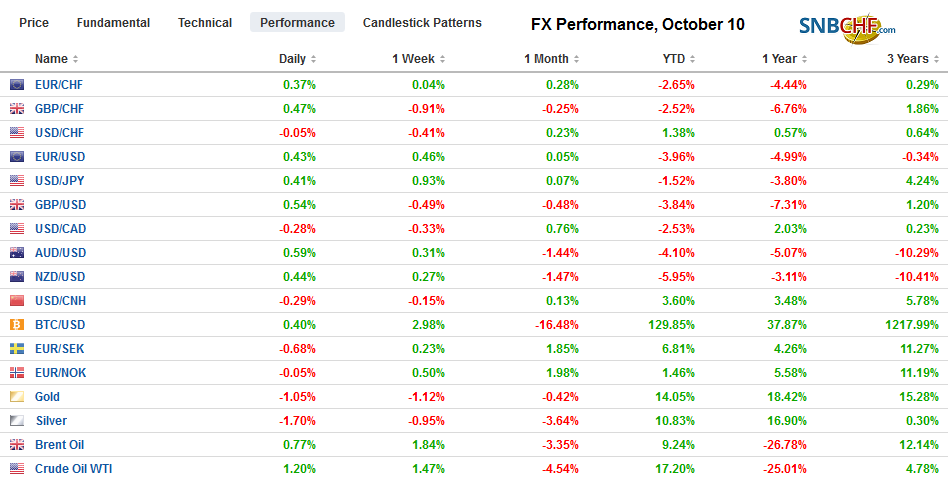

Swiss FrancThe Euro has risen by 0.37% to 1.0962 |

EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Conflicting headlines about US-China trade whipsawed the markets in Asia, but when things settled down, perhaps, like the partial deal that has been hinted, net-net little has changed. Asian equities were mixed, with the Nikkei, China’s indices, and HK gaining, while most of the others slipped lower. The 0.9% gain in the S&P 500 yesterday failed to lift European stocks, and the Dow Jones Stoxx 600 is near the week’s lows. US shares also are trading softer. Benchmark 10-year bond yields are edging higher, perhaps playing a little catch-up to the 5.5 bp increase in the US 10-year yields yesterday. The dollar is heavy. Among the majors, the Scandis are the strongest after firmer than expected CPI figures. The dollar is around the middle of the roughly JPY107.00-JPY107.75 range seen already today, while the euro is punched above the $1.10 level for the first time since September 25. The euro’s gains have helped lift eastern and central European currencies. The Turkish lira is little changed ahead of the UN Security Council session later today. Oil is lower for the fourth session. November crude has risen in three of the past 18 sessions and only once since September 24. Gold reached a five-day high today, rising for its third consecutive session. |

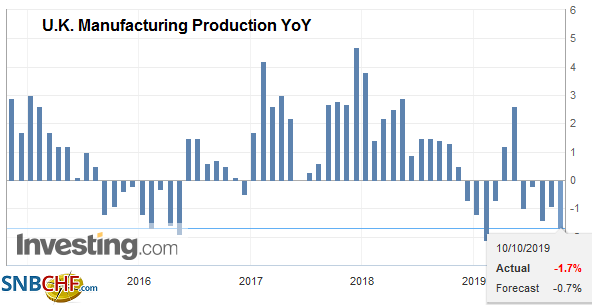

FX Performance, October 10 |

Asia Pacific

Conflicting headlines made for a volatile Asian session. At the heart of it is US-Chinese trade talks that formally start in Washington today. Talk that the Chinese delegation could leave a day earlier was reported in the South China Morning Post, and the market reacted to it even though it was out yesterday, and we cited in yesterday’s note. There are reports that the US wants China’s previous currency commitment (ultimately more transparent practices) in a possible interim agreement. This is low hanging fruit for China as it mostly seems to reiterate G20 statements. The yuan is off about 3.5% year-to-date and is, in fact, broadly stable. Consider that all the major currencies but the Canadian dollar, Japanese yen, and Swiss franc are down more that it. Metrics and enforcement of such an agreement are also vague.

An interim agreement is mostly about appearances and not even returning to status quo ante. China would buy US grains and meats, which given the shortage in China and the surge in food inflation, is necessary. The US would ostensibly suspend next week’s tariff increase on around $250 of Chinese imports from 25% to 30%. We argue that such an increase is immaterial. Once a good is taxed sufficiently to make it uncompetitive, it does not matter so much if it becomes even less competitive. The NY Times reports that the US is ready to offer some licenses for US companies to sell non-sensitive products and services to Huawei is also not new. The US made this commitment in June but apparently has not carried through with it yet.

Japan reported deepening producer deflation and new weakness in core machinery orders. PPI fell 1.1% year-over-year in September after a 0.9% decline in August. Core machine orders fell 14.5% in August year-over-year, after a 0.3% gain in September. On the month, orders fell 2.4%, more than twice the decline expected. Separately, the weekly MOF portfolio flow data shows foreigners bought more than JPY1 trillion of Japanese stocks last week and JPY900 bln in bonds. We do not read much into that the buying spree and would link it to the start of the new fiscal half-year, and the purchases re-establish positions liquidated in late September.

For the third session, the dollar has made higher highs and higher lows against the Japanese yen. It briefly traded above the 20-day moving average (~JPY107.65) for the first time since October 2, but this did not signal a breakout, and the dollar is little changed on the day now (~JPY107.40). There are 1.4 bln in options struck between JPY107.25 and JPY107.50 that roll-off today and another one for $1.3 bln at JPY107.70. The Australian dollar is posting an outside up day by trading on both sides of yesterday’s range. A close above yesterday’s high (~$0.6750) is necessary to confirm the possible reversal. There is an option struck there ($0.6750) for A$660 mln that expires today.

Europe

A campaign is being waged against the ECB since its decision to resume its asset purchase plan. Since those that won the debate have little to gain from going to press, we have been confident that it is the dissenters that leaking material to the media. Today, citing three unnamed officials, the Financial Times revealed that the ECB’s monetary and legal committee advised against the resumption of the asset purchase program. Its advice is not binding, and it is not the first time that a majority overruled its recommendation. We suspect the purpose of these leaks is to 1) embarrass Draghi, and arguably, more importantly, 2) send a warning to Lagarde. Although Draghi quickly reversed the Trichet inspired rate hikes, we do not think Lagarde (and a majority of the ECB) will cancel the new initiatives. Recent data has shown the economic conditions are not improving.

Today’s EMU data disappointed. German exports fell 1.8% in August. The median forecast in the Bloomberg survey was for a 1% decline after a 0.8% gain in July. Imports rose by 0.5%, in line with expectations, but the July series was revised to show a 2.4% decline rather than a 1.5% fall that was initially reported. France reported a 0.9% slump in August industrial output, The median forecast was for a 0.3% gain. Manufacturing contracted by 0.8%. Economists hoped for a 0.3% increase. Italy’s 0.3% rise in industrial production was better than expected, but the 1.8% decline year-over-year was in line with forecasts and is the weakest this year.

Italy issued dollar-denominated bonds for the first time in a decade. Despite the occasional references to America’s exorbitant privilege, US rates are higher than Italian rates. Italy’s Treasury wants to diversify its investor base, and it is willing to pay a little for that. The decline in Italian yields will lower the debt servicing costs next year by around an estimated 7 bln euros. And the premium, Italy pays for borrowing dollars instead of euros, is mitigated by the interest rate differentials. Indicative prices suggest that Italy can swap the dollars into euros for the 30-year bond it sold, and all-in would pay a little less than it pays to borrow euros’ for 30-years. For the five and 10-year dollar bonds on a currency-hedged basis, it would cost Italy about 25 bp more than it pays on the euro-denominated bonds.

| It may come as a surprise to many, but the Swedish krone is the weakest of the majors this year, down about 11% against the US dollar. The Norwegian krona is the third-worst of the majors off about 5.75% (the New Zealand dollar has fallen about 6.3%). What makes the Nokkie’s depreciation exceptionally notable is that the central bank doubled the deposit to 1.50%. Not only does Norway have positive rates and has tightened monetary policy, but it also has a current account surplus of nearly 7% of GDP. Sweden’s Riksbank had ideas/hopes of raising rates this year, but the economy has disappointed. The September composite PMI fell to 48.8, the lowest in six and a half years. Price pressures are easing. The preferred CPI measure, which uses fix rate mortgages for its calculations, has fallen from 2.5% in September 2018 to 1.3% reported today for last month, unchanged from August. It is a three-year low. Yesterday, Norway reported a 0.6% contraction in August GDP, but most of this was energy. The mainland economy contracted by 0.2%. The monthly GDP numbers are noisy, and the economy appears to be faring better but is not immune to the global weakness in manufacturing. There is a whiff of disinflation in Norway too. Headline inflation finished last year at 3%. Today’s report showed that it stood at 1.5% last month. The underlying rate (excludes energy and adjusts for tax changes) has fared better. It peaked in March at 2.7%, a three-year high and last month was ticked up to 2.2% (from 2.1%). |

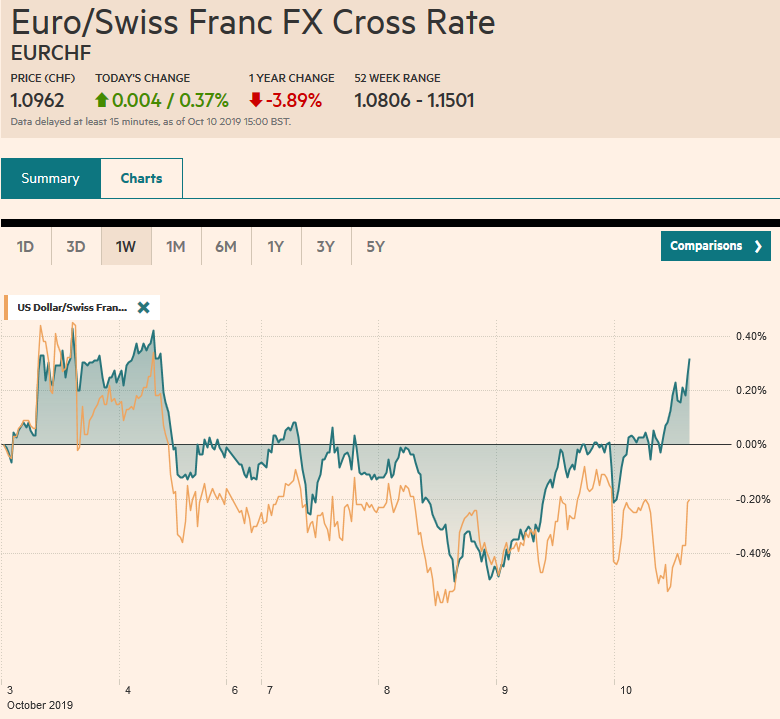

U.K. Gross Domestic Product (GDP) YoY, October 2019(see more posts on U.K. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

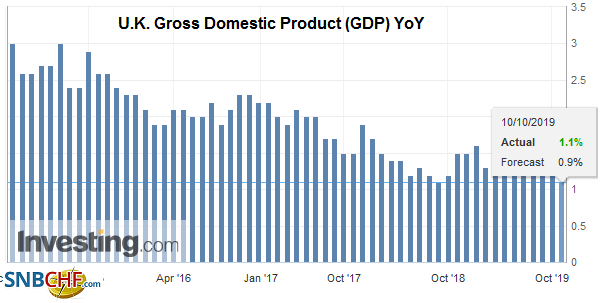

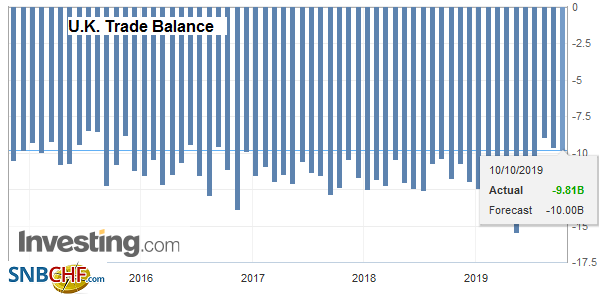

| The UK released several economic reports for August. From a high level, industrial output fell more than expected (-0.8%), and the year-over-year contraction (1.8%) was the most in six years. Flat services in August did not offset the weakness in the industrial sector and a deterioration of the trade balance.The economy contracted by 0.1%. |

U.K. Manufacturing Production YoY, August 2019(see more posts on U.K. Manufacturing Production, ) Source: investing.com - Click to enlarge |

| The one bright spot in today’s data dump was construction. It rose 0.2% in August while economists had expected a 0.4% decline. The July series was revised to show a 1.8% gain instead of a 0.5% rise initially reported. |

U.K. Trade Balance, August 2019(see more posts on U.K. Trade Balance, ) Source: investing.com - Click to enlarge |

The euro is testing the $1.1030 area, which corresponds to the (61.8%) retracement of the sell-off since the September 13 high a little north of $1.11. The break higher took place in late Asia/early Europe. The intraday technicals are stretched as North American dealers return to their posts. A close above $1.10 and ideally $1.1020 to confirm the breakout. Note that there is a nearly 800 mln euro option struck there that expires today and another one for 1.1 bln euros that will rolls-off tomorrow. The daily technical readings are constructive. The next target is around $1.1050. Sterling is firm, but this seems to reflect the greenback’s softness more than demand for the pound. It is underperforming most of the majors. That said, it is finding bids near $1.22, which has stalled the downside momentum. The euro is pushing through GBP0.9000 for the first time in a little more than a month. The next target is near GBP0.9050.

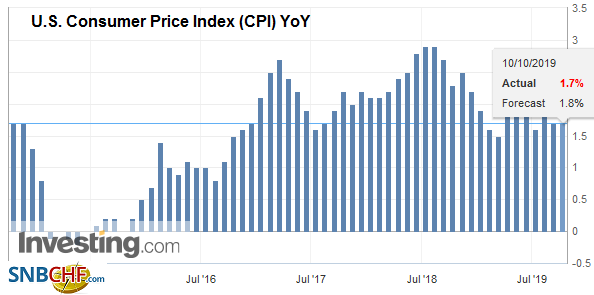

AmericaThe US reports September CPI figures. The PPI reported earlier this week was softer than expected. The 0.3% decline matched the January decline, which was the most in four years. |

U.S. Consumer Price Index (CPI) YoY, September 2019(see more posts on U.S. Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The median forecast in the Bloomberg survey calls for a 0.1% rise in the headline rate and a 0.2% rise in the core. If true, the headline rate may tick up to 1.8% from 1.7%, and the core rate would stay steady at 2.4%. |

U.S. Core Consumer Price Index (CPI) YoY, September 2019(see more posts on U.S. Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The Fed’s formal target is for the PCE deflator, though officials often talk about the core deflator. The elevated CPI did not deter the Fed from cutting rates last month, and the market is pricing in odds of an October move north of 80%. Three regional Fed presidents, Daly, Meister, and Bostic, speak today. None are voting members of the FOMC this year. |

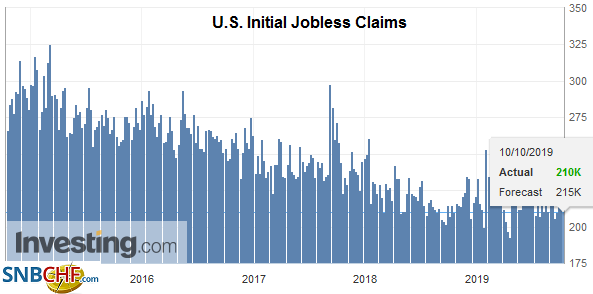

U.S. Initial Jobless Claims, October 2019(see more posts on U.S. Initial Jobless Claims, ) Source: investing.com - Click to enlarge |

Canada reports new house prices. It tends not to be a market mover in the best of times, and today’s report is overshadowed by tomorrow’s employment report. Much of the month-to-month volatility of the jobs report comes from part-time employment. Note that this year, Canada has created an average of 28.6k jobs. This is twice the average of the first eight months last year. Minutes from Mexico’s central bank meeting that resulted in the second 25 bp rate cut this year (to 7.75%) will be released. After yesterday’s decline in September CPI to 3%, the lowest in three years, the minutes will be scrutinized for hints of another rate cut as early as the middle of next month.

The US dollar pushed to new highs for the week against the Canadian dollar but stopped shy of CAD1.3350 and is reversing lower. A convincing break of CAD1.3285 is needed to boost confidence that a high is in place, though that is our leaning. The greenback is testing support near MXN19.50, and a push below there could signal a move toward MXN19.40 and possibly MXN19.30 in the coming sessions.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,China,Currency Movement,ECB,EUR/CHF,newsletter,Norwegian Krone,SEK,Trade,u-k-trade-balance,U.K. Gross Domestic Product,U.K. Manufacturing Production,U.K. Trade Balance,U.S. Consumer Price Index,U.S. Core Consumer Price Index,U.S. Initial Jobless Claims,USD/CHF