Swiss FrancThe Euro has fallen by 0.07% to 1.1661 CHF. |

EUR/CHF and USD/CHF, November 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

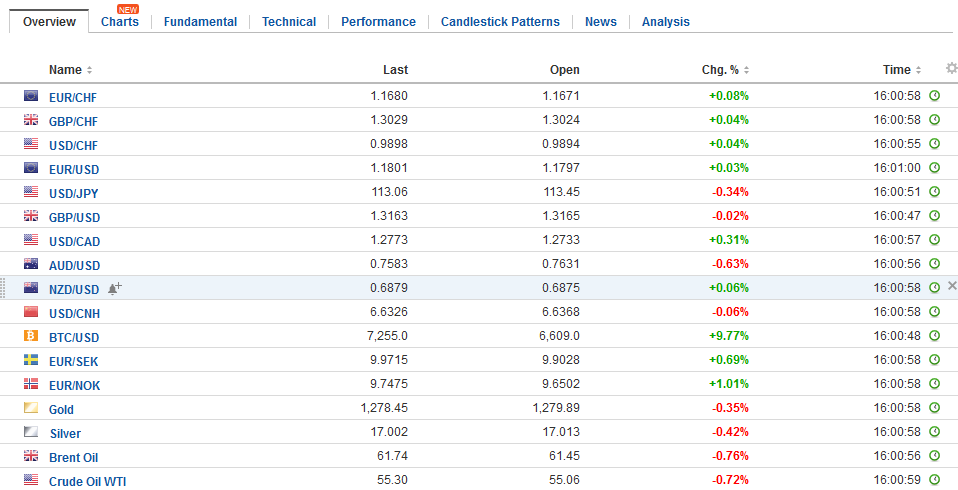

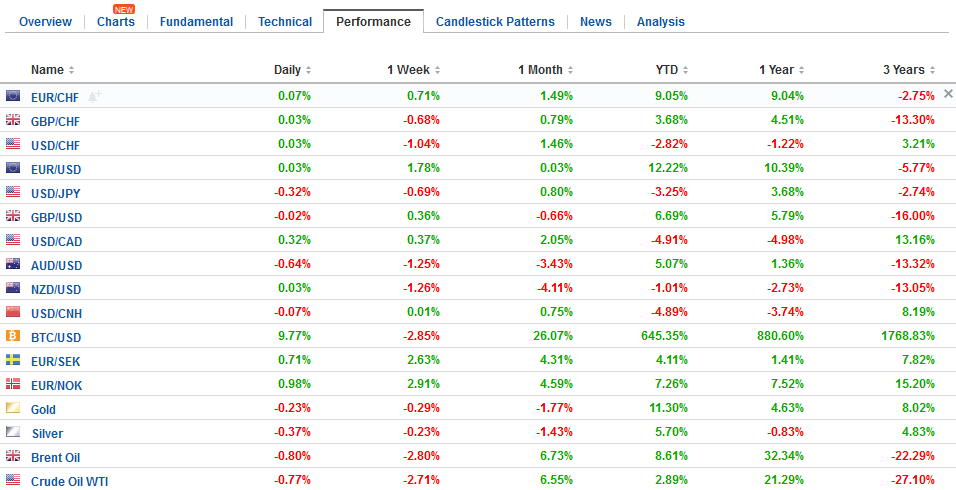

FX RatesThe euro and yen are extending their gains, casting a pall over the US dollar. The euro is extending its advance into a sixth consecutive session, which is the longest streak since May. It is approaching last month’s highs in the $1.1860-$1.1880 area. As was the case yesterday, a consolidative tone in Asia was followed by strong buying in the European morning. There does not appear to be a fresh fundamental driver. The dollar has slumped against the yen and is trading at its lowest level since October 20. It was sold to JPY113.00 in Asia and took another leg down toward JPY112.65 in Europe before steadying. The further drop in US yields, with the 10-year now off seven basis points this week, and the continued pullback in equities, are taking a toll. The slump in equities accelerated today. The MSCI Asia Pacific Index fell 0.85%, which is not only the largest decline in this four-day swoon, but it is the biggest drop in five months. Japanese markets led the decline with the Nikkei off 1.6% and the Topix off nearly 2%. One of the few markets that were higher was Korea’s KOSDAQ. It rallied 1.5% and is up 6.3% this week. It was the sixth consecutive advance. MSCI Emerging Markets Index is off for the fifth session, which is its longest swoon in two months. |

FX Daily Rates, November 15 |

| The retreat in European equities is continuing for the seventh straight session. The sell-off in commodities is taking a toll on the energy and materials sector, but information technology and financials are also down more than the market as a whole. Of note, the DAX gapped lower and is testing the 38.2% retracement objective of the nearly 14% rally since late August (found near 12892). France’s CAC is through a similar retracement level and has approached the 50% retracement (~5266).

The US S&P 500 has fared considerably better. It did fall nearly 0.25% yesterday, its third decline in four sessions. However, it closed near session highs, and once again, despite intraday violation, managed to close back above its 20-day moving average. It has not closed below that moving average for 2.5 months. It is found today near 2576.65. There have been three economic reports to note: Australian wages, Japanese GDP, and UK employment. Australian wage pressure was more moderate than expected, rising 0.5% in Q3, the same as in Q2. However, economists were looking for a larger increase. The Australian dropped half around half a cent on the disappointment. It was sold through $0.7600 to trade at four-month lows. The next target is near $0.7530. Mining, gas, and water employees saw weak wage increases, while the hospitality, food and public workers saw better wage growth. |

FX Performance, November 15 |

CHF/GBPThe Swiss Franc could find itself under considerable pressure all of a sudden after the Swiss government has described the Swiss Franc as highly valued. The comments come at a time when the Swiss Franc has in fact weakened against both the pound and the Euro so it is interesting that the central bank feels it has to say more on the strength of the Franc. GBP CHF is currently sitting at just over 1.30 for the pair which has presented clients looking to buy Swiss Francs with some better opportunities in recent weeks. Depending on what happens in the Brexit negotiations over the next two weeks it could create considerable volatility for the pound against the Swiss Franc. There is currently a lot of pressure on Theresa May with a reported 40 members of the conservative government who would like to see her go. Another eight signatories could see that become a reality which could see major volatility for the pound across the board including the Swiss Franc. The Swiss National Bank Chairman Thomas Jordan has highlighted the importance of negative interest rates in Switzerland to prevent the currency appreciating further and his comments highlight how ready the Swiss National Bank are to tackle adverse market movement. It is almost a warning shot to the markets that the SNB hold the keys and can and will introduce measures to control the exchange rate when needed. Any clients looking to either buy or sell Swiss Francs would be wise to get in touch and look at the options available to take the risk out of the market. Clients looking to buy Euros with Swiss Francs are beginning to see a depreciation in the Franc largely as result of the tapering programme that has been started by the European Central Bank. With a much brighter outlook in the Eurozone which was reinforced by the stronger EU Gross Domestic Product figures this week the Swiss Franc could continue to weaken against the Swiss Franc especially as the European Central Bank continues with its tapering programme. |

CHF/GBP - Swiss Franc British Pound, November 15 |

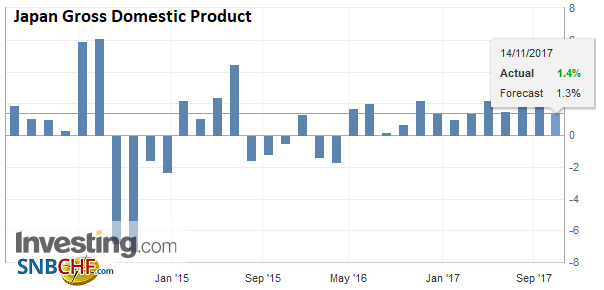

JapanJapan’s first estimate of Q3 GDP was slightly slower than expected. The 0.3% quarter-over-quarter growth was half the pace of Q2. Still, it is the seventh consecutive quarterly expansion, which Japan’s longest growth streak since 2001. Growth was driven primarily by net exports and capex. |

Japan Gross Domestic Product (GDP) YoY, Q3 2017(see more posts on Japan Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

| Private consumption was a drag, falling 0.5% after Q2 consumption was revised to 0.7% from 0.8%. Japan’s initial estimate for quarterly GDP, like the US estimate, is often subject to statistically significant revisions. The first revision is due on December 8. |

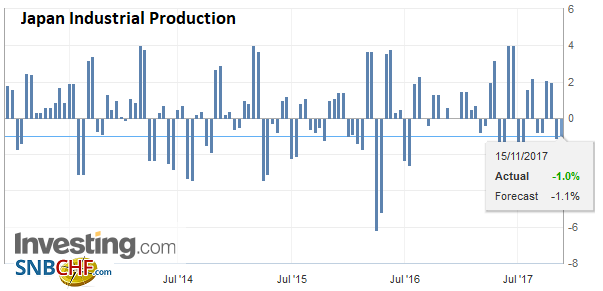

Japan Industrial Production, Oct 2017(see more posts on Japan Industrial Production, ) Source: Investing.com - Click to enlarge |

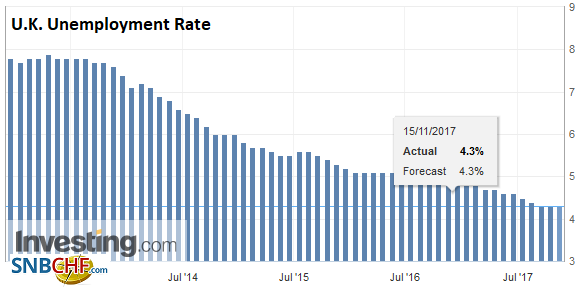

United KingdomThe UK’s employment report showed signs of slowing in the labor market. The number of people working fell (14k) for the first time in a year. Those neither working nor looking for work rose by the most in seven years. The unemployment rate was unchanged at 4.3%. Average weekly earnings rose 2.2% in the three-month year-over-year period, after the upward revision to 2.3% in the period ending in August. Excluding bonus payments, weekly earnings rose at 2.2%, the same as previously. Sterling initially rallied on the news and reached the session high (~$1.3215) before sliding back to session lows (a little below $1.3140). It then recovered to little-changed levels (~$1.3165). |

U.K. Unemployment Rate, Sep 2017(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

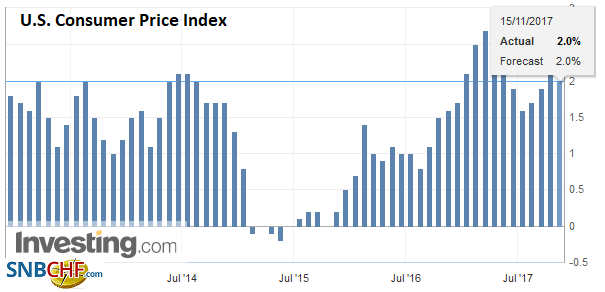

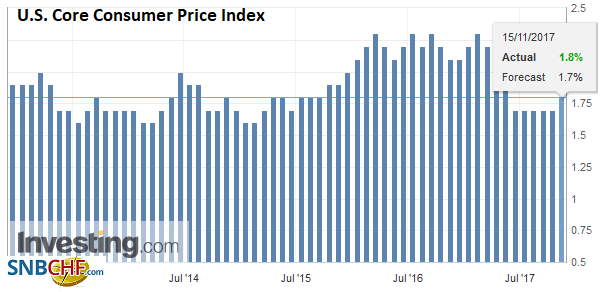

United StatesThe US economic calendar features CPI, retail sales, Empire Survey and business inventories. Lower gasoline prices may weigh on headline CPI. The core rate is expected to be flat at 1.7% for the sixth month. If there is a surprise, we suspect that it could be that the core rate ticks up. It has little implication for policy and the market appear to have fully discounted a hike next month. |

U.S. Consumer Price Index (CPI) YoY, Oct 2017(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| We note that yesterday the December 2018 Fed funds futures contract slumped to imply an effective Fed funds rate of 1.735%. The current effective rate is 1.16%. It suggests that the market has come around to price in a little more than two hikes next year. The market has converged with the Fed’s dot plot, as it has, albeit reluctantly, with this year’s signal that three hikes would be appropriate. |

U.S. Core Consumer Price Index (CPI) YoY, Oct 2017(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

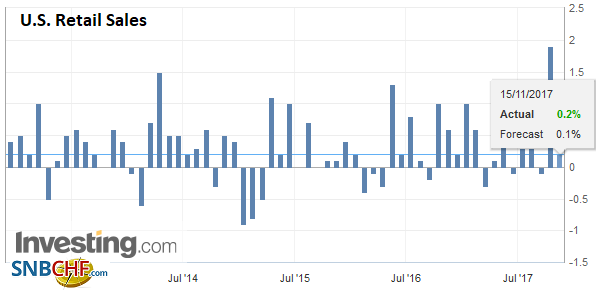

| October retail sales will not be able to come close to matching the 1.6% rise in October, that was flattered by the recovery from the storms. Still, the GDP components are expected to be firm, rising 0.3% after a 0.4% rise in September. We are concerned that the recovery may have boosted these core retail sales as well, warning that there may be scope for disappointment today. |

U.S. Retail Sales, Oct 2017(see more posts on U.S. Retail Sales, ) Source: Investing.com - Click to enlarge |

| The Fed’s Evans and Rosengren speak today, and the DOE energy report will be closely watched. Progress on US tax reform continues. The House is still expected to have a floor vote tomorrow. Late yesterday, the Senate version was changed to include a repeal of the individual mandate requirement of the Affordable Care Act, and a sunset provision on tax breaks for the middle class and small businesses, while keeping permanent the corporate tax cut, which is starts in 2019. |

U.S. NY Empire State Manufacturing Index, Nov 2017(see more posts on U.S. NY Empire State Manufacturing Index, ) Source: Investing.com - Click to enlarge |

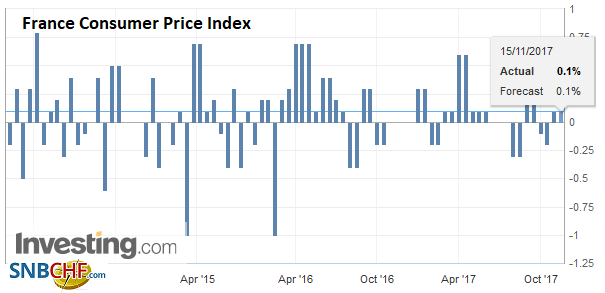

France |

France Consumer Price Index (CPI), Oct 2017(see more posts on France Consumer Price Index, ) Source: Investing.com - Click to enlarge |

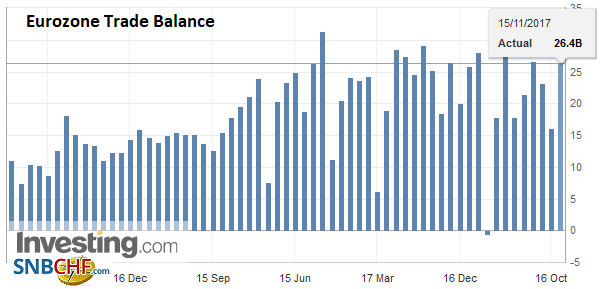

Eurozone |

Eurozone Trade Balance, Sep 2017(see more posts on Eurozone Trade Balance, ) Source: Investing.com - Click to enlarge |

Oil is still getting the proverbial tar kicked out of it. Brent is off another 1.25% after dropping 1.5% yesterday. It is the fourth consecutive decline, and it is off six of the past seven sessions. WTI is also off a little more than 1% after yesterday nearly 1.9% drop. Supply concerns appear to be the main culprit again.

The IEA offered an optimistic assessment of US energy output growth in the coming years. It sees the output more than demand by 600k barrels a day through Q1 18. At the same time, reports suggest Russia may be balking at cutting output further or extending the production restraint. Adding insult to injury, the API estimated that US oil stocks rose 6.5 mln barrels last week, which if confirmed by the DOE today, it would be the largest increase since March. Support in the light sweet contract for December delivery is seen in the $54.00-$54.60 band.

Canada reports existing home sales. They have been up for the past two months (August and September) after falling for four months. The Canadian dollar may be vulnerable to a weak report. Note that there is a $265 mln option struck at CAD1.2730 that expires today.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,EUR/CHF and USD/CHF,Eurozone Trade Balance,France Consumer Price Index,Japan Gross Domestic Product,Japan Industrial Production,newslettersent,U.K. Unemployment Rate,U.S. Consumer Price Index,U.S. Core Consumer Price Index,U.S. NY Empire State Manufacturing Index,U.S. Retail Sales,USD/CHF