Swiss FrancThe Euro has risen by 0.18% to 1.0997 |

EUR/CHF and USD/CHF, November 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Equities in the Asia Pacific managed to mostly shrug off the drag of the losses in US equities yesterday. China and India could not escape the pull, but most other bourses were higher, led by Singapore and Hong Kong. It was the second consecutive week that the MSCI Asia Pacific Index fell. The US and European benchmarks are paring this week’s small losses. Their six-week advances are in balance. Neither Lagarde’s first speech as ECB President nor the flash November PMI readings provided new incentives for traders. Bond markets are mixed, with Asia Pacific yields moving higher, while European and US yields are mostly a little softer. On the week, the US 10-year yield is about six basis points lower at 1.75%. Most European bond yields are also lower on the week, with the exception of Spain and Portugal. The dollar is narrowly mixed, with the Scandis and dollar-bloc currencies firmer. A disappointing flash PMI has weighed on sterling. Emerging market currencies are trading with a heavier bias, though the South African rand is a notable exception. For the week, the rand and Turkish lira are the best performers, with roughly a 0.5% and 0.8% gain respectively. With today’s small gains, gold is turning higher for the week, while oil is paring this week’s gains but is still up for the third consecutive week. |

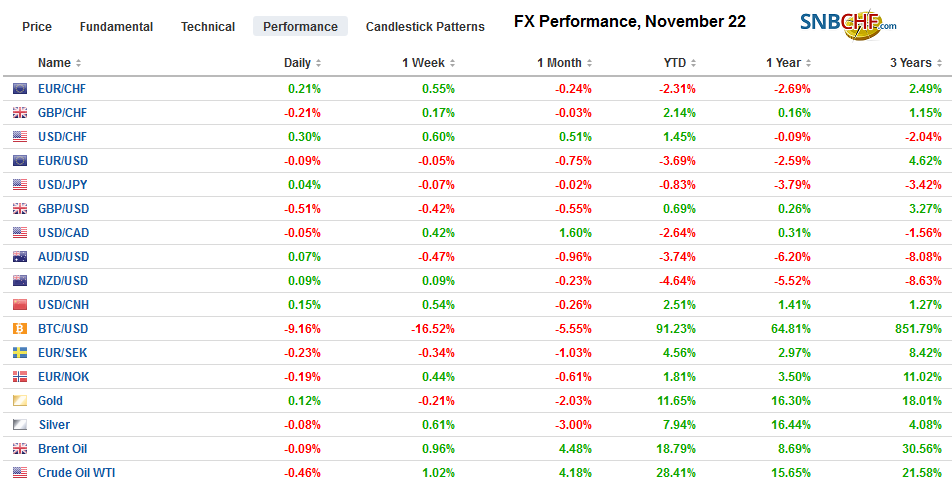

FX Performance, November 22 |

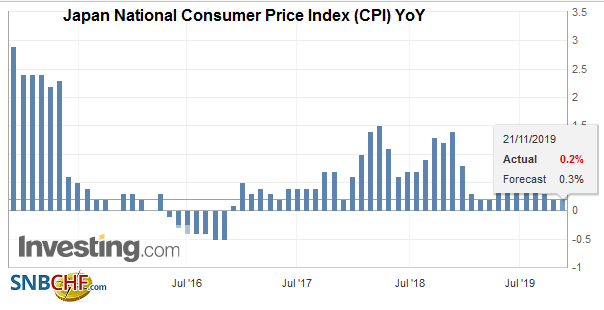

Asia PacificJapan reported October CPI and the November flash PMI. Headline consumer prices were steady, rising 0.2% year-over-year, the same as in September. Excluding fresh food prices to arrive at the core rate, CPI rose 0.4% after a 0.3% increase year-over-year in September. It is the first increase since April. Stripping away fresh food and energy, consumer prices rose 0.7% in October, which is the most in three years. |

Japan National Consumer Price Index (CPI) YoY, October 2019(see more posts on Japan National CPI, ) Source: investing.com - Click to enlarge |

| The increase in the sales tax on October 1 seems to be masked by the decline in electricity, gas, mobile phone service, and free child education. If the tax increase did not bolster inflation, it also did not derail the economy, it appears. |

Japan National Core Consumer Price Index (CPI) YoY, October 2019(see more posts on Japan National Core CPI, ) Source: investing.com - Click to enlarge |

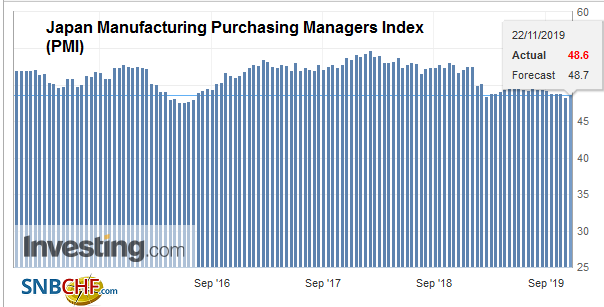

| The flash PMI ticked up. Manufacturing rose to 48.6 from 48.4, while services rose back above the 50 boom/bust level to 50.4 from 49.7. The composite stands at 49.9, improving from 49.1. |

Japan Manufacturing Purchasing Managers Index (PMI), November 2019(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Australia’s preliminary November PMI went in the other direction. Manufacturing slipped to 49.9 from 50.0, and services fell to 49.5 from 50.1. The composite eased to 49.5 from 50.0. Although the Reserve Bank of Australia meets next month (December 3), the market is not pricing in a cut until Q1 20. The market appears divided over whether it will launch an asset purchase program.

Hong Kong is to hold district elections Sunday. Chief Executive Lam had threatened to postpone the election, but this would likely only antagonize the situation further. The pro-government parties hold about 3/4 of the 452 that are being contested out of a total of 479 seats. However, the pro-democracy parties are fielding a record of more than 500 candidates. Around 4.3 mln people can vote compared with 3.12 mln in the last district election. The pro-government parties are widely expected to lose in what is being heralded as a referendum on the demonstrations that are nearly six-months-old. A strong showing by the pro-democracy parties would ostensibly lay a good foundation for the more important Legislative Council election next year. Still, Sunday’s vote is unlikely to change the way Hong Kong is governed nor sap the energy of the protests.Separately, the Hong Kong court allowed the government to reinstate the ban on face masks for seven days.

Some expect the Trump Administration to play down the recently passed measures to support the demonstrations in Hong Kong and will encourage China to keep it separate from the trade negotiations like it has sought to compartmentalize Huawei. However, Beijing may not accept this. Hong Kong is a red line for it. In its protests, China has made it clear in no uncertain terms that if Trump signs the bills into law, it will retaliate. If Trump does not sign the bills, which were passed with hardly a dissent, he will be widely criticized, and it would undermine this claim of being hard on China. Separately, but related, US officials hinted that even if a trade deal is not struck with China by the middle of December, the new tariffs that were threatened to be implemented (15% on roughly $160 bln) might be suspended as were last month’s.

The dollar has been pinned in a narrow range against the yen all week (~JPY108.30-JPY109.1), which is inside last week’s range. For the past two sessions and today, the dollar has been blocked near JPY108.75. It has not been below JPY108.25 since November 4. Despite disappointing PMI, the Australian dollar found support near the week’s low (~$0.6785). Last week’s low was near $0.6770. There is an A$1.1 bln option at $0.6795 that expires today. Without an advance above roughly $0.6815, the Aussie will record its third consecutive weekly loss. The US dollar traded higher against the Chinese yuan today and has risen in four of this week’s five sessions. Near CNY7.0420, it is poised to close at its best level this month.

EuropeLagarde’s first speech as ECB President did not reveal anything new. And for good reason. She has not held her first meeting yet. One of the criticisms of Draghi was that he would make announcements and only later informed the Board. That Lagarde did not reflects a sensitivity to the governance style, which seems to be as important to many as the substance of policy. In terms of substance, little new was said. Fiscal support is needed to complement the monetary stimulus, and a strategic view of monetary policy could be launched early in Lagarde’s tenure. |

Eurozone Manufacturing Purchasing Managers Index (PMI), November 2019(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

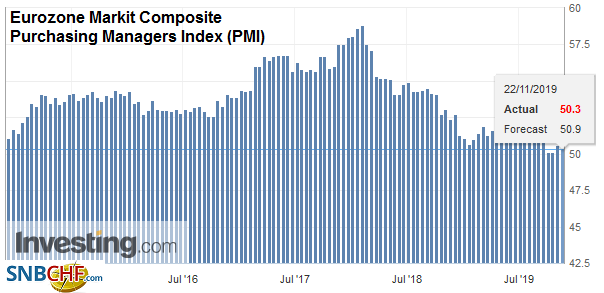

| The flash PMI for the EMU was a bit confusing frankly. The German and French composite PMIs edged higher 49.2 from 48.9 and 52.7 from 52.6, respectively. However, the aggregate composite fell to 50.3 from 50.6. Orders fell for the third month, and employment growth slowed. Prices eased. It suggests significant deterioration elsewhere. In Germany, the manufacturing PMI rose to 43.8 from 42.1. |

Eurozone Markit Composite Purchasing Managers Index (PMI), November 2019(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

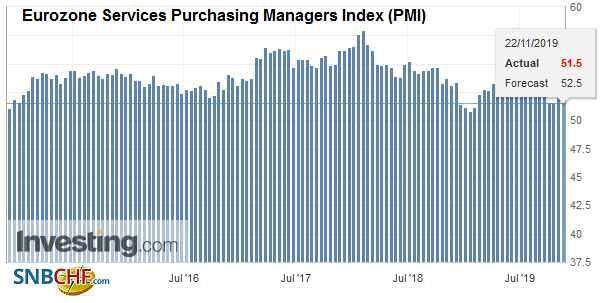

| It does not sound impressive, but it is a five-month high. The service slipped to 51.3 from 51.6. France’s service PMI was unchanged at 52.9, while the manufacturing PMI rose to 51.6 from 50.7. The aggregate manufacturing PMI rose to 46.1 from 45.9, while the service PMI fell to 51.5 from 52.2. |

Eurozone Services Purchasing Managers Index (PMI), November 2019(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

The UK flash PMI disappointed, and it would seem to bolster the care for a rate cut early next year. The manufacturing PMI unwound the October gain and returned to September’s 48.3 reading. The service PMI fell to new cyclical lows of 48.6, down from 50. These results pulled the composite to new lows, as well. The 48.5 reading is down from 50.0 in October and 51.4 at the end of last year.

The euro briefly dipped below $1.1050 early in the European morning to record new lows for the week. Although it stabilized, the intraday technicals warn that the low may not be in place. The next area of support is around $1.1030. We suspect the upside is blocked ahead of $1.11 that is approached yesterday and where a nearly 840 mln option is struck that expires today. Sterling has been sold to new six-day lows (~$1.2865) after the disappointing PMI. Chart support is seen closer to $1.2850. Although the 2/3-cent decline has extended the technical indicators, a pre-weekend bounce is likely to be limited. Look for the $1.2900-$1.2910 area to cap near-term upticks.

America

There is some talk that the lapsing of the 180-day deadline on the Commerce Department report that auto imports were a threat to US national security could mean that Trump lost the authority under Section 232 to impose tariffs. Prior to the deadline, there were signals that the US was backing off its threat. Nevertheless, if Trump wanted to impose such levies, there are plenty of other ways it can be achieved. Separately, Pelosi and Lighthizer met, and in like the talks with China, progress was reported but no agreement. With the number of legislative sessions ahead of year-end shrinking, it is making it less likely that USMCA gets passed this year. There is seen to be a small window for early next year.

The US sees the flash Markit PMI, which is expected to tick up a little across the board, though if there is a surprise, it is more likely to the downside as economists forecasts have been too high in recent weeks. The University of Michigan’s final November reading and the Kansas Fed ‘s manufacturing survey are typically not market movers. Canada reports September retail sales. A small decline is expected. It would be the second consecutive decline and the fourth in five months. Still, Poloz and Wilkens underscored the neutral setting of the central bank. Mexico reports its bi-weekly CPI, which is expected to be little changed a touch above 3%.

The US dollar is straddling the 200-day moving average against the Canadian dollar found a little below CAD1.3280. The US dollar surged higher on Tuesday and Wednesday this week and is consolidating yesterday and today. A break of the CAD1.3240 area would suggest a near-term high is in place. The greenback is also consolidating the gains it scored against the Mexican peso in the first half of the week. Support is seen in the MXN19.27-MXN19.32 area. Lastly, the Dollar Index poked above 98.00 to record a new high for the week. It settled last week just below there. A lower close this week would be the sixth in the past eight weeks since closing a little above 99.35 at the end of September.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,EMU,EUR/CHF,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,FX Daily,Hong Kong,Japan Manufacturing PMI,Japan National Core CPI,Japan National CPI,newsletter,Trade,USD/CHF