Tag Archive: Italy Manufacturing PMI

The Manufacturing Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in the manufacturing sector. A reading above 50 indicates expansion in the sector; below 50 indicates contraction. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance.

FX Daily, April 03: Markets in Search of Footing

The sell-off in US tech shares dragged the market lower. The S&P 500 fell for the sixth session of the past eight and closed below the 200-day moving average for the first time in a couple of years. The sell-off in Asia and Europe is more muted. The MSCI Asia Pacific Index slipped less than 0.1%. The Hang Seng, an index of H-shares, and Korea's KOSDAQ managed post gains.

Read More »

Read More »

FX Daily, March 01: USD Snaps 3-Month Slide, Firm Ahead of Powell Part II

The US dollar rebounded last September and October before the downtrend resumed in November, and lasted through January. The dollar gained broadly last month, except against the yen, which rose almost 2.4% in February. This pattern is evident today, the first trading day of March. The dollar is extending its gains against most currencies but is only managing to consolidate in a narrow range against the yen.

Read More »

Read More »

FX Daily, February 01: Fed’s Hawkish Hold Keeps Dollar Consolidation Intact

The Yellen Fed ended on a high note. She took over the reins the of Federal Reserve an implemented a strategic normalization process monetary policy, and helped engineer not only the first post-crisis rate hikes but also the beginning of unwinding its balance sheet. Most reckon she has done an admirable job at the Federal Reserve, not only in terms of the economic performance on her watch but also the nimble execution policy.

Read More »

Read More »

FX Daily, January 2: Dollar Slump Accelerates

The US dollar's slump seen in the final two weeks of 2017 is carried into today's activity. The greenback's sell-off extends to the emerging market currencies as well. The Hungarian forint is the strongest rising nearly 1%, ostensibly helped by the euro approaching last year's high. However, our sense that fumes and momentum more than fresh news is pushing the dollar down is illustrated by the Korean won. It has gained nearly 0.9% today even though...

Read More »

Read More »

FX Daily, December 01: Dollar Consolidates Weekly Gain, while Equities Ease to Start New Month

The release of the manufacturing PMIs confirm that the synchronized global expansion remains intact. The focus today is on three unresolved political challenges: US tax reform, the UK-Irish border and the talks that may produce another grand coalition in Germany. The US dollar is mixed, with the dollar-bloc currencies and Scandis pushing higher.

Read More »

Read More »

FX Daily, November 02: Dollar Pulls Back in Asia

We suggested the market was at crossroads. It is still not clear if the dollar's breakout, supported by higher yields is real or simply the fraying of ranges. Asia has pushed the dollar broadly lower. While the greenback finished the North American session above JPY114.00 for the first time since July, the fact that the US 10-year yield could not push back above the 2.40% level, does not help confidence.

Read More »

Read More »

FX Daily, October 02: Dollar Upbeat to Start Fourth Quarter

The US dollar is broadly higher as the quarter-end positioning losses seen at the end of last week area reversed. Developments in the US are seen as dollar positive, while the Catalonia-Madrid conflict, and slightly softer EMU manufacturing PMI weighs on the euro. The UK also reported a disappointing manufacturing PMI, and more differences with the Tory government are taking a toll on sterling. Japan's Tankan Survey was stronger than expected, but...

Read More »

Read More »

FX Daily, September 01: Manufacturing PMIs, US Jobs, and Implications of Harvey

As the markets head into the weekend, global equities are firmer, benchmark 10-year yields are mostly lower, and the dollar is consolidating after North American pared the greenback's gains yesterday. Manufacturing PMIs from China, EMU, and the UK have been reported, while in the US, the August jobs data stand in the way of the long holiday weekend for Americans.

Read More »

Read More »

FX Daily, August 01: The Most the Dollar Can Hope for on Turn Around Tuesday is Consolidation

After taking a step lower in the North American session yesterday, the dollar is consolidating today. The euro is holding above $1.18, and the dollar held JPY110.00. Global equities are mostly higher, while bonds are mixed. Asia-Pacific yields were mostly higher, while European rates are a little lower. The US 10-year yield is flat just below 2.30%.

Read More »

Read More »

FX Daily, July 03: Dollar Bounces to Start H2

The beleaguered US dollar is enjoying a respite from the selling pressure that pushed it lower against all the major currencies in the first six months of 2017. A measure of the dollar on a trade-weighted basis fell about 5% in the first half after appreciating nearly 8% in Q4 16.

Read More »

Read More »

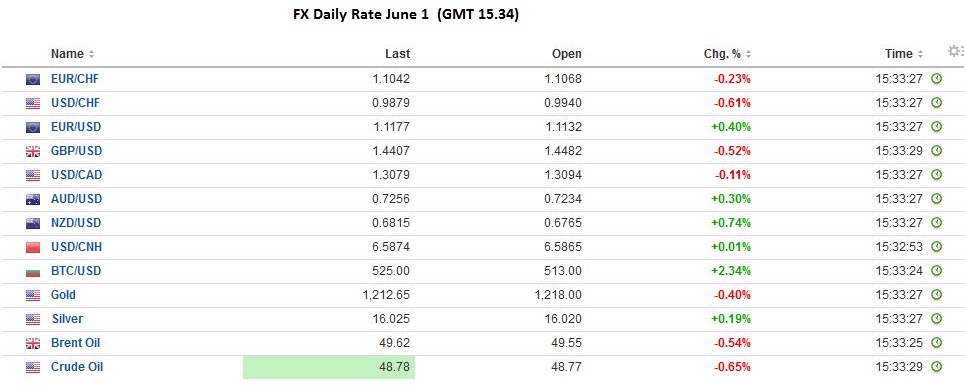

FX Daily, June 01: Greenback Steadies at Lower Levels, Sterling Struggles

The US dollar is mostly firmer against the major currencies. It is consolidating yesterday's losses more than staging much of a recovery. Even sterling, where a YouGov poll has the Tory lead at three percentage points, down from seven previously, is above yesterday's lows. On the other hand, even strong data from Japan did not drive the yen higher.

Read More »

Read More »

FX Daily, 01 February: Markets Stabilize, Investors Await Signals from US data and FOMC, and POTUS

(commentary will be sporadic for the next couple of weeks during a European business trip) The US dollar is consolidating yesterday's losses that were spurred speculation that the US was abandoning the more than 20-year old strong dollar policy. The meaning of that policy was clear to global investors even if it was often parodied.

Read More »

Read More »

FX Daily, November 02: Standpat FOMC Trumped by US Political Jitters

The single biggest driver in the capital markets is the continued narrowing of the US election polls. The prospect of a Trump presidency and the dramatic changes that could entail is rattling investors and spurring position squaring.The dollar is broadly lower as are stocks. The surge in global yields has been arrested.

Read More »

Read More »

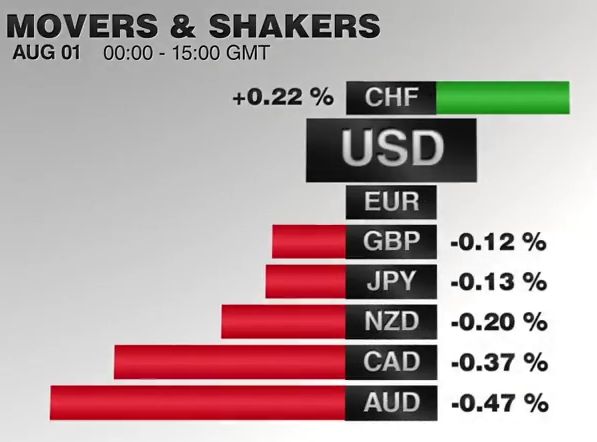

FX Daily, August 01: Dog Days of August Begin

The US dollar is trading with a small upside bias in narrow trading ranges. The main news has consisted of PMI reports, while investors continue to digest last week's developments. In particular the BOJ's underwhelming response to poor economic data and a missed opportunity to reinforce the fiscal stimulus, and the dismal US GDP.

Read More »

Read More »

FX Daily, June 1: Swiss SVME PMI strongest PMI

The Swiss SVME PMI was the strongest PMI in this data release. It is driven by machinery and electronics industry. They strongly compete with the Germans, and got shocked by the end of the peg.

Surprisingly they have outperformed in recent months.

Read More »

Read More »