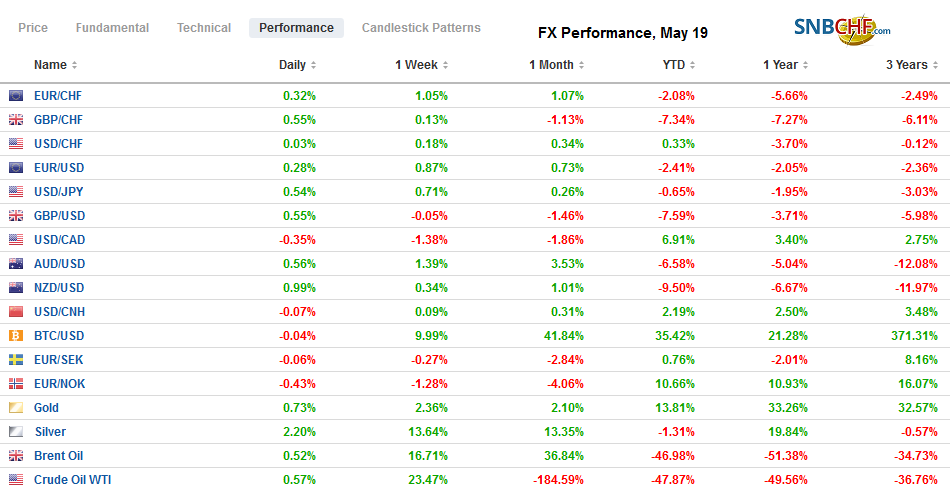

Swiss FrancThe Euro has risen by 0.08% to 1.0601 |

EUR/CHF and USD/CHF, May 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Hopes for a vaccine and a German-French proposal to break the logjam at the EU for a joint recovery effort helped propel equities higher yesterday. There was strong follow-through in the Asia Pacific region, where most markets advanced by more than 1% today. However, the bloom came off the rose, so to speak, in Europe. After a higher opening, markets reversed lower, and the Dow Jones Stoxx 600 is off about 0.75% in late morning turnover. All the major sectors are lower, led by utilities and industrials. The US 10-year yield closed yesterday at 72 bp, its highest in a month, and sent Asia Pacific yields higher. However, the German-French proposal and ideas that the ECB will likely increase its bond purchases saw peripheral yields fall more than core rates. The US 10-year yield is also a little softer. The risk appetites were expressed as a weaker US dollar, yen, and Swiss franc, while high-beta dollar-bloc currencies and Scandis jumped, and this has continued today. The JP Morgan Emerging Market Currency Index rose by nearly 1% and is up another 0.2% today and is at new highs for the month. Gold reached $1765.4 yesterday before stabilizing, and today it is consolidating around $1726-$1740. Oil is also consolidating after yesterday’s surge. The July WTI contract reached $33 yesterday. It bottomed in late April a little above $17. It is trading today between $31 and $33 a barrel. |

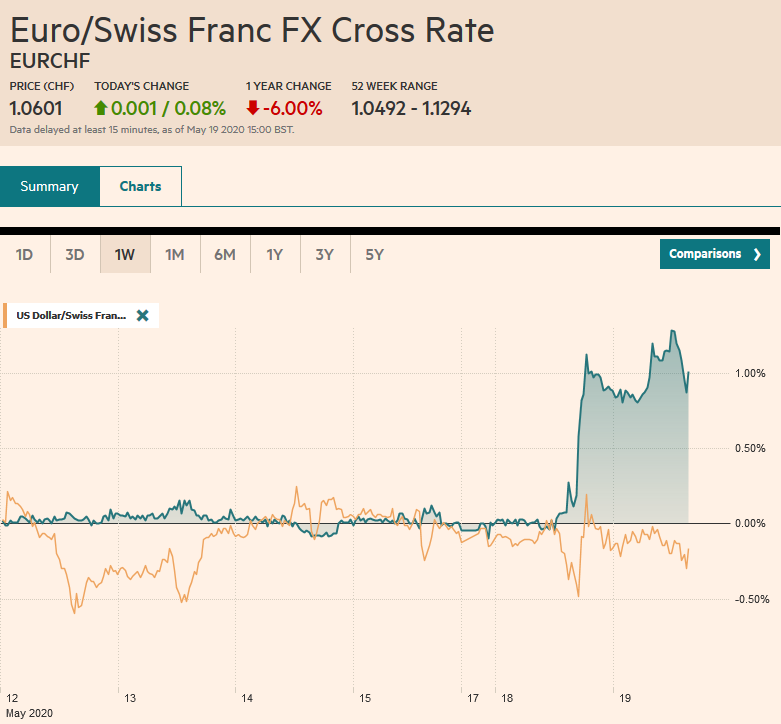

FX Performance, May 19 |

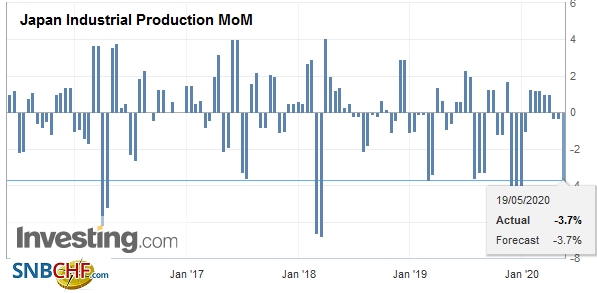

Asia PacificThe Bank of Japan’s next scheduled meeting is on June 18, but officials signaled an emergency meeting at the end of this week. The ostensible purpose is not to adjust monetary policy itself. Instead, it is expected to unveil a new program to support small businesses. The central bank left its bond-program unchanged today and stepping into the market to buy JPY1.2 bln of ETFs and REITs. |

Japan Industrial Production MoM, April 2020(see more posts on Japan Industrial Production, ) Source: investing.com - Click to enlarge |

China is adding pressure on Australia. Even though Beijing has not formally linked its actions against Australian barley and beef as retaliation for its calls for an investigation into Covid-19 and the wet markets, there is little doubt about the subtext. China is threatening to widen the trade dispute, and reports suggest it could extend to other products, such as wine, seafood, and oatmeal. On the other hand, Australia is the largest producer of iron ore, and Chinese demand has lifted prices to eight-month highs. Brazil, the second-largest producer, is being hobbled by a surge in virus cases and is now the world’s third-largest hotspot. Still, China’s apparent willingness to disrupt trade, as it has with Canada over Huawei, is unsettling.

The dollar has been confined to about a 30-pip range against the yen below JPY107.60. For the sixth session, it has been limited to the range set on May 11 (~JPY106.40-JPY107.75). There are options for $1.5 bln that expire today between JPY107.65 and JPY107.75 and a $640 mln option at JPY107.35 that will also be cut today. Just when the Australian dollar looked to be (finally) rolling over, with its first close below the 20-day moving average in a month before the weekend, it jumped up yesterday, and the follow-through buying today is testing recent highs. The late April high was set near $0.6570, and today’s high is just below. The intraday technicals suggest consolidation is likely. The PBOC set the dollar’s reference rate a little higher than the bank models suggested. The dollar remained above CNY7.10 for the second session, which had been seen as the upper end of the acceptable range. We had thought that ahead of the National’s People Congress later this week, officials would have wanted a more stable yuan exchange rate. Meanwhile, tomorrow, the Loan Prime Rate is set, and more than 75% in a Reuters poll expect the one and five-year rate to be unchanged at 3.85% and 4.65%, respectively.

EuropeIt has been up to the individual European countries to respond to the virus. The federal or joint effort has been limited largely to the ECB. However, that will change in the coming weeks as the EU prepares to respond. Yet, that is a point in itself, the level is not the monetary union but the larger group of 27. The vehicle is the EU’s budget seven-year financial framework that has been a bone of contention even before the pandemic. Germany and France jointly proposed a 500 bln joint borrowing as part of the EU budget that will be used to help spur economic recovery. Germany and France envisioned grants, while several countries want loans. The funds would be raised by the EU and available based on need, while the repayment will be according to the share of the EU budget (tied to the size of an economy). |

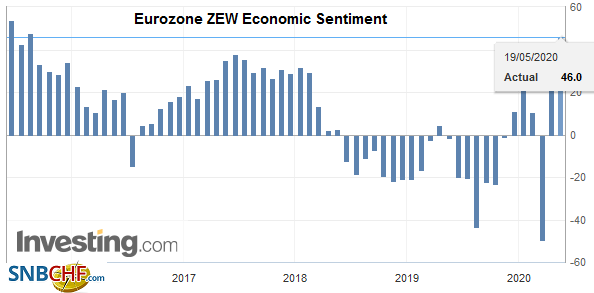

Eurozone ZEW Economic Sentiment, May 2020(see more posts on Eurozone ZEW Economic Sentiment, ) Source: investing.com - Click to enlarge |

| The ultimate EU effort will likely be larger than these funds, which still require agreement among the members. Last month the EC suggested a 2 trillion-euro packaged that included 320 bln euro borrowing. Its proposal included grants, loans, and guarantees. Investors liked what they saw, and Italian bonds rallied strongly. The 10-year yield fell 19 bp, the most since late March, and the premium over German narrowed to below 215 bp for the first time in a month. The French 10-year yield rose a couple of basis points, less than the (~six basis-point) increase in the German Bund yield, despite Fitch’s cut in the outlook to negative before the weekend. |

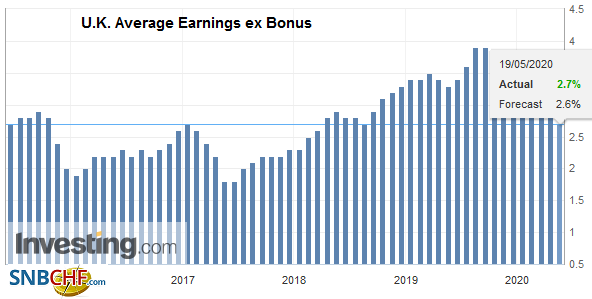

U.K. Average Earnings ex Bonus, March 2020(see more posts on U.K. Average Earnings ex Bonus, ) Source: investing.com - Click to enlarge |

| The UK reported jobless claims surged by 856.5k in April, while the claimant count rate rose to 5.8% from 3.5% in March and 3.4% at the end of 2019. Those working but experiencing an income loss qualify. The average weekly earnings (2.4% vs. 2.8%) and unemployment rate (3.9% vs. 4.0%) are March readings. Separately, while in trade talks with the EU, the US, and Japan, the UK unveiled a new post-Brexit tariff schedule. Some items like dishwashers and freezers will enter the UK duty-free next year. A 10% tariff will remain on cars, and duties will still be levied on agriculture goods. |

U.K. Unemployment Rate, March 2020(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

The German ZEW survey was mixed. The current assessment deteriorated to a new low of -93.5 (from -91.5). However, the expectations component soared to 51.0 from 28.2. This is its highest level in five years. The IFO survey and the PMI, both due later this week, are seen as more important soft economic reports.

The euro is extending yesterday’s rally, which was the largest in a month, and the first push above $1.09 since May 4. The high from May 1, when Europe was on holiday, was near $1.1020, and that area is the next target, and the 200-day moving average is found there as well. The euro has not traded above it since late March. The intraday technical readings, however, are stretched, and initial support is seen near $1.0920. Sterling recovered smartly yesterday. After falling to almost $1.2075, its lowest level since late March, sterling rebounded to nearly $1.2230 yesterday and reached almost $1.2270 today. The gain is notable too because another MPC member (Tenreyro) weighed on on the negative interest rate debate and claimed it was a powerful transmission mechanism with a positive impact on some EU countries. An option for nearly GBP430 mln is set at $1.23 rolls off today. As is the case with the euro, sterling’s gains through the European morning have stretched the intraday technical readings, cautioning against chasing it immediately higher.

America

An experimental vaccine by Moderno, the US biotech firm, showed some promise in a small first study to spur an immune system response to the novel coronavirus. The innovation here appears to be stimulating one’s own body to generate the spike protein that, like Covid-19, which ideally triggers the creation of antibodies. This helped lift sentiment. On the other hand, President Trump has given the World Health Organization 30-day for “major substantive improvements,” or America’s temporary funding freeze will become permanent.

NASDAQ reportedly will tighten its rules for IPOs that will make it more difficult for small Chinese companies to list. The listing of many Chinese companies on US exchanges has come under greater scrutiny recently. While the need for reform is clear, in the current setting, it is seen as part of the larger US campaign against China.

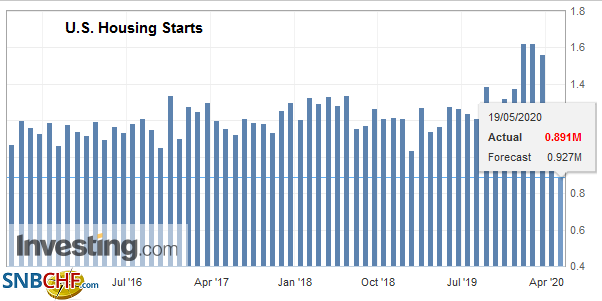

| The US reports April housing starts and permits. At issue is the magnitude of the decline, and expectations are for a drop of 20-25%. It is the May survey data that, like the Empire State survey and University of Michigan consumer sentiment, that may show the first signs that a bottom was reached. Still ahead this week are the Philly Fed survey and preliminary PMI. Separately, Treasury Secretary Mnuchin and Fed Chairman Powell will testify remotely before the Senate Banking Committee, and their prepared remarks have already been released. The takeaway is that although more steps may be taken, the economic recovery is expected to begin in Q3. |

U.S. Housing Starts, April 2020(see more posts on U.S. Housing Starts, ) Source: investing.com - Click to enlarge |

Canada and Mexico’s economic calendars are light today. The US dollar tested this month’s low near CAD1.3900 earlier day to extend yesterday’s loss that began from a little above CAD1.4100. The downside momentum appears to be stalling, and initial resistance is seen in the CAD1.3970-CAD1.4000 area. The greenback is also consolidating yesterday’s losses against the Mexican peso. Yesterday, it had fallen to its lowest level since mid-April near MXN23.45. The next support area is seen in the MXN23.25-MXN23.35 band.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,Australia,China,Currency Movement,EU,EUR/CHF,Eurozone ZEW Economic Sentiment,FX Daily,Japan Industrial Production,newsletter,U.K.,U.K. Average Earnings ex Bonus,U.K. Unemployment Rate,U.S. Housing Starts,USD/CHF