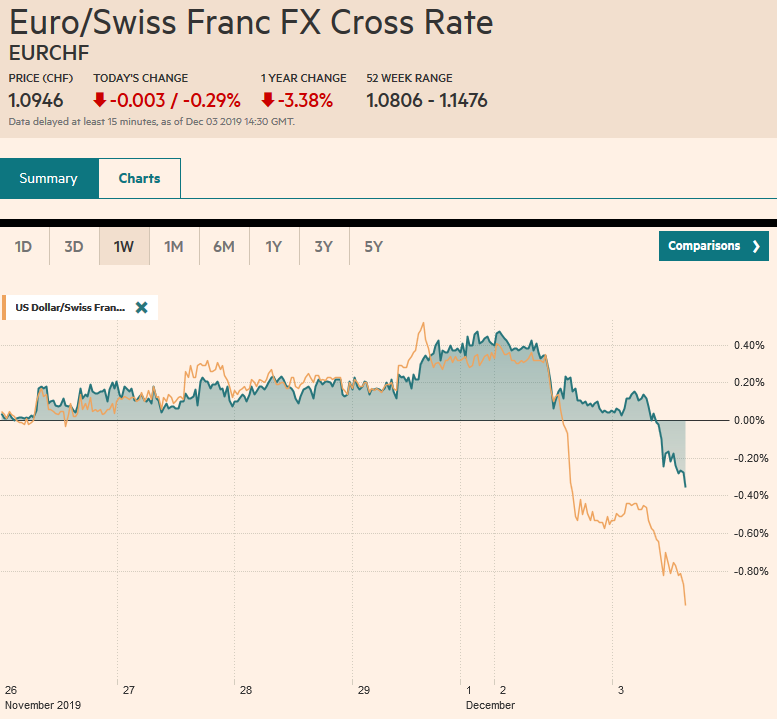

Swiss FrancThe Euro has fallen by 0.29% to 1.0946 |

EUR/CHF and USD/CHF, December 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Asia Pacific equities mostly declined in sympathy with yesterday’s large sell-off in the US and Europe. China and Taiwan were the notable exceptions, while Australia’s 2.2% decline, following the central bank meeting that resulted in what many are seeing as a hawkish hold, led the move lower. Europe’s Dow Jones Stoxx 600 fell 1.6% yesterday, the largest loss in two months, and is extending the losses for a third session today. US shares are trading with a lower and a gap lower opening is possible. Benchmark 10-year yields are narrowly mixed, accept in Australia and New Zealand, where they jumped 10 bp and 8 bp, respectively. The dollar sold-off yesterday and is trading with a mixed tone today in narrow ranges against all the major currencies. JP Morgan’s Emerging Market Currency Index is a little weaker, threatening to end its two-day bounce to resume its downtrend. Gold is firm and is moving above its 20-day moving average ($1464.6), which it has not traded above in a month. Oil continues consolidating its pre-weekend loss that saw WTI for January delivery fall from above $58 to $55. |

FX Performance, December 3 |

Asia Pacific

One Chinese media outlet reports China is drawing up a list of “unreliable entities,” ostensibly a list of US companies it will sanction. Beijing has been threatening to do this for around six months. While it could be in retaliation for the recently signed HK bills in the US, it could also be in anticipation of the passage another bill working its way through the Senate that would sanction officials and companies involved with China’s campaign against the Uighur Muslims. Yesterday, Trump renewed his threat to raise tariffs on China if there is no agreement. The market had expected the mid-December tariffs the US threatened to be suspended like the October’s. However, there appears to be some second-guessing now.

The Reserve Bank of Australia kept rates steady, as widely expected. However, the statement and press conference took on a less than dovish cast. The three rate cuts since June appear to be helping the property market, which can lift consumption through the wealth effect. The central bank is seen with 50 bp of easing before it must resort to unconventional methods (asset purchases) and has signaled it is in no hurry presently to exhaust its remaining monetary ammunition. The next meeting is not until February, and the market is split about a rate cut then. The labor market and consumption are the most important elements going forward. Separately, Australia’s swing into a current account surplus position extended in Q3 to A$7.9 bln from Q2 A$4.7 bln. In the same quarters in 2018, Australia reported a combined deficit of A$22.5 bln.

The dollar posted a potential key downside reversal against the yen yesterday, by trading on both sides of the pre-weekend range and settling below that low. However, there has been no follow-through selling. News that the Government’s Pension Investment Fund (GPIF) will no longer lend out its equity holdings to short-sellers failed to have an immediate impact. The dollar, which was testing JPY109.75 yesterday, has not been above JPY109.20 today. There is a $780 mln option struck at JPY109.10 that expires today. Support is seen near JPY108.80. A break could signal another half yen decline. The Australian dollar has seen strong follow-through buying today. It bottomed yesterday near $0.6755 and is near $0.6860 in the European morning. It is testing the (61.8%) retracement of the decline in the past month. The $0.6900-$0.6920 is the next technical objective. The US dollar edged higher against the Chinese yuan to resurface above CNY7.05, to reach its best level since late October.

EuropeFrance also became subject to US tariff threats yesterday. The 90-day grace period since the US concluded that France’s digital tax hurts US interests ended last week. The Trump Administration has threatened up to 100% tariffs on about $2.4 bln of French goods (mostly consumer goods like wine, cheese, handbags, and cosmetics). The next step is for public hearings. The US also said it will investigate if Austria, Italy, and Turkey should be subject to retaliatory action as well. Note that UK Prime Minister Johnson has also advocated a similar tax. A global solution seems preferable and an EU solution second best, but the failure of both left it in individual countries’ hands. |

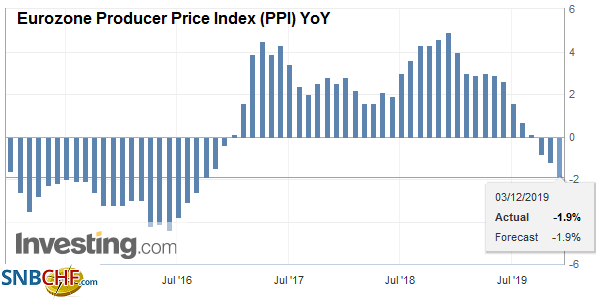

Eurozone Producer Price Index (PPI) YoY, October 2019(see more posts on Eurozone Producer Price Index, ) Source: investing.com - Click to enlarge |

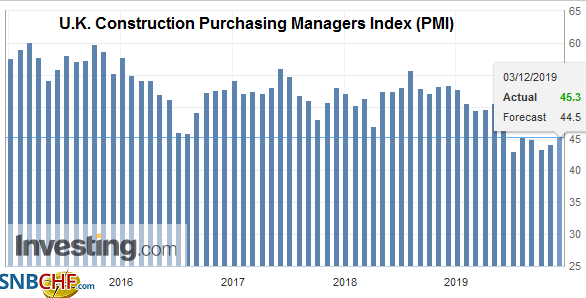

| Like the manufacturing PMI, the UK’s construction PMI rose a little more than expected but is still in contracting mode. Yesterday’s manufacturing PMI showed an improvement from the flash reading but was still lower than October. The construction PMI was sequentially better at 45.3 from 44.2 in October. It matches the best level since May but remains below the 50 boom/bust level. Last November, it stood at 54.3. The final services and composite PMI will be reported tomorrow. |

U.K. Construction Purchasing Managers Index (PMI), November 2019(see more posts on U.K. Construction PMI, ) Source: investing.com - Click to enlarge |

Yesterday’s jump to a higher range failed to inject much excitement in the euro, which is stuck again in a less than a 20-pip range against the dollar as it consolidates. The euro has not been below $1.1070 or above $1.1090. The euro has not traded above $1.11 since November 5. A move below the $1.1050 area would suggest the short-squeeze has run its course. Sterling is firm and pushing closer to $1.30, where there is a GBP225 mln option that expires today. It had not traded above $1.30 since October 21 when it approached $1.3015. Note that Turkey’s November CPI was softer than expected, rising 0.38% on the month, about half as much as the median forecast in the Bloomberg survey. However, the base effect translated into a big jump on a year-over-year basis to 10.56% from 8.55%, and this likely keeps the central bank on the sideline when it meets next week. The lira continues to consolidate. Lastly, a surprisingly weak Q3 GDP from South Africa (-0.6% annualized compared with expectations for a flat report) sent the rand sharply lower. The dollar jumped from near ZAR14.52 to almost ZAR14.70. The next important chart points are near ZAR14.72-ZAR14.77.

America

The news stream from the US was poor. The President threatened again to increase tariffs on China if there was no deal and reinstated tariffs on aluminum and steel from Argentina and Brazil, bemoaning their weak currencies. It threatened France. The economic data were not much better. Not only did the manufacturing ISM unexpectedly deteriorated, but construction spending missed broadly, falling 0.8% in October instead of increase by 0.4% of the median forecast in the Bloomberg survey. Adding insult to injury, the September series was revised to show a decline of 0.3% instead of a 0.5% gain. The one bright spot was the rise in the November manufacturing PMI to 52.6 from 52.2 flash reading and October’s 51.3. The dollar fell, but the disappointing data does not have the heft to alter expectations of Fed policy. Foremost, that requires a deterioration in the labor market.

It is not clear why the US deemed it necessary to put the tariffs back on Argentina and Brazil and to the extent, their currencies have weakened, it is a sign of a troubled economy, not a crafty manipulator. Perhaps they are being punished because farmers in Argentina and Brazil compete with US farmers in third markets, especially China. The US fights a rearguard action. China’s market for Brazil’s agriculture is ten-times larger than the US market for Brazilian steel. The value of Argentian soy exported to China is three times the value of Argentina’s shipments aluminum and iron pipe to the US, according to Bloomberg.

Trump has suggested that there is unlikely to be an agreement with China this year and suggested it might be preferable to wait until after next year’s election. Outside of US auto sales, the North American economic calendar is light, leaving investors to contemplate the implications of the deterioration in the trade situation over the past 24-hours. Brazil reports Q3 GDP. It is expected to have risen by 0.4%, the same as Q2 and 1% on a year-over-year basis, also the same as in Q2.

The Canadian dollar was one of the few major currencies not to have gained against the greenback yesterday. It is little changed today. The US dollar continues to straddle the CAD1.33-level. The technical condition has not changed. The MACDs are elevated but have yet to turn down. The Slow Stochastics are trending gently lower. Only a break of CAD1.3260 or CAD1.3330 signals anything of note. The US dollar is little changed against the Mexican peso. Its recent uptrend is intact, and the trendline is near MXN19.45 today. On the topside, the MXN19.60-MXN19.65 needs to be overcome to signal the next leg up.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Argentina,Brazil,Currency Movement,EUR/CHF,Eurozone Producer Price Index,newsletter,South Africa,tariffs,Trade,Turkey,U.K. Construction PMI,USD/CHF