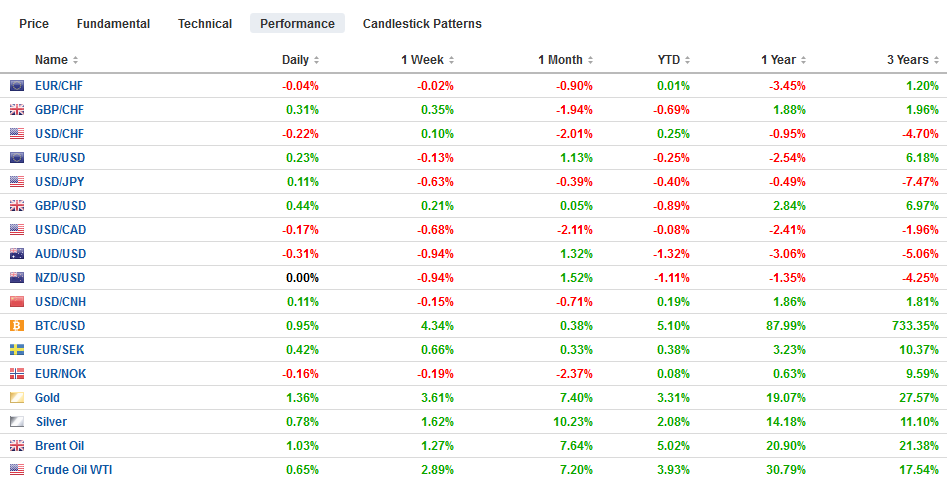

Swiss FrancThe Euro has fallen by 0.06% to 1.0851 |

EUR/CHF and USD/CHF, January 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The global capital markets have yet to stabilize amid heightened geopolitical tension. Even though the US stock market finished last week off its lows, the sell-off continued in the Asia Pacific region. Japan’s markets re-opened after an extended holiday, and the yen, at three-month highs, saw the Nikkei sell-off nearly 2%. Several markets in the region lost over 1%, including Taiwan, India, Thailand, and Indonesia. Europe’s Dow Jones Stoxx 600 is off about 1.3% in late morning turnover. US stocks are trading heavily, and the S&P 500 is poised to gap lower. Yields in the Far East played a little catch-up with the nearly nine basis point decline in the US 10-year yield ahead of the weekend, but Europe ad US benchmark yields are only slightly lower today. The dollar is heavy against the major currencies, with the Swedish krona the chief exception. Among emerging market currencies, central and eastern European currencies are faring best, though the JP Morgan Emerging Market Currency Index is flat. Gold is up another $25 after advancing $23 ahead of the weekend. Today is the sixth consecutive advance and the 10th in the past 11 sessions. It reached $1588 an ounce before stabilizing. Oil prices are also higher. Brent poked above $70 a barrel and is holding near there in the European morning, while WTI for February delivery reached almost $65 and is hovering around $64. |

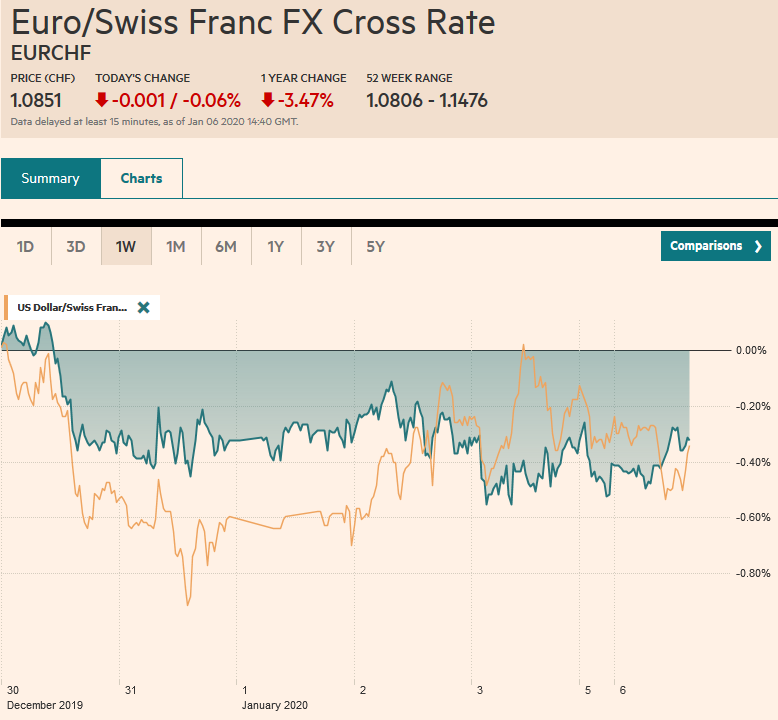

FX Performance, January 6 |

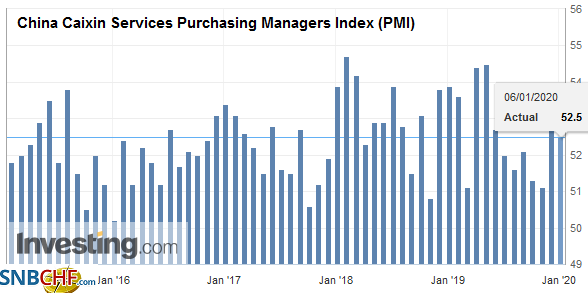

Asia PacificChina replaced its top official in Hong Kong. Luo Huining will assume the post from Wang Zhimin. Observers are trying to read the implications. Luo may be a rising star of China’s Communist Party, and his appointment is seen as a potentially tougher line from Beijing. Separately, the South China Morning Post reported that a Chinese delegation is indeed coming to the US next week. However, officials were surprised by 1) the Trump Administration’s unilateral announcement of a signing ceremony on January 15 and 2) by pushing forward even if XI was not available. China’s Caixin service and composite PMI for December weakened. The former fell to 52.5 from 53.5, which was a seven month high. The latter eased to 52.6 from 53.2. The November reading was the highest since early 2018. |

China Caixin Services Purchasing Managers Index (PMI), December 2019(see more posts on China Caixin Services PMI, ) Source: investing.com - Click to enlarge |

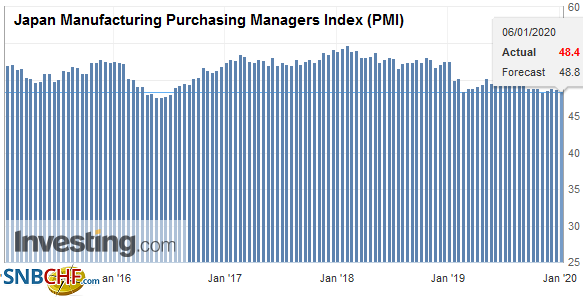

| Japan returned from the long holiday and reported the manufacturing PMI fell to 48.4 rather than 48.8 from November’s 48.9. The December reading matches the cyclical low. The services and composite PMI will be reported tomorrow. Between the sales tax increase and typhoon, economists expect that the Japanese economy contracted in Q4 19. |

Japan Manufacturing Purchasing Managers Index (PMI), December 2019(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Australia reported the services PMI edged up from 49.5 in November to 49.8 in December, which is a touch better than the flash reading. However, the weakness in the manufacturing PMI (49.2 from 49.4 flash and 49.9 in November) was enough to drag the composite reading to 49.6 from the 49.7 initial estimate. The devastating fires will take an economic toll, and investors are still trying to assess the implication for macro policy.

The dollar’s losses against the yen were marginally extended to almost JPY107.75 in early Asia. It reached a high of nearly JPY108.20 before the European session began. A $1.2 bln option at JPY108.50 that expires today does not appear in play. The Australian dollar held the pre-weekend low (~$0.6930) and bounced to almost $0.6970, which is the (38.2%) retracement of the decline since New Year’s Eve, before running out of steam. The dollar edged up against the Chinese yuan for the third consecutive session. The dollar had ended last year near CNY6.9632 and reached almost CNY6.98 today before settling around CNY6.9720.

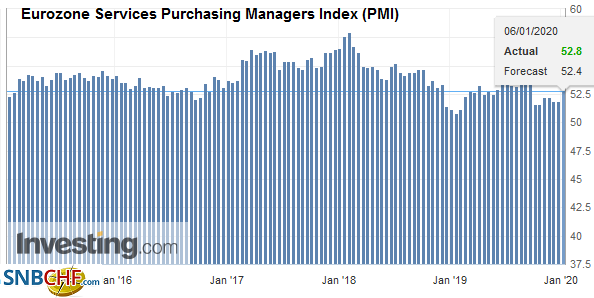

EuropeThe eurozone service and composite PMI were revised higher from the flash readings. Both reached their best levels since August. The service PMI rose to 52.8 from the 52.4 initial estimate and 51.9 in November. |

Eurozone Services Purchasing Managers Index (PMI), December 2019(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

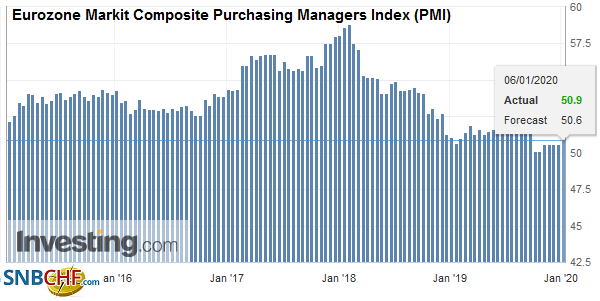

| The composite rose to 50.9 from 50.6 of the flash reading, which unchanged from October and November. The highlights include the German composite moving back above 50 for the first time since August. Italian services rose to 51.1, but the weakness in manufacturing weighed on the composite (49.3 vs. 49.6). Spain’s services reading (54.9) is a nine-month high, while the composite to 52.7, is the best since April. |

Eurozone Markit Composite Purchasing Managers Index (PMI), December 2019(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

| The takeaway is that the EMU seems to be on the mend, led by the resilience of the service sector. Separately, the Sentix sentiment survey for the eurozone rose to its best level since November 2018. Lastly, we note a strong German November retail sales report. The 2.1% gain on the month was twice what economists expected and lifted the year-over-year rate to 2.8%, double the upwardly revised October rate. |  |

The UK’s final December service and composite PMI was not as bad as the initial estimate suggested. The service PMI was revised to 50.0 from the 49.0 flash estimate and 49.3 in November. The composite PMI weighed down by manufacturing and construction, was changed to 49.3 from 48.5 of the initial estimate and was unchanged on the month.

The euro is snapped a three-day decline to rise for the first time this year. It is testing the $1.12-area in the European morning after finished last week near $1.1160. Today’s high is just beyond the (61.8%) retracement of the decline since New Year Eve’s push to almost $1.1240. The intraday technicals are stretched, suggesting North American operators may find it difficult to significantly extend the euro’s gains today. Sterling has also recouped the pre-weekend losses but ran out of steam in the European morning near $1.3175, a little more than a cent off its lows. The (50%) retracement of its losses since New Year’s Eve is found near $1.3170, and the next retracement (61.8%) is found closer to $1.3200. Here too, the intraday technical readings are extended, making additional meaningful gains difficult.

America

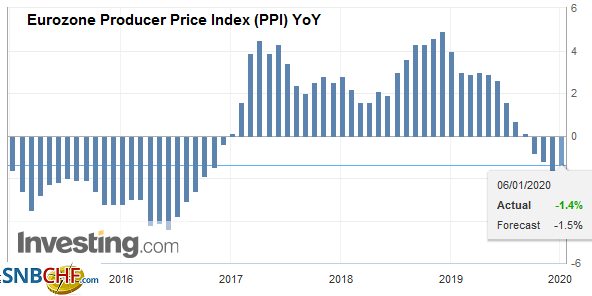

The North American calendar is light to begin the week. The main report will be the final US PMI readings. The US strike in Iraq and the Iraqi parliament voting to expel US troops dominate the talking points. The parliament vote is a recommendation and is not binding. Many are trying to game the Iranian response. At the same time, the US manufacturing ISM, which has a longer history than the PMI, dealt a blow to sentiment before the weekend as it unexpected fell (47.2 from 48.1 in November), which is its lowest in a decade. New orders also fell (46.8 vs. 47.2) to its lowest since the Great Financial Crisis. Employment fell to a three-year low (45.1 vs. 46.6). On the other hand, prices paid jumped above 50 for the first time since May to 51.7 from 46.7, which feeds into our anticipation of an inflation scare (in the US and Europe in the first part of the year). We note that several of the regional Fed surveys (e.g., Philadelphia and KC) also showed weakness, while the Empire State survey rose less than expected).

Ironically, the US data have not clarified the picture of the world’s largest economy. The NY Fed’s GDP tracker puts Q4 GDP at 1.1% (and Q1 20 at 1.0%). The Atlanta Fed’s model puts it at a firm 2.3%. The highlight of the week will be the December employment report, and slower job growth is anticipated.

The Canadian dollar is within the pre-weekend range, but the brief attempt to take the US dollar above CAD1.30 was rebuffed. The New Year’s Eve low was near CAD1.2950, and the pre-weekend low was about CAD1.2960. We see the daily technical indicators as stretched, which would likely limit the greenback’s losses from here. Before the weekend, the US dollar pushed above MXN19.00, but it was not sustained, and the dollar remains in the MXN18.80-MXN19.00 range that has more or less confined the price action since the middle of December. The Dollar Index was bid through 97.00 before the weekend, but it was unable to sustain the move. It has not closed above 97.00 since Boxing Day. It is near session lows in late morning turnover in Europe near 96.50. The low from New Year’s Eve was near 96.35. The technical indicators are stretched on both intraday and on the dailies.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,China,China Caixin Services PMI,Currency Movement,EMU,EUR/CHF,Eurozone Markit Composite PMI,Eurozone Producer Price Index,Eurozone Services PMI,Japan Manufacturing PMI,newsletter,U.K.,USD/CHF