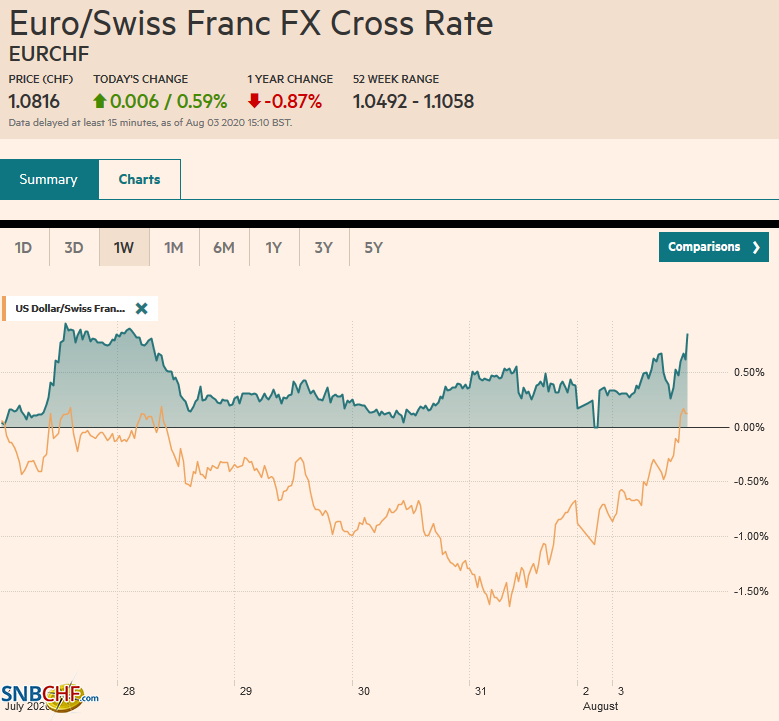

Swiss FrancThe Euro has risen by 0.59% to 1.0816 |

EUR/CHF and USD/CHF, August 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The capital markets are decidedly mixed today as investors are pulled between rising infections, heightened tensions between the US and China, lack of progress on new US stimulus, and technical forces as the new month begins. Asia Pacific equities were mixed though the Nikkei gained more than 2%, aided by the yen’s slump ahead of the weekend, and the Shanghai Composite began the month with a 1.75% gain after the Caixin manufacturing PMI rose to its best level since January 2011. Most of the other markets in the region fell, including Hong Kong, Taiwan, India, and Australia. Europe’s Dow Jones Stoxx 600 is up about 0.5% near midday, trying to snap a three-day downdraft and last week’s nearly 3% decline. Investors may be encouraged by the stronger than expected July manufacturing PMI. US stocks are little changed. European benchmark yields are firmer, while the US 10-year yield is near 53 bp. The dollar is mixed. Currency pairs that often move together like Sweden and Norway and Japan and Switzerland are moving in opposite directions. The Swedish krona and the Japanese yen are among the leaders, while the Norwegian krone and Swiss franc are nursing modest losses. The euro is little changed. Emerging market currencies are mostly lower, and the JP Morgan Emerging Market Currency Index is slipping for the third session in a row, the longest losing streak since mid-June. Gold recorded a marginal new high (~$1988.40) before moving lower. Oil is trading heavier, with the September WTI contract spending more time below $40 a barrel. It continues to consolidate in last Thursday’s range when it saw a low of around $38.70. |

FX Performance, August 3 |

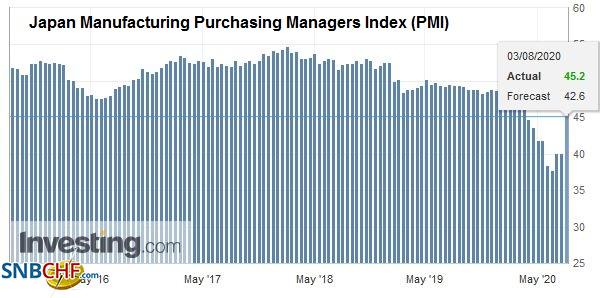

Asia PacificThe manufacturing PMIs from around the region improved, but many remain below the 50 boom/bust level. Japan’s was revised to 45.2 from the preliminary estimate of 42.6 after June’s 40.1. South Korea’s improved to 46.9 from 43.4. Taiwan was one of the rare countries that rose above 50 (50.6 from 46.2), and it was the first time since April. Australia CBA manufacturing PMI rose to 54.0 from 53.4 initially and 51.2 in June. The AiG measure rose to 53.5 from 51.5. There were a few exceptions to the broad improvement. India’s manufacturing PMI slipped to 46.0 from 47.2, and Malaysia’s eased to 50.0 from 51.0. |

Japan Manufacturing Purchasing Managers Index (PMI), July 2020(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

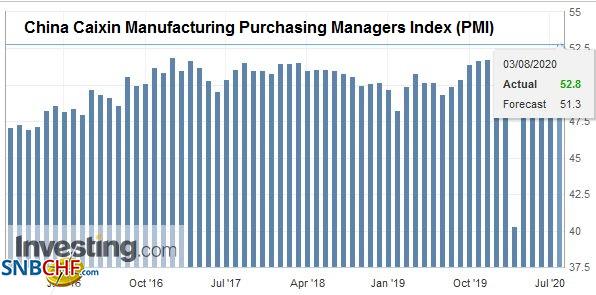

| China’s Caixin PMI rose to 52.8 from 51.2 in June and 50.7 in May. The details were constructive, with output above 50 for the fifth month and improving new orders. China’s recovery seems very much intact. Meanwhile, the US is hinting at broader action against some Chinese apps, in addition to TikTok. The owner, ByteDance, wants to spin-off TikTok rather than sell it in a shotgun marriage to Microsoft. TikTok has promised more US-based jobs. At the same time, Germany joined several countries it scrapping its extradition treaty with Hong Kong. The US had indicated it would but has yet to make the official announcement. |

China Caixin Manufacturing Purchasing Managers Index (PMI), July 2020(see more posts on China Caixin Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Over the weekend, Samsung announced it was shuttering its last computer factory in China. Starting this year, it stopped making smartphones there too. Its two remaining facilities fabricate semiconductors. This may not be a response to the US tariffs on Chinese goods. It may be more a reflection of evolving supply chains as competition to China has emerged (e.g., Vietnam, Thailand) for labor-intensive manufacturing and assembly in some industries and some products.

After posting a key upside reversal ahead of the weekend, the dollar was lifted to almost JPY106.45, which seemed to exhaust the short-squeeze after it reached a six-day high. The greenback was sold down to almost JPY105.50 in early European turnover. The JPY106 area should now offer resistance, and nearby support extends toward JPY105.30. The Australian dollar’s reversal ahead of the weekend was not as dramatic, but the follow-through selling today has taken it to a new five-day low near $0.7100. A break signals a test on the $0.7060 area. The dollar edged slightly higher against the Chinese yuan, which the PBOC set the reference rate of CNY6.9980, a touch lower than expected. The yuan has been falling for two weeks against its CFETS basket but edged higher today. The Hong Kong Monetary Authority has continued to intervene to prevent the HKD from rising through the top of its band.

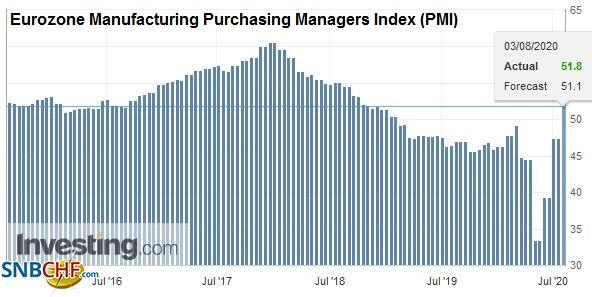

EuropeThe key takeaway is that the EMU manufacturing recovery continues, and, if anything, it is stronger than perceived last week. German and French flash estimates were revised up (51.0 from 50.0 and 52.4 from 52.0, respectively). |

Eurozone Manufacturing Purchasing Managers Index (PMI), July 2020(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| In June, the German manufacturing PMI was at 45.2, and France was at 52.3. Italy and Spain’s July manufacturing PMI were stronger than expected, and both rose above the key 50-level. Italy’s rose to 51.2 from 47.5, while Spain’s increased to 52.3 from 49.0. The net effect was to lift the EMU aggregate reading to 51.8 from 51.1 flash estimate and 47.4 in June. The report lends credence to those who see Europe poised to outgrow the US in H2 after being hit harder in H1. |

Germany Manufacturing Purchasing Managers Index (PMI), July 2020(see more posts on Germany Manufacturing PMI, ) Source: investing.com - Click to enlarge |

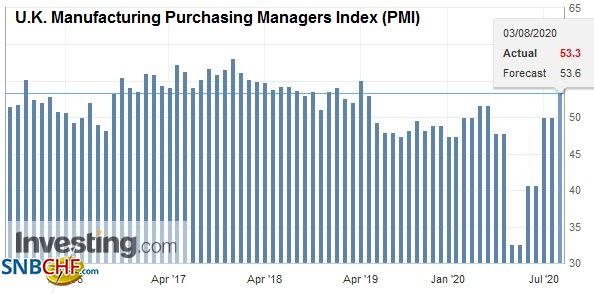

| Outside of EMU, the European PMIs were mixed. The UK’s preliminary reading of 53.6 was revised to 53.3. It was a little disappointing, but it is the second month above 50, and it still reflects a healthy improvement from 50.1 in June. Sweden’s final manufacturing PMI rose to 51.0 from the 50.5 flash reading and 47.6 in June. Norway went the other way. Its manufacturing PMI slumped to 43.3 from 48.8 in June.

While the UK negotiates with the EU on a trade agreement after this year’s standstill arrangement, it is also in talks with Japan and the US. Hopes that the deal with Japan could go beyond essentially rolling over the EU agreement are fading. Similarly, it seems clear that with less than 100-days to go, there will not be an agreement ahead of the US election. Nevertheless, and UK’s Trade Minister Truss will be meeting with the US Lighthizer today. A Democrat victory in November (President and Senate) would likely see the US return to the more traditional multilateral approach (e.g., WTO), the UK may be seen as a unique case, relatively low hanging fruit, as it were. |

U.K. Manufacturing Purchasing Managers Index (PMI), July 2020(see more posts on U.K. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

The euro has seen limited follow-through selling after reversing lower from the push above $1.19 ahead of the weekend. It has not been able to resurface above $1.18 today, and the upside momentum that had appeared so strong of the last couple of weeks seems to be broken. A test on the $1.17 area seems reasonable; we favor a move toward $1.1650, where a $1.8 bln euro option expires tomorrow. Sterling snapped a 10-day rally ahead of the weekend, and some stale longs and momentum plays seem to be paring positions. The $1.30-level holds a GBP550 mln option that expires today. At the same time, the euro is straddling the GBP0.9000 area, where an option for around 575 mln euros will be cut today.

America

Fitch cut the outlook of the AAA rating it attributes to the US. Its concern about the rising US deficit is undermined by three concessions it acknowledged. First, Fitch acknowledged that the US enjoys “exceptional financing flexibility.” Second, echoing insight that may not be new but strongly emphasized by the leading advocates of Modern Monetary Theory, Fitch recognized, “It is a truism that the US government cannot run out of money to service its debt.” Third, Fitch agreed that the potential for the debt burden to weaken the US economic dynamism and undermine its reserve status is “remote.”

Fitch’s announcement comes as the US Treasury will announce its borrowing requirements for the next three months. Two important shifts will likely be marked. First, until now, the issuance has been concentrated in the bill sector. It will begin being rolled out longer. Indeed the longer-end of the curve, 10, 20, and 30-year notes and bonds are likely to be boosted. US long-term rates have fallen, and the 10-year yield posted a record weekly close last week (~53 bp). Second, is a jump in size. Over the past three months, Treasury has sold about $400 bln of notes and bonds. It is expected to more than double in the next three months.

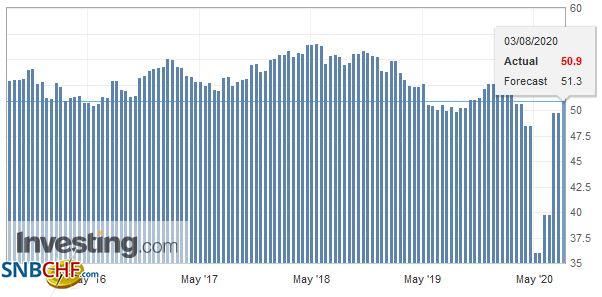

| In addition to the Treasury’s announcement, the US reports the Markit PMI and the and manufacturing ISM. Both are expected to be consistent with a gradual recovery in the manufacturing sector, which we expect to be reflected in the employment data at the end of the week. The US also reports July auto sales, and a continued recovery speaks to stronger consumption and production. |

U.S. Manufacturing Purchasing Managers Index (PMI), July 2020(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| In this context, it is notable that the Atlanta Fed GDP tracker is looking at nearly 12% growth in Q3, while the NY Fed’s model is a 16.8% expansion. With last week’s FOMC meeting history, Fed-speak picks up with Bullard, Evans, and Barkin today. |

U.S. ISM Manufacturing Employment, July 2020(see more posts on U.S. ISM Manufacturing Employment, ) Source: investing.com - Click to enlarge |

Canada’s big week that features trade and employment figures begins off slowly, while Mexico reports remittances (which have been faring better than we anticipated). Mexico also reports its Markit manufacturing PMI and IMEF manufacturing and non-manufacturing surveys. They are expected to remain well below the 50-level. Mexico moved passed the UK in terms of the number of fatalities related to the virus and is now in third place behind the US and Brazil. The peso rose by 3.2% against the dollar last month but reflects the attractiveness of the carry and the correction from the earlier sharp depreciation. The peso is still off around 15.7% year-to-date.

The US dollar reversed higher last Thursday against the Canadian dollar and appears to have entered a new phase. Support was found just ahead of the June low (~CAD1.3315), and it now straddles the CAD1.3400 area. Last Thursday’s high around CAD1.3460 offers initial resistance, and beyond that, a band of resistance is seen in the CAD1.3480-CAD1.3530 band. The greenback spent some time below MXN22 last week, but the momentum stalled, and it closed firmly ahead of the weekend near MXN22.2750. It is climbing further today to approach MXN22.50. The upper end of the recent range is near MXN23.00, and a test on it seems likely in the coming days.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,Featured,federal-reserve,HK,newsletter