For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword.

Way back in 2012, under Bernanke’s direction officials would finally admit to an explicit 2% inflation target for the PCE Deflator. There would be regular press conferences when it would be expected all Chairman present and future should explain themselves in plain language. The Federal Reserve was going to really become your Federal Reserve.

While that was the fuzzy, warm feelings end of it in truth the pendulum was swinging for very different reasons. Traditionally, a central bank stayed in the dark because it didn’t need nor want the publicity. If it was operating in the market at any given time, it could be taken the wrong way. A liquidity problem arose, they fixed it before anyone knew they solved the matter or that there was a matter to solve.

Back then, though, there was actual money in monetary policy. Money did the talking in place of talk. Today, central banks aren’t banks at all; they are pop psychologists plying the role of hand holder. This is a very different set of circumstances, this expectations management. Thus, what matters is not what a central bank does in markets, it doesn’t really do much, rather what does matter (to Economists) is how you think of it.

Therefore, if central bankers provide an optimistic baseline and forecast assessment, then whatever they might be doing (or not doing) today is thought to be grounded in that official characterization. You needn’t worry because they aren’t – and they are going to give you all the reasons why so you can be overly assured.

It is the modern doctrine of “trust us.” This isn’t evolution, however, it is very clear devolution.

Yellen’s commitment to transparency could be questioned because there were so many “unexpected” questions. I don’t mean to suggest she took a step back from Bernanke’s “transparency”, not at all. She just didn’t make much time for it. Though there were more problems during Bernanke’s time it was easier in a sense because he could just meet them with another QE, or more forward guidance of “lower for longer.”

His successor, by contrast, was supposed to have been handed a recovery take-off. Under expectations management another QE would have been totally against grain. She couldn’t even use lower for longer because they were committed to “rate hikes” by late 2014.

It left the FOMC paralyzed to what was nearly a recession in the US in 2015, a full global downturn that devastated many parts of the global economy (which happened to be the same parts everyone was counting on to drive global growth). The buzzword for Yellen was “transitory” not transparency. Transitory what and when? She couldn’t really say, therefore not really all that transparent.

Things are supposedly back on track now, the gift of 2017’s globally synchronized growth.

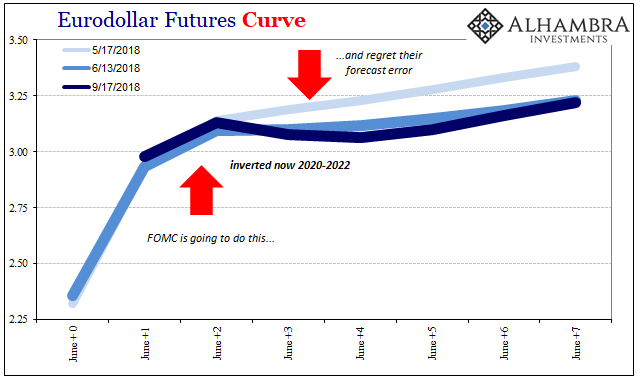

The eurodollar futures curve, an extremely important juxtaposition of market expectations versus policy expectations, was at its steepest point way back in February. Nominally, rates were rising in UST’s and inflation expectations were moving in the right direction if still at a more deliberate pace. Global money market investors, those operating in eurodollar futures, were starting to wonder if Janet Yellen may indeed exit on the right economic note after all.

Jay Powell took over on February 5 in the middle of renewed market turbulence. As Bernanke, Powell’s first message was to reaffirm his commitment to transparency. In a video message, the new Chairman promised to explain “what we are doing and why we are doing it.” Monetary policy was back on track – so long as the economy continued to be.

| It’s not that money markets don’t like Powell (well, it may be they don’t like his Bernanke-like surety that courts the same kind of arrogance), it’s just that he started out under the questionable circumstances left for him. If this sounds familiar for each time there is a switch in Fed Chairmen it is only because the economy never gets past these questionable circumstances.

By the middle of May, Powell turned clearly “hawkish” while global markets were rocked by a gigantic collateral call of a still-undetermined nature. Eurodollar markets would notice; even the FOMC would notice what with its later hesitant reference to “strong worldwide demand for safe assets.” |

Eurodollar Futures Curve, May - Sep 2018(see more posts on EUR/USD, ) |

| The eurodollar futures curve began to turn on Jay Powell afterward. It inverted in the middle and received scant attention for it. Quite simply, one of the largest, deepest perhaps most important markets in the world was saying Powell’s Fed was going to “raise rates” and then regret it.

This mid-curve inversion wasn’t an expectation for timing; the June 2021 contract inverted to the June 2020 didn’t mean the market was thinking the years 2020 into 2021 was when a teary-eyed Powell would hold that one press conference professing his error and begging for forgiveness. This inversion is non-specific as to time, even as it grew larger; it inverted further out to 2022. The market believes there is a non-trivial chance the Fed is making a forecast error, it just doesn’t know when officials will finally get around to realizing it. Central bankers are extremely stubborn ideologically and are the last to figure things out. |

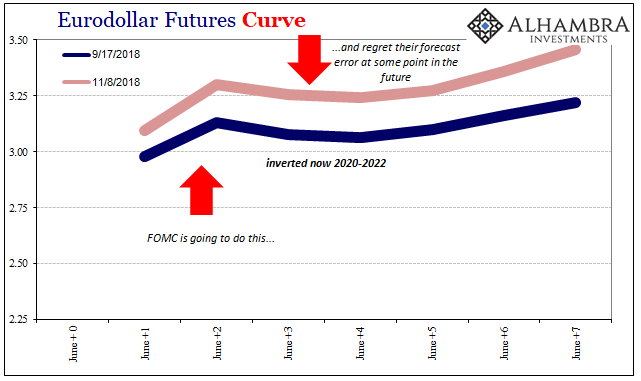

Eurodollar Futures Curve |

| Since early September, Powell seemed to have found some real justification for his case. The August 2018 payroll report showed the highest wage gains in a decade, the very thing Yellen had been waiting for her whole time in office.

Yet, the curve twisted some more even as it pushed upward. Rates were going to get a little further now that Powell had the wage data, the market said, meaning a greater terminal point before the turnaround. May 29’s collateral debacle continued to weigh on market sentiment, meaning there was very likely going to be that turnaround regardless of BLS data. |

US Treasury Real Yields 2017-2018(see more posts on US Treasury, ) |

| Over the last several weeks, however, alarms and concerns have multiplied. Another curve unable to make front page news for every reason that it should, WTI, has been signaling a very different scenario than economic acceleration. Worse, for Powell, a continued collapse in the crude price means regardless of wage data all the major inflation indices will begin to turn against him. |

U.S. CPI Changes On Energy 1995-2019(see more posts on U.S. Consumer Price Index, ) |

| To say nothing about the real economic case oil contango presents. It isn’t a good one, to put it mildly.

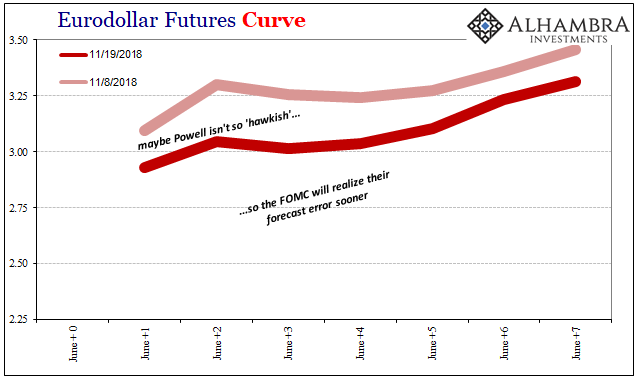

Beginning November 9, eurodollar futures have rallied. To this point (and it is ongoing as of this morning’s session), it is the biggest move since May. And as futures prices have come back up, meaning reduced expectations for future LIBOR therefore federal funds, the curve is twisting back toward a more normal shape. |

Eurodollar Futures Curve |

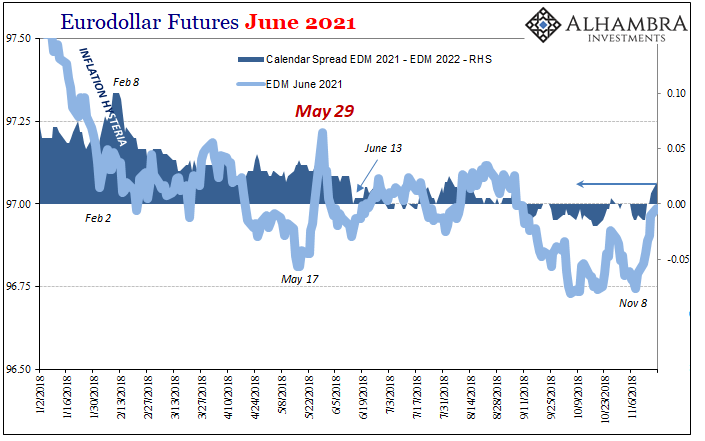

Eurodollar Futures June 2020 |

|

| The 2021-22 inversion is now gone, a positive calendar spread in its place. This doesn’t suggest Powell is in the clear, quite the opposite. This market is now hinting that perhaps the FOMC will realize their big forecast mistake sooner than previously thought.

In other words, things are getting so bad, so many negative indications spreading over the globe, there is a very good chance Jay Powell won’t be able to remain in his “transparent” bubble as long as he would like. The wage data from August and September payrolls aren’t very compelling in November. |

Eurodollar Futures June 2021(see more posts on EUR/USD, ) |

| Last week, Powell even admitted to “growing signs of a bit of a slowdown for 2018.” The eurodollar futures curve was already betting he would. None of the Fed Chairmen are really that transparent in what would actually count. Things like collateral and how modern money really works. If they were really committed to complete openness they would have to confess they have no idea. |

TIC - US Banking Data 2001-2018 |

Tags: Ben Bernanke,Bonds,collateral,CPI,currencies,economy,EUR/USD,eurodollar futures,eurodollar futures curve,Federal Reserve/Monetary Policy,inflation,Janet Yellen,jay powell,Markets,Monetary Policy,newsletter,OIL,repo,Transparency,U.S. Consumer Price Index,US Treasury,WTI