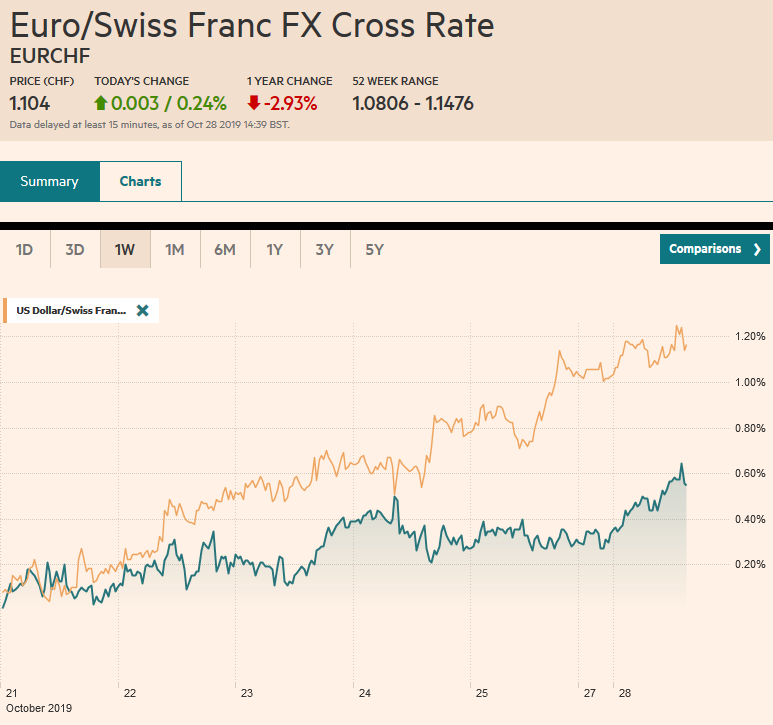

Swiss FrancThe Euro has risen by 0.24% to 1.104 |

EUR/CHF and USD/CHF, October 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The pre-weekend rally in US shares, with the S&P 500 flirting with record highs and the back-up in US yields, set the tone for Asia Pacific trading earlier today. Nearly all the equity markets advanced, and bond yields rose. Europe’s Dow Jones Stoxx 600 took a five-day advancing streak into this week, but shares are struggling to sustain the upside momentum. US stocks are trading a little firmer in Europe. Benchmark yields have continued to rise, and the US 10-year yield is near 1.83%, closing in on last month’s high near 1.90%. Hopes that S&P upgrades the outlook for Italian bonds at the end of the week is offering little reprieve for Italian bonds today, where the 10-year yield is almost six basis points higher as the yield pokes above 1.0%. The dollar is mixed but mostly softer. Against the majors, the Swiss franc, Japanese yen, and Canadian dollar are nursing small losses. Sterling steady above $1.28. Gold is consolidating its gains above $1500, while WTI is reversing lower after extended last week’s nearly 5.2% rally. |

FX Performance, October 28 |

Asia Pacific

China reported industrial profits fell by 5.3% year-over-year in September, the largest decline in four years. A combination of falling prices (PPI fell each month in Q3) and slower sales were responsible, according to the press statement. This year, through September, industrial profits fell 2.1% year-over-year, but this masks a couple the weakness in autos (-16.6% Jan-Sept y-o-y) and in oil, coal, and fuel processing, profits have been more than halved (-53.5%). Separately, reports indicate that the Communist Party Plenum will focus on politics rather than economics. Some expected a focus on the slowing economy to signal to ease monetary policy (a reduction in required reserves and/or a rate cut).

About 60% of the respondents to the Bloomberg survey do not expect the Bank of Japan to provide more stimulus this week. However, those expecting the BOJ to cut rates in the coming months increased to about 75% from a little less than 66% a month ago. That said, many expect it change its forward guidance to push further out a rate hike.

The dollar is in less than a 15 tick range below JPY108.80 against the Japanese yen through the European morning. Important resistance continues to be seen near JPY109, and it has not traded below JPY108.25 for two weeks. The greenback also remains in a narrow band against the Chinese yuan, though it made a marginal new two-week low near CNY7.0530. Despite a suggestion by some that it has been re-pegged, suspect the tight ranges are opportunistic and not a commitment, though the phase 1 of the US-China agreement calls for greater fx transparency and reduces the chances of a significant devaluation. The Australian dollar is forging a shelf near $0.6800. A break of it is needed to rekindle the downside momentum. Initial resistance is seen near $0.6835.

Europe

The EU is recommending that a three-month extension be granted to the UK, with the understanding that 1) it can leave earlier, if it wishes, and 2) there will be no more negotiating over the withdrawal agreement. Both of these conditions seem to be what the UK Prime Minister would like, given he was forced by Parliament to ask for a delay in the first place. Over the weekend, France seemed to be the lone holdout, wishing to grant a one-month extension only. A formal decision is expected tomorrow. The EC had previously reject re-opening the agreement struck after 18-months of negotiating with the May government.

Prime Minister Johnson seeks a snap election. He as sought two previous times but lacked the required 2/3 majority. An effort to change the requirement to a simple majority also lacks the necessary support. The Liberal Democrats and the Scottish Nationalist Party seem poised to increase their representation in an election and seem eager to have one, if not on December 12th, as Johnson wants, then December 9. Labour and the Democrat Unionist Party (DUP) are opposed. Labour is insisting that a no-deal exit needs to be prevented before it will agree to an election. The DUP feels betrayed by the Tories, who previously promised no economic barrier in the Irish Sea. Under Johnson’s plan, it appears that Northern Ireland will be in the EU customs union and the UK’s depending on the good’s final destination, in a complex and seeming unprecedented Schrodinger’s Cat-like solution.

If an economic contraction cannot get Germany to use the fiscal space it clearly has, perhaps political self-interest will. The AfD topped Merkel’s CDU in the state election in Thuringia (24% to 22%). No one wants to form a coalition with the AfD, especially in Thuringia, as the local leadership is too far to the right. In the last election, the CDU drew a solid third. The AfD more than doubled its share. Support for the Social Democrats (SPD) fell by a third it 8.5%. Linke, the Left Party, saw its share edge a little higher to 29%. The Greens drew 5% as did the Free Democrats (doubling its share). It will take some time to forge a coalition. National politics, from the immigration, to climate protests, and the economic slowdown worked against the CDU and SPD who form the federal coalition. Meanwhile, Annegret Kramp- Karrenbauer, who heads the CDU and is the Defense Minister (and is seen a Merkel’s likely heir), proposed that German troops participate in a peace-keeping force in northern Syria. It is not particularly popular, and the SPD was not consulted. At the same time, SPD’s leadership contest got underway. SPD Finance Minister Scholz was the only candidate to support staying in the national coalition won with less than 23% of the vote. A run-off will be held on November 30. A decision whether remain in the federal government “grand coalition” will be made before year-end.

Italy narrowly escaped a crisis earlier this year when the Five-Star Movement and the Democratic Party joined forces to thwart the League’s Salvini attempt to force new national elections. In its first local election, the coalition was unable to arrest the momentum enjoyed by the center-right. Umbria is a small region with less than one million people. The candidate backed by the League, Berlusconi’s Forza Italia, and the far-right Brothers of Italy won handily. The local government in Umbria has been a left-of-center stronghold. Next month Calabria (in the south) holds local elections, and in late January, Emilia Romagna (north) holds its elections. The League continues to appear to be the country’s most popular party with about 30% support.

The euro retested the pre-weekend low a little above $1.1070 and firmed to approach $1.11 in quiet turnover. There is a 1.3 bln euro option struck at $1.11 that expires today. We are not convinced that the decline in recent days is over after a three-week rally though it holding above the (38.2%) initial retracement objective near $1.1065. Sterling has also been confined to a narrow range above $1.2800. Last week’s low was just below there. Initial resistance is near the pre-weekend high around $1.2865. We see the risk on the downside if, as seems likely, Prime Minister Jonhson’s third election bid fails today.

America

The week’s big events for the US, namely the FOMC meeting and the first look at Q3 GDP, and the October employment report lie ahead. Today there may be passing interest in the Chicago Fed’s national activities index, the Dallas Fed’s manufacturing survey, and the advanced goods trade balance for September. The data are unlikely to change perceptions that the US economy is slowing, nor will today’s reports have much impact on Q3 GDP estimates, which the Bloomberg survey of 61 economists produced a median forecast of 1.6% (in 1.2%-2.0% range). The Bank of Canada also meets on October 30. It is expected to hew its neutral stance.

Latin America is also a central stage. First is the Argentine election. The opposition candidate Fernandez secured 48% of the popular vote, which was sufficient to avoid a run-off next month. The central bank immediately announced it was dramatically tightening capital control, allowing on $200 a day to be bought instead of the $10,000 cap announced on September 1. Brazil’s markets were lifted by the passage of pension reform. The Brazilian real rose to 2-month highs against the dollar, and the Bovespa reached record highs before the weekend. This week, the central bank is expected to cut the Selic rate by 50 bp to 5.00%. It reduced rates by 50 bp in both July and September. Mexico reports Q3 GDP on October 30. A small gain is expected after a 0.8% contraction in Q2. Banxico its overnight rate by 25 bp in both August and September to 7.75%. The central bank meets again in the middle of November, but many expect it to wait until December ease policy further.

Since October 10, the US dollar has fallen almost 2.2% against the Canadian dollar, but the downside momentum stalled at the end of last week near CAD1.3050. Some momentum traders may have moved to the sidelines. The CAD1.31 area offers the first hurdle, and a move above CAD1.3120 could confirm a near-term low is in place. The greenback has fallen nearly 3% against the Mexican peso over the same period. It edged briefly through MXN19.03 before the weekend, and like most of the currencies, it moving sideways in a narrow range so far today. We see the risk-reward discouraging new dollar shorts given the proximity of important support near MXN19.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,China,Currency Movement,EUR/CHF,Germany,Italy,newsletter,USD/CHF