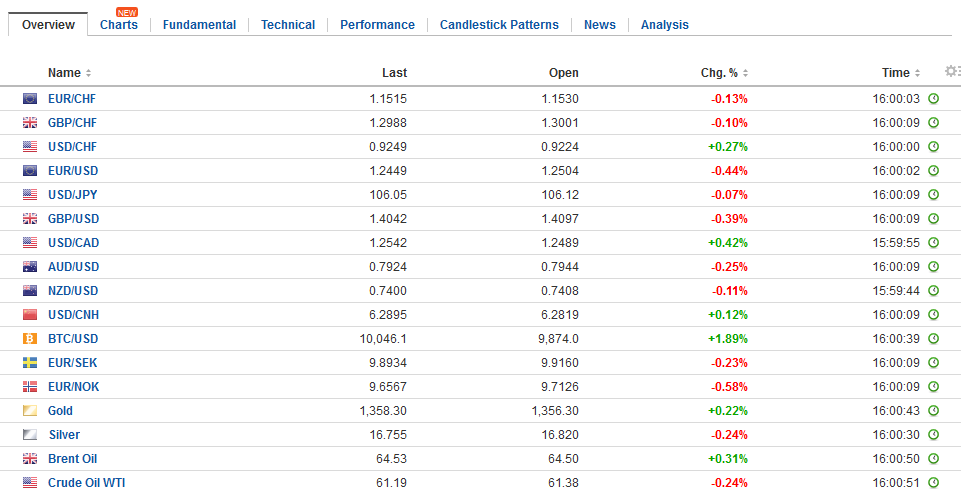

Swiss FrancThe Euro has fallen by 0.13% to 1.1513 CHF. |

EUR/CHF and USD/CHF, February 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

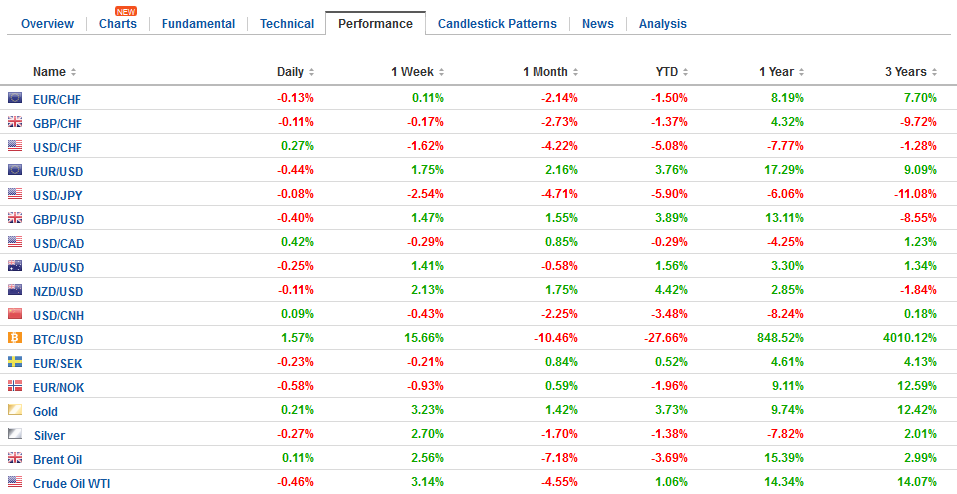

FX RatesNearly all the major currencies have risen at least two percent against the US dollar this week. The Canadian dollar is an exception. It has risen one percent this week ahead of today’s local session. Sterling is becoming another exception after disappointing retail sales. It is up just shy of two percent. The Dollar Index is off 2.3% on the week, which would be the biggest weekly loss since 2015. The dollar has firmed a bit on the European morning, but look for North American operators to see the upticks as a selling opportunity. The greenback slumped to nearly JPY105.50 in Tokyo, which appears to have led this week’s decline. It is the biggest weekly loss since July 2016. Japanese officials are becoming more concerned. Reports suggest a high level meeting today between the BOJ, MOF and FSA on the yen’s strength. Although Finance Minister had said earlier this week that the yen’s movement did not require intervention, the MOF’s point man on FX, Asakawa, expressed greater concern for “one-sided” move that was “not in line with fundamentals.” |

FX Daily Rates, February 16 |

| This still seems to be low level concerns. Reiterating the G7/G20 boilerplate line about “excessive volatility” needs to be avoided, and hints that there are talks among G7 officials about the recent foreign exchange market developments, would be additional rungs on the escalation ladder. Still, we suspect that the Japan’s cabinet submission to the Diet of Kuroda’s nomination for a second term (leaked in the media for the past several days) and the appointment of two deputies (Amamiya, a key Kuroda ally within the BOJ, and a dovish academic Wakatabe), is not really much of a yen protest. It underscores the continuity of monetary policy. Still nearly half of a Bloomberg survey expect the BOJ to tightened policy late this year.

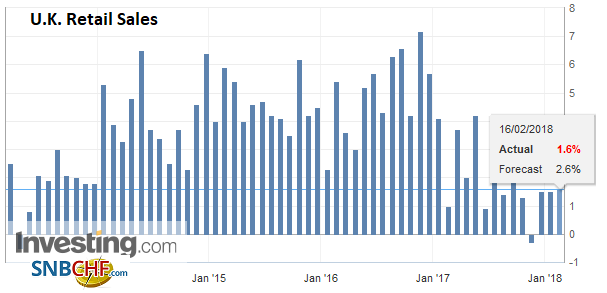

The euro reached near three-year highs today near $1.2555. It is the sixth consecutive advancing sessions. The euro has appreciated 2.2% this week. The dollar was sold through CHF0.92 to see its lowest level since June 2015. Sterling has been dragged off its high near $1.4145 by the soft retail sales report. It has advanced every day this week and is straddling the unchanged level today. Headline retail sales rose 0.1%. The median forecast was for a 05% gain after a revised 1.4% decline (initially -1.5%). The 1.6% year-over-year pace makes it the weakest January since 2013. But sterling has not been trading higher because the economy is booming. Recall that the January PMIs were all weaker than expected. Sterling may find support ahead of $1.4050. |

FX Performance, February 16 |

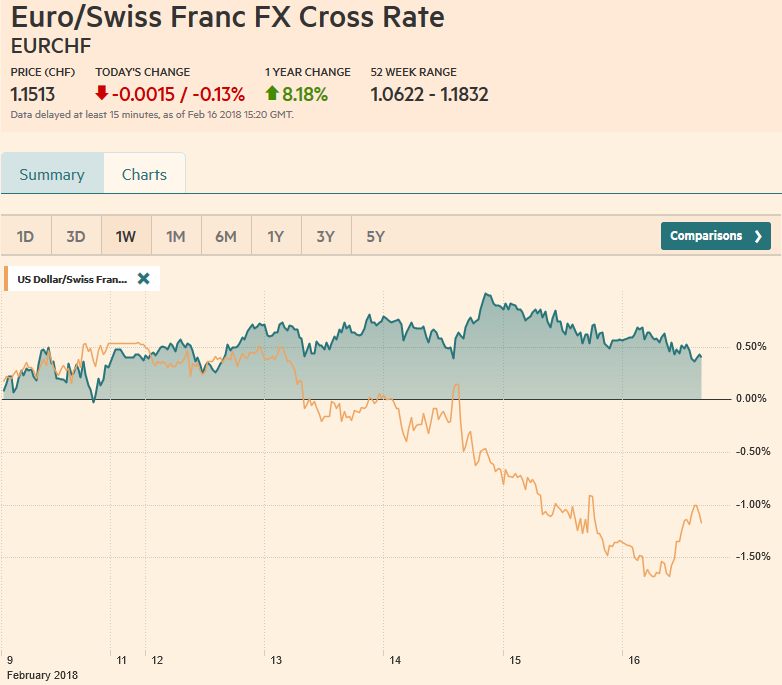

United StatesThe US has a several economic reports on tap today, but none have the heft to change market sentiment. January import prices were likely lifted by oil’s appreciation. Excluding oil, import prices may have edged 0.1% higher. January housing starts are expected to have bounced back from the weather-induced 8.2% drop in December. |

U.S. Housing Starts, Jan 2018(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

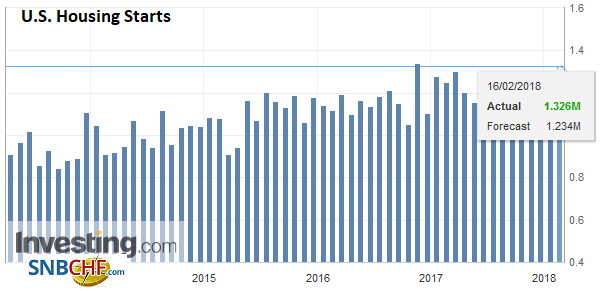

| University of Michigan’s consumer sentiment is expected to have edged fractionally lower. The long-term inflation expectations may draw more interest given the sensitivities now. In January, it stood at 2.5%, up from 2.4% in November and December, matching the 2017 low prints. |

U.S. Michigan Consumer Sentiment, Feb 2018(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

United Kingdom |

U.K. Retail Sales YoY, Jan 2018(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

The RBA’s Lowe was equally circumspect on Australian dollar, which is up 2% this week. The Australian dollar has appreciated in 8 of the past ten weeks, and those two losing weeks were here in February. The Aussie has approached the $0.7990 area that houses the 61.8% retracement of recent decline. Lowe said that the trade-weighted index was manageable, and that although he would prefer a lower rather than higher exchange rate, “we are where we are.”

What a difference a week makes for equities. After last week’s drop, this week has been up. In fact, coming into today’s session the S&P 500 is up 5.8%, leading the major markets higher, and poised to record its best week since 2011. A weekly close above 2743 would be seen as a constructive technical development. The MSCI Asia Pacific Index rallied advanced every day this week for a 3.8% weekly gain. The MSCI Emerging Markets Index is up 5.9%. The Dow Jones Stoxx 600 is up 3%. This week’s price action lends credence to our hypothesis that last week’s meltdown was more like the 1987 crash than 2000 end of the tech bubble or the 2008 financial crisis.

While US Treasury yields edged higher this week, there is a sense of consolidation ahead of the psychologically important 3.0%-handle. On the week, the yield has risen three basis points, while the two-year yield is up eleven. This likely reflect the shift in Fed views illustrated by the 10 bp increase in the implied yield of the December 2018 Fed funds futures contract this week.

The two-basis point decline in the US 10-year yield today is sufficient to encourage a decline in European yields, which are now slightly lower on the week. The UK gilts are the notable exception, and the yield is a single basis point higher on the week, even with today’s 3.5 bp decline.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,newslettersent,SPY,U.K. Retail Sales,U.S. Housing Starts,U.S. Michigan Consumer Sentiment,USD/CHF