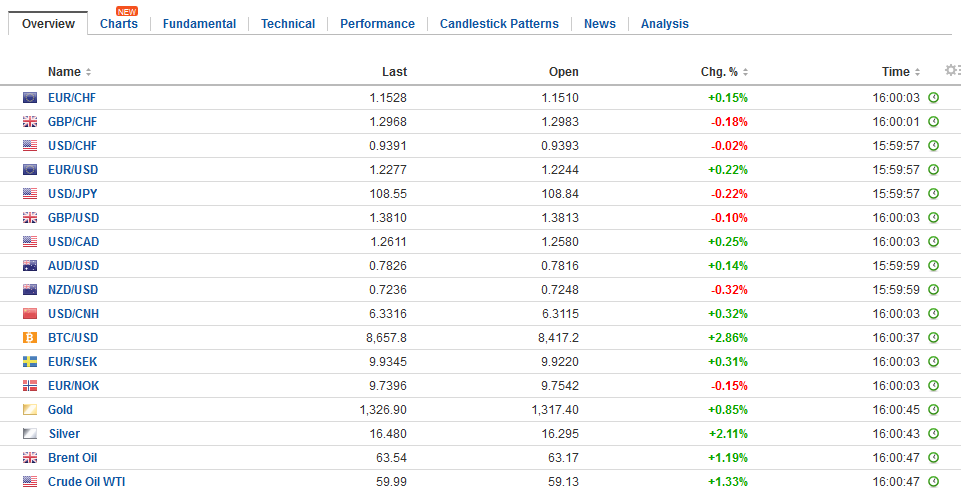

Swiss FrancThe Euro has fallen by 0.11% to 1.1505 CHF. |

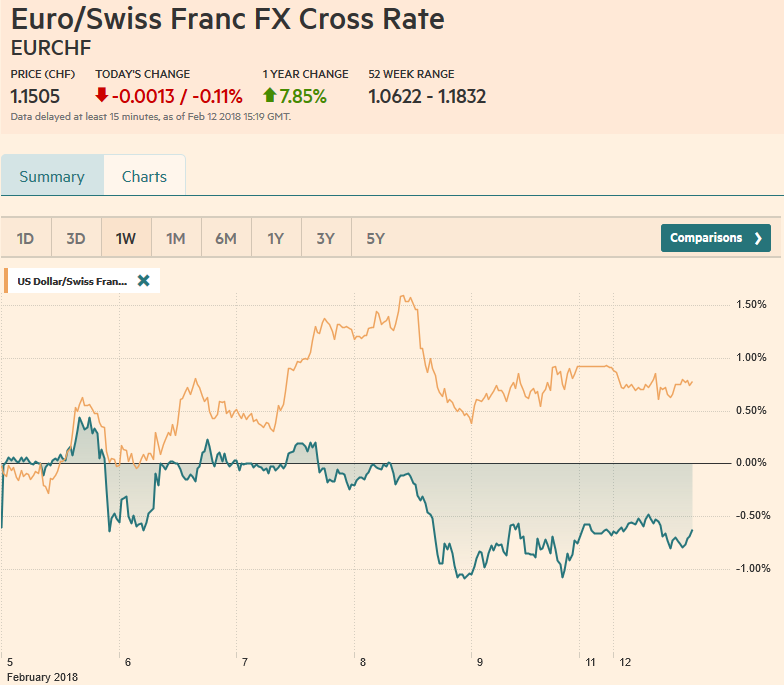

EUR/CHf and USD/CHF, February 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe most important development today has been the stability in the equity markets after last week’s meltdown. The recovery from new lows in the US before the weekend set the tone for today’s moves. Tokyo markets were on holiday, and the MSCI Asia Pacific Index excluding Japan snapped a seven-day slide with a nearly 0.6% gain. China’s markets led the rally with the CSI 300 gaining 1.3%. There were reports suggesting that some Chinese officials offered informal direction to shareholders to support the market. Separately, the PBOC set the reference rate of the yuan stronger, but the market drove the yuan lower, finishing about 0.5% lower against the dollar. |

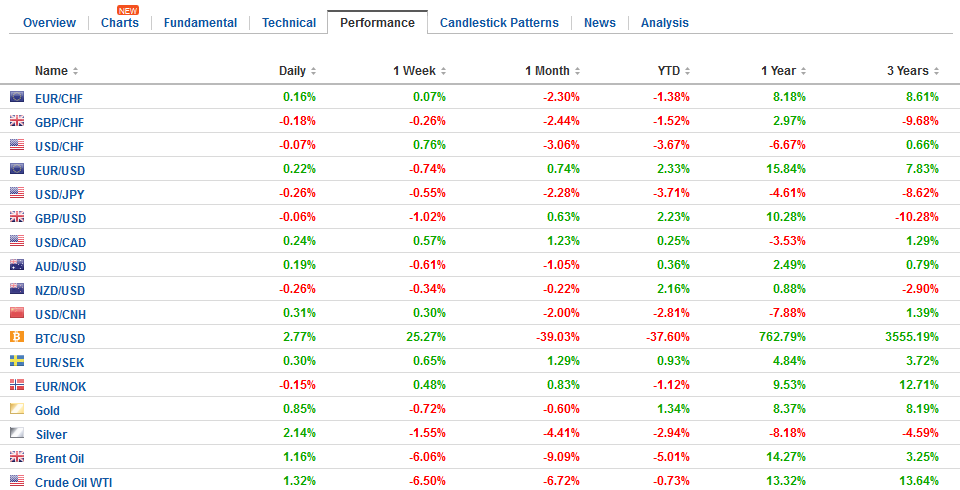

FX Daily Rates, February 12 |

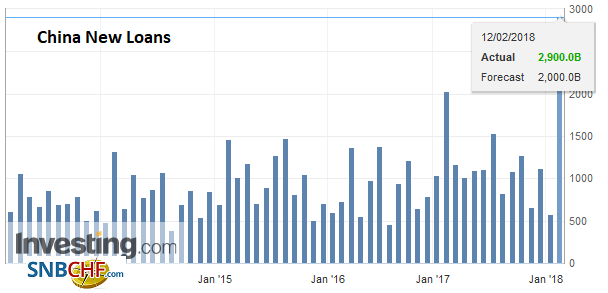

| China also reported strong growth in M1 and M2 money supply, while a surge in new yuan loans (CNY2.9 trillion) accounted for the bulk of the aggregate financing (CNY3.06 trillion). New yuan lending typically rises strongly in January as unpaid loans and interest are often rolled into new and higher loan balances.

The Dow Jones Stoxx 600 in Europe is up more than 1.6% near midday on the Continent. Materials and information technology are the strongest sectors, but all the main industry groups are participating. If gains can be retained, it would be only the second advancing sessions since January 26. The S&P 500 is currently trading a little more than 1% stronger. |

FX Performance, February 12 |

China |

China New Loans, Jan 2018(see more posts on China New Loans, ) Source: Investing.com - Click to enlarge |

Looking at 10-year benchmark yields, Australia and New Zealand are three-five basis points higher, as are core bond yields in Europe and the US. Peripheral European bond yields are softer with Italy and Spain off a little more than one basis point, while Portugal is nearly three basis points lower.

The US dollar is sporting a softer profile against most of the major currencies. The Swedish krona and New Zealand dollar are challenging the generalization. There is little enthusiasm and the market feels tentative. The euro backed off the initial test on $1.2300, but the market does not appear to have given up on it, and appears to be nibbling at the pullback below $.12260. The dollar has been kept in a half a yen range below JPY109. Between JPY108.75 and JPY109.00, there are about $1.1 bln in options struck that expire today. Higher core yields and firmer equities would give one a bias to expect a weaker yen, but it has not materialized yet.

Sterling has held above $.13800 but saw sellers in early Europe cap it near $1.3875. The cross is in a tight range, and the euro continues to probe resistance in the lower part of the GBP0.8880-GBP0.8900 band. The Australian dollar and Canadian dollars are firm, extending the pre-weekend advance in a limited fashion.

There is a light economic schedule today. The main event will be the formal unveiling of the Trump Administration’s infrastructure initiative. The leaked details suggest there may be less to it than meets the $1.5 trillion headline. Although the recent tax cuts mean that state and local taxes are not as deductible from federal taxes as previously, the infrastructure initiative will be laid largely at their door. The federal government will limit its contribution to $200 bln, and it appears that bulk of this will be funds that are already earmarked for transportation investment, and other programs, like loan extensions, and refurbishing federal buildings.

Nevertheless, the idea of an infrastructure initiative that is following tax cuts and a lifting of spending caps, is making for optics suggesting fiscal policy is out of control. Preferably, the fiscal position improves during the expansion part of the cycle, but in the US, the deficit is swelling in cyclically adjusted terms, and this can become more worrisome, and the pipers are more likely to be paid, not so much during expansion, but when the business cycle ends.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,$TLT,China New Loans,EUR/CHF,newslettersent,SPY,USD/CHF