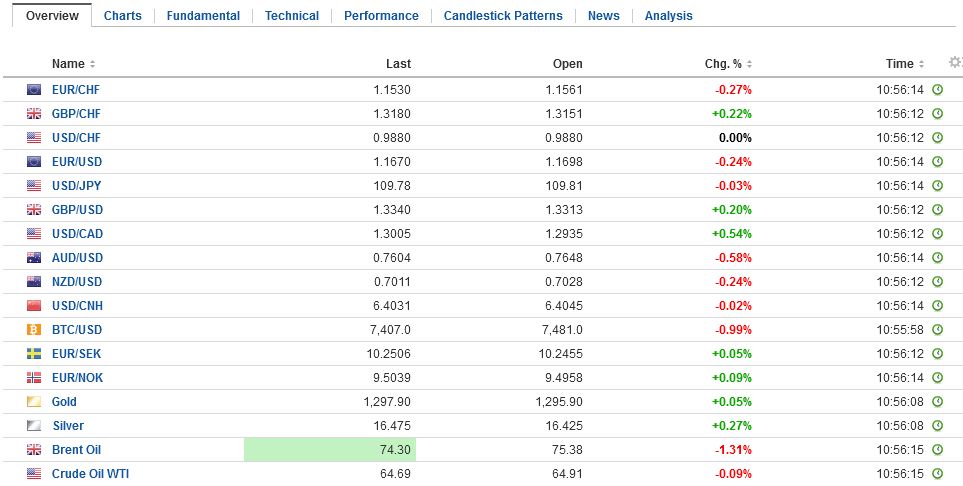

Swiss FrancThe Euro has fallen by 0.23% to 1.1526 CHF. |

EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThere are several euro options that expire today and are stacked every quarter of a cent from $1.1675 to $1.1750. The size of the options increase with the price beginning with 688 mln euros at $1.1675, then 775 euros at $1.17, 1.1 bln euros at $1.1725 and 2.0 bln euros at $1.1750. The 20-day moving average is just above $1.750 today, and the euro has not traded above it since April 20. On the other side of the spectrum is the Australian dollar. It is the weakest of the majors, losing about 0.25% against the greenback (@~$0.7630). It gained a little more than 1% yesterday, helped by a relatively strong string of economic data. The RBA left the cash rate at 1.50% as widely expected. There were minor tweaks in the statement, but there was a hawkish twist in the suggestion that wage growth may be bottoming. Support for the Aussie is seen near $0.7600. |

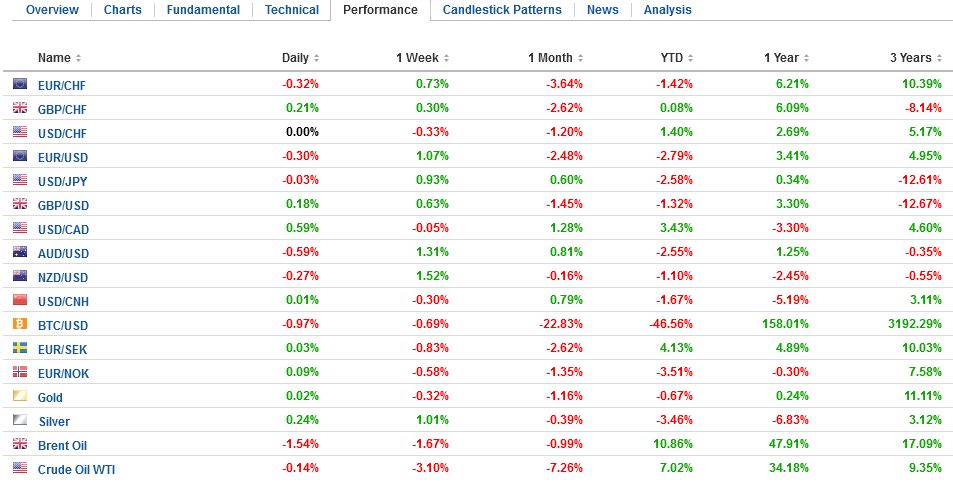

FX Daily Rates, June 05 |

| News that the Nikkei’s PMI for Singapore rose to a new three-year high is seen as a constructive indication of the regional economy. Petrochemicals have recently joined electronics as the main focus. Note that South Korea reported a small increase in its reserves as of last month. They moved $500 mln closer to the $400 bln mark. Separately, Korea reported a $10.36 bln goods trade surplus for April. However, the broader measure, the current account surplus as $1.77 bln. It is experiencing a rising income deficit fueled by dividend payouts.

The NASDAQ made a record high close yesterday, and the S&P 500 closed near three-month highs. However, the gains have not given a strong lift to global equities today. After a 1.4% rally on Monday, the MSCI Asia Pacific Index eked out the smallest of gains. The Topix was virtually flat, while Chinese and Hong Shares were higher. |

FX Performance, June 05 |

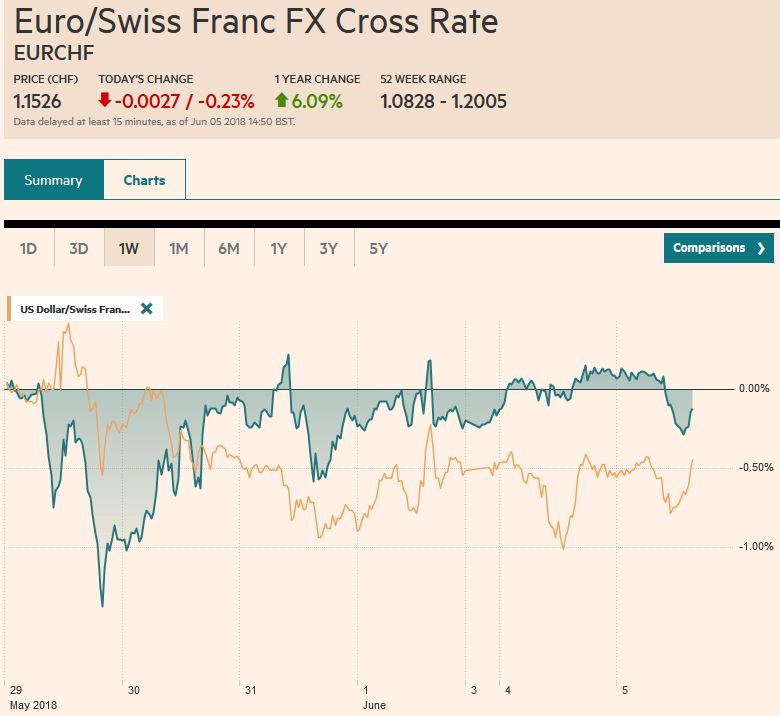

United KingdomThe British pound is benefiting from the stronger than expected service and composite PMI readings, which among other things are serving as a distraction from the government’s seemingly tortured approach to Brexit and the sales of part of its stake in RBS for a GBP2 bln loss. Financials are a drag on the FTSE 100 today (~-0.5% while other major bourses are higher). Sterling itself recovered from the around $1.3320 to almost $1.3385 on PMI news. However, it stalled in front of yesterday’s high near $1.3400. The UK’s service PMI rose for the second month, and the 54.0 reading compares with a 53.1 average in Q1 and 54.2 for all of last year. Overall, the composite reading rose to 54.5 from 53.2. It averaged 53.4 in Q1 and 54.7 in 2017. |

U.K. Services PMI, May 2018(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

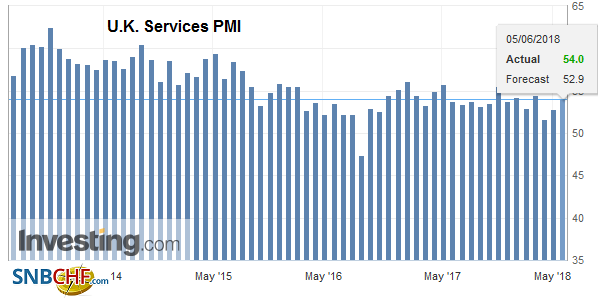

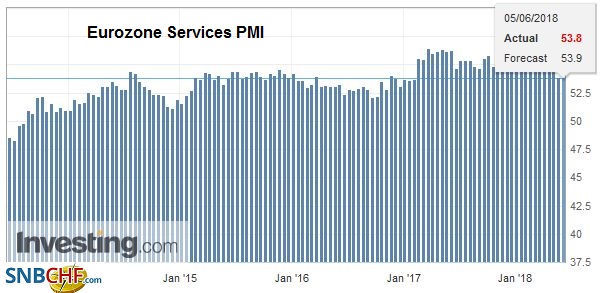

EurozoneEMU service and composite PMIs were reported. The market seems uninterested, and the euro has been in less than a 20 tick range on either side of $1.17 and remains well within yesterday’s range. The services PMI slipped to 53.8 from 53.9 flash and the 54.7 reading in April. |

Eurozone Services PMI, May 2014 - 2018(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

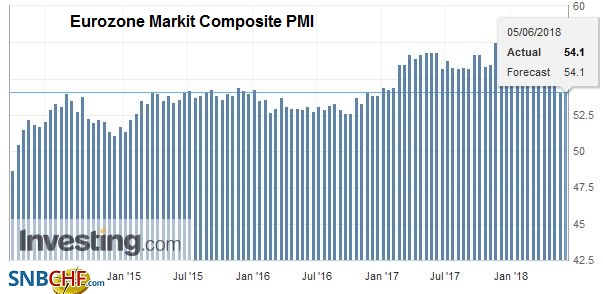

| The composite confirmed the flash of 54.1, which is off from 55.1 and is the lowest reading since November 2016. Of note, Italy and Spain edged higher from April readings. |

Eurozone Markit Composite PMI, June 2014 - 2018(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

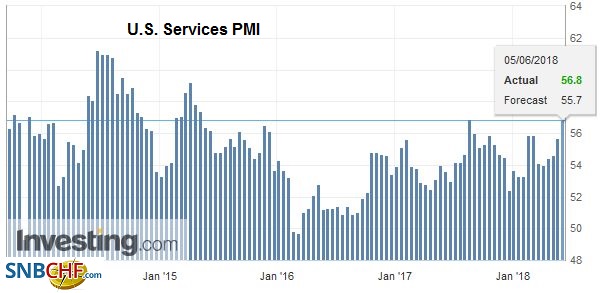

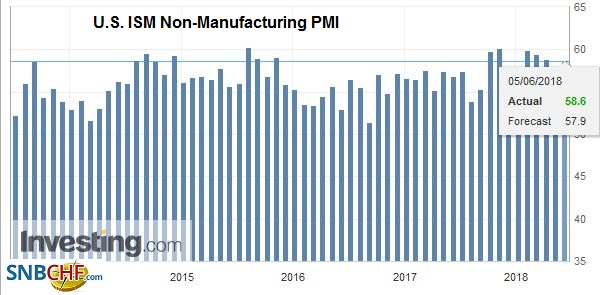

United StatesThe US sees the services PMI and |

U.S. Services PMI, Jun 2014 - 2018(see more posts on U.S. Services PMI, ) Source: investing.com - Click to enlarge |

| Markit composite PMI and |

U.S. Markit Composite PMI, May 2014 - 2018(see more posts on U.S. Markit Composite PMI, ) Source: investing.com - Click to enlarge |

| the ISM non-manufacturing report. Investors and economists seem to recognize the US economy has accelerated in Q2. The data may not cause much of a reaction outside of the headline effect. The JOLTS report is not a market mover either, but it is expected to confirm that the labor market is robust.

Two other US initiatives may attract attention today. First, as both China and Taiwan take military exercises, the US has threatened to send a ship to the Straits of Taiwan. This would be seen as provocative, but of course well within US rights. Separately, reports indicate that the US has asked Saudi Arabia and other OPEC producers to boost output by around 1 mln barrels. Recall that US sanctions may take a million Iranian barrels off the market. Saudi Arabia and Russia already appear to be boosting output, and they are among the only ones thought to have the spare capacity. Brent is nearly 1% lower while WTI is flat. |

U.S. ISM Non-Manufacturing PMI, May 2014 - 2018(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Bank of Japan’s Wakatabe confirmed that buying Treasuries was not being considered. This seemed to coincide with the greenback holding the JPY110 level. There had been some talk during Abe’s first campaign, and from time to time a government adviser may suggest it is worth considering, but it is highly unlikely. It would appear too similar to intervention, and given the US present stance that the entire world is taking advantage of it in trade, it would be seen as particularly aggressive.

As Italy’s new prime minister prepares to lay out the government’s agenda and ahead of the confidence vote in the Senate, Italian bonds have come under modest pressure. The 10-year yield is up nine basis points to almost 2.60%. Note that in the futures market, the Italian bond held an important retracement in the bounce since last Tuesday panic. The two-year yield is up 11 bp to 78 bp. Indicative prices point to easier credit default prices. The 196 bp quote compare with 221 yesterday and a peak of almost 270 last week. As recently as mid-May, the five-year CDS less than 100 bp. The government seems to have three priorities: 1) Immigration, 2) a new transfer payment that may be being misconstrued as a universal basic income and is really an unemployment compensation program tweaked for Italy’s circumstances where entry into the labor force is difficult, and 3) a flat tas that is really a two-tiered system for all income at rates 15% and 20%.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,EUR/CHF,Eurozone Markit Composite PMI,Eurozone Services PMI,FX Daily,newslettersent,OIL,SPY,U.K. Services PMI,U.S. ISM Non-Manufacturing PMI,U.S. Markit Composite PMI,U.S. Services PMI,USD/CHF