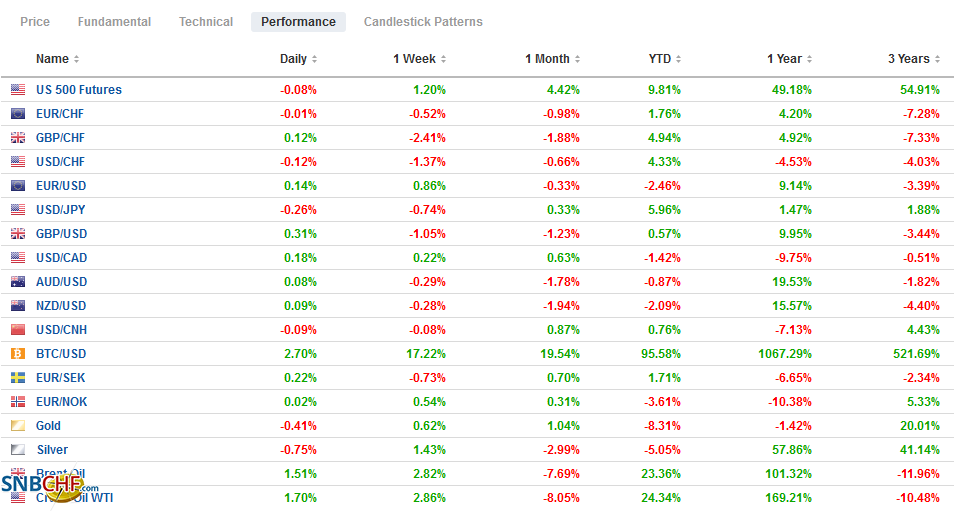

Swiss FrancThe Euro has fallen by 0.07% to 1.0997 |

EUR/CHF and USD/CHF, April 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Risk appetites have not returned from the weekend. Equities are heavy, and bond yields softer. The dollar is drifting lower in Europe. China’s unusually candid admission of the shortcomings of its vaccine and record new cases in India saw all the equity markets in the region fall. Only South Korea and Taiwan escaped the carnage that saw the Indian market tumble 3.5%. Recall that the MSCI Asia Pacific peaked on February 16. European shares have been faring better. The Dow Jones Stoxx 600 has a six-week rally in tow but is off almost 0.25% through the European morning today with all the sectors under waters but utilities. US futures are around 0.15%-0.25% lower. Benchmark 10-year yields are 1-2 basis points lower in Europe and the US, leaving the Treasury near 1.65%. The US Treasury will sell $96 bln in coupons today (a new three-year note and re-opening of the 10-year) and $111 bln of bills. The dollar’s gains in Asia-Pacific turnover have reversed in Europe. Among the majors, only the Swedish krona and Canadian dollar have been unable to turn higher on the day. The yen and sterling are leading the move. Emerging market currencies are mixed, leaving the JP Morgan Emerging Market Currency Index slightly changed after falling ahead of the weekend. Gold rose to its highest level since late February last week (almost $1759) but pulled back ahead of the weekend and is lower today, straddling the $1740 area. Support is seen near $1730. June WTI is firm but below $60. The contract continues to trade within the range set on April 5 (~$57.70-$61.50). OPEC updates its outlook tomorrow and the IEA on Wednesday. |

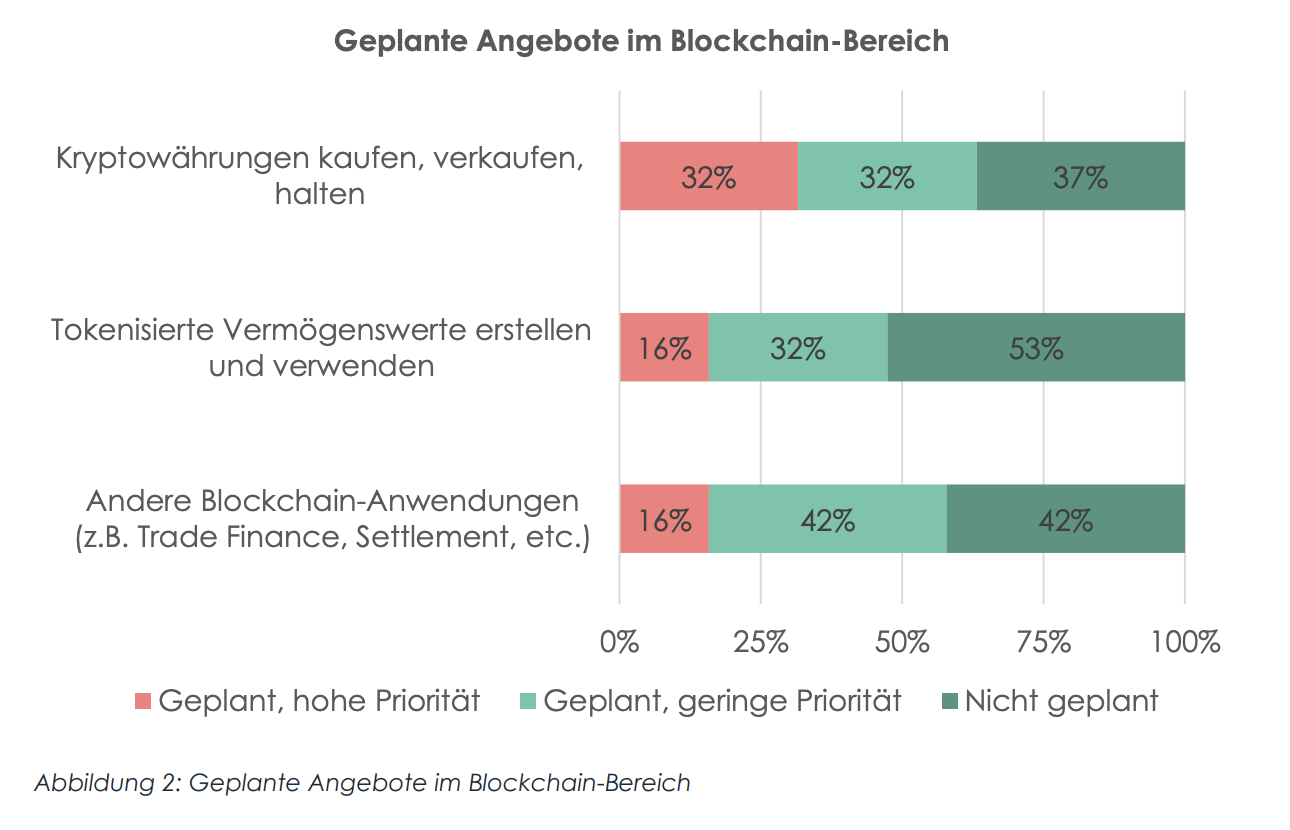

FX Performance, April 12 |

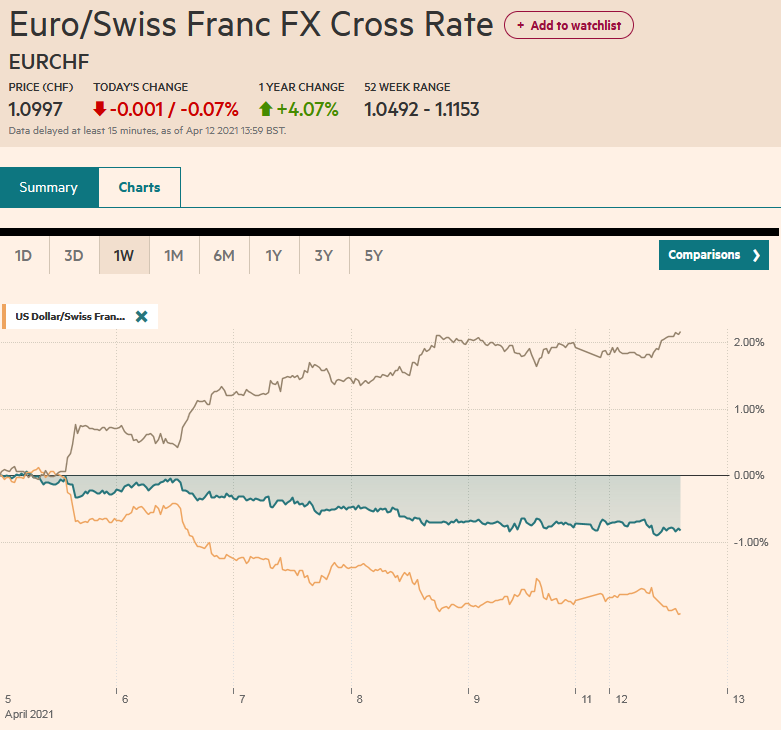

Asia PacificJapan’s vaccine efforts kick-off in earnest today. While continental Europe has lagged behind the UK and US, Japan is lagged behind the large European countries in rolling out the vaccine. Its infection numbers and fatalities are considerably lower than in most other high-income countries. Meanwhile, new social restrictions came into force in Tokyo, Kyoto, and Okinawa earlier today. Prime Minister Suga will be the first foreign leader to visit US President Biden in Washington at the end of the week. The two big issues seem to be containing China and Tokyo’s support for the administration’s new tax proposals. The economic news was better with a surge in March machine tool orders. The 65% increase (year-over-year) is the most in a decade. The base effect flatters, but it still represents a 21% increase month-over-month. |

Japan Producer Price Index (PPI) YoY, March 2021(see more posts on Japan Producer Price Index, ) Source: investing.com - Click to enlarge |

Gao Fu, the Director of China’s Centers for Disease Control, acknowledged that its vaccines are not particularly effective over the weekend. It looks to offer around half the protection of the Pfizer and Moderna vaccines. China has yet to approve foreign vaccines. Beijing has exported millions of vaccines and has thrown shade on the mRNA vaccines. Some countries have been suspicious of the efficacy of China’s vaccine. The UAE has experimented with giving three doses instead of two to boost the antibodies. Singapore has stockpiled but not used the Sinovac.

US confrontation with China is poised to escalate shortly. A bill will be debated by the Senate Foreign Relations Committee as early as tomorrow that will sharpen the antagonism and could draw the most bipartisan support of any initiative so far in the new Biden administration. The bill builds on efforts in the previous administration’s waning days to deepen/broaden relations with Taiwan while still stopping shy of a defense pact or formal recognition of Taipei. The US is concerned that China is trying to change the status quo through its persistent harassment of Taiwan through aerial excursions with what appears to be an increasing number of planes. China fears that the US is trying to change the status quo with its diplomatic parries as part of its larger encirclement and isolation strategy. The previous Secretary of State had called for regime change in Beijing. The bill would expand the scope of the Committee on Foreign Investment in the US (CFIUS). It could also entail more sanctions and other measures to check China’s territorial claims.

In the last three sessions, the dollar traded between JPY109 and JPY110.00. It remains in that range today. Within that range, JPY109.20-JPY109.80 is likely to confine today’s action. The dollar fell one week in both February and March. It slipped about 0.9% last week. Strong US data and new supply may lift US yields and help underpin the dollar against the yen this week. Australia’s Prime Minister Morrison is reluctant to provide a new target date for full vaccination. The week’s economic highlight will be the March jobs data (early on April 15), where Australia has enjoyed success in bringing back full-time workers. The Australian dollar has found support a little below $0.7600. The nearby cap is seen around $0.76050. China’s March lending figures are slightly softer than expected but still show the customary recovered from the holiday-induced weakness in February. Chinese officials have reportedly discouraged continued strong lending growth starting this month. Its first estimate of Q1 GDP is due out on April 16 in Beijing. The dollar eased against the yuan today for the first time in four sessions. The PBOC dollar fix at CNY6.5578 was very much as anticipated by the bank models in Bloomberg’s survey. The dollar’s low last week was about CNY6.5370, and the high was around CNY6.5615.

EuropeRussia’s troop build-up on the East Ukraine border, the largest since the 2014 invasion, is becoming more significant. The US European Command raised its alert status to the highest level. Turkey has announced that the two US warships will enter the Black Sea toward the middle of this week, having made due notifications a couple of weeks ago. The ships can remain in the Black Sea until May 4. The US is making a fullcourt press. The Secretary of State Blinken and Defense Secretary Austin will spend the better part of the week ahead in Europe. Europe has an arduous task. It has two months to get the two defectors from the 2015 treaty with Iran back into compliance. When the US withdrew from the agreement, it not only reimposed sanctions that had been in place but added more. Iran has breached several restrictions of the treaty. The issue is what sanctions the US is willing to lift and what nuclear restrictions Iran is willing to implement. The sequencing of the moves is also important but seems secondary to the material agreement. The Iranian presidential election is on June 18, and if an agreement is not reached before it, the risk is of a longer delay. An agreement is also seen as strengthening the moderates, and it would also be a diplomatic win for the EU where the news stream has not been particularly good. |

Eurozone Retail Sales YoY, February 2021(see more posts on Eurozone Retail Sales, ) Source: investing.com - Click to enlarge |

German politics are particularly fluid now. The CDU/CSU is trying to pick a successor to Merkel, who will lead the coalition into the September elections. The CDU picked its new leader Lashet as its candidate, but the CSU is likely to pick its leader, Soeder. A divided center-right could provide new openings not just for the Greens but for the AfD. Soeder is seen to the right of Lashet. Meanwhile, in France, Le Pen is running neck-and-neck with Macron. Many observers see a shift to the right and are lumping Johnson in the UK as a similar shift.

The euro found support in the last three sessions ahead of $1.1860. Today, it found a bid near $1.1870 in the European morning, helped by some assurances from the ESM head Regling who offered comforting words about the 750 bln-euro Recovery Fund, opining that the German court will not block it. EMU retail sales in February rose by 3.0% (nearly twice what economists forecast), and the January slide (-5.9%) was revised better (-5.2%). Initial resistance is seen in the $1.1930 area. Sterling slipped briefly to a new two-week low (~$1.3670) before recovering and trading above the pre-weekend high (~$1.3750). The UK’s next phase in re-opening, including non-essential shops, hairdressers, pubs, and restaurants with outdoor seating, will open for the first time since January 5. The next area of resistance is seen around $1.3780-$1.3800.

America

Ahead of the weekend, Logan, who manages the Fed’s asset purchases, put the market on notice for some technical adjustments and perhaps more frequent adjustments to the Treasury purchases’ allocations. The underlying goal is to remain roughly in line with the supply. The challenge is that the Treasury Department has changed the supply. It has renewed the issuance of a 20-year bond and has increased the size of other tenors. That means, for example, the 7-year-to-20-year bucket that was 10% of the outstanding supply last spring is now 13%. Market participants knew from Logan’s remarks that more of this bucket will be bought and front-ran the Fed a bit. Less shorter-dated coupons and inflation-protected securities will be bought. Tomorrow, the Fed will announce its new buying schedule.

The Biden administration hosts the semiconductor summit today as producers and automakers meet to discuss the shortage that is already leading to plant slowdowns and shutdowns. There does not appear to be an imminent solution, but the industry will work through the shortage. In the medium and longer term, it seems to reinforce the growing sense that countries will seek more supply chains brought home. This is already evident in medicines and medical supplies.

The busy week for US data starts slowly today but features the March CPI tomorrow and retail sales and industrial production on Thursday. The Bank of Canada updates its business outlook, and after the strong jobs report ahead of the weekend, a more confident assessment is expected. Given the elevated concern about the real estate market, the housing starts data at the end of the week will draw attention. Mexico has a light economic calendar this week. Brazil reports February retail sales tomorrow (recovery after a January decline) and unemployment figures ahead of the weekend (~14.2%).

The US dollar moving sideways in the lower end of the pre-weekend range. The US dollar fell to around CAD1.2525 from above CAD1.26 on the back of the Canadian jobs report. It has not traded below CAD1.2500 since March 22. On the topside, the greenback has held below CAD1.2650 since March 10. The US dollar is trading a little heavier against the Mexican peso, but it remains within the recent range that in the second half of last week extended to MXN20.0650, its lowest level since mid-February. A break of MXN20.00 would set up a test on the MXN19.89 area, the last significant area before MXN19.50. On the other hand, a move above MXN20.25 would suggest a low may be in place.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,Featured,federal-reserve,newsletter,Russia,Treasury