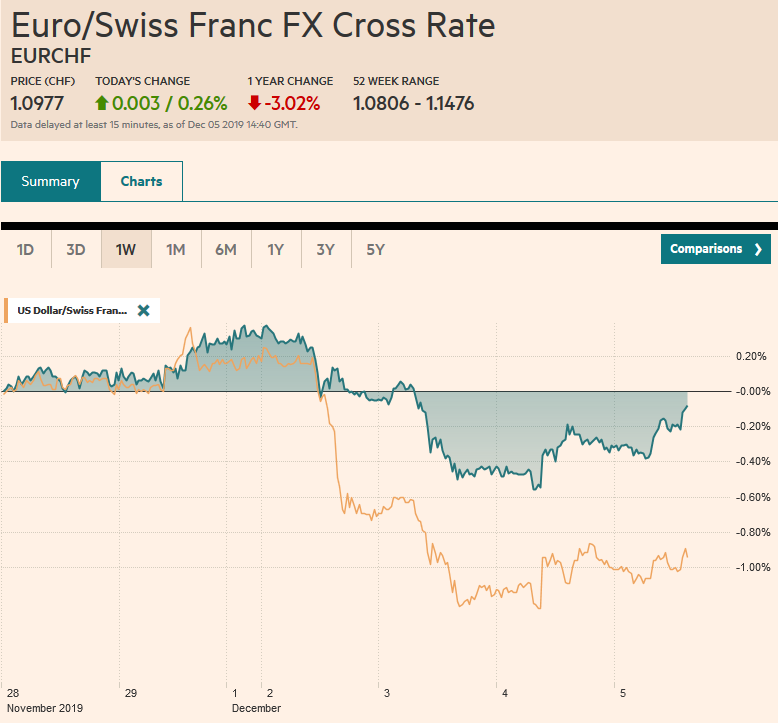

Swiss FrancThe Euro has risen by 0.26% to 1.0977 |

EUR/CHF and USD/CHF, December 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

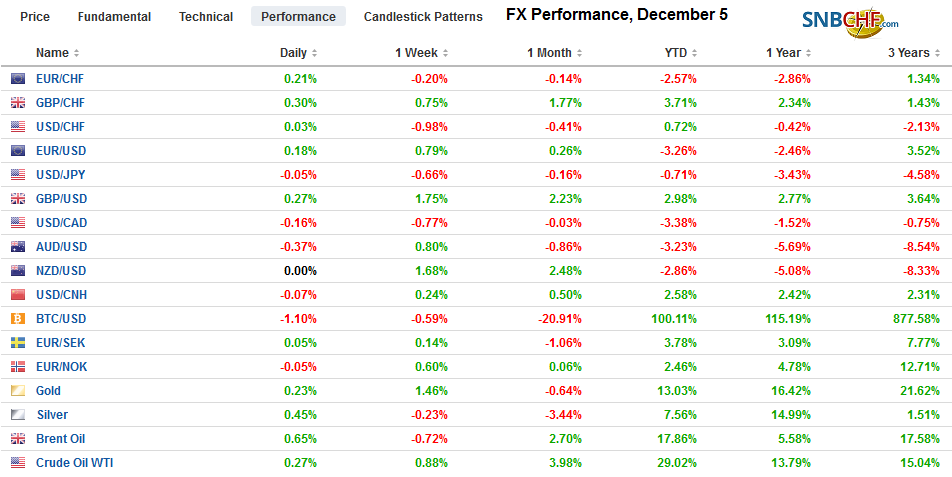

FX RatesOverview: Global equity markets have resumed their climb after a wobble at the end of last week and earlier this week. A strong recovery in the S&P 500 on Tuesday signaled yesterday’s strong advance that left a bullish one-day island low in its wake. MSCI Asia Pacific Index snapped a two-day decline today with nearly all the market with the notable exception of South Korea advanced. Europe’s Dow Jones Stoxx 600 jumped 1.2% yesterday, its largest gain in a month and a half, and is extending the gains marginally today, despite an unexpected decline in German factory goods orders. US shares are trading firmer in Europe. Benchmark bond yields are mostly a little higher. India surprised investors by leaving policy on hold, and although it was seen as temporary, 10-year bond yields jumped around 13 bp to almost 6.6%. The US dollar is slightly lower against most of the major currencies. Optimism over next week’s UK election is continuing to lift sterling. Australia, which reported disappointing retail sales and a smaller trade surplus, is the weakest of the majors, (~-0.2% around $0.6835). The yen and Swiss franc are also nursing small losses. Although the Turkish lira and South African rand are trading heavily, most of the other emerging market currencies are firm. Gold is consolidating this week’s roughly $20 advance. After surging more than 4% yesterday after US oil inventories fell three-times more than expected (almost five mln barrels), the most since early September and offsetting near three weeks of builds, WTI for January delivery is little changed (~$58.20). |

FX Performance, December 5 |

Asia Pacific

More details of Japan’s fiscal stimulus have been reported. The headline figure is around JPY25 trillion, but what Japan calls “real water” is about JPY13 trillion (~$119 bln). The main aim is to support the economy in the face of the unpopular sales tax increase, the typhoon, and anticipation of a post-2020 Olympic slump. Despite negative interest rates and still large asset purchases by the Bank of Japan, the economy is thought to be contracting sharply now. Many are projecting that the world’s third-largest economy will shrink by about 2.7% at an annualized rate here is Q4.

Bloomberg surveyed 43 economists. They all expected the Reserve Bank of India to cut rates earlier today. It did not. The central bank cited rising inflation expectations despite weakened growth prospects. It has cut rates five times this year. Officials made it clear. However, this was not the end of the easing cycle but a temporary pause. October inflation was above the 4% target while growth slowed to its weakest pace in six years. Indian bond yields, among the highest in Asia, and surged about 13 bp. The rupee edged higher.

The Reserve Bank of Australia left the cash rate at 75 bp when it met earlier in the week. While it claimed to be prepared to cut rates again, it seemed in no hurry. Today’s disappointing retail sales report and smaller trade surplus strengthen the market’s confidence that the RBA will have to deliver early next year. A Reuters survey showed economists expected a 0.3% increase in October retail sales. In fact, they were flat, which matches the worst since April. Separately, Australia reported an October trade surplus of A$4.5 bln, which was almost a third smaller than expected, and adding insult to injury, the September surplus was revised a little lower.

The dollar is trading in a narrow band at the upper end of yesterday’s range against the yen, knocking again on JPY109. There are about $1.1 bln in options in the JPY109.00-JPY109.15 area that expire today. We suspect that the dollar will not get much above there in North America today. The Australian dollar recovered smartly yesterday from the PMI-induced weakness, but today’s disappointing data have deterred follow-through buying. Support is seen around $0.6810. The US dollar was bid to about CNY7.0735 yesterday before reversing lower, and today the dollar was pushed below slightly below CNY7.04. The lower end of the range is seen near CNY7.02.

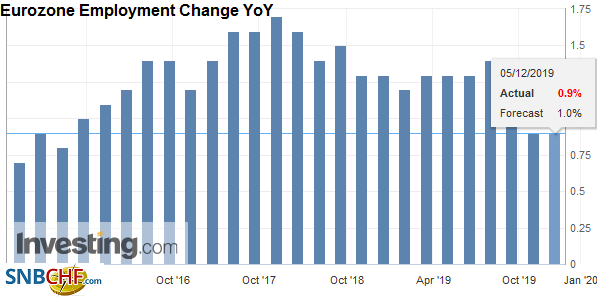

EuropeGerman factory orders disappointed. Instead of rising by 0.3-0.4% as the newswire survey suggested, orders fell by 0.4%. This confirms for many observers that the German economy, and by extension, Europe, remains mired in weakness. The world’s fourth-largest economy is likely to still near stagnant here in Q4 and is projected to grow less than 1% next year. Domestic orders fell 3.2%, and non-European orders fell 4.1%, which is where China’s data would be embedded. Orders from the EMU jumped by a little more than 11%, which likely reflects bulk orders. Germany reports industrial output figures tomorrow. A small gain was expected before today’s data after a 0.6% decline in September’s figures. Separately, Germany did report a stronger than expected construction PMI, which at 52.5 is at a seven-month high. However, the sector is not big enough to support the economy. |

Eurozone Employment Change YoY, Q3 2019(see more posts on Eurozone Employment Change, ) Source: investing.com - Click to enlarge |

| The Yellow Vest protests in France spurred the Macron government to give a 17 bln euro tax break. However, Macron faces a new challenge. His attempt to dramatically reform the pension system in a direction that appears to cut benefits and boost retirement ages is triggering a general strike (“la greve”). Such action has bedeviled previous French governments and could cripple the economy. Macron needs social stability to have a strong voice on the international stage and negotiate with Germany. |

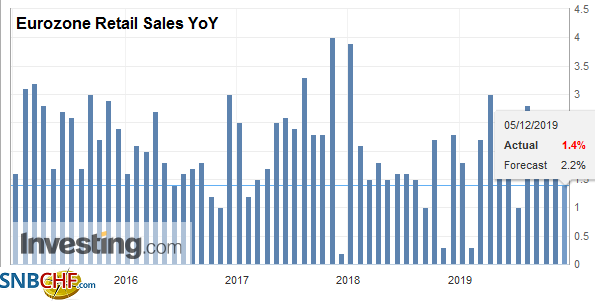

Eurozone Retail Sales YoY, October 2019(see more posts on Eurozone Retail Sales, ) Source: investing.com - Click to enlarge |

The euro briefly poked through $1.11 yesterday, but it failed to close above there. It is trading quietly in about a 15-tick range through the late morning in Europe. Support is seen near $1.1065. There are nearly 2.2 bln euros in options between $1.1110 and $1.1120 that expire today. These look sufficient to cap the euro, though the technical indicators still show more upside room. Short-term participants may be reluctant to extend positions ahead of tomorrow’s US jobs data. Sterling had been comfortably trading in a $1.28-$1.30 range since mid-October. Participants are feeling more confident that of next week’s election outcome and a fueling a sterling breakout. It traded up to almost $1.3150 today. It finished last week near $1.2925. Many are looking for sterling to trade toward $1.35 as the expected electoral results are discounted.

AmericaThe Bank of Canada softened its neutral stance in October and noted a “weakening growth assessment.” Yesterday it seemed to almost say “never mind” and fueled the largest gain in the Canadian dollar in three months. The central bank noted the “waning recession concerns,” and that the economy was operating near capacity. It continued to identify trade as the biggest risk. The key to the change of heart may lie with fiscal policy, and Prime Minister Trudeau begins his push for tax cuts. The Bank of Canada said it would incorporate the implications in next month’s economic outlook. We had thought there was a chance for the Bank of Canada to cut rates earlier this year, while the Fed was cutting (and the ECB). When it did not materialize, we accepted looser ties in the monetary cycle. However, if we are right and the Federal Reserve cuts rates next year due to the same trade-offs that were made this year (low inflation gives scope for efforts to extend the already record long expansion cycle), the Bank of Canada will again be challenged. Note that, like in October, Canada is once again offering a premium to the US on two-year rates. |

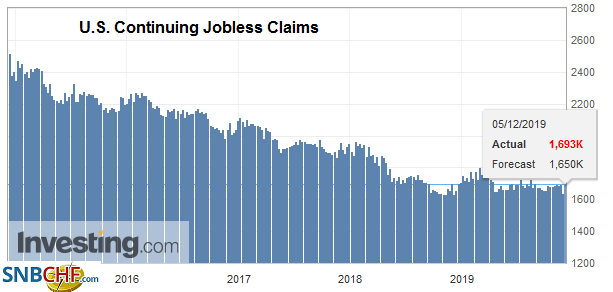

U.S. Continuing Jobless Claims, December 2019 Source: investing.com - Click to enlarge |

| The ADP estimate of private sector employment does a good job over the medium-term of tracking the official estimate. Still, it often readjusts its calculations (curve-fitting?) and in any event, can be markedly different from the non-farm payroll report. Yesterday’s 67k increase, the weakest in six months, was half of what was expected, continuing the deterioration of data surprise models. The non-manufacturing ISM shows a rise in employment, with the sub-index reaching its best level since July. The PMI, on the other hand, pointed to slower service sector job growth after gains in September and October. It creates more uncertainty around the jobs report, which are expected to be flattered by the end of the strike against GM. The implied yield of the June fed funds futures contract has risen 1.5 bp this week to 1.425%. The current effective average is 1.55%. |

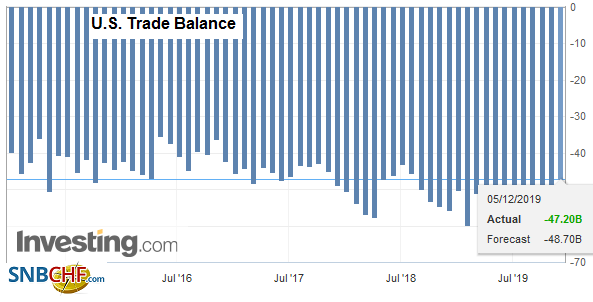

U.S. Trade Balance, October 2019(see more posts on U.S. Trade Balance, ) Source: investing.com - Click to enlarge |

The US reports trade and factory goods orders data today, in addition to the weekly jobless claims. Given the importance of tomorrow’s data ahead of next week’s FOMC meeting, the impact of the news is likely to be limited. Canada reports its trade figures and the IVEY survey, but given the central’s bank’s stance, they are unlikely to have much impact either. Canada also reports its jobs data tomorrow.

The US dollar slumped against the Canadian dollar yesterday, losing 0.7%, the most since early September. There has been follow-selling today, and the greenback has approached CAD1.3175. It began the week straddling CAD1.33. The near-term risk extends to around CAD1.3150, which corresponds to a (61.8%) retracement of the rally from the last October low. On the upside, the CAD1.3200-CAD1.3220 should offer resistance. The dollar fell by about 0.6% against the Mexican peso yesterday. The market is trying to extend the losses today. Initial support is seen in the MXN19.38-MXN19.40 area. A break could see a push today, MXN19.30. The underlying technical tone of the peso appears to be improving. Lastly, we note that the central bank of Chile, which has begun intervening in the foreign exchange (and forwards) market to stabilize the peso, did not cut the overnight rate (1.75%) yesterday, as many had expected. The dollar has fallen around 5.75% since the intervention plan was announced. The charts warn of scope for another couple of percent pullback that would take the US dollar toward CLP773.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Chile,Currency Movement,EUR/CHF,Eurozone Employment Change,Eurozone Retail Sales,Germany,India,newsletter,U.S. Trade Balance,USD/CHF