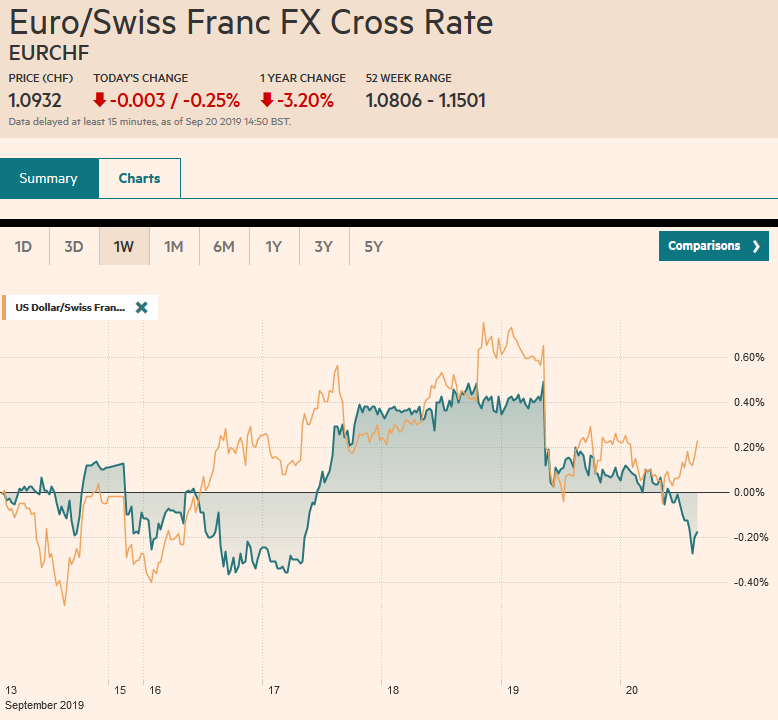

Swiss FrancThe Euro has fallen by 0.25% to 1.0932 |

EUR/CHF and USD/CHF, September 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: A word of optimism on a Brexit deal has sent sterling to its best level in two months. Corporate tax cuts sparked a more than 5% rally in Indian stocks as the week draws to a close. The MSCI Asia Pacific Index snapped a four-day losing streak to pare this week’s decline. Europe’s Dow Jones Stoxx 600 was flat for the week coming into today, and its four-week advance is at stake. US shares are trading firmer in Europe, and the S&P 500 is near its record high set in late July. Benchmark 10- year bond yields are narrowly mixed. The US 10-year yield that had been flirting with 1.90% a week ago is closer to 1.77%. The US dollar is mostly softer, though the New Zealand and Canadian dollars are struggling. The Norwegian krone is lower against the dollar for a third session and against the euro for a second session despite (or because?) or this week’s rate hike. Crude oil is firmer but within yesterday’s ranges. November WTI is up about 7% this week, the most in three months. Gold is poised to end a three-week downdraft and near $1503 is up about 1% for the week. |

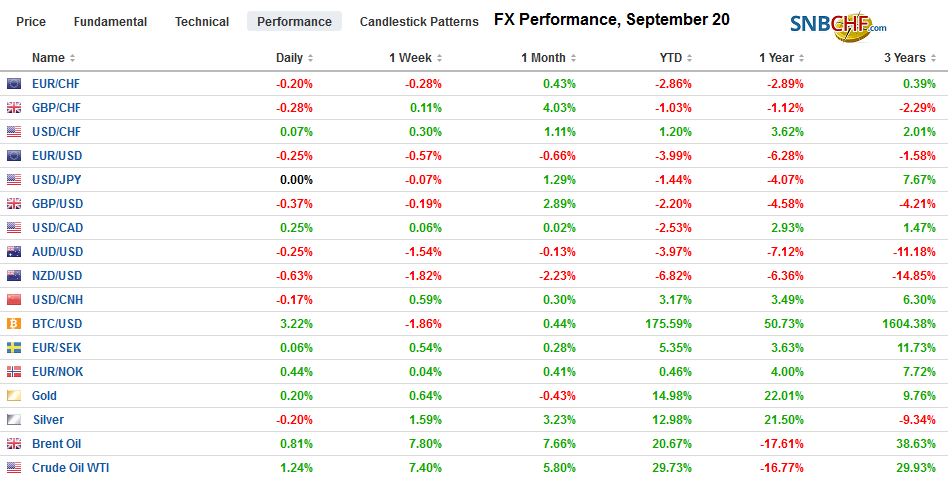

FX Performance, September 20 |

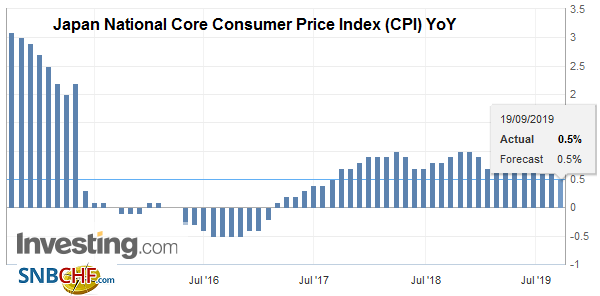

Asia PacificJapan’s price pressures as they are softened in August. The headline rate eased from 0.5% in July to 0.3% in August. |

Japan National Consumer Price Index (CPI) YoY, August 2019(see more posts on Japan National CPI, ) Source: investing.com - Click to enlarge |

| The core rate, which excludes fresh food, rose 0.5%, which is the lowest level since July 2017. The target is 2%. The cut in mobile phone plans and falling pre-school costs may continue to weigh on core CPI in the coming months. BOJ Kuroda seems more concerned about the yield curve than the level of interest rates per se. Today, the BOJ announced it would reduce the amount of JGBs it buys in the three maturity buckets from five to 25 years. |

Japan National Core Consumer Price Index (CPI) YoY, August 2019(see more posts on Japan National Core CPI, ) Source: investing.com - Click to enlarge |

China set its prime lending rate (one-year) to 4.20%, a five basis point decline. The small reduction likely signals what should be expected going forward. Small drip-fed rate cuts instead of larger moves, but it likely means that this will continue in the period ahead. This week the previously announced reduction in reserve requirements became effective, which freed up an estimated CNY800 bln. Note that since September 3, the dollar has been in a sawtooth pattern against the yuan, alternating sessions between gains and declines. The dollar eased slightly today, keeping the pattern intact.

India announced the equivalent of a $20 bln corporate tax cut that slashes the schedule to 22% from 30%. Due to other fees, the new effective tax rate is 25% and will be effective April 1. New businesses that are launched will have a 15% tax schedule and a little more than 17% effective rate. Indian stocks soared on the news. Foreign investors have sold nearly $4.9 bln of Indian shares here in Q3, almost halving the amount bought in H1 19. The rupee pared this week’s loss to about 0.2% after gaining 1% last week.

Taiwan reported shockingly poor export figures. July exports had fallen 3% year-over-year, and economists had expected improvement in August. Instead, they slumped 8.3%. Exports to the US were off 7.8% (-1.6% July) and to China (including HK) fell 8.9% (-6.7% in July). Shipments to Europe were down 7% from a year ago (-1.8% in July). Exports of chemicals and machinery were particularly weak.

The dollar has lost its upside momentum against the yen. It peaked near JPY108.50 in the past two sessions but has not been able to resurface above JPY108.10 today. There is a $1.1 bln option at JPY108 that will be cut today. The technicals suggest a weaker dollar is likely in the days ahead. Initial support is seen near JPY107.40 and then just ahead of JPY107. The Australian dollar is consolidating in yesterday’s trough below the 20-day moving average (~$0.6805). The $0.6765 area is a (61.8%) retracement objective of this month’s advance. A break of it may signal losses back toward $0.6700.

Europe

Brexit is the main story in Europe today. Outgoing EC President Juncker inspired a short squeeze that lifted sterling a little through $1.2580 before cooler heads prevailed. Juncker suggested that a deal can still be worked out before the end of October, and he was open to an alternative to the backstop. He said that some arrangement that avoided a hard Irish border, including a shift in customs and regulatory checks elsewhere, and aligning Northern Ireland and the EU agriculture and food policies may make a backstop unnecessary. Comments by Ireland’s Deputy Prime Minister that contradicted Juncker and emphasized that the UK “solution” does not bear up under scrutiny. He emphasized the wide gap between Dublin and London. Sterling came off half a cent.

Many observers are trying to make sense of the shockingly poor utilization of the ECB’s new TLTRO. Yesterday there was demand for only 3.4 bln euros. Economist estimates ranged from 20 to 100 bln euros. Some conclude that the ECB cannot even give away money at this point, and the narrative fits into the broader meme that monetary policy is exhausted. We are reluctant to reach that conclusion and suspect that a couple of technical considerations, such as the fiscal year-end, regulatory needs, and waiting for the tiering, which exempts some deposits from the negative ECB rates, maybe behind the disappointing results. We reserve judgment until we see the results of the December offering.

The euro has spent the week inside the range established on Monday, roughly $1.0990-$1.1090. It finished last week a little below $1.1075 and is straddling $1.1050 in the European morning. There is a 1.1 bln euro option that expires today at $1.1050, an option for ~510 mln euros at $1.1020, and a 2.6 bln euro option at $1.1000. The pullback of sterling from the session highs found new bids near $1.2520. It takes a break of $1.2460-$1.2480 to suggest a high is in place.

America

The North American calendar today features Canada’s July retail sales. The headline is expected to bounce back (~0.6%) after the flat report in June. Excluding auto sales, retail sales are forecast to increase by 0.3% after a 0.9% increase in June. The data is too old to make much of a difference to the market. The market has pushed out expectations for a cut until well into next year. About seven basis points of easing have been discounted for year-end.

The issue that has captured the market’s attention this week is not so much the second Fed cut this year and the prospects for a third, but the disruption with the plumbing. The Federal Reserve has preannounced today’s repo operation that injects reserves overnight (today is over the weekend) into the banking system. These operations may continue through the end of the month and quarter. This mismatch, provided it is addressed, is not an economic issue. Growth and inflation and the like are not impacted. Precisely how the Fed addresses it, such as a standing repo facility or allowing the balance sheet to expand organically like it did through most of its history, is not yet clear, though we suspect a combination of measures will be taken. Various drivers have been widely discussed for the disruption, including the corp tax payment, coupon settlement, and possible pullback of Saudi provided liquidity, hitting a banking system whose bulk of excess reserves were encumbered by regulatory demands. Another factor that has not received much attention is the Treasury’ cash management. Circumventing the debt ceiling drained the Treasury’s cash holdings. Rebuilding it may also drain reserves from the banking system.

The US dollar finished last week a little below CAD1.3290. It is trading near CAD1.3270 now. It is in a range of roughly CAD1.3230 to CAD1.3300. The intraday technicals suggest the US dollar may slip a little lower ahead of the weekend. The US dollar posted a key reversal against the Mexican peso yesterday by first trading below the previous day’s low and then recovering and settling above the previous day’s high. There has been no follow-through dollar buying yet today. The week’s high was set near MXN19.55. We suspect that yesterday’s low near MXN19.30 may mark the low point in the dollar’s pullback that began in late August from above MXN20.20. Mexico’s central bank meets on September 26, and the market is pricing in about a 70% chance of a rate cut.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,EUR/CHF,federal-reserve,India,Japan National Core CPI,Japan National CPI,newsletter,Taiwan,USD/CHF