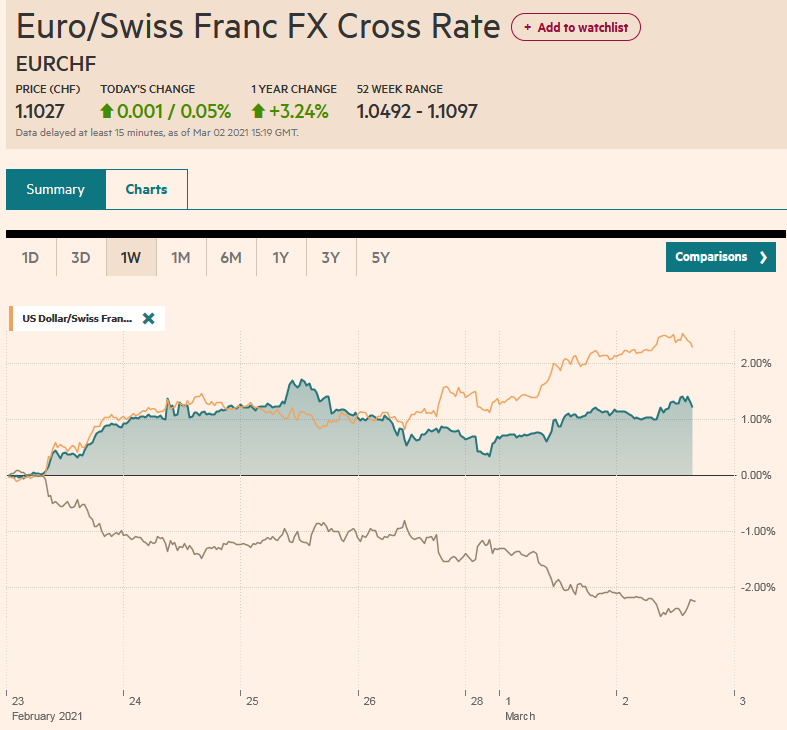

Swiss FrancThe Euro has risen by 0.05% to 1.1027 |

EUR/CHF and USD/CHF, March 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: A warning from China’s top banking regulator about the frothiness of foreign markets appeared to blunt the knock-on effect of yesterday’s largest rise in the S&P 500 since last June (~2.4%) and weighed on global equities. The large markets in the Asia Pacific region but India and South Korea fell. Europe’s Dow Jones Stoxx 600 steady, recovering from initial losses. US index futures are off around 0.5%. Benchmark yields are firmer, with the US 10-year yield around 1.45%. The Reserve Bank of Australia took no fresh initiatives, and the 3-year yield targeted at 10 bp is closer to 15 bp. Its 10-year yield rose five basis points to 1.7%. European yields are mostly 2-5 bp higher. The dollar is extended the recovery that began last week. The euro traded below $1.20 for the first time since February 5, and sterling, which peaked last week near $1.4240, tested $1.3860. The dollar is also firmer against most emerging market currencies. Gold traded below $1710 for the first time since last June before recovering to almost $1735. Last week’s high was near $1816. Oil is lower for the third consecutive session, its longest losing streak in nearly three months ahead of the OPEC+ meeting later this week that is expected to confirm plans to bring more production back online. |

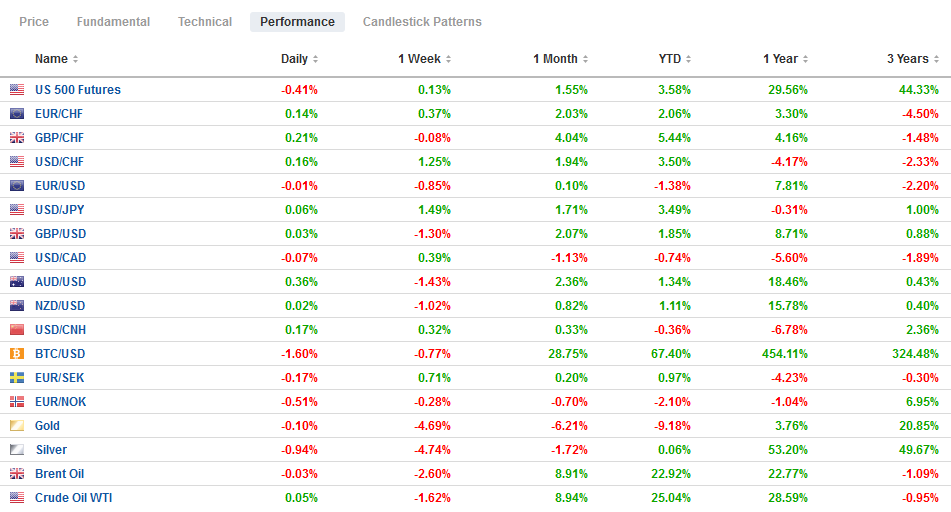

FX Performance, March 2 |

Asia Pacific

Guo Shuqing, China’s top banking regulator (chair of China Banking and Insurance Regulatory Commission), expressed concern about foreign equity markets’ speculative heights and the rapid foreign capital inflows into China. He also cited concern about the domestic property market. At the start of the year, officials took action to cap bank lending to real estate, squeezed the shadow banking sector, and forced peer-to-peer lending to unwind. The MSCI Asia Pacific Index was higher before Guo’s remarks. China and Hong Kong share indices fell the most in the region.

The Reserve Bank of Australia defied expectations. Given the pressures on the bond market and in particular that the three-year note yield was above the 10 bp target, many, including ourselves, expected the RBA to boost its bond-buying. Instead, led by Governor Lowe, the RBA did nothing but signaled that it would likely extend its asset purchases. Currently, the effort is slated for A$200 bln through September. This follows yesterday’s A$4 bln of purchases, twice the usual amount. At the long-end, the RBA says it is not targeting a yield but providing liquidity and ensuring a smooth functioning bond market. The RBA reiterated its pledge not to increase the cash rate target (10 bp) until actual inflation is on a sustainable path within the 2-3% range and does not expect this to happen until 2024. The market does not fully accept the RBA’s guidance and appears to be pricing an earlier hike.

Japan reported an unexpected decline in the January unemployment rate to 2.9% but only because the December series was revised to 3.0% from 2.9%. On the other hand, the job-to applicant ratio jumped to 1.10 from a revised 1.05. It is the highest since last June. Public investment in construction seemed to be partly responsible for the tick-up, but it appears likely that the emergency discouraged people from looking for jobs.

For the fifth consecutive session, the dollar rose above the previous session’s high. It is in a narrow range above JPY106.70 and below JPY106.95. It has not been this high since last August. A move above JPY107 would target the JPY107.50 area, but we suspect the initial potential extends toward JPY108.00. It is notable that despite the greenback’s gains, implied volatility is softer, and the benchmark three-month measure is lower for the second session and around 6.24% below last week’s lows. The Australian dollar is quiet. It is inside yesterday’s range, which itself was inside the pre-weekend range. The consolidative tone keeps the Aussie below $0.7780. A move above the $0.7820 area could signal the end of the consolidative phase. Alternatively, a break of $0.7700 would suggest a deeper correction has begun. The dollar’s reference rate was set at CNY6.4625 today, a little firmer than expected. The broadly sideways price action that has persisted since the start of the year is now being attributed to the caution ahead of the National People’s Congress that starts at the end of the week.

Europe

The preliminary eurozone February CPI was in line with expectations. It rose by 0.2% on the month for an unchanged 0.9% year-over-year pace. The core rate slipped to 1.1%, as projected, from 1.4%. Energy will likely have a greater impact as last spring’s precipitous decline falls out of the year-over-year comparisons. The ECB meets next week (March 11), and the risk is that the near-term growth forecasts are reduced. The focus at the meeting will likely be on measuring financial conditions, which seems to be the key to the declaratory policy.

Yesterday’s ECB figures indicated under the Pandemic Emergency Purchase Program, it settled only 12 bln euros of purchases. This was below the recent averages and got the chins wagging, but there two important mitigating factors. First, the purchases are net of redemptions, and last week there was a large redemption (~31 bln euros in France). Second, the strong upward pressure on yields was seen last Thursday and Friday, after the settlement cut off. We suspect ECB President Lagarde will be questioned about its purchase pace at next week’s ECB meeting. She will likely emphasize the official commitment to ensuring easy financial conditions and extremely flexible asset purchases. Recall the difference. The Fed is committed to buying $80 bln of Treasuries and $40 bln of Agency MBS a month. The ECB has what it calls an envelope–a sum it grants itself (1.85 trillion euros) that it can use as it sees fit. It can use less, and if more is needed, it can increase it again.

A few other data points garner attention today. First, German data disappointed. February unemployment unexpectedly rose by 9k. Bloomberg’s survey found a median expectation for a 10k decline. Instead, the increase was the first since last June. The unemployment rate was unchanged at 6.0%. Separately, Germany reported another sharp decline in retail sales. The January slump of 4.5% contrasts the Bloomberg survey looking for a 0.3% gain after the more than 9% decline in December (revised to -9.1% from -9.6%). The aggregate figure for the eurozone’s retail sales is due Thursday and was expected to have fallen by 1.4% after a 2.0% gain in December. It seems clear the risks are on the downside. The UK’s Nationwide reported a stronger jump in house prices than expected. The 6.9% year-over-year increase was more than the 5.6% projected. It is the seventh increase in the year-over-year rate in the past eight months.

The euro was pushed below $1.20 as the European session began. The dip was greeted with fresh buying. Initial resistance is seen in the $1.2050 area, and there are expiring options struck at $1.2065. Last month’s low was near $1.1950. Since 1 December 2020, the euro has closed below $1.20 once (February 4). Sterling extended its pullback and traded below its 20-day moving average (~$1.3890) for the first time since February 4. In the European morning, it is recovering from the test on $1.3860. Nearby resistance is around $1.3900 and then $1.3930.

America

The US has a light data schedule today. February auto sales are due, and the poor weather is likely to slow sales from the 16.63 mln seasonally-adjusted annual pace reported in January. However, while slowing auto sales dampen headline retail sales, the real takeaway from the US economy is its strength in Q1, helped by the $900 bln stimulus package approved last December. The US ISM figures were solid and stronger than expected. Output, orders, and employment rose, and employment rose. It appears that estimates for this Friday’s employment report are also ticking up toward 200k. The increase in unfilled orders and longer delivery times (both measures are at multi-year highs) reflects the bottlenecks, which may spur short-term price increases but typically is not what makes for sustained inflation. Investors may be sensitive to headline risks emanating from the confirmation of hearings of the SEC head nominee Gensler and Chopra, nominated to head up the Consumer Financial Protection Bureau.

Canada reported December monthly GDP figures, but the interest will be in the Q4 20 figures. Canada was likely the fastest growing economy in the G7 in the last three months of 2020. Bloomberg’s survey median forecast is for a 7.3% annualized pace in Q4. The US grew by 4.2%. Although it often reports its job figures the same day as the US, it does not do so this month. Canada’s February employment report will be released on March 12. After yesterdays’ worker remittance figures (a little stronger than expected) and Markit manufacturing PMI (44.2 vs. 43.0 in January), Mexico’s calendar is quieter today, with January leading economic indicator and its monthly budget balance. Neither report are typically market movers. Tomorrow’s central bank’s inflation report may garner more attention ahead of the policy meeting on March 25.

The US dollar is little changed against the Canadian dollar and remains within the pre-weekend range (~CAD1.2590-CAD1.2750). It met sellers in late Asia and early Europe near CAD1.2700. Initial support is seen near yesterday’s lows (~CAD1.2640). The greenback remains within the February 25 range against the Mexican peso (~MXN20.37-MXN21.03). The first level of resistance today is near MXN20.80, but MXN21.00 may prove more formidable.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,ECB,Featured,newsletter,RBA