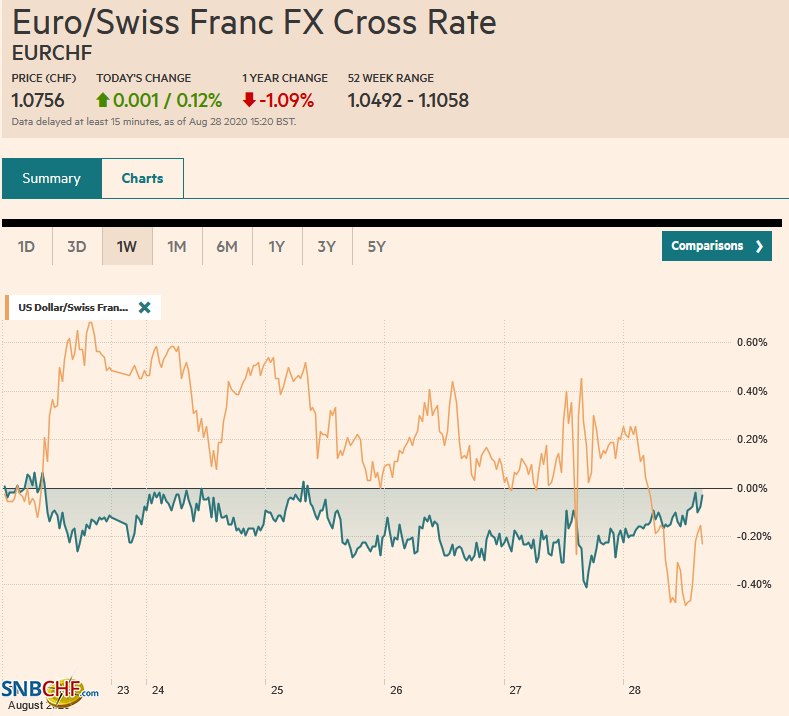

Swiss FrancThe Euro has risen by 0.12% to 1.0756 |

EUR/CHF and USD/CHF, August 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: After a confused and volatile reaction to the Federal Reserve’s formal adoption of an average inflation target, it took Asian and European traders to embrace the signal and take the dollar lower. It is falling against nearly all the currencies and has slumped to new lows for the year against sterling and the Australian dollar. Compounding the volatility, Japan’s Prime Minister Abe has signaled his intention to resign over health issues as soon as the LDP picks a successor. The yen strengthened, in line with the other major currencies, but the Nikkei fell. Asia Pacific equities were mostly lower, with Chinese, Korean, and Indian shares posting independent gains. Note that New Zealand’s exchange has been a victim of a cyberattack for the fourth session. European stocks are also a bit heavy and are paring this week’s gains. US shares are trading higher. The S&P 500 has a six-day advancing streak in tow coming into today. Benchmark 10-year yields are higher. Asia Pacific yields were pulled higher by the jump in US yields yesterday, and Australia’s 10-year yield jumped 10 bp, and European yields are 2-3 bp higher today. The US 10-year yield is extended yesterday’s rise and is now around 76 bp after reaching 78 bp, the highest since early June. Gold is trading firmly, but well within yesterday’s broad range. Oil prices have drifted lower, and the October WTI contract is within yesterday’s range, and slipping below the 200-day moving average (~$43.15). |

FX Performance, August 28 |

Asia Pacific

Speculation that Abe’s health issues were going to force his resignation had circulated in recent days. We had thought it was more likely that today’s announcement was going to be about the pandemic. However, Abe did, in fact, submit his resignation, effective after the LDP picks his successor. We recognized that there were alternatives to Abe, but less convinced about alternatives to Abenomics, which seemed like traditional LDP policy choices (loose monetary and fiscal policy and tax consumption). While some potential successors have been critical of low-interest rates, it is difficult to see a different strategy.

Consider today’s economic news from Tokyo. Headline August CPI was unexpectedly halved to 0.3% year-over-year. The core rate, which excludes fresh food, fell back into the deflationary territory (-0.3% from +0.4%). Excluding fresh food and energy, Tokyo prices are 0.1% below year-over-year levels after being +0.6% in July. That said, the report may exaggerate the downside pressure on prices as there was a one-off drop in accommodation prices (Tokyo was excluded from the national campaign to promote travel, but the calculation uses national indices).

The dollar initially extended its gains to almost JPY107 in early Asia Pacific turnover, but Abe’s resignation spurred a sharp sell-off that took the greenback below yesterday’s low around to JPY105.50 in the European morning. A weak close today would set up a possible test on JPY105, the August low next week, and possibly a test on the July low (~JPY104.00). The Australian dollar extended yesterday’s gains and is at new highs for the year above $0.7300. It has reached nearly $0.7325. The next important technical target is near $0.7500. The PBOC set the dollar’s reference rate at CNY6.8891, a little above the median bank model in the Bloomberg survey. It is the fifth week, the yuan has risen against the dollar, and the fourth week it has risen against its CFETS basket. The dollar is at new seven-month lows against the yuan. The 10-year Chinese bond yield rose to 3.08%, its highest since mid-January.

Eurozone

There are several data points from the eurozone today, but the EMU is really outside the high drama from the Fed’s new interpretation of its inflation target and the resignation of Japan’s Abe. The ECB is wrestling with low inflation, as is the US, and next week’s August CPI report will underscore this. It is reviewing its policy framework, but it is difficult to see it duplicating the “average’ inflation targeting approach of the Fed. Still, the official comments will be closely watched.

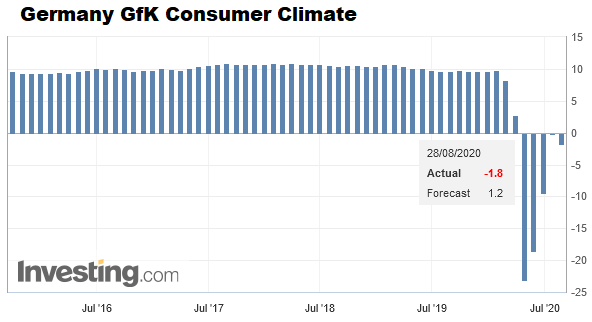

GermanyGerman GfK consumer confidence was a bit weaker, though the IFO survey earlier this week of investors showed fresh upticks. France reported prices edged lower in August (-0.1%), and this brought the harmonized measure to 0.2% from 0.9% in July. Separately, July consumer spending was around half of what was expected 0.5% vs. 1.2%). Part of the sting was offset by the revision in the June series to 10.3% from 9.0%, but it does suggest a loss of momentum at the start of Q3 and amid an increase in the virus. Italy reported gains in its August confidence survey, and Spain reported softer July retail sales (-3.7% year-over-year vs. -3.3% in June). The EMU Sentix surveys of consumer, economic, industrial, and service for August all improved more than expected. |

Germany GfK Consumer Climate, August 2020(see more posts on Germany GfK Consumer Climate, ) Source: investing.com - Click to enlarge |

The euro had traded a little through $1.19 yesterday initially on Powell’s comments, but then reversed lower and fell a little below $1.1765. Asia bid it up, and Europe has taken it to $1.1920, where the buying interest appears to be slackening. The year’s high was set a little above $1.1965 on August 18, but it seems beyond the reach today, as momentum indicators are already stretched. Sterling rose to about $1.3285 yesterday before pulling back as the greenback showed resilience. Today is has edged a little higher, closer to $1.3300 before the buying slowed. Initial support is seen in the $1.3230-$1.3250 area. The euro is little changed against both sterling, and the Swiss franc, underscoring the impression that is is a dollar-adjustment taking place.

America

The Fed formally adopted an average inflation target. It signals a willingness to accept higher inflation going forward because of the past undershoot. Besides a vague reference to the medium-term, it is not clear the timeframe of the average. For example, since adopting the formal inflation target in 2012, the headline PCE deflator has averaged about 1.4%. If the Fed was to seek a 2% average rate, it needs to see a 2.5% average for the next decade. In addition to pushing out in the time the first rate hike in a cycle, and seemingly embracing a more robust understanding of full employment, it is not clear what else the Fed will do to achieve its average inflation target. While a new target unveiled, no new tools were. The 10-year break-even (the difference between conventional and inflation-linked yields) edged up less than two basis points to 1.75%. Ironically, the implied yield of the back-month fed funds futures contracts ticked up. The same is true of Eurodollar’s futures strip. The long-end of the curve responded more along the lines one would have expected. The 10- and 30-year yield rose by 5 and 8 bp (to 75 bp and 150 bp), respectively, yesterday and have edged up a little more today. The yields are at two-month highs.

The US reports a slew of data today, preliminary July trade figures, inventory data, the University of Michigan consumer confidence, and inflation expectations. But to the extent any of today’s data will capture the market’s attention, it will likely be the personal income, consumption, and deflator data. These will be important in adjusting Q3 GDP forecasts and understanding the price pressures. The headline PCE deflator, which the average 2% inflation target applies, is expected to rise to 1.0% from 0.8%, and the core measure, (which excludes food and energy), which the Fed talks about, may increase to 1.2% from 0.9%.

Canada reports June monthly GDP and Q2 GDP. The economy returned to growth in May (4.5%) and likely accelerated in June (5.6%). However, the body blow in April was so severe that the Canadian economy likely contracted by around 39.5% at an annualized rate in Q2 after an 8.2% decline in output in Q1.

The US dollar is falling against the Canadian dollar for the fourth consecutive session and will extend its slump for a sixth successive week. It is at its lowest level since January and approached CAD1.3060 in Europe. It finished last week near CAD1.3175. Initial resistance is now seen around CAD1.3100. The greenback saw a broad range against the Mexican peso yesterday (~MXN21.82-MXN22.2260). It has trended lower today and reached near MXN21.9550 in the European morning and has begun moving sideways. A bounce could see MXN22.05-MXN22.10 today.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Currency Movement,EUR/CHF,Featured,federal-reserve,Germany GfK Consumer Climate,inflation,Japan,newsletter,USD/CHF