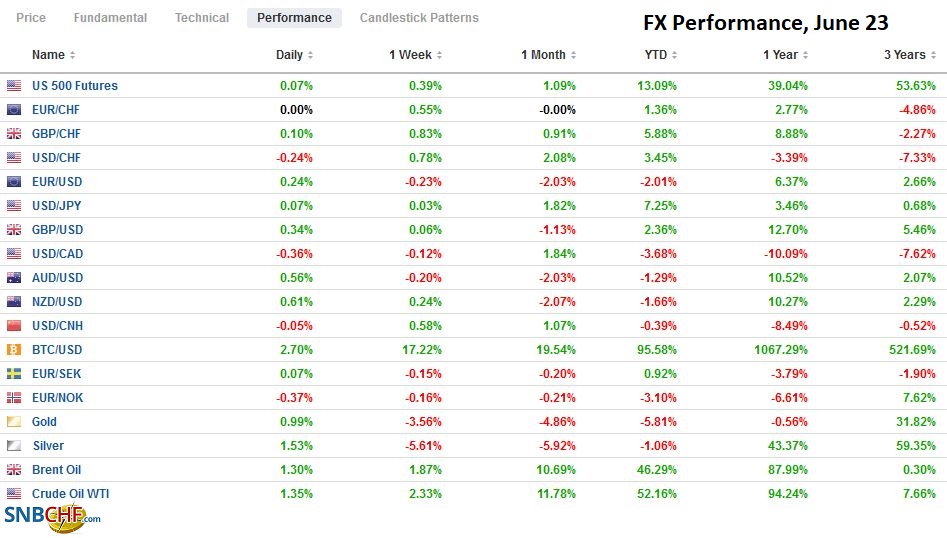

Swiss FrancThe Euro has fallen by 0.01% to 1.0956 |

EUR/CHF and USD/CHF, June 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Federal Reserve officials, lead by Chair Powell, pushed gently against the more hawkish interpretations of last week’s FOMC meeting. Tapering not a rate hike was the focus of discussions. Powell reiterated that price pressures would prove transitory and would ease after the re-opening disruptions settled down. The implied yield on the December 2022 Eurodollar futures fell for the second day, and the cumulative three basis point decline was the most in a month. The 10-year yield was capped near 1.50% and remains below there today. The stronger than expected EMU preliminary PMI did not prevent European bond yields from slipping either. The dollar is softer against most major currencies, but the Japanese yen and Japan retain the distinction of being the only G7 country with a composite PMI below the 50 boom/bust level. Despite a strong preliminary PMI, the euro is struggling to extend yesterday’s recovery. The freely accessible and liquid emerging market currencies are also higher. The JP Morgan EM FX index is higher for a third day after dropping in the previous six sessions. The Czech central bank is expected to hike 25 bp later today after Hungary hiked by 30 bp yesterday and announced the start of a new tightening cycle could see monthly adjustments. Asia Pacific equities were mixed. China, Hong Kong, Taiwan, and South Korea advanced, while Japan, Australia, and India slipped. Europe’s Dow Jones Stoxx 600 recovered yesterday after a soft start. It is trading a little heavier in the European morning. US futures indices are slightly higher. Industrial commodities, including copper, iron ore, and steel rebar, are trading higher. August WTI is at a new high of around $73.50, helped by a 7.2 mln barrel drawdown of US inventories, according to reports citing API. It confirmed it would put US inventories at a new 14-month low. Gold is consolidating in a narrow range of around $1780. |

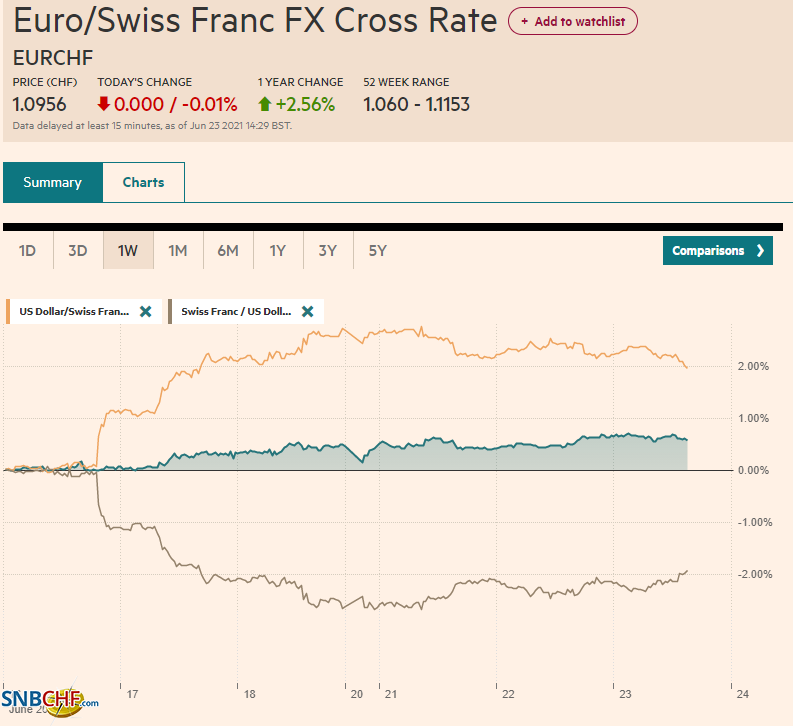

FX Performance, June 23 |

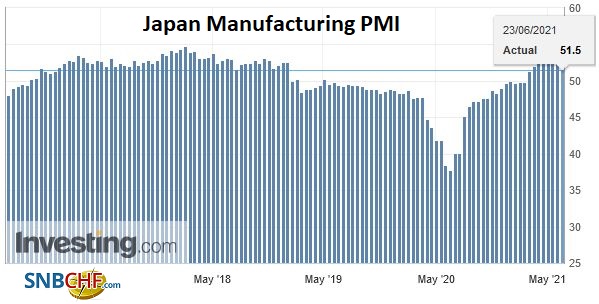

JapanJapan’s preliminary PMI underscores the toll of the formal state of emergency and the slow vaccine rollout. The manufacturing PMI slipped to 51.5 from 53.0, while the contraction in the services slowed, signaled by the services PMI edging up to 47.2 from 46.5. The composite fell further from the 50 boom/bust level, easing to 47.8 from 48.8. |

Japan Manufacturing PMI, June 2021(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Asia Pacific

Australia’s flash PMI softened, but it remains at strong levels. The manufacturing PMI eased to 58.4 from 60.4, and the services PMI dropped to 56.0 from 58.0. This resulted in the composite slipping to 56.1 from 58.0. The strength of last week’s employment data and today’s report gives the central bank reason to adjust policies at the July 6 meeting. The focus is on its bond-buying and three-year yield target. The market does not see a rate hike until at least the middle of next year.

China had indicated that it was prepared to sell some industrial metals from its state inventories to relieve some pressure on prices. It appears the vague signal was more powerful than the actual announcement. Yesterday, it announced it would auction 20k metric tons of copper, 30k metric tons of zinc, and 50k metric tons of aluminum on July 5-6.

The dollar reached nearly JPY111.00, its best level since March 31. The disappointing Japanese preliminary PMI reinforces perceptions that the BOJ will lag behind the other major central banks in normalizing policy. Last year’s dollar highs were recorded near JPY112.25 in February and JPY111.70 in March. Initial support is now seen in the JPY110.60-JPY110.70 area. Note that there is a $1.15 bln option at JPY110.75 that expires tomorrow.

The Australian dollar is trading at four-day highs around $0.7570. It is trying to re-establish a foothold above the 200-day moving average (~$0.7560) and the (38.2%) of the losses suffered since the FOMC meeting, found near $0.7570. The next (50%) retracement is closer to $0.7600.

The greenback rose to a two-month high against the Chinese yuan, a little above CNY6.49, before easing back to CNY6.48. We had seen potential toward CNY6.4950. The PBOC set the dollar’s reference rate that was again softer than the models expected (CNY6.4621 vs. CNY6.4634).

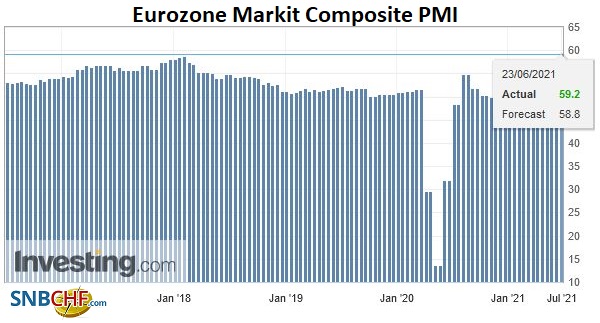

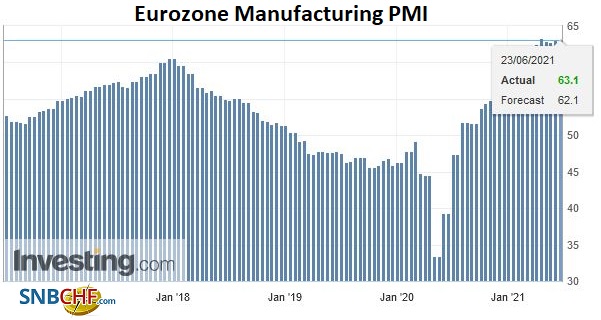

EurozoneThe flash EMU composite June PMI reached a 15-year high of 59.2. Not only was the May reading (57.1) surpassed, but so was the median forecast in Bloomberg’s survey (58.8). |

Eurozone Markit Composite PMI, June 2021(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| The manufacturing PMI held steady at 63.1 in the face of expectations for a modest softening, while the service PMI matched expectations by rising to 58.0 from 55.2. |

Eurozone Manufacturing PMI, June 2021(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

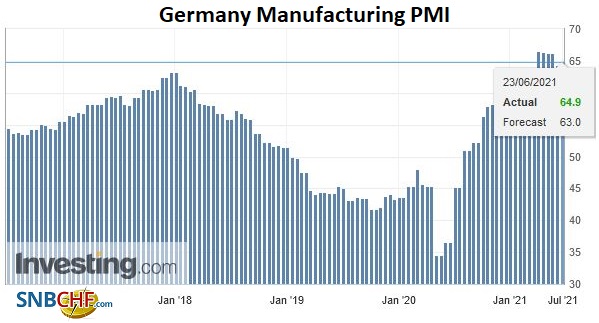

GermanyGermany’s PMI accelerated while the French reading was mixed. Germany’s manufacturing PMI rose to 64.9 from 64.4. The median projection was for a pullback. The service sector surged as social restrictions eased (58.1 from 52.8). The composite jumped to 60.4 from 56.2. Fewer companies were reporting longer lead times and rising material costs. France’s results were somewhat less inspiring but still solid. The manufacturing PMI stands at 58.6 (from 59.4 in May), and the service PMI rose to 57.4 (from 56.6). The composite rose to 57.1 (from 57.0). |

Germany Manufacturing PMI, June 2021(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

United KingdomThe UK, which has to delay its re-opening measures into the middle of next month, saw its preliminary PMI slip. The manufacturing PMI eased to 64.2 from 65.6, which is still a strong result and slightly better than expected. The services PMI slipped to 61.7 from 62.9. That is a bit less strong than expected. The composite also stands at 61.7, down from May’s 62.9 and below the median forecast in Bloomberg’s survey. Separately, the UK and EU appear to be edging toward an extension in the border checks in Northern Ireland that will avoid escalating the tensions. While formally requesting an extension, the UK has threatened unilateral action. The EU wants to ensure it will not be one extension followed by another and another. Both sides have it in their interest to resolve the situation before a recriminating trade war is sparked. |

U.K. Manufacturing PMI, June 2021(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

The euro is holding above $1.1910 but has not risen above the high (almost $1.1955) seen in the US yesterday afternoon. There is an option at $1.1975 for about 465 mln euro that expires today. An option that expires tomorrow for 1.2 bln euros at $1.1925 is also notable. The $1.20 area houses the 200-day moving average and the (38.2%) retracement of this month’s decline. It represents an important hurdle.

Sterling is approaching $1.40, where a GBP700 mln option expires today, and a GBP540 mln option expires tomorrow. The (38.2%) retracement of this month’s fall is near $1.3965, and the (50%) retracement is a little above $1.4015.

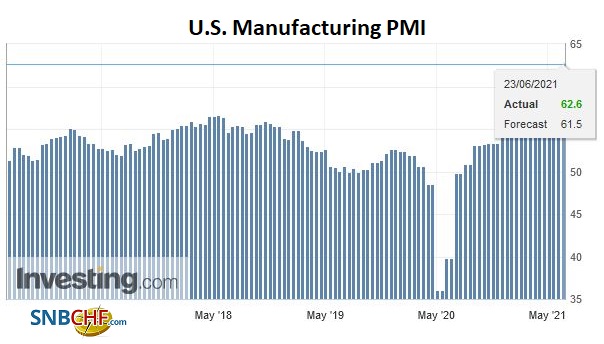

United StatesThe US flash PMI is expected to soften a little, but the reading is expected to be strong. That said, looking at survey results, many economists expect the pace of US growth to peak around now. Some of the preliminary estimate details involving lead times and prices may be more important than the headline figures. |

U.S. Manufacturing PMI, June 2021(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

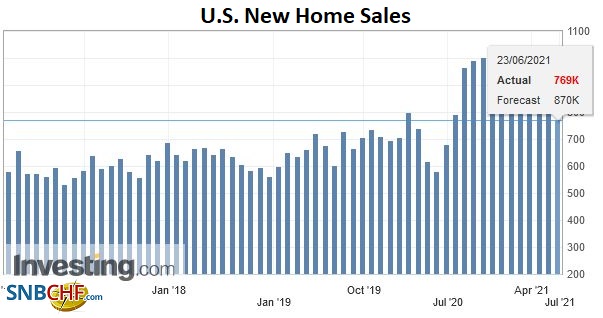

| Separately, the US reports the current account deficit for Q1. It may surpass the $200 bln-mark for the first time since 2007. In Q4 19, it was a little below $105 bln. We have suggested that when coupled with the large budget deficit (already at 4.7% of GDP in 2019), the US typically has to offer higher interest rates or the dollar bears a greater burden in the adjustment process. Also, the market is interested in the different nuanced stances of Fed officials after last week’s FOMC meeting. Today, Bowman, Bostic, and Rosengren speak. |

U.S. New Home Sales, May 2021(see more posts on U.S. New Home Sales, ) Source: Investing.com - Click to enlarge |

Canada’s April retail sales are expected to have fallen by nearly 5% after surging 3.6% in March and 5.8% in February. We would not read too much into the monthly volatility. The Canadian economy is recovering, and the key to the July 14 central bank meeting may be the July 9 employment report. Mexico also reports April retail sales. A small rise is expected after its retail sales rose by 3.6% in March (and 2.5% in February). The central bank meets tomorrow. Although it is widely expected to keep the overnight rate target at 4.0%, the rhetoric has become steadily less dovish. The market anticipates around 50 bp of tightening in H2.

The dollar peaked on Monday near CAD1.2485 before reversing lower. Follow-through selling has pushed it below CAD1.2300 today. The greenback bottomed (four-year low) near CAD1.20 on June 1. The CAD1.2300 area corresponds to a (38.2%) retracement. The halfway mark is around CAD1.2245 is the next target. Below there, initial potential extends toward CAD1.2200.

The greenback peaked against the Mexican peso at the end of last week near MXN20.75. It has fallen to a five-day low around MXN20.2630 today. The dollar may be capped in the MXN20.40-MXN20.42 area, which holds the 200-day moving average and the initial high from the FOMC meeting conclusion on June 16. The next target is near MXN20.17.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,China,commodities,EUR/CHF,Featured,federal-reserve,newsletter,PMI,USD/CHF