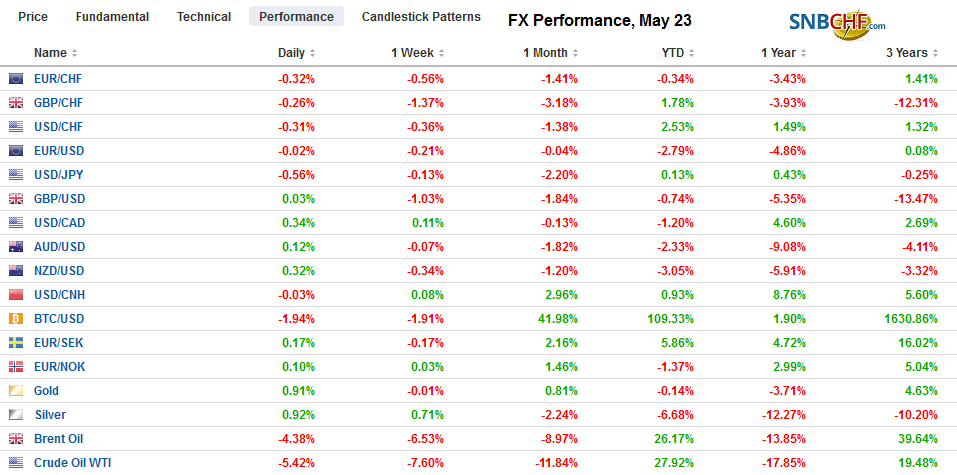

Swiss FrancThe Euro has fallen by 0.43% at 1.121 |

EUR/CHF and USD/CHF, May 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The deterioration of the investment climate is spurring the sales of stocks and the buying of bonds. The dollar is firm. China and the US appear to be digging as if the trade tensions will remain for some time and the breech is beginning to look too big for Trump and Xi to pull another rabbit out of the hat like they did at the end of last year when the tariff truce was struck. The move against Huawei and possible a number of companies involved in surveillance equipment represents a new front. India and Indonesia were notable exceptions to the sell-off in Asian Pacific shares, which saw the Shanghai Composite fell almost 1.4%. Modi looks to have secured a majority. European bourses are lower with the Dow Jones Stoxx 600 off almost 1% following the disappointing flash PMI, and a poor IFO survey added to the pressure. The 10-year German Bund yield is back on its lows as yields slip through negative 11 bp. Benchmark 10-year yields are off 1-2 basis points, with the 10-year Gilt off a bit more and now is below 1%. The 10-year Australian yield is off five basis points to a new record low of below 1.6% and just above the overnight cash rate target of 1.5%. Note that the US 10-year yield at 2.36% is below the effective average fed funds rate and one basis point more than the interest the Fed pays on reserves. The dollar is firm against most major and emerging market currencies. The yen and Swiss franc are benefitting from the risk-off mood. |

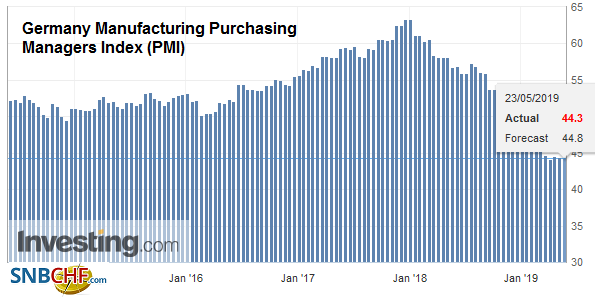

FX Performance, May 23 |

Asia Pacific

References to the “Long March” and “self-reliance” in Chinese state media and rhetoric are important signals that like the US, China is preparing the people for a potentially sustained confrontation with the US. The hardliners in China have long argued that the US main strategy was containment. Graham Allison’s Thucydides Trap hypothesis offers a consistent framework along these lines, while President Trump’s comments seem to confirm it. Chinese officials do not seem to be taking Trump’s bait that the Democrats would be easier negotiating partner. Despite the lack of agreement on almost everything else, the Democrat leadership (Pelosi and Schumer) have encouraged Trump shortly after he ended the tariff truce through tweets.

The long arm of the US is seen in several carriers in Japan and Taiwan that have stopped taking orders for Huawei smartphones. BT in the UK has shelved plans to offer Huawei phones for the 5G it is rolling out next week for fear that they will be not able to access updated in the Android operating system or have access to the app store. Five countries are rolling out 5G: the US, where Huawei is now banned, China, where Huawei dominates, South Korea that is dominated by Samsung, Switzerland, which is using another Chinese manufacturer (Oppo) and finally the UK, which is the current battleground. BT won’t use Huawei for the smartphones, but Huawei (alongside Nokia) provides much of the infrastructure.

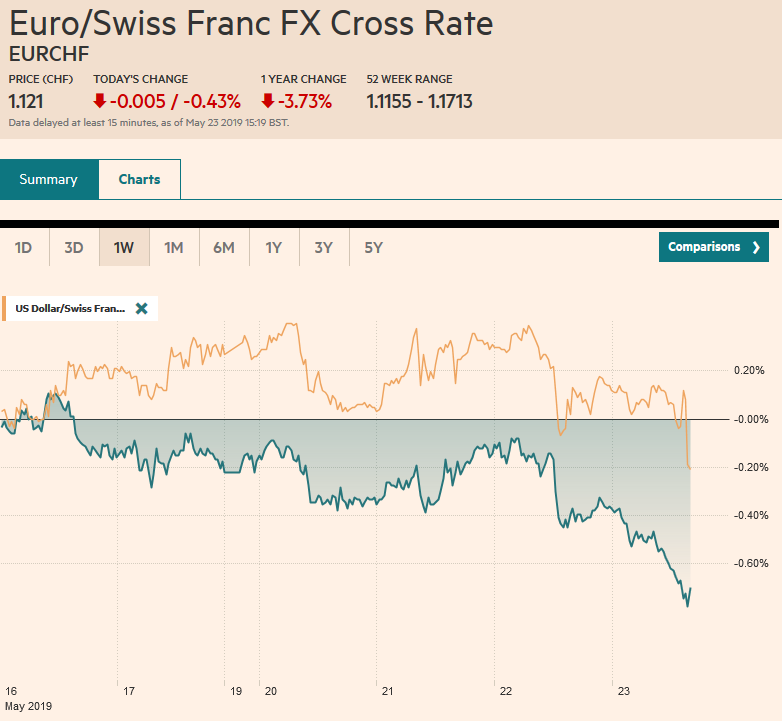

| After moving above the 50 boom/bust level in April for the first time since January, Japan’s flash manufacturing PMI slipped back again to stand at 49.6 from 50.2. Separately, the Finance Ministry’s weekly report showed Japanese investors took advantage of the yen’s strength and bought JPY1.35 trillion (~$12.3 bln) of foreign bonds last week, the most since March and more than the previous six weeks combined. |

Japan Manufacturing Purchasing Managers Index (PMI), May 2019(see more posts on Japan Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

Yesterday’s inside day for the dollar-yen exchange rate signal a near-term trend reversal and a lower dollar today. The dollar is testing the JPY110.00 area. A break of the JPY109.65-JPY109.85 area warns of a return to last week’s low near JPY109.00. There is a $1 bln option at JPY110.25 that expires later today. The Australian dollar is sitting just above last week’s lows (~$0.6865). The uptick in the flash PMIs does nothing to dampen the heightened expectations for a rate cut in early June. There is an option for roughly A$615 mln at $0.6850 that will be cut today. The dollar rose slightly against the Chinese yuan to new highs for the week, just shy of CNY6.92.

Europe

The resignation of Andrea Leadsom, the leader of the House, who presents the government’s agenda is a significant blow to Prime Minister May. The Tories may suffer a historic loss in the EU Parliamentary elections. Some polls warn that the Tories may come in fifth place. It is difficult to envision May’s Withdrawal Bill coming back to the House of Commons in early June. The odds that May is not Prime Minister at the end of next month has risen markedly. On Predict.org, May was the odds on favorite to still occupy 10 Downing Street a week ago at around 85% chance. Now it is less than 50%. Some are urging her to resign before the results of the election are known (May 26). Sterling is getting pounded because the odds favor a hardline Brexiter to replace May, and especially the more the Conservative party is trounced in the EU elections. This, in turns, increases the risk of a more disruptive exit.

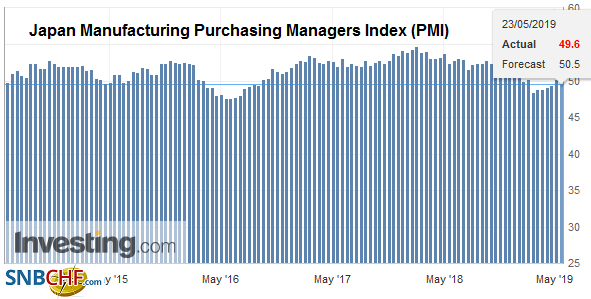

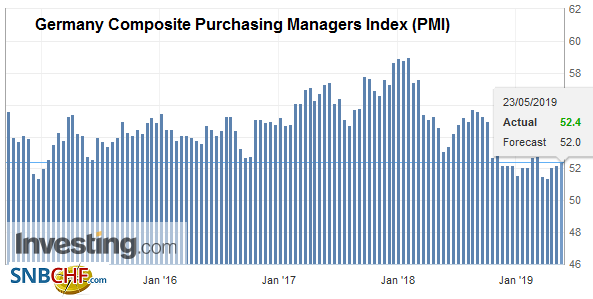

| There is an odd development in the disappointing flash European PMI. To wit, the German manufacturing and service readings slipped, but the composite rose. The manufacturing PMI eased to 44.3 from 44.4, and the service PMI dropped to 55.0 from 55.7. |

Germany Manufacturing Purchasing Managers Index (PMI), May 2019 Source: investing.com - Click to enlarge |

| The composite is said to have risen to 52.4 from 52.2. The French flash PMIs all improved, but on the composite level that German anomaly was evident. |

Germany Composite Purchasing Managers Index (PMI), May 2019(see more posts on Germany Composite PMI, ) Source: investing.com - Click to enlarge |

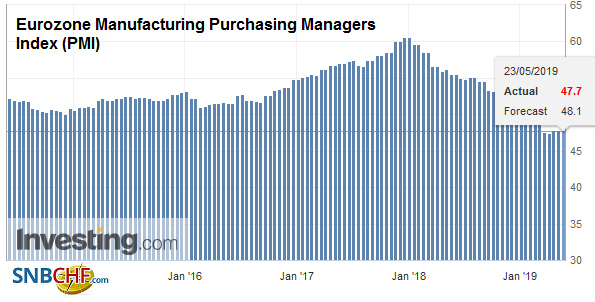

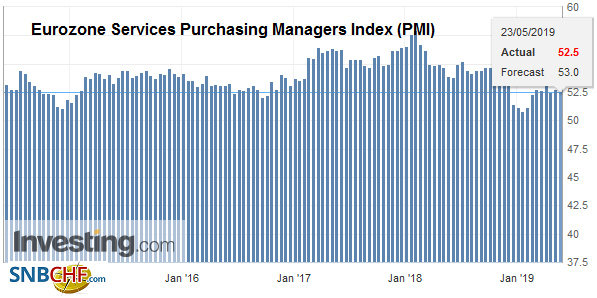

| The manufacturing (47.7 vs. 47.9) and service (52.5 vs. 52.8) PMIs moved lower, but the composite edged up to 51.6 from 51.5. |

Eurozone Manufacturing Purchasing Managers Index (PMI), May 2019 Source: investing.com - Click to enlarge |

| The price component fell to a new three-month low. The key takeaway is that the engine of the eurozone economy, Germany may still be struggling, and this is the message from the IFO survey, where the overall business climate fell to 97.9 from 99.2 as both expectations, and the current assessment fell more than expected. That said, the survey data has been weaker than the real sector reports. |

Eurozone Services Purchasing Managers Index (PMI), May 2019(see more posts on Eurozone Services Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

The euro has been sold to a new low for the month near $1.1130. The 18-month low set last month in the immediate response to the stronger than expected Q1 US GDP report on April 26 was a near $1.1110. The 1.5 bln euro options struck at $1.1180 may not be in play, but tomorrow there is a 1.4 bln euro option at $1.1100 that may slow the euro’s descent. Sterling was sold to almost $1.26 and set a new four-month low. The low from last December was near $1.2480, and the flash crash low from January 3 is close to $1.2440. The option for approximately GBP325 mln at $1.2665 may help cap upticks.

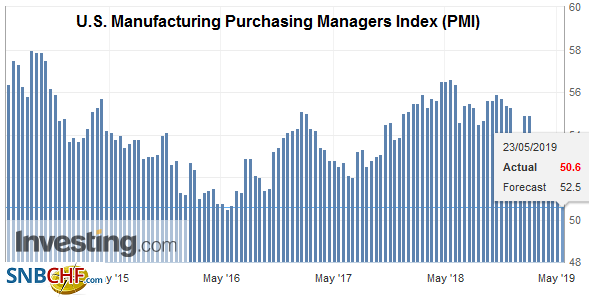

AmericaThere is a significant discrepancy between the patience of the Federal Reserve and the aggressive easing discounted by investors. The Bank of England releases the minutes at the conclusion of the MPC meeting. The Fed does so with a lag. A few days after the FOMC meeting, President Trump reignited of the trade war with China by ending the tariff truce. Because of that many observers argue the FOMC minutes are dated. They point to the weakness in retail sales and industrial production since the FOMC meeting to play down the Fed’s wait-and-see attitude clearly expressed in the minutes. Investors should understand the minutes through the comments, as recently as this week, by several Fed officials, including Powell, Clarida, and Williams. Even the dove Bullard who says that maybe the Fed overdid it a little with the December hike was on reading from the same chorus book. There is no urgency to change policy. This is also likely the message of the four Fed presidents that speak today (Kaplan, Daly, Bostic, and Barkin. High-frequency economic data is noisy, and maybe especially now with the trade tensions, (and building inventories), and the impact of Boeing’s production cuts. Also, the Empire and Philadelphia May manufacturing surveys were stronger than expected, and they should temper any judgment one wants to make about the weakness in April industrial output. The implied yield of the January 2020 fed funds futures contract rose a single basis point to 2.135%. It finished last week at 2.095%. Before Trump’s tweets declaring the end of the tariff truce, the implied yield was 2.24%. Bullard noted that it may take several months to see the impact of the tariffs. |

U.S. Manufacturing Purchasing Managers Index (PMI), May 2019(see more posts on U.S. Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

The US economic calendar today includes the flash Markit PMIs, the weekly jobless claims, new home sales, and the Kansas Fed’s manufacturing survey. Even with few other distractions, these are not the reports that typically move the capital markets. Meanwhile, Trump’s refusal to work with the Democrats on bipartisan issues, like infrastructure, until it ends its investigations may put a damper on the House of Representative’s willingness to support the new NAFTA treaty, though it looks like Canada will try to ratify it before its summer recess and fall elections.

Canada reported better than expected retail sales, which followed a strong jobs report. Nevertheless, the Bank of Canada will remain on hold next week. The lifting of the US steel and aluminum tariffs and Canada’s canceling of its counter-measures reduces cloud hanging over the economic outlook, but it has incurred the wrath of China. Through the European morning, the Canadian dollar is the weakest of the majors, off about 0.25%. After the US dollar fell below CAD1.3360, the lowest in a month, it staged a reversal and closed, Bloomberg says, ever so slightly above the previous day’s range. The follow-through US dollar buying today confirmed the reversal. It is approaching the upper end of its recent range near CAD1.35. The greenback has not closed above there since January 2. The risk-off mood seeing the Mexican peso trim yesterday’s gains. Indeed, the dollar is trying to snap a three-day slide against the peso that took it from near MXN19.1850 to about MXN18.9350 yesterday. If the current mood prevails, the dollar can return toward the week’s highs.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Brexit,EMU,EUR/CHF,Eurozone Manufacturing PMI,Eurozone Services PMI,Eurozone Services Purchasing Managers Index,FX Daily,Germany Composite PMI,Germany Manufacturing PMI,Japan Manufacturing PMI,Japan Manufacturing Purchasing Managers Index,newsletter,Trade,U.S. Manufacturing PMI,U.S. Manufacturing Purchasing Managers Index,USD/CHF