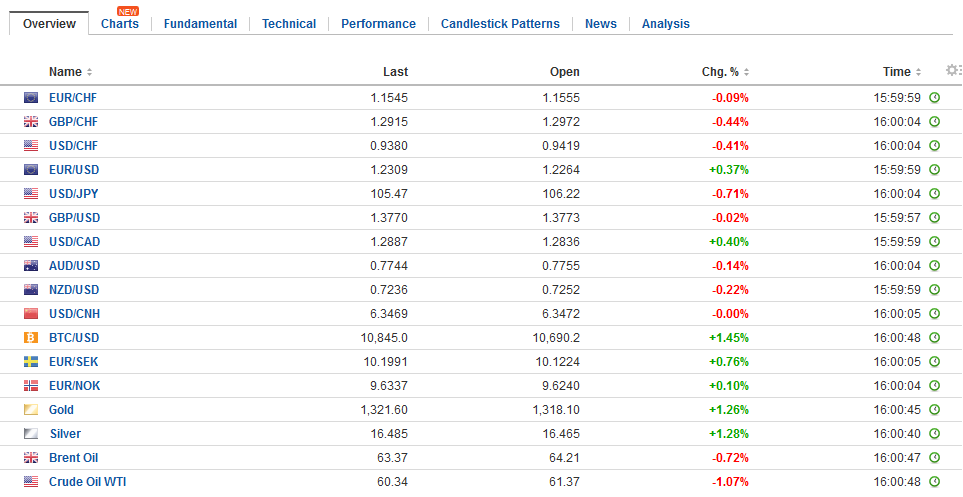

Swiss FrancThe Euro has fallen by 0.18% to 1.1531 CHF. |

EUR/CHF and USD/CHF, March 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe announcement of the US intention to impose tariffs on imported steel and aluminum on national security grounds has sent ripples through the capital markets. Yet there is certainly more going on here than that. The tariffs, justification, and magnitude have indicated and expected. After reversing lower on Tuesday and selling off on Wednesday, equity investors hardly needed a fresh reason to sell on Thursday. The MSCI Asia Pacific Index fell today for the fourth consecutive session and is off 2.1% on the week. The European Dow Jones Stoxx 600 also is off for a fourth consecutive session, and down more than 1%, like yesterday. It is off nearly 3% for the week. The S&P 50 is off 2.5% this week coming into today’s session. It tested the 2660 we identified yesterday, and the next retracement target is seen near 2630. |

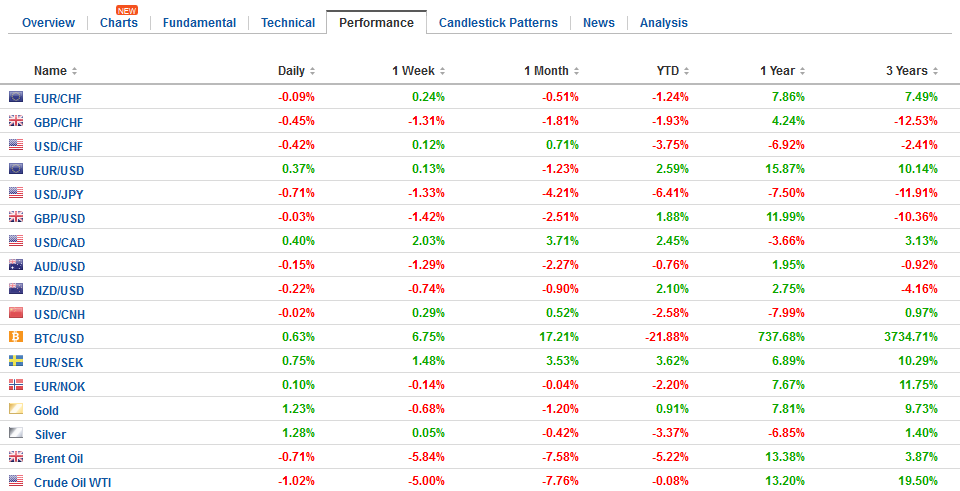

FX Daily Rates, March 02 |

| The initial reaction is to fear the worst, which in this case is a tit-for-tat retaliation, which like an-eye-for-an-eye, a rational game theory strategy, leads to a village of blind people, or in this case, an end to the multilateral free-trade system. Yet, this is not the most likely scenario. The most likely scenario is to challenge the US action at the WTO. Moreover, and this is important, there is precedent for this. In 2002, then President Bush imposed 30% tariffs on steel, and that is what happened. The US lost the challenge and the tariffs were rescinded.

The US claim of national security will be challenged. The prosecution’s first piece of evidence could be the US Defense Department’s opposition to the tariffs. Either it is being derelict in its duties or US security may not be at stake. Many Republicans in Congress take exception with the tariffs, and if so inclined, Congress could seek to rein in President’s unilateral authority on trade, as it has on some international sanctions. |

FX Performance, March 02 |

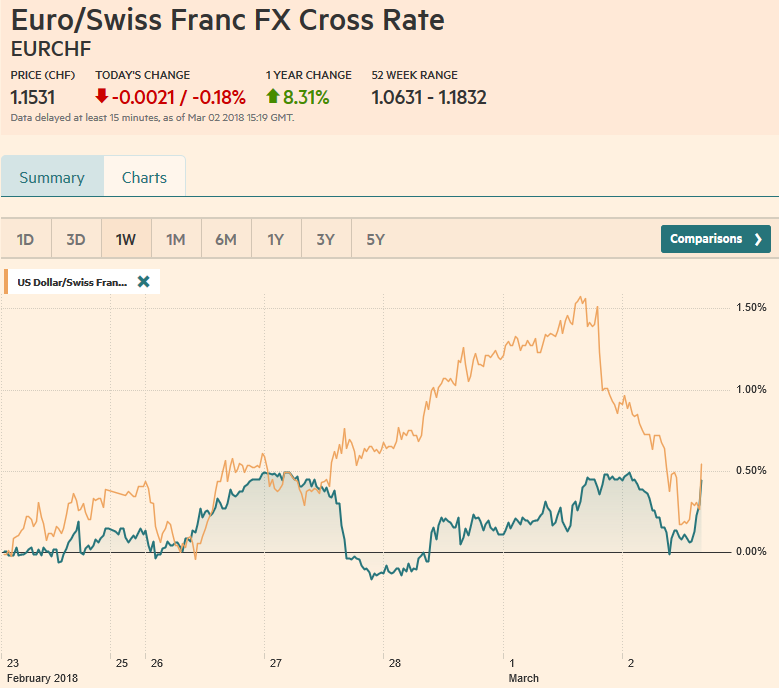

Eurozone |

Eurozone Producer Price Index (PPI) YoY, Апр 2013 - Мар 2018(see more posts on Eurozone Producer Price Index, ) Source: Investing.com - Click to enlarge |

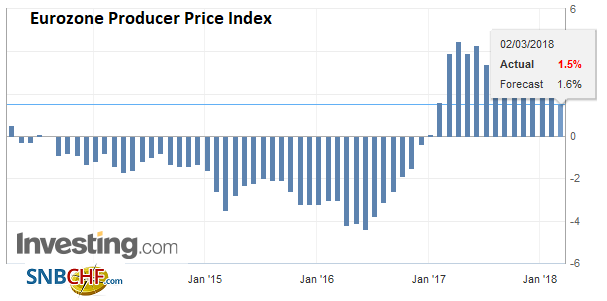

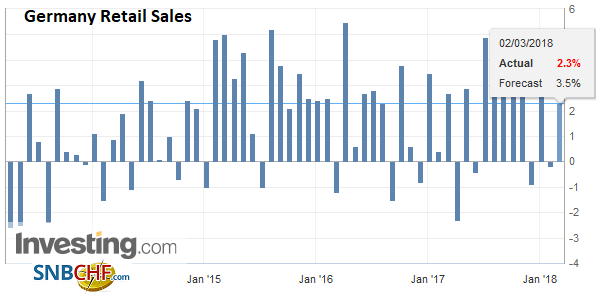

Germany |

Germany Retail Sales YoY, Mar 2013 - 2018(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

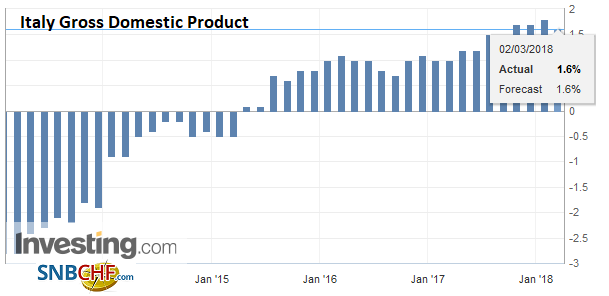

Italy |

Italy Gross Domestic Product (GDP) YoY, Mar 2013 - 2018 Source: Investing.com - Click to enlarge |

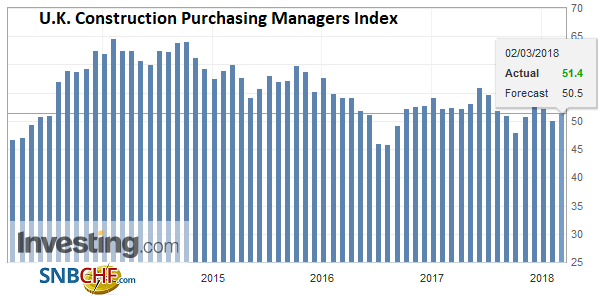

United Kingdom |

U.K. Construction Purchasing Managers Index (PMI), Mar 2013 - 2018(see more posts on U.K. Construction PMI, ) Source: Investing.com - Click to enlarge |

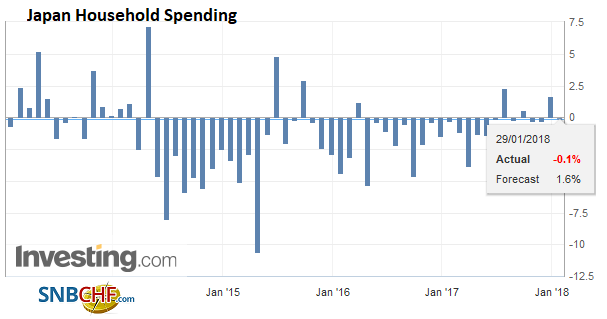

Japan |

Japan Unemployment Rate, Mar 2013 - 2018(see more posts on Japan Unemployment Rate, ) Source: Investing.com - Click to enlarge |

Japan Household Spending YoY, Jan 2013 - 2018(see more posts on Japan Household Spending, ) Source: Investing.com - Click to enlarge |

|

United States |

U.S. Michigan Consumer Sentiment, Mar 2013 - 2018(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

Many observers recognize that the tariffs could increase the price of goods that use steel and aluminum. Some suggest that this could add to pressure on the Fed to tighten policy more aggressively. Yet, there is an accepted distinction between relative prices and the general level. Americans buy more services than goods, and their steel consumption is limited in their basket of goods.

Autos come to mind as particularly steel intensive. There is a little more than a ton of steel in an auto. The base price of such steel may be around $850 a ton. In recent years, automakers have been substituting lightweight aluminum for steel and some vehicles may have as much as 400 pounds of aluminum and its sells for around $1 a pound. Given that work must be done to the metals to make them car-ready, even if we were to increase the raw costs by 50%, we are still talking about a relatively modest cost relative to the price of a car the consumer buys.

On top of this, Ford and GM reportedly source something on the order of 90% of their steel and aluminum domestically. An official from GM was quoted on the news wires acknowledging that he was unsure whether the tariff would lead to higher prices for consumers. Still, while many observers seemed to emphasize the inflationary nature of the tariffs, there is another impact from higher prices. Weaker demand.

Also, when considering the knock-on effects, it does not suffice to observe that Canada account for 1/6 of US steel imports. Note that Canada’s data shows that the US runs a trade surplus on steel with it, as Canada buys around half of US steel exports. On top of that, Canada is recognized by US law as part of the US National Technology and Industrial Base related to national defense.

In addition to the US tariffs, which are expected to be formally enacted next week (though there is a chance that they are modified), another development has also served to keep investors off balance. Just as the BOJ’s Kuroda had seemed to convince market participants that the reduced buying of the JGBS, like this week’s paring of super-long bond purchases, did not reflect a change in policy, the Governor set the proverbial cat among the pigeons by suggesting that April 2019, the bank would begin considering an exit from its extraordinary monetary policy. He intimated that it could begin before the 2% inflation target was reached.

This kicked on a door that was already open. The dollar had been falling against the yen since peaking on Tuesday near JPY107.70. It closed on its session lows on Wednesday and Thursday. Kuroda’s comments sent it lower still. It is within ticks of last month’s low near JPY105.55. Important psychological support is at JPY105.

More broadly, the dollar is mixed. The dollar-bloc and the Swedish krona are slightly heavier. After on the yen, the Norwegian krone has jumped higher following the central bank’s unexpected announcement that it was cutting it inflation target to 2.0% from 2.5%. It is understood as bringing forward a rate hike, though it is not an immediate consideration. In January, Norway’s CPI stood at 1.6% on the headline rate and 1.1% underlying, which excludes tax changes and energy. The February report is due next week.

The euro posted a potential key reversal yesterday, by making new lows for the move (~$1.2155, the lowest since mid-January) and closing above Wednesday’s high. There has been modest follow through buying today that lifted the single currency to $1.23. There is chart resistance and retracement levels may be formidable ahead of the weekend in the $1.2310-$1.2350 area. We had expected the weekend SPD decision and Italian election to deter the upside at the end of the week. Note there is an option struck at $1.23 for 1.1 bln euros today that expires.

Lastly, UK Prime Minister’s speech on Brexit is expected shortly. Some of the details have been reported. She will argue that the arrangement should allow the UK to control is borders, laws, and money. However, events appear to be moving faster. Although it is not up for a vote yet, a trade bill in parliament has an amendment that supports the UK remaining in a customs union has the support of enough opposition and Tory Remainers to pass. Sterling is off 1.4% against the dollar this week but more importantly, it has sold off against the euro. A euro close above GBP0.8930 could signal a test on GBP0.9000, which has not been seen since the middle of last November. There is a GBP744 mln option struck at $1.38 that expires today.

Graphs and additional information on Swiss Franc by the snbchf team.

Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Eurozone Producer Price Index,Germany Retail Sales,Italy Gross Domestic Product,Japan Household Spending,Japan Unemployment Rate,newslettersent,SPY,U.K. Construction PMI,U.S. Michigan Consumer Sentiment,USD/CHF