Swiss FrancThe Euro has risen by 0.04% to 1.1754 CHF. |

EUR/CHF and USD/CHF, April 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

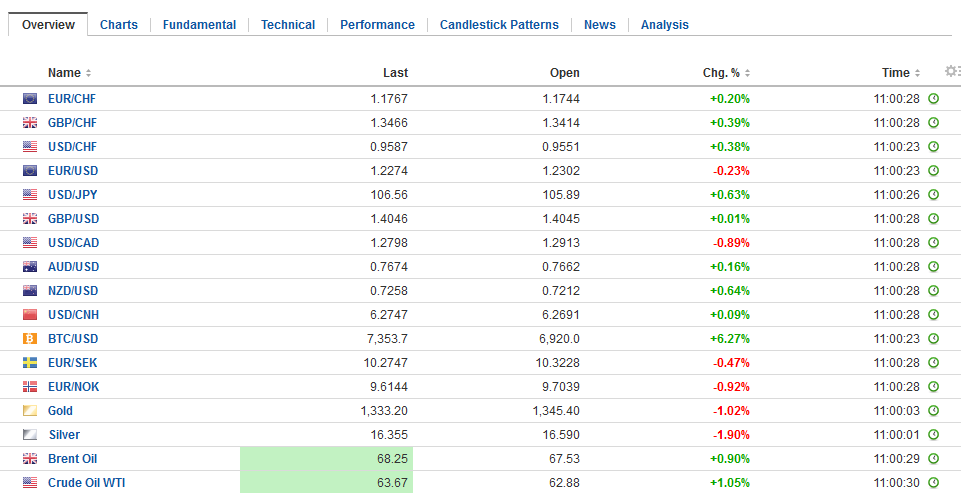

FX RatesThe sell-off in US tech shares dragged the market lower. The S&P 500 fell for the sixth session of the past eight and closed below the 200-day moving average for the first time in a couple of years. The sell-off in Asia and Europe is more muted. The MSCI Asia Pacific Index slipped less than 0.1%. The Hang Seng, an index of H-shares, and Korea’s KOSDAQ managed post gains. European shares are down a bit more with the Dow Jones Stoxx 500 nearly 1% lower in late morning dealings, with industrials and information technology providing the largest drags. Meanwhile the S&P 500 is trading about 0.3% higher. Bonds are finding little comfort from the sell-off in equities. The US 10–year yield is up two basis points to 2.75%. Peripheral European benchmark yields are also up a couple of basis points while the core is up a little less. The 10-year UK Gilt yield is slightly lower at 1.34%. |

FX Daily Rates. April 03 |

| The dollar is mostly softer, though against the euro and yen, it remains within yesterday’s ranges. The dollar-bloc currencies, Scandis and sterling are outperforming. The Mexican peso and Canadian dollars continue to respond positively to the latest turn in the NAFTA plot. On Sunday, President Trump threatened to leave NAFTA talks and was critical of Mexico’s border controls. Late yesterday, press report suggested that Trump was pushing for a preliminary NAFTA agreement to be announced next week at the regional summit in Peru (April 13-14). The idea is to get an agreement in principle and then allow the technical talks to work out the precise details.

The eighth round of talks were to begin next week in Washington, but top Mexican and Canadian officials were reportedly coming to the US this week to meet US officials. Trump’s weekend tweet may have been designed to exert pressure on the (Mexican) negotiators for additional compromises. Of course, it seems like in all three parties interest to reach an agreement shortly. The talks were to have ended last year and were extended. Many see the Mexican elections in July as an obstacle if talks continue much longer. A re-negotiated NAFTA would be seen as a win for Trump–that the negotiating strategy worked. |

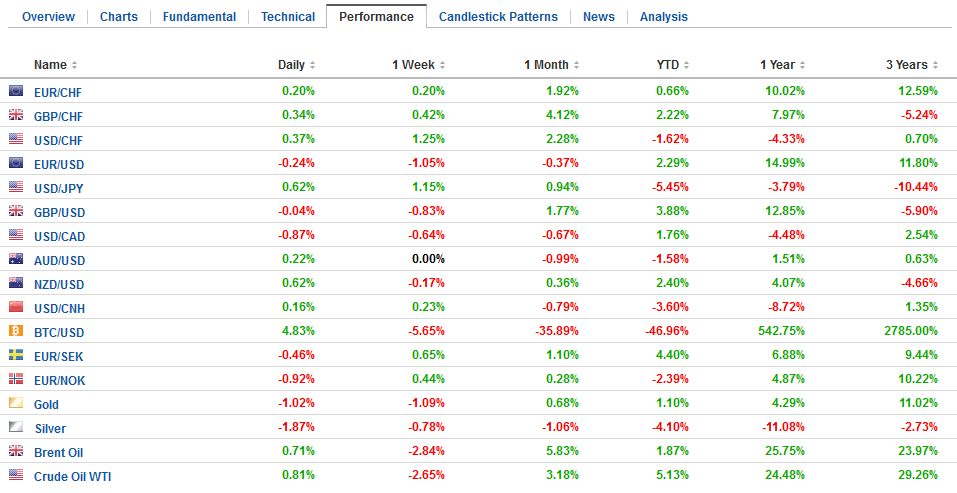

FX Performance, April 03 |

EurozoneToday’s economic reports have been largely limited to Europe’s manufacturing PMI. The eurozone’s report was in line with the flash reading of 56.6, but that is down from 58.6 in February. A spokesperson for Markit that compiles the surveys seemed to play down the loss of momentum on expectations of Q1 growth, but did recognize a change was afoot. |

Eurozone Manufacturing Purchasing Managers Index (PMI), Apr 2013 - 2018(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

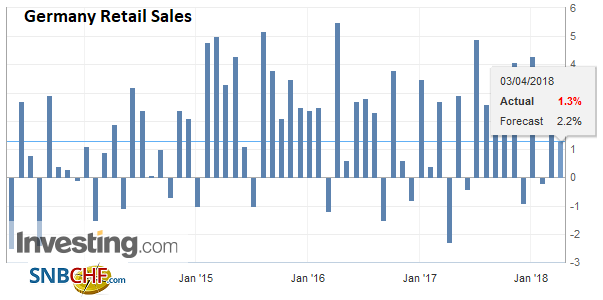

GermanyThe German and French revisions seemed to offset each other (Germany to 58.2 from 584. flash and 60.6 in February). |

Germany Manufacturing Purchasing Managers Index (PMI), Apr 2013 - 2018(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Germany Retail Sales YoY, Apr 2013 - 2018(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

|

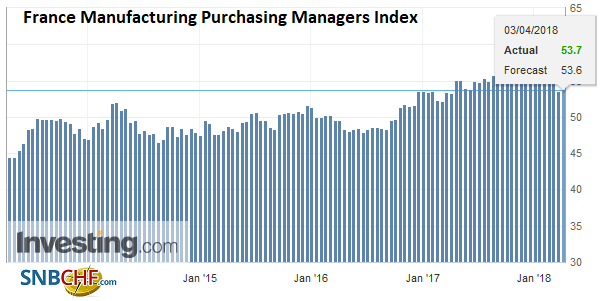

FranceFrance to 53.7 from 53.6 and 55.9 in February). |

France Manufacturing Purchasing Managers Index (PMI), Apr 2013 - 2018(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

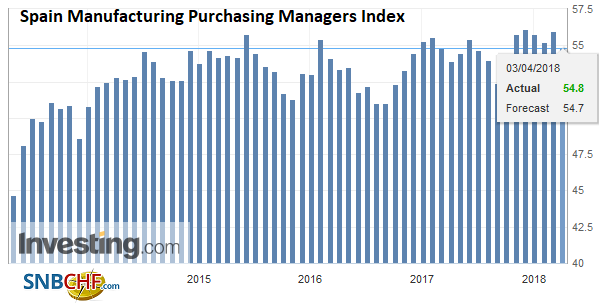

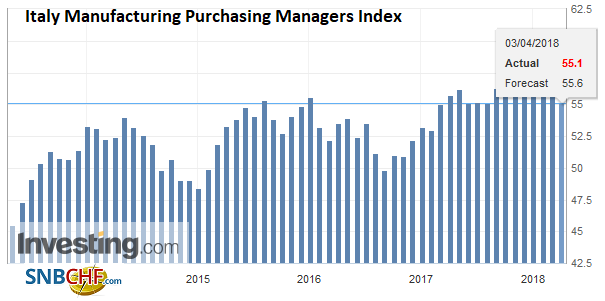

SpainSpain slipped to 54.8 from 56 in February, which was slightly better than expected. Italy’s fell to 55.1 from 56.8 and was a bit worse than expected. |

Spain Manufacturing Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on Spain Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

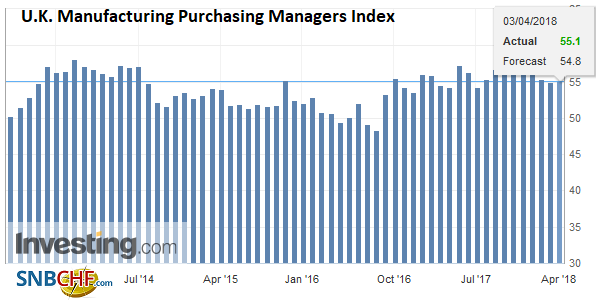

United KingdomThe UK’s manufacturing PMI offered an upside surprise. It came it at 55.1. The median forecast (Bloomberg survey) was for 54.7. On the other hand, the February series was revised to 55.0 from 55.2. The winter storm seemed not to have had much impact. Output and employment rose, but the pipeline is thinning. New orders rose by the least in nine months and the backlog fell every month in the quarter. Markit recognizes that the UK “manufacturing has entered a softer growth phase.” |

U.K. Manufacturing Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Italy |

Italy Manufacturing Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on Italy Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

The disruptive impulses emanating from the United States are challenging for investors and officials. Some observers are linking the US stock market slide to a kind of buy the rumor sell the fact type of activity after following the passage of the tax cuts. The new slide in US tech stocks come as the US President attacks one by name on twitter. The Reserve Bank of Australia left rates on hold today, as widely expected, but linked the increase in equity market volatility to US trade policy, and noted that the rise in LIBOR, in excess of Fed policy, was impacting Australia.

It seems like the standard interpretation for the rise of LIBOR is the surge in US bill supply following the lifting of the debt ceiling. If we treat that interpretation as a hypothesis, we may be able to test it in the coming weeks. First, with today’s bill auction, US supply is being reduced. The three- and six-month bill auctions are each being reduced by $3 bln, and the four-week bill auction will be cut by $10. As the tax deadline draws near (April 15), the Treasury’s cash holdings will rise, reducing the need for bills. It is currently near 59 bp. We have been persuaded that in addition to the bill auction, tax changes, not only encouraging repatriation, but also changing the dynamics of intra-firm lending is also playing an important role.

Today is also the first day that the Federal Reserve will begin publishing its alternative to LIBOR. It is called the Secured Overnight Financing Rate (SOFR). The volume that underpins it regularly exceeded $700 bln a day compared with $500 mln in three-month LIBOR.

It is a light schedule in terms of North American economic data, with only March US auto sales on tap. The Fed’s Kashkari speaks around the open of the US equity market today, while Brainard speaks after the close. The euro and sterling don’t have large maturing options near current spot levels, but there is a $363 mln option struck at JPY106 that may be relevant. There is a A$1.1 bln option struck at $0.7680 that expires today and is in the thick of things. There is NZ$497 mln struck at $0.7250 and another NZ$250 mln struck at $0.7275 that expire today.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$TLT,EUR/CHF,Eurozone Manufacturing PMI,France Manufacturing PMI,Germany Manufacturing PMI,Germany Retail Sales,Italy Manufacturing PMI,NAFTA,newslettersent,Spain Manufacturing PMI,SPY,U.K. Manufacturing PMI,USD/CHF