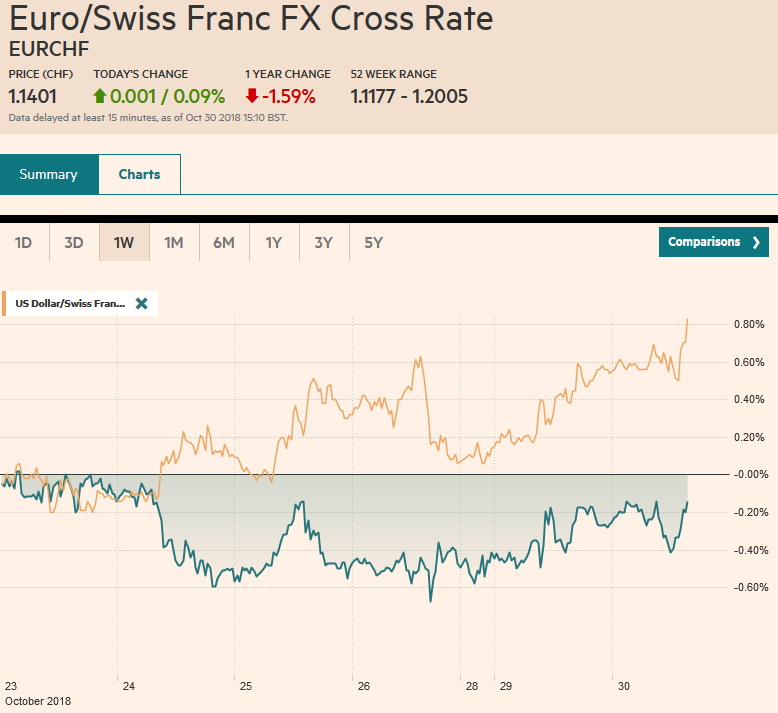

Swiss FrancThe Euro has risen by 0.09% at 1.1401 |

EUR/CHF and USD/CHF, October 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: First, reports suggested that if China refused to make any trade concessions, the Trump-Xi meeting on the sidelines of the G20 meeting next month would not take the issue up. Fair enough. Then, new reports indicated that the White was prepared to take additional trade measures if there was no agreement between Trump and Xi. The news hit a weak market. The NASDAQ was also in negative territory, and the S&P 500 had seen its early gains pared, but the escalation of US trade pressure sent shares reeling. The 103 point range for the S&P 500 was the largest since February. Asia followed suit initially but reversed higher and the MSCI Asia Pacific Index snapped a five-day slide. Most markets in the region but Hong Kong, India and Singapore participated in the advance. Still, judging from Korea, where foreign investors were net sellers of shares today for the 16th consecutive session, show sentiment remains fragile. Some linked the recovery, especially in China to Trump’s claim that “I think we will make a great deal with China, and it has to be great because they’ve drained our country.” European bourses enjoying modest gains in the morning session ahead of the US open. It is the second consecutive advancing session for the Dow Jones Stoxx 600, something it could not do last week. The more stable equity tone is sapping the bid from bond and yields are higher across the board, with Italy being the notable exception. It sold 5.5 bln euros of bonds today to complete a little more than 90% of this year’s funding interest. Often lost on observers, Italy’s experience makes it a good manager of debt with the depth in secondary markets. There are 10 bln euro of maturing Italian bonds this week and 5 bln euros in coupon payments and the premium over German Bunds is back below 3%. In the foreign exchange market, the dollar-bloc currencies are edging higher, while the funding currencies (aka safe havens) like the Swiss franc and Japanese yen on softer. Among emerging market currencies, the Turkish lira and South African rand are firmer, while most are little changed. |

FX Performance, October 30 |

Asia-Pacific: The US has imposed tariffs on $250 of Chinese goods. Of that, the 10% tariff on $200 bln of goods will be hiked to 25% on January 1. Yesterday, Trump renewed this threat to put a tariff on the remaining roughly $255 bln of goods the US imports from China. Given the process, these could be implemented as early as February. Economists and investors need to give more thought to the possibility that the US puts a 25% tariff on nearly all Chinese goods. Without a policy response, economists project that is could slow the world’s second-largest economy by 1%-2% next year. Of course, China would have a policy response. Over the past few days, Chinese officials have brandished another domestic policy card to play. Tax cuts. Not only will the government cut income taxes, but it may also cut the sales tax on autos to help spur demand. China is already securing new markets and supply sources to replace America, though of course, this takes time, which means some disruption is likely. The prospect of protracted Sino-American trade confrontation will create new opportunities and may impact investment decisions, encouraged too by rising costs in China. The yuan slipped to its lowest level in a decade before recovering somewhat. The CNY7.0 level has taken on special significance, but we suspect it is not inviolable. The yuan has weakened about 6.5% against the dollar since the start of the year. Because of the import intensity of China’s exports, with yuan incurred production costs relatively modest, the depreciation of the yuan, therefore, barely blunts the impact of the rising tariffs.

Japan’s labor market tightened. The unemployment rate unexpectedly slipped to 2.3% in September from 2.4%. The jobs to applicant ratio ticked up to 1.64. The natural disasters in the month may have skewed the data, but as the Bank of Japan meets, the takeaway message is the labor market remains strong even if wage growth, especially among full-time workers remain modest. The natural disasters may also have weighed on September industrial production figures, which will be released tomorrow before the conclusion of the BOJ meeting. The Nikkei posted an upside reversal today and a gap from last week extends to 21911 may attract prices. We had been concerned that the dollar was going to hold below the JPY112.50 area but it has pushed through there to test last week’s highs just shy of JPY112.90. A move above there would target the JPY113.40 area.

EMU: There were two data streams from the EMU today. Growth and prices. The Bundesbank warned last week that the German economy may have stagnated in Q3. France didn’t. It may be of little help to President Macron who has slumped in the opinion polls, but the economy grew 0.4% in Q3, twice the pace in Q2. Still, the year-over-year pace slowed to 1.5% from 1.7%. Italy disappointed as well. The economy did not grow in Q3 after expanding 0.2% in Q2. The year-over-year pace eased to 0.8% from 1.2%. We suspect the Italian government’s fiscal proposals would go over much easier if investors and others could be confident that the efforts would boost growth on a sustained (structural) basis. But, alas, judging by the government’s even optimistic forecasts, they don’t believe it either. The initial estimate for Q3 GDP for the euro area as a whole was 0.%, down from 0.4% in Q1 and Q2 and 0.7% every quarter last year.

Spain and German states reported preliminary October inflation readings. The year-over-year pace in Spain was flat at 2.3%. This matches the high for the year but is well below last year’s 3.0% peak. German states reported 0.1%-0.2% monthly increases in CPI while the base effect sees the year-over-year pace increase by a bit more, except in the most populated state North Rhine-Westphalia. The EU-harmonized measure for the country will be reported shortly. It is expected to rise to 2.4% from 2.2%, and represent a new six-year high. The preliminary CPI estimate for the eurozone will be released tomorrow. The headline rate is expected to have ticked up to 2.2% from 2.1%, while the core rate is forecast to rise to 1.1% from 0.9%.

The euro is in an exceptionally narrow range of less than a third of a cent today. So far, it is the first session since August 15 that the euro has not traded above $1.14. There are roughly 1.3 bln euros in options struck at $1.1400-05 that expire today and another 500 mln euros at GBP0.8900 that will be cut today. While we had been looking for the euro to get some traction, yesterday and today it has remained within the pre-weekend range of about $1.1335 to $1.1420.

UK: While it was not exactly Christmas, Chancellor of the Exchequer Hammond’s budget announced the end of austerity with some modest tax cuts and small spending increases. Yet the uncertainties surrounding Brexit made plans for next year tenuous at best. The forecasts by the Office for Budget Responsibility shift growth from this year to next. This year’s GDP had been projected to rise by 1.5%. It has been pared to 1.3%. However, the economy is expected to expand 1.6% next year rather than 1.3%. The Bank of England will provide its own forecasts later this week when the Quarterly Inflation Report will be released the conclusion of the MPC meeting (Nov1).

Sterling can’t catch a bid. It has eased to new two-month lows today ahead of $1.2750. The mid-August low, which was also the low for the year was near $1.2660. and there is little in the way of chart support ahead of it. Our technical target is closer to $1.25.

Mexico: In 2002, in the face of protests, then Mexican President Fox canceled plans to build another airport around Mexico City. Sixteen years later and the people voted overwhelmingly against the new airport proposals. Investors responded dramatically to President-elect AMLO’s willingness to respect the non-binding plebiscite. It plays on market fears that AMLO would not be a friend to investors.

Mexican stocks lost more than 4.2%. It was off a little less than 7% year-to-date at the end of last week. Bonds sold off hard too. Mexico’s 10-year dollar bond yield jumped 15 bp while the 10-year peso bond leaped by more than 35 bp to 8.70%. Moody’s downgraded Mexico City Airport by two notched to Baa3 (= BBB-), and the outlook was changed from stable to negative. The premium over the US is the widest in a decade. Growth prospects are dimmer.

The peso returned to levels last seen around the time of the July 1 election. The MXN20.00 area is important technically and psychologically. The dramatic move, of course, leaves it stretched but short-term speculators were caught leaning the wrong way. In the futures market, the non-commercial (speculators) were net long 58k contracts as of a week ago, compared with being short 20k contracts ahead of the election. The highs from late June in the MXN20.25 area is the next targets. The sell-off in the peso, if sustained, is inflationary.

Mexico reports Q3 GDP today. It is expected to rise about 0.5% after a contraction in Q2 (-0.2%). The central bank does not meet until the middle of next month. It has hiked rates twice this year. If the peso were to continue to sell-off, a rate hike could not be ruled out.

US and Canada: The US and Canadian economic calendars are light. The US sells four and eight-week bills today to raise $70 bln. With the distraction of macro data, the bill auctions may spur more interest today in the US money markets. The average effective Fed funds rate has crept up recently and now it is at 2.20%, the same level as interest on reserves (excess and required). This is spurring some speculation that the Fed looks to reinforce the fed funds target range by possibly not raising the interest on reserves as much as it lifts the target range. This seems to be a more important consideration what appears to be the softening of some rates tied to expectations of Fed policy. Some think that this pressure will ultimately lead the Fed to slow its balance sheet reduction, which they see at the heart of the problem.

The Canadian dollar is consolidating within yesterday’s range, which was within the last Friday’s range (~CAD1.3070-CAD1.3160). There are several key data points in the coming days, including, monthly GDP, trade, and jobs data. The US dollar continues to fray a downtrend line since June found near CAD1.3125 today.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CNY,$EUR,$JPY,EUR/CHF,MXN,newsletter,USD/CHF