It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.” In 2014, the clock was ticking but expectations were extremely high nonetheless.

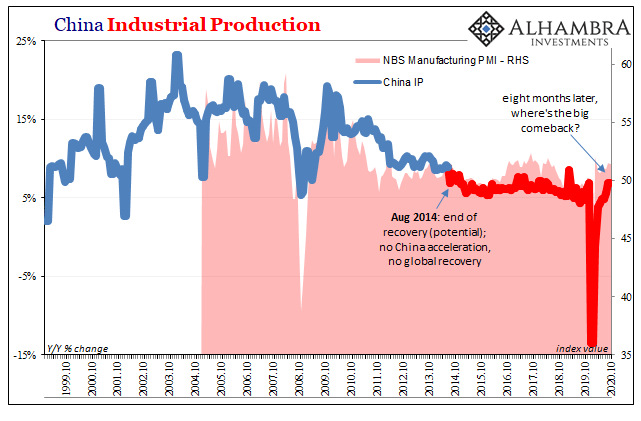

In September 2014, however, massive setback. Though it had been building all year by then – CNY abruptly falling right from 2014’s start along with global bond yields, then oil prices following those by that July – when China’s National Bureau of Statistics (NBS) reported how Chinese Industrial Production had grown just 6.9% during the month of August, suddenly prospects for acceleration and recovery were gone.

Instead, a downturn seemed undeniable, markets sure seemed to be right, after all.

Denials, of course, would continue in the official sector on both sides of the Pacific anyway; they simply persisted much longer on this side. Even the pages of the Wall Street Journal couldn’t adequately spin such a surprisingly stark slowdown in sino-manufacturing:

China’s economic engine sputtered in August [2014] as industrial production growth slowed to its lowest level since the 2008 global financial crisis, according to data released Saturday, increasing the chance that Beijing will step up stimulus measures to bolster the world’s second-largest economy.

The newspaper did spin, though; the economy really was materially slowing rather than accelerating, but according to the WSJ this was good anyway because more “stimulus!”

The country’s number two Communist (at the time), Premier Li Keqiang, remained defiantly confident – and in doing so argued against the mainstream opinions as adequately expressed by the writers at the Journal. Li had countered:

The government will not be distracted by short-term fluctuations of individual indicators.

While many also hoped for “short-term fluctuations”, they would both end up being wrong. Chinese economic authorities, with Li at the forefront, sat on their hands for as long as they could all the while watching economic (and financial; see: August 2015) conditions deteriorate around them. The government wouldn’t panic into big “stimulus” until early 2016.

And when they did it wouldn’t do China (or the rest of the world) much good. Contrary to the Journal’s orthodox Keynesian worldview, there really was no realistic pathway back. Given the sordid nature of this affair, no wonder Xi Jinping spent 2017 sidelining Li, battening down the political hatches, and preparing for what’s only now being more comprehensively written into China’s 14th 5-year plan.

All the while clueless Western Economists and central bankers (same thing) are still trying to piece together what went wrong (inflation “puzzle”) and when.

| The when was 2014; as in, when China IP dumped below 8% for the first time, this had actually signaled a true end to all the recovery fantasies. No anomaly, it was the beginning of the end, QE globally hadn’t worked at all. On the contrary, Euro$ #3, the world’s third major global dollar shortage since 2007, really was, as so many (ignored) markets warnings were right then warning about, squeezing the last bits of potential recovery out of the system.

August 2014 would prove to have been only the beginning of a new, recovery-less “normal” (because we continue to accept it). Early today, China’s NBS reports that Industrial Production in that nation during October 2020 rose, oh boy, 6.9% when compared to production during October 2019. Somehow, this is being reported in the media as some kind of triumph. The “recovery” is “proceeding” numerous stories have all said, the rebound from the COVID pandemic allegedly on schedule and undeterred. Like 2014, it couldn’t be farther from the truth. Denial remains the most powerful economic drug, way more powerful than “stimulus” (because that’s all it does, feed denial). To begin with, the Chinese shutdown happened in January and February, meaning that October was the eighth month of reopening in that place. Back in those first two months of the year, IP had plunged 13.5% year-over-year. Rather than recover like a “V”, China’s vast industrial sector has meandered back toward growth rates that for years have clearly pointed toward nothing good. |

China Industrial Production, 1999-2020(see more posts on China Industrial Production, ) |

| Worse, October’s 6.9% was actually the second 6.9% in a row (same as September, no acceleration).

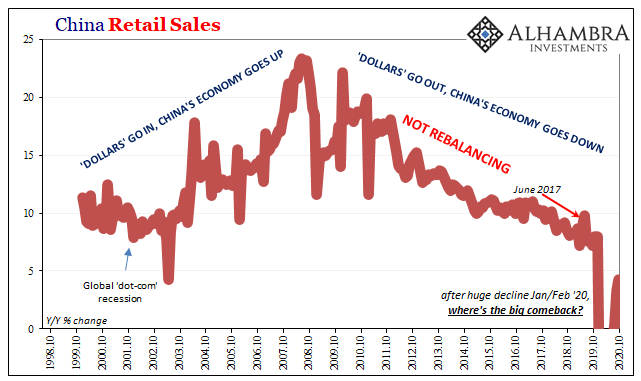

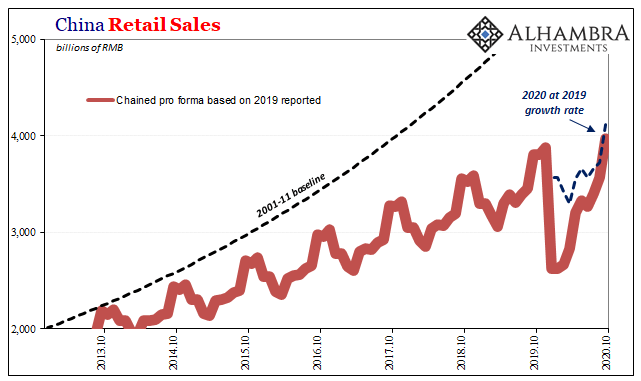

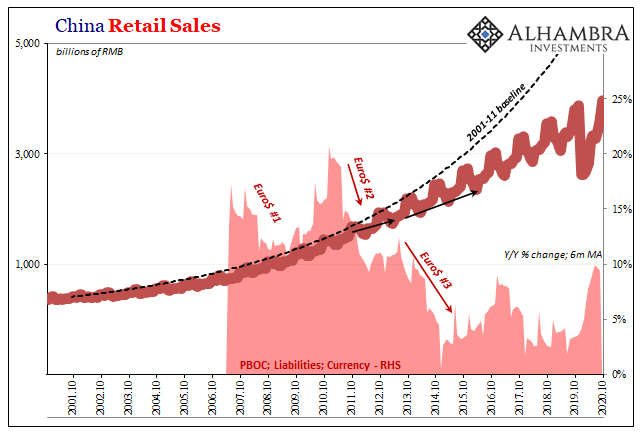

Hardly a condition for Chinese industry alone, that whole national economy remains firmly in the recessionary rut. Retail sales, the very fabric of “dual circulation” or rebalancing (or whatever authorities will end up calling the same idea five years from now when it, too, fails), gained just 4.3% year-over-year last month – still one of the worst rates in Chinese economic history even after eight months of this upturn. It’s not easy to see just how alarming this is, but when you do a little bit of work (the way the NBS tabulates growth rates makes yearly comparisons a little more difficult) what you end up with is a better sense of how China’s economy (by virtue of whichever economic account) hasn’t even caught up let alone begun to make up for such a massive amount of activity that didn’t happen this year. And that’s after half a decade of already having fallen off. The only thing proliferating in China is just how many ways the economy can fall behind. By definition, both “V” and “recovery” require such an acceleration over and above. |

China Retail Sales, 1998-2020(see more posts on China Retail Sales, ) |

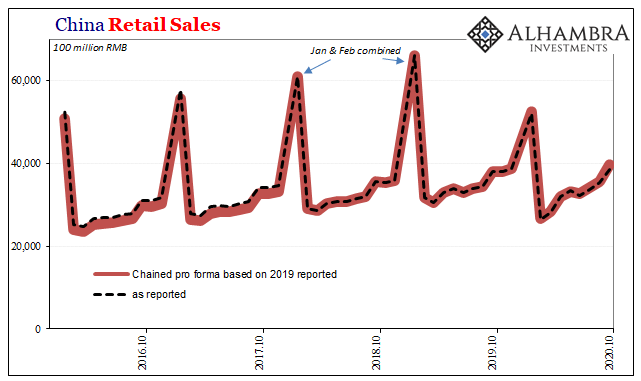

China Retail Sales, 2016-2020(see more posts on China Retail Sales, ) |

|

| Normalizing retail sales to 2019’s estimates, and then flattening out the Jan-Feb months (by just assigning half to each month), like IP you see that in retail sales, too, trouble really became obvious in…2014. It had begun several years earlier, though as markets were pricing (including falling UST yields, as well as rising dollar exchange values) it really would go on to become a permanent change. |

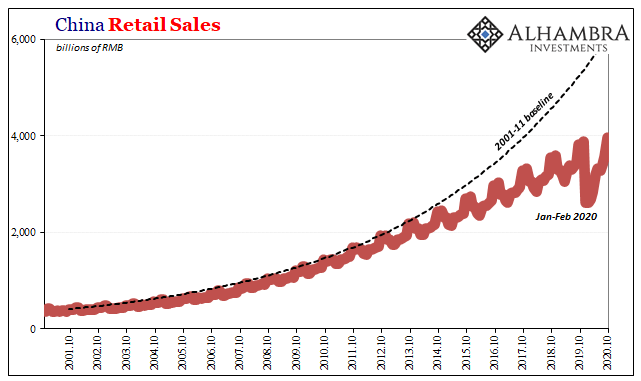

China Retail Sales, 2001-2020(see more posts on China Retail Sales, ) |

| On top, January and February 2020 were together a huge further stumble to a place that can’t afford more of them. A V-shaped recovery from the shutdown would have looked very different than 4.3% eight months into it (below: assuming no COVID or further Euro$ #4 slowdown, so retail sales in 2020 growing at 2019 rates). China can’t even catch up to where it would’ve been this year at post-2014 low levels of expansion. |

China Retail Sales, 2013-2020(see more posts on China Retail Sales, ) |

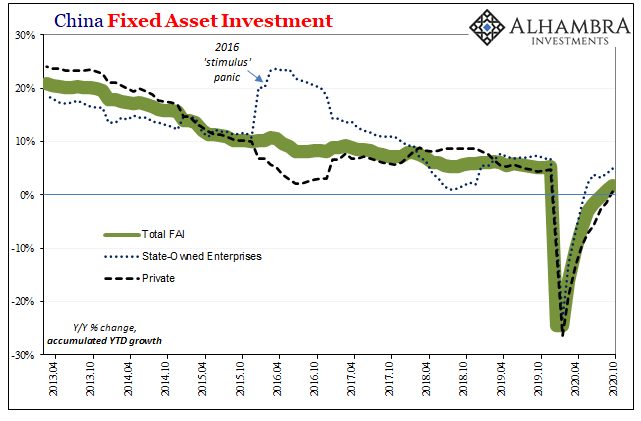

| It leaves the world into much the same misguided belief as expressed in mainstream financial opinion back in 2014. “Stimulus!”

And that’s simply because the 2020 “V” just never happened, so now the narrative surrounding it has to change from recovery expected today to recovery hoped for tomorrow (it hasn’t happened yet, but it is proceeding and ‘stimulus’ will see that it does!) China is not only two maybe three months further along than everyone else, everyone else is also – like 2014 and 2017 – counting on the Chinese economy to be the world’s marginal source of strength when it’s back to using the future tense. Xi (as well as, we assume, Li) has learned there’s just no point to “stimulus”, one key factor that actually is different; when tried, it didn’t work before, the eurodollar’s overall grip too persistent on both global growth as well as China’s monetary engine. |

China Fixed Asset Investment, 2013-2020(see more posts on China Fixed Asset Investment, ) |

| Jay Powell’s reported 2020 “flood” of digital “dollar” “printing” never happened (just as QE’s 1 through 4 hadn’t solved anything). The PBOC is trying to manage more currency growth in 2020 but still at the expense of bank reserves, leaving the RMB money markets precariously insufficient, potentially illiquid, and therefore at high risk of being a further drag (see: here).

In that sense, absolutely nothing has changed since 2014 (really 2011) except how Xi views the futility of the Keynesian textbook. Industrial Production gaining 6.9% in August 2014 really did prove to be a sign of things to come, none good, and that was at a time when the Chinese economy was slowing down from many years of truly rapid rates. |

China Retail Sales, 2001-2020(see more posts on China Retail Sales, ) |

| This is no “V” at all; quite the opposite, actually. Not only is the rebound suspiciously lethargic and devoid of clear, unambiguous V-like momentum, in 2020, after such a huge drop to begin this year, 6.9% spells big trouble; more than it had in 2014. Xi knows this. He gave Li one more chance in 2016 to figure it out, but Li never could.

No wonder the 14th 5-year plan audaciously seeks to invent a completely new future Chinese economy. The current one doesn’t work, hasn’t in a very long time, and doesn’t appear like it will start to anytime soon. Six point nine in twenty fourteen wasn’t the anomaly postponing the start of recovery, it was the first concrete economic signal that markets were right about how there wouldn’t be one. What’s changed in 2020 for the better? |

China Exports, 1995-2020(see more posts on China Exports, ) |

China Exports, 1995-2020(see more posts on China Exports, ) |

|

China Exports, 1995-2020(see more posts on China Exports, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: $CNY,Bonds,China,currencies,Currency,economy,eurodollar system,Featured,Federal Reserve/Monetary Policy,fixed asset investment,industrial production,Markets,newsletter,PBOC,QE,Retail sales,RMB,stimulus