Tag Archive: U.K. Retail Sales

Retail sales are an aggregated measure of the sales of retail goods over a stated time period, typically based on a data sampling that is extrapolated to model an entire country. Measuring consumer demand for finished goods, retail sales help gauge the pulse of an economy and its projected path toward expansion or contraction. As a leading macroeconomic indicator, healthy retail sales figures typically elicit positive movements in equity markets.

FX Daily, April 24: Markets Limp into the Weekend

Overview: The reversal in US equities yesterday set the stage for today's losses. All the Asia Pacific bourses fell today but Australia. For the week, the regional index is off more than 2%. Europe's Dow Jones Stoxx 600 was flat for the week coming into today's sessions. It is off around 0.5% in late morning activity.

Read More »

Read More »

FX Daily, March 26: Rumor Bought, Fact Sold

Overview: Speculation that the US Senate would pass the large stimulus bill worth around 10% of US GDP is thought to have fueled a bounce in equities in recent days. The bill was approved and will now go to the House, where a vote is expected tomorrow. If the rumor was bought, the fact has been sold. The first to crack was the Asia Pacific region.

Read More »

Read More »

FX Daily, January 17: China and the UK Surprise in Opposite Directions

Overview: Helped by new record highs in the US, global stocks are moving higher today. Nearly all the markets in the Asia Pacific region advanced and the seventh consecutive weekly rally is the longest in a couple of years. Europe's Dow Jones Stoxx 600 is at new record highs and appears set to take a four-day streak into next week. US shares are trading firmly.

Read More »

Read More »

FX Daily, December 19: Whiff of Inflation in the Air

It is risky to read too much into the price action in holiday-thin markets, but inflation fears are beginning to surface. The price of January WTI is around $61, having tested $50 a barrel in Q3. The CRB Index made new highs for the year yesterday and is up almost 9% for the year. The US yield curve (2-10 year) has been steepening after being inverted for a few days in August, and now at nearly 29 bp, also is new highs for the year.

Read More »

Read More »

FX Daily, November 14: Unexpected German Growth Fails to Buoy the Euro

Overview: Rising trade anxiety and disappointing economic reports from the Asia Pacific region helped unpin the profit-taking mood in equities, while bond yields continued to pullback. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 are in the red for the fourth time in the last five sessions. Germany reported a surprise 0.1% expansion in Q3, but it has done little for the DAX or the euro.

Read More »

Read More »

FX Daily, September 19: Investors Looking for New Focus

Overview: Central bank activity is still very much the flavor of the day, but investors are looking for the next focus. The Bank of Japan and the Swiss National Bank stood pat, while Indonesia cut for the third consecutive time and the Hong Kong Monetary Authority and Saudi Arabia quickly followed the Fed. Brazil cut its Selic rate yesterday by 50 bp as widely expected.

Read More »

Read More »

FX Daily, August 15: Animal Spirits Lick Wounds

Overview: It took some time for investors to recognize that the scaling back of US tariff plans was not part of a de-escalation agreement. There was an explicit acknowledgment by US Commerce Secretary Ross that there was no quid pro quo. The US tariff split was more about the US than an overture to China.

Read More »

Read More »

FX Daily, June 20: Doves Rules the Roost Except in Oslo

Overview: The prospect of "lower for longer" continues to fuel the bond and stock rally. The initial US equity response to the Fed was positive but not strong and closed about 0.3% higher. Asia Pacific equities followed suit with mostly modest gains, except for China and Hong Kong, where gains of more than 1% were recorded.

Read More »

Read More »

FX Daily, April 18: EMU Disappointment Lifts the Dollar

Overview: A bout of profit-taking in equities began in the US yesterday and has carried through Asia and Europe today. The MSCI Asia Pacific Index fell for the first time in five days, while the Dow Jones Stoxx 600 is snapping a six-day advance. The Nikkei gapped higher to start the week and a gap low tomorrow would undermine the technical outlook.

Read More »

Read More »

FX Daily, July 19: Greenback Extends Gains

The US dollar is extending its recent gains against most of the world's currencies. We continue to see the most compelling case for the macro driver being the diverging policy mixes. There are also more immediate factors too. The surprisingly poor UK retail sales report, for example, managed to do what the Brexit chaos and softer than expected CPI fail to do.

Read More »

Read More »

FX Daily, June 14: Dollar Punished Ahead of ECB

The US dollar is slumping against all the major currencies in the aftermath of the hawkish Federal Reserve. In fact, the inability of the greenback to hold on to the gains scored in the initial reaction to the Fed's hike, optimism on the economy, and the signal of hikes in September and December, foretold today's push lower.

Read More »

Read More »

FX Daily, April 19: Markets Calm But Lack Immediate Focus

A light news stream and less trade rhetoric lend the equity markets a positive impulse amid a strong US earnings season while leaving the dollar narrowly mixed. The MSCI Asia Pacific Index rose 0.5% and is up 1% for the week with one session left. It would be the second consecutive weekly advance. The Dow Jones Stoxx 600 has edged higher for a third consecutive session. It is up about 0.7% for the week, and if sustained, would extend the advance...

Read More »

Read More »

FX Daily, March 22: Dollar Trades Off

The US dollar has not recovered from the judgment that yesterday's that Fed was not as hawkish as many had anticipated. There was no indication that officials thought they were behind the curve or prepared to accelerate the pace of hikes. Powell is comfortable with the broad policy framework that has been established but seemed to have little time for the summing up of the individual forecasts (dot plot).

Read More »

Read More »

FX Daily, February 16: Worst Week for the Dollar since 2015-2016, While Stocks Continue to Recover

Nearly all the major currencies have risen at least two percent against the US dollar this week. The Canadian dollar is an exception. It has risen one percent this week ahead of today's local session. Sterling is becoming another exception after disappointing retail sales. It is up just shy of two percent. The Dollar Index is off 2.3% on the week, which would be the biggest weekly loss since 2015.

Read More »

Read More »

FX Daily, January 19: Dollar Crushed as Government Shutdown Looms

The US dollar is broadly lower as the momentum feeds on itself. Asia is leading the way. The Japanese yen, Taiwanese dollar, Malaysian Ringgit, and South Korean won are all around 0.45% higher. Asian shares also managed to shrug off the weakness seen in the US yesterday. The MSCI Asia Pacific Index advanced 0.7%. It is the sixth consecutive weekly gain. The dollar's drop comes as US yields reach levels now seen in year. The 10-year yield is at its...

Read More »

Read More »

FX Daily, December 14: US Rates Bounce Back, but Dollar, Hardly

US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment forecasts. Yet its interest rate trajectory and inflation forecasts were largely unchanged. Yellen, as her recent predecessors have done, played down the implications of the flattening of the yield curve.

Read More »

Read More »

FX Daily, November 16: Euro Extends Pullback

After rising to its best level since October 20, the euro reversed direction yesterday and has extended its pullback today. The unexpected tick up in US core CPI and better than expected retail sales may have helped spur the euro losses after three cent run-up over the past several sessions. There bearish candlestick (shooting star) leaves the late euro longs in weak hands.

Read More »

Read More »

FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

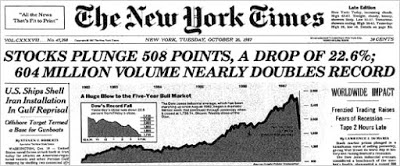

The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these factors has been addressed to some extent. Circuit breakers have been introduced, and have evolved. The financial capacity has grown immensely.

Read More »

Read More »

FX Daily, September 20: Shrinkage and Beyond

After much anticipation, the FOMC decision day is here. Much of the focus is on the likely decision that the Fed will allow its balance sheet to shrink gradually. No other country who employed quantitative easing has is in a position to begin unwinding the emergency expansion of its balance sheet. The Fed's experience in QE, communication, and now unwinding, will be part of the information set other central banks can draw upon.

Read More »

Read More »

FX Daily, August 17: Euro Softens on Crosses, Treasuries Stabilize

The US dollar had steadied after softening in the North American afternoon yesterday when the dissolution of President Trump's business councils as a series of executives stepped down. The FOMC minutes added more fuel to the move.

Read More »

Read More »