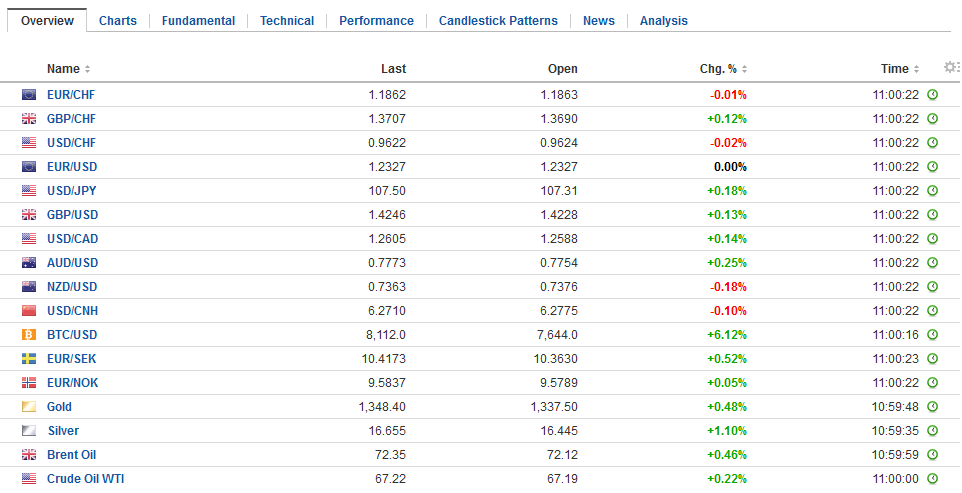

Swiss FrancThe Euro has fallen by 0.03% to 1.1858 CHF. |

EUR/CHf and USD/CHF, April 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

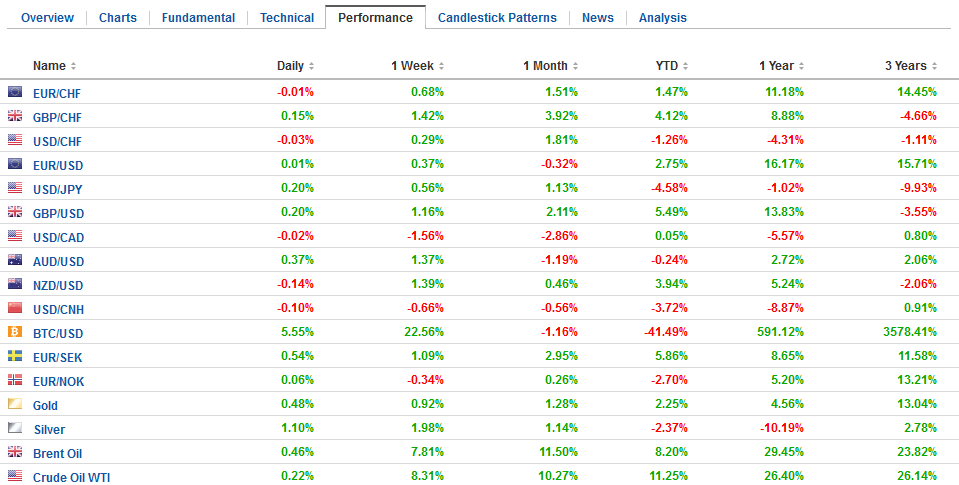

FX RatesIt had looked to many investors that world was headed for a trade war and an escalating risk war in Syria. But now it seems less clear. US President Trump’s rhetoric on trade took a more constructive tone, and a divided Administration leaves Syria in a bit of a limbo. US equities rallied yesterday, and Asia and European bourses are advancing today, but the conviction may not be particularly strong. The MSCI Asia Pacific Index rose 0.2% for a 1.3% weekly gain. Near midday in Europe, the Dow Jones Stoxx 600 is up 0.15% and 1.2% for the week, making it the third weekly advance. The German DAX and French CAC are at six-week highs. The US dollar is mixed, with a slightly heavier bias. The Australian dollar and British pound are leading the advancing currencies. A glimmer of hope that trade tensions may de-escalate0 is helping lift the Australian dollar 0.5% to straddle the $0.7800 for the first time since mid-March. The weekly gain of 1.5% is the largest this year. |

FX Daily Rates, April 13 |

| Sterling has been bolstered by ideas that the Bank of England is the next major central bank to lift rates (next month) and that Brexit may be less extreme. The record from the ECB meeting and the strong indication this week that Austria’s Nowotny’s rate hike talk was not representative of the Board, has seen the euro fell below GBP0.8650 for the first time since May 2017.

Against the dollar, sterling moved toward $1.43, its highest level since late January. Sterling is rising for the sixth consecutive session and is up about 1.3% on the week. It is also the fifth week in six that sterling has appreciated. What appears to be at least a temporary pullback from the proverbial edge has helped lift the dollar to nearly JPY107.70, a seven-week high. We have been monitoring a bottoming chart pattern that projects toward JPY110. Initial resistance now is seen near JPY108. It is the third consecutive weekly advance for the dollar against the yen. S&P upgraded Japanese credit outlook to positive from stable. |

FX Performance, April 13 |

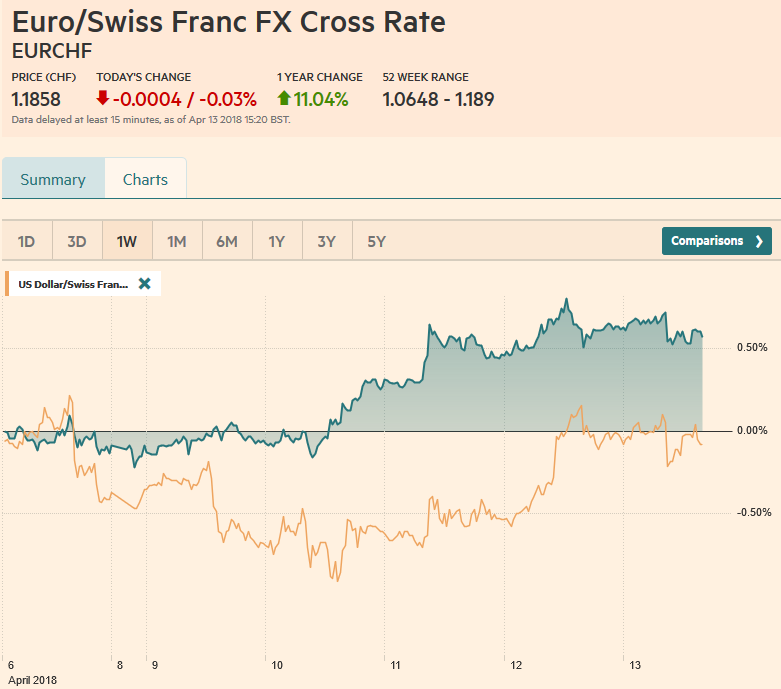

ChinaChina had a surprise of its own today. It reported an unexpected trade deficit for March. The deficit of nearly $5 bln compares with expectations for a $27.5 bln surplus (median forecast in the Bloomberg survey). |

China Trade Balance (USD), May 2013 - Apr 2018(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

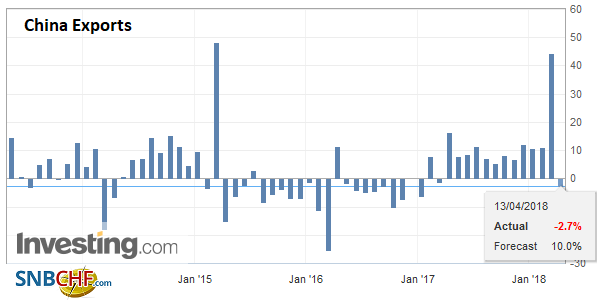

| Exports fell 2.7%. |

China Exports YoY, May 2013 - Apr 2018(see more posts on China Exports, ) Source: Investing.com - Click to enlarge |

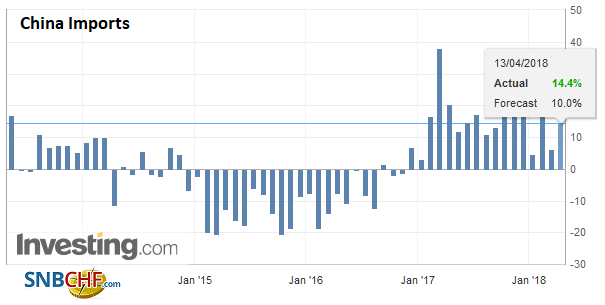

| Imports rose 14.4%. The data is skewed by the distortions around the Lunar New Year. But the optics help in the current environment. One of our concerns is that even if China adopted all the right measures in a timely fashion, its sheer size would be disruptive to the world economy and would still come to loggerheads with other large countries, including the US. |

China Imports YoY, May 2013 - Apr 2018(see more posts on China Imports, ) Source: Investing.com - Click to enlarge |

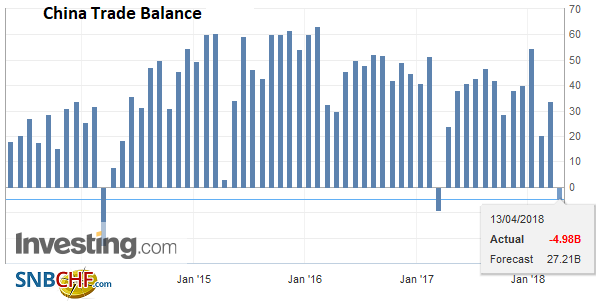

United StatesThe North American session does not feature much data. Canada reports March existing home sales and the US sees the University of Michigan consumer survey. It includes 5-10-year inflation forecast that in the past has been cited by the Fed. It has been stable at 2.4% to 2.6% range with few exceptions since the middle of 2016. Three Fed officials (Rosengren, Bullard, and Kaplan) speak ahead of the weekend, and a couple large US banks report earnings. |

U.S. Michigan Consumer Sentiment, Apr 2013 - 2018(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

The Swedish krona continues to trade heavier after yesterday’s somewhat softer than expected CPI. We suspect the market is exaggerating, as price pressures rose but not as much as expected. The euro appears to be losing some momentum near SEK10.40.

Late yesterday, reports indicate that Trump instructed his top advisers to look into re-joining the Trans-Pacific Partnership, which he pulled out of last year. He had kept the door open to join at some point, but there had been no follow-up, which makes this a bit different. Still, the remaining Pacific Rim members did sign an agreement last month. It is unclear if the members are ready to re-open negotiations or how serious Trump is, but the signal was timely and is helping to diffuse some tensions, at least for the moment.

Trump also indicated that the NAFTA talks are proceeding and he was optimistic about an agreement. He similarly toned down the rhetoric with China, suggesting that ultimately neither side may levy new tariffs. In some ways, the seeming reversal in the softer rhetoric is just as off-putting for many investors as was, the harsher, more aggressive rhetoric.

Separately, China reported slower money supply growth. Aggregate lending was a little stronger than expected, but shadow banking activity slowed considerably. The dollar fell 0.4% against the yuan this week. It is the third decline in four weeks.

The Monetary Authority of Singapore tightened policy by increasing the slope of the foreign exchange basket. It is the first time in two years, and the Singapore dollar strengthened. About 2/3 of the economists expected the move. Indonesia’s credit rating was upgraded by Moody’s to Baas (=BBB) matching Fitch’s judgment from last year. S&P still has it at BBB-, which is the lowest investment grade rating.

Meanwhile, the Hong Kong Monetary Authority intervened for the second day to prevent the Hong Kong dollar from falling through the bottom of its band. The HKMA has bought about HKD3.25 bln (~$145 mln) over the past two sessions. The Hong Kong Interbank Offered Rate (HIBOR) is edging higher. It could issue bills next week to also mop up the extra liquidity.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CNY,$EUR,$JPY,China Exports,China Imports,China Trade Balance,EUR/CHF,newslettersent,SPY,U.S. Michigan Consumer Sentiment,USD/CHF