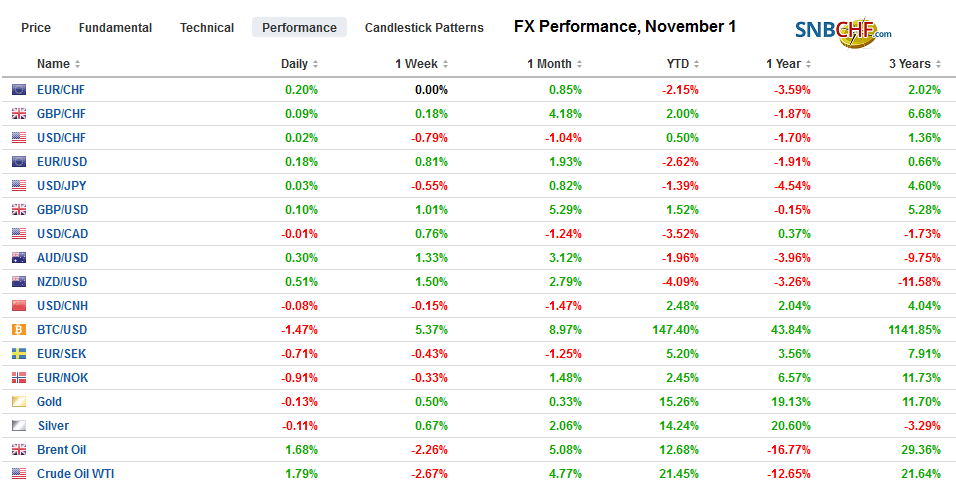

Swiss FrancThe Euro has risen by 0.24% to 1.1023 |

EUR/CHF and USD/CHF, November 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: An unexpected increase in China’s Caixin manufacturing PMI helped lift Asia Pacific equities after the S&P 500 stumbled yesterday amid concerns that there will not be a phase 2 in US-China trade negotiations. The MSCI Asia Pacific Index rose 4.3% in October, and with the help of gains in China, Hong Kong, Korea, and Taiwan began November with a gain. European stocks posting modest gains after the Dow Jones Stoxx 600 rose a little less than 1% last month. US shares are firm, and the S&P 500 is up about 0.5% on the week coming into today’s session. It rose by about 2% last month. Benchmark 10-year yields are narrowly mixed. Last month, yields rose around 15 bp in core Europe and 7-8 bp in Spain and Italy. The US 10-year yield rose about five basis points in October Japan was a notable exception as its benchmark yield slipped almost three basis points. The dollar is on the defensive ahead of the jobs report, where the headline is expected to be depressed by strike activity. The currencies typically sensitive to risk appetites, like the Scandis and Antipodeans, are leading the advance. Over the course of the week, only the Canadian dollar, where the central bank softened its neutral stance, did not gain on the US dollar. The dollar fell against all the majors save the Norwegian krone (-1%) in October, Gold edged higher this week (~0.6% at around $1514.5). It is the third weekly advance and the fourth in the past five weeks. Light sweet crude oil is trying to snap a four-day slide. After rising nearly 5.2% last week, it is off about 4.2% this week (~$54.35 December WTI). |

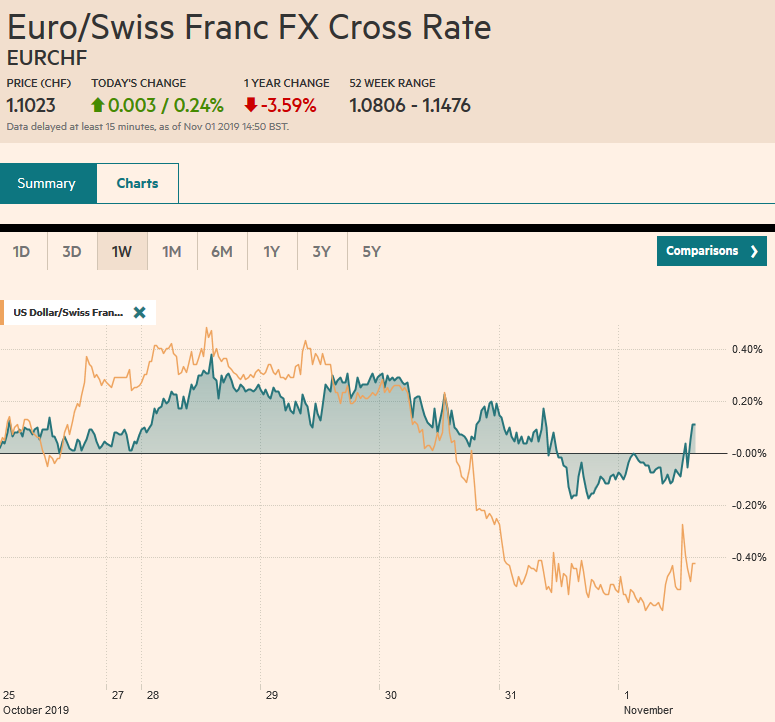

FX Performance, November 1 |

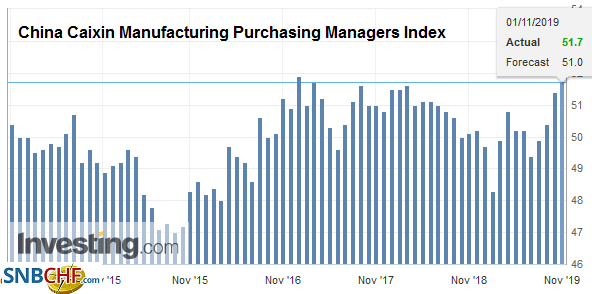

Asia PacificChina’s official manufacturing PMI fell in October to 49.3 from 49.8, but the Caixin measure, which puts more weight on smaller companies to 51.7 from 51.4. The forward-looking new orders component jumped to its highest in several years. As one swallow does not make a spring, the importance of the Caixin PMI should not be exaggerated. Nevertheless, investors will scrutinize the upcoming data for confirmation that the economy is finding some traction. Recall that the September industrial output did tick up (5.8% year-over-year vs. 4.4% in August). |

China Caixin Manufacturing Purchasing Managers Index (PMI), October 2019(see more posts on China Caixin Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| The dollar fell below CNY7.05 yesterday, and it remained below there today. However, the PBOC made a mild but clear protest. It set the dollar’s reference rate against the yuan weaker than Thursday but not as weak as the bank models suggested. That gap was the widest since August 2 and comes as speculation that the dollar could fall back below CNY7.0.

Between the sales tax increase and the typhoon, the Japanese economy is flashing new warning signs. Although retail sales and industrial output surprised on the upside in September, the labor market deteriorated. The unemployment rate unexpectedly rose to 2.4% from 2.2%, and the jobs-to-applicants ratio softened. |

Japan Unemployment Rate, September 2019(see more posts on Japan Unemployment Rate, ) Source: investing.com - Click to enlarge |

| The October manufacturing PMI slipped to 48.4 from the 48.5 preliminary estimate, which was down from 48.9. It has only been above the 50 boom/bust level in January and April this year. Separately, Japan reported vehicle sales in October plunged by 26.4% after rising 12.8% (year-over-year) in September. |

Japan Manufacturing Purchasing Managers Index (PMI), October 2019(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

South Korea’s trade figures continue to disappoint. October exports fell 14.7% (year-over-year) after falling 11.7% in September. Exports to China were off almost 17%. Semiconductor chip exports fell 32.1% year-over-year. South Korea’s exports are import-intensive, and the decline in imports also accelerated. They were off 14.6% in October after a 5.6% decline in September. With a sharp drop in South Korea’s chip inventories, the trade figures for early November will be keenly awaited for signs that adjustment is nearly complete. Separately, South Korea reported somewhat firmer consumer prices. The headline rose 0.2%, while the median Bloomberg forecast was for a flat report. The year-over-year rate is zero after a -0.4% deflation in September. The core rate edged up to 0.8% from 0.6%. The October manufacturing PMI rose to 48.4 from 48.0.

The dollar reversed lower in the middle of the week against the Japanese yen after reaching almost three-month highs near JPY109.30. The decline accelerated yesterday when the dollar briefly traded below JPY108. The 0.75% loss yesterday was the largest move (in either direction) since late August. The greenback is straddling JPY108 today in narrow ranges. There is an option for about $410 mln at JPY108 and another for almost $700 mln at JPY108.50, both of which expire today. A trendline connecting the August and early October lows comes in today near JPY107.80. For its part, the Australian dollar is straddling the $0.6900-level where an A$1.4 bln option has been struck that expires today. Yesterday’s high was near $0.6930, and the 200-day moving average, which has checked previous recoveries this year, is found near $0.6955.

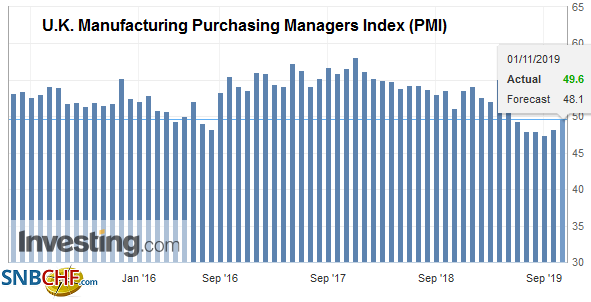

EuropePresident Trump seems more supportive of Brexiter Farage’s position than Prime Minister Johnson. He warned Johnson that his withdrawal bill will make it more difficult for a bilateral deal with the US. At the same time, he encouraged Johnson and that Tories to work with the Brexit Party, which seems to be underway so as not to split the “leave” vote. Separately, the UK’s October manufacturing remained below 50, but it rose for the second consecutive month. It bottomed in August at 47.4 and was 49.6 in October. The unexpected increase was helped by export orders, which may have been in anticipation of an October 31 exit. Employment fell for the seventh month. Finished goods inventories jumped, and the stockpiling was also likely related to Brexit. |

U.K. Manufacturing Purchasing Managers Index (PMI), October 2019(see more posts on U.K. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Germany’s Constitutional Court rejected an effort to prevent the Bundesbank from participating in the Eurosystem’s new asset purchase program. The court has rejected similar arguments in the past. Earlier this week, BBK President Weidmann cautioned against giving a preference for “green bonds” in the purchase program. This could be a potential flashpoint with the new ECB President. Lagarde wants the central bank to look into whether and how it can help mitigate climate change and incorporate environmental into its portfolio at some point. That said, the economic impact of climate change is being studied by many central banks.

The euro is in a narrow range today at the upper end of where it has traded over the past couple of months. It has stalled in front of $1.1180 approached a couple of weeks ago. The 200-day moving average is a little higher, just below $1.12. If it is not able to move to new highs today, it might signal a return to the $1.1070 shelf that had been formed at the end of last week and earlier this week. There are some large options set to expire today, after the US jobs data: There is a 715 mln euro option at $1.1175, and 3.4 bln euro sat $1.1150. The 1.2 bln euro option at $1.11 does not appear in play. Sterling is firm near $1.2950, where a GBP1.1 bln option is struck that will expire today. There is also a GBP2.8 bln option at $1.29 that rolls off today too. Lastly, note that there is also a 570 mln euro option at GBP0.8600 that expires today.

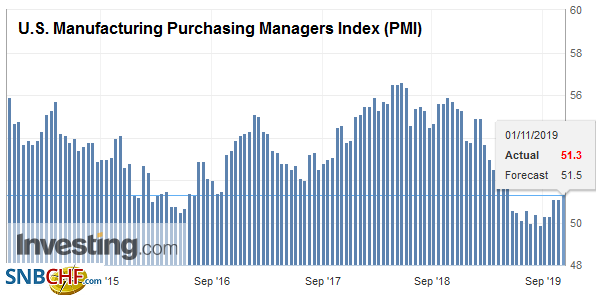

AmericaUS jobs data cap the busy week. Everyone is well aware that the report will not be clean due to the GM strike and other labor disputes, like the Chicago teachers. The Bureau of Labor Statistics estimates that GM strikers numbers around 46k. Observers will put back most of the jobs lost in manufacturing to avoid the distortion. Through September, the US added about 5k manufacturing jobs a month. Nevertheless, it seems undeniable that job growth is slowing. This year, the US has created an average of 161k net new jobs a month. This is a little less than three-quarters of the average of the first nine months of 2018. Economists often argue that income drives consumption, and it is fair as far as it goes, but credit also fuels consumption. According to Autonomous Research, cited by the Wall Street Journal, interest rates of credit cards issued by large banks have actually risen this year, and the volume growth is slowing. Moreover, in Q3, credit card delinquency rates among the four largest issuers continued to rise and now are at levels not seen in seven years. |

U.S. Manufacturing Purchasing Managers Index (PMI) , October 2019(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Canada Markit PMI for October is on tap today. It stood at 51.0 in September. It averaged 50.1 in Q3 and 50.5 year-to-date. In the first nine months of 2018, it had averaged 56.1. Mexico’s Markit manufacturing PMI will also be reported. It was at 49.1 in September. It averaged 49.3 in Q3 and 50.1 year-to-date. Mexico’s disappointing Q3 GDP report earlier this week boosted expectations for another rate cut at the November 14 Banxico meeting.

The US dollar rallied in the middle of the week against the Canadian dollar on the somewhat softer neutral stance of the central bank. It consolidated yesterday and is in the same range today. A $610 mln option at CAD1.3150 expires today, and it is within the range seen already today. Initial resistance for the greenback is seen near CAD1.3180. The dollar has also firmed against the Mexican peso this week.and is poised to snap a four-week slide that had left the technical indicators stretched. The risk-reward cautioned against chasing the greenback lower as the MXN19.00 area was approached. The dollar’s bounce stalled yesterday near MXN19.25, which was our initial objective. The 200-day moving average is just above MXM19.26. We look for further dollar gains in the coming sessions, and our next target is near MXN19.34.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,China,China Caixin Manufacturing PMI,Currency Movement,EUR/CHF,Japan Manufacturing PMI,Japan Unemployment Rate,jobs,newsletter,South Korea,U.K. Manufacturing PMI,U.S. Manufacturing PMI,USD/CHF