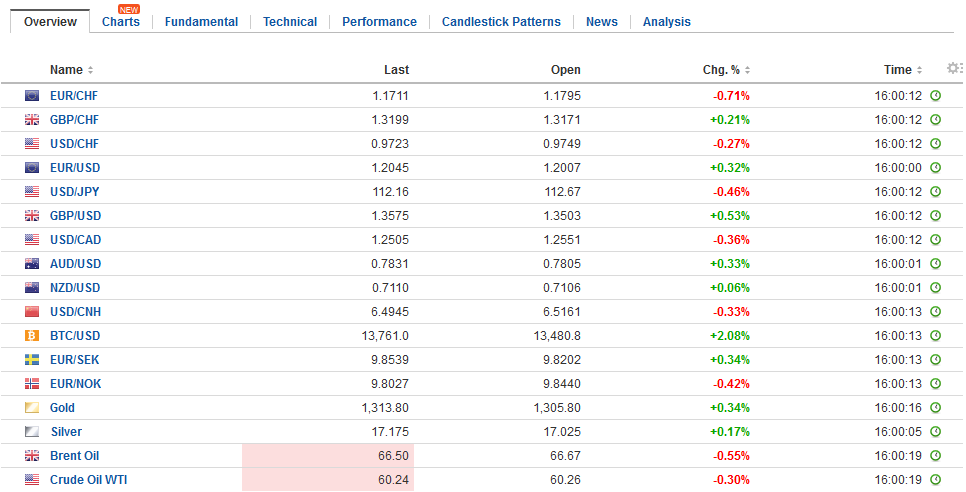

Swiss FrancThe Euro has risen by 0.03% to 1.1703 CHF. |

EUR/CHF and USD/CHF, January 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

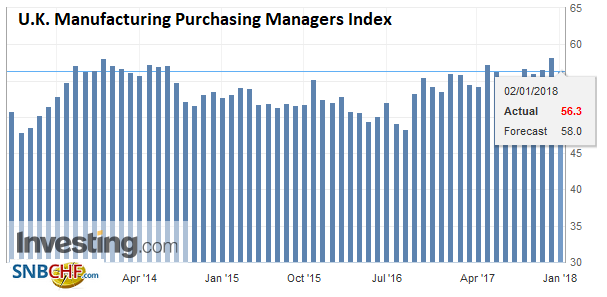

FX RatesThe US dollar’s slump seen in the final two weeks of 2017 is carried into today’s activity. The greenback’s sell-off extends to the emerging market currencies as well. The Hungarian forint is the strongest rising nearly 1%, ostensibly helped by the euro approaching last year’s high. However, our sense that fumes and momentum more than fresh news is pushing the dollar down is illustrated by the Korean won. It has gained nearly 0.9% today even though its manufacturing PMI fell below the 50 (49.9) boom/bust level for the first time in six months. The same can be said for sterling. It is up 0.3% and at three-month highs, but the main economic news today was disappointing. The December manufacturing PMI eased to 56.3 from 58.2. The market had expected a smaller decline. The pullback on the news was limited to about $1.3540 after poking through $1.3565. |

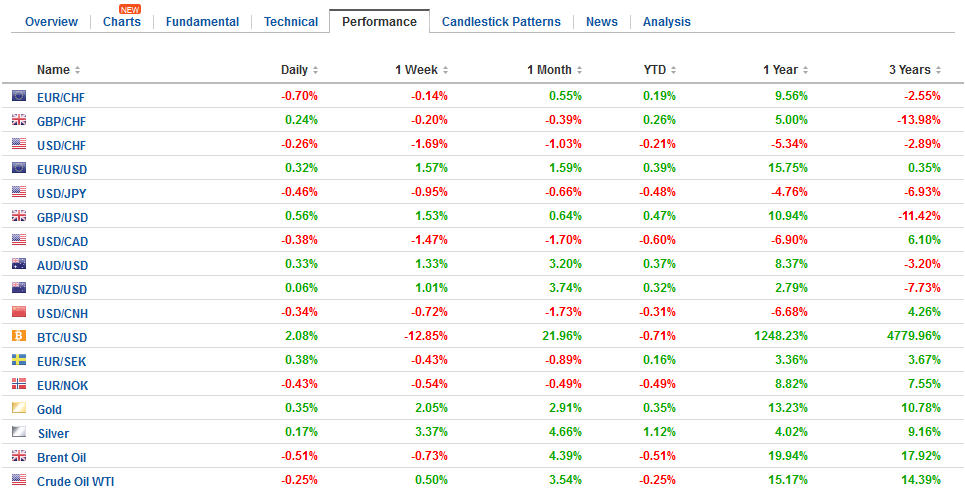

FX Daily Rates, January 02 |

| The euro has approached last year’s high recorded in September near $1.2090. The high recorded in the European morning is just shy of $1.2080. We expected some follow though buying, given the momentum in the second half of December. We see the near-term risk extending toward $1.2165, which is the 50% retracement of the euro’s decline from the 2014 high near $1.40. That said, the technical indicators are stretched. Consider that the upper Bollinger Band is near $1.2035 today. It has closed the North American session above the upper Bollinger Band in the last three sessions of 2017. |

FX Performance, January 02 |

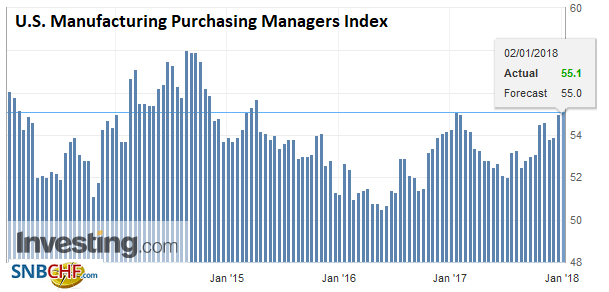

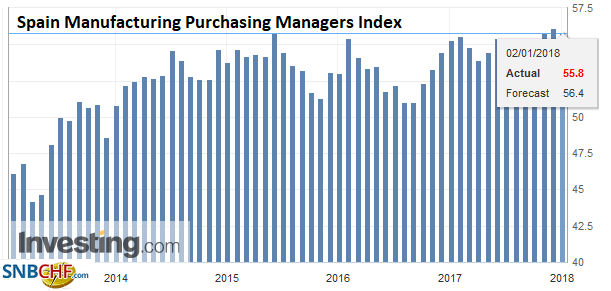

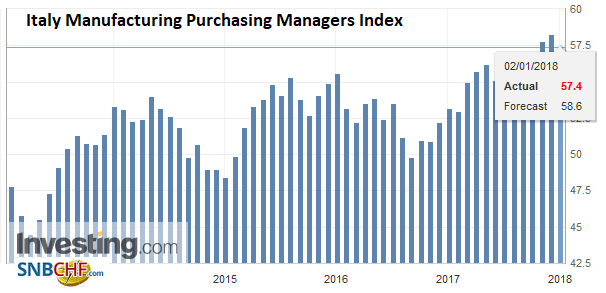

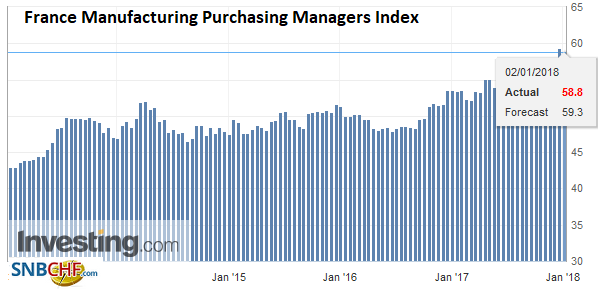

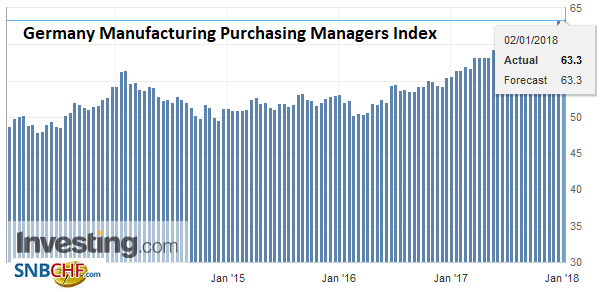

EurozoneThe eurozone’s manufacturing PMI flash reading of 60.6 was confirmed by today’s final reading. Recall this is the strongest reading since the series began in mid-1997. New orders are near a record and jobs maintained November’s record pace. There was strong demand for investment goods, like plant and equipment. Regionally, strength was seen from Germany, Austria, Ireland, and even Greece. The French flash reading of 59.3 was shaved to 58.8 but this is still a healthy gain on top of the 57.7 November reading. Spain was a bit disappointing with a 55.8 reading. It had been expected to tick up to 56.2 from 56.1. Italy also disappointed. The market expected a small gain to 58.5 from 58.3. Instead it fell to 57.4. However, this should be kept in context. It is the third best reading of 2017 and compares with a 53.2 reading at the end of 2016. |

Eurozone Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

ChinaDespite the softer regional PMIs in Asia, including Indonesia and Malaysia, the MSCI Asia Pacific Index excluding Japan (which is on holiday today and tomorrow) rose nearly 1.1%. It is the largest gain in a month. The Hang Seng was up nearly 2% to a 10-year high, while the Enterprise Index (H shares) was up a little more than 3%, led by property developers and financial institutions. The Shanghai Composite rose 1.25%, perhaps helped by the Caixin manufacturing PMI which rose to 51.5 from 50.8. The official manufacturing PMI had slipped to 51.6 from 51.8. Caixin’s survey found the fastest rise in new orders in four months and strong gains in output and export sales. |

China Caixin Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

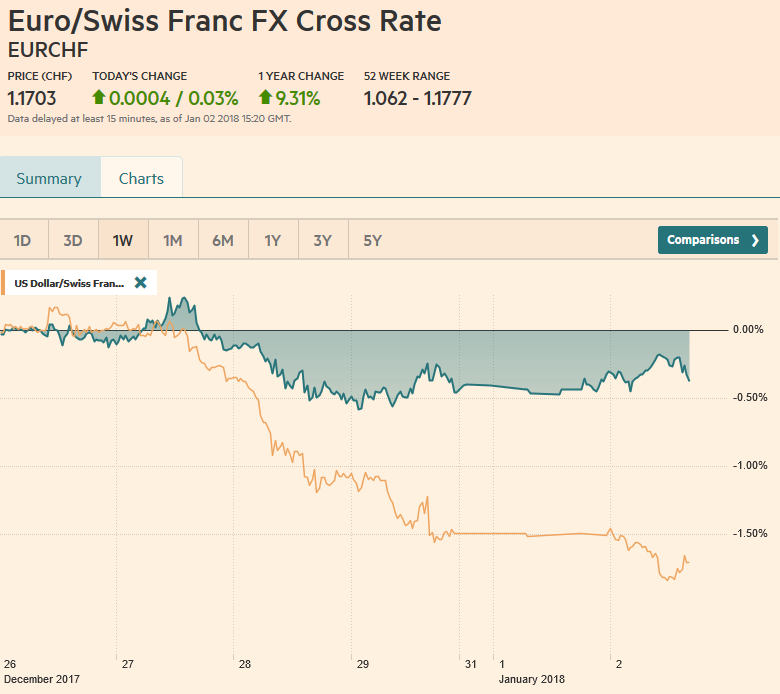

United StatesThe North American session features the final reading US manufacturing PMI. The flash report put it at 55.0, up from 53.9 in November. It finished 2016 at 54.3. Canada’s manufacturing PMI will also be reported. It stood at 54.5 in November. It peaked in April at 55.9. The Canadian dollar is the weakest of the major currencies, with a 0.1% gain. The US dollar is holdings a little above the low it set at the end of last year near CAD1.2515. The 50% retracement of the US dollar rally from last September and October is found near CAD1.2490. The 61.8% retracement is CAD1.2390. |

U.S. Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Spain |

Spain Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on Spain Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Italy |

Italy Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on Italy Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

France |

France Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Germany |

Germany Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

United Kingdom |

U.K. Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

The equity market rally hit the wall in Europe and major markets are lower. The Dow Jones Stoxx 600 is off 0.4% and no sector is advancing today. The losses are led by consumer discretion, real estate, and materials. Spain’s IBEX is faring best, losing 0.25%. Energy, industrials, and health care are offsetting a slump in real estate, consumer discretion and financials.

Yields are rising and curves are steepening today. European benchmark 10-year yields are mostly two-four basis points higher, but the UK, Italy and Portugal are seeing yields rise six-seven basis points. US 10-year yields finished last year near 2.40% and are up a couple of basis points today. Two year-yields are mostly higher, though Italy’s flat showing is an exception.

Industrial metals that were on a tear at the end of last year are mixed now. Copper is off about 0.5%. Iron ore, zinc, and lead are higher. A fire at the end of last year in a Chinese smelter may have helped nickel prices which are near eight-week highs. Oil prices are flat.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$EUR,$JPY,$TLT,China Caixin Manufacturing PMI,EUR/CHF,Eurozone Manufacturing PMI,France Manufacturing PMI,Germany Manufacturing PMI,Italy Manufacturing PMI,newslettersent,Spain Manufacturing PMI,U.K. Manufacturing PMI,U.S. Manufacturing PMI,USD/CHF