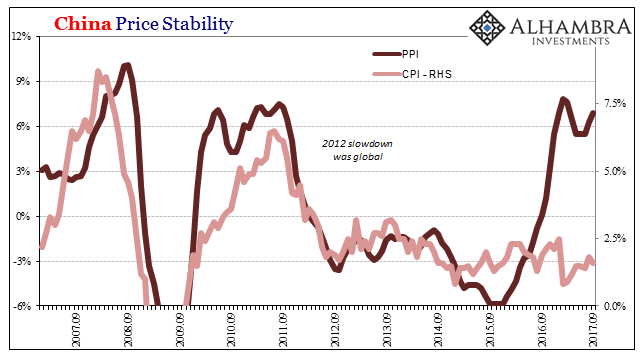

| Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months there has been more influence from other industrial metals like copper and iron. |

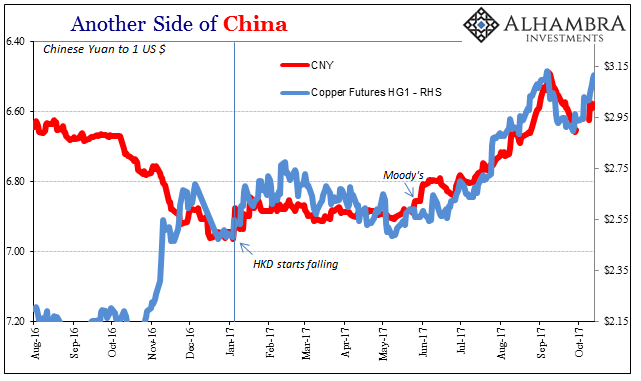

Another Side of China, Aug 2016 - Oct 2017 |

| Where the Chinese PPI is being boosted by these market shifts, consumer prices are not. It suggests the same disparity between those raw market prices and those ultimately yielded by later economic processes. China’s CPI registered only 1.6% growth year-over-year in September, down from 1.8% in August and 2.5% back in January 2017. The government has mandated for this year, as is usual, a 3% CPI rate as its definition of “price stability.” |

China Price Stability, Sep 2007 - 2017(see more posts on China Producer Price Index, ) |

| This disparity suggests the difficulties for industrial firms in passing along price increases to customers (weak end demand). Chinese industrial profits are up and have been since last year, but that increase is due to these price effects bolstering the resource sector over and above the price squeeze occurring in the manufacturing sector.

Because the global economy has not rebounded all that much, either, Chinese manufacturers are left without the possibility of passing off some of that PPI to global customers in the US and in Europe. It’s as if these industrial metals prices are in some ways detached (fears over pollution controls, for one) from economic fundamentals. As noted last week, US inflation remains suspiciously subdued, as well. No matter how much any one central bank does (or does not), consumer prices have largely ignored those efforts. The PBOC has contributed since the start of 2016 to those energies in RMB terms. That the outcome is the same for Chinese consumer prices as US consumer prices again reflects global money as opposed to local central bank theory and experiment. |

China Price Stability, Sep 2007 - 2017(see more posts on China Consumer Price Index, ) |

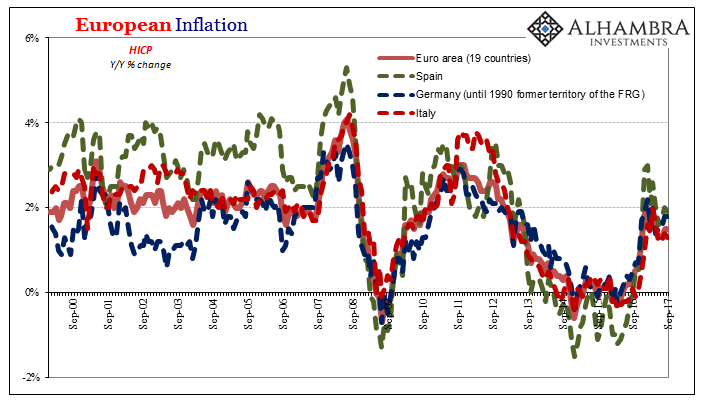

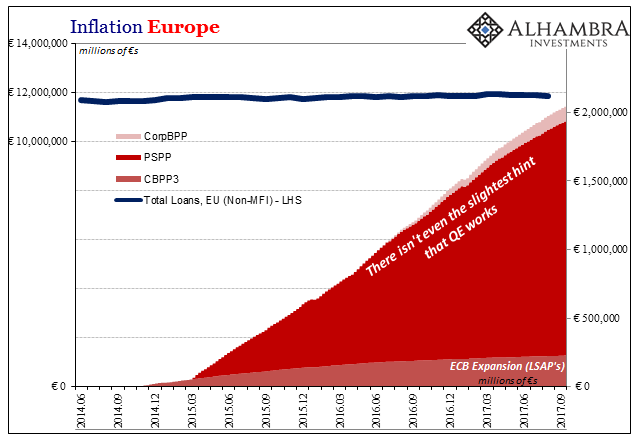

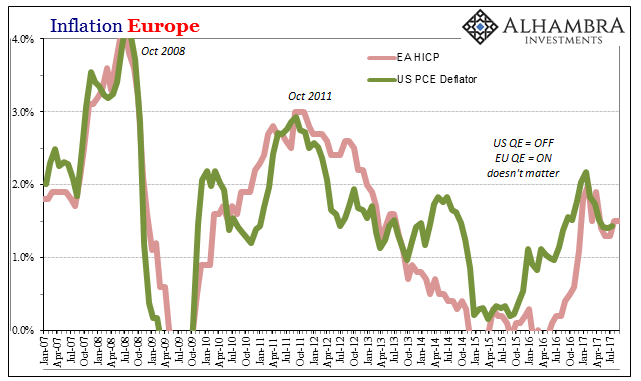

| Inflation in Europe, for instance, has behaved completely independent of the ECB’s much-discussed but still ongoing (at its stepped up rate) QE. Combined among its large-scale asset purchases (PSPP, CBPP3, CorpBPP), total purchases since 2014 add up to a stunning €2.1 trillion (as of latest daily data). And yet, Europe’s HICP or CPI consumer price indices register little or nothing from them. |

European Inflation, Sep 2000 - 2017(see more posts on European inflation, ) |

| That’s true in both viewing the EU as a combined entity, as well as broken down by individual economic constituents. The post-August 2007 pattern remains in greater force ten years later; national inflation rates in Europe act in very close proximity this past decade when compared to the decade before. There has been a unifying element to European inflation that isn’t the European central bank. |

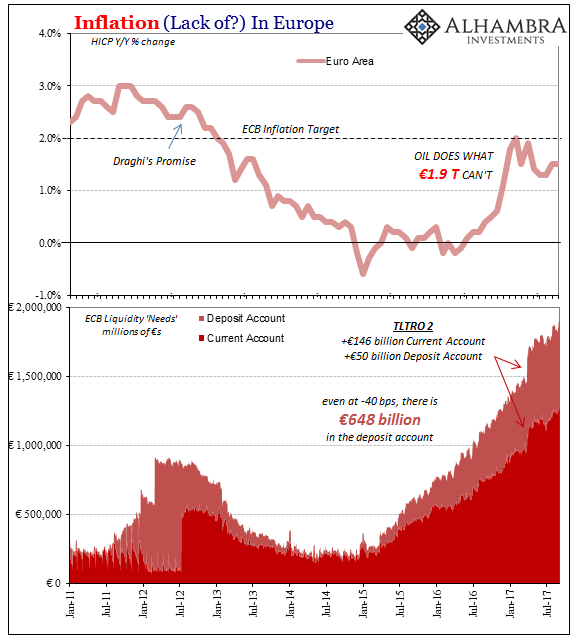

European Inflation, Jan 2011 - Jul 2017(see more posts on European inflation, ) |

| Core inflation rates in Europe are closer to 1% than 2%, and like US “core” measures are suggestive only of missing monetary and economic momentum. For September, Eurostat reported a core HICP rate of just 1.1%, and an overall HICP increase of 1.5% despite another (smaller) oil boost.

There is simply no channel between what the ECB does (and calls money) and what European banks do and were supposed to have done. Because effective monetary conditions in Europe remain very much like those in the rest of the world, including China and the US, liquidity preferences rule to the pointed exclusion of lending in the real economy. No matter how many corporate bonds Europe’s central bank owns and will own, banks refuse to lend to the corporate sector (or any other). |

European Inflation, Jun 2014 - Sep 2017 |

| Even in the household sector where some small margin of lending growth has taken place, it is nowhere near enough to make even a small difference in inflation or overall economic conditions. |

European Inflation, Jun 2014 - Sep 2017(see more posts on European inflation, ) |

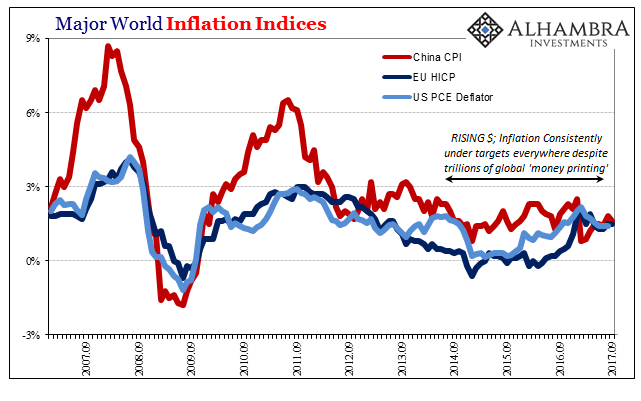

| The ECB buys and buys and buys, while the PBOC lends and lends RMB interbank, meanwhile Yellen’s Fed does nothing, and yet inflation in all three places underwhelms to the same degree, at the same times, and in much the same manner. |

World Inflation Indices, Sep 2007 - 2017(see more posts on China Consumer Price Index, ) |

| More than enough time has passed in all these places for any “transitory” effects to have dissipated, leaving open every theoretical channel between monetary policy and the real economy. More and more even central bankers are left with the same conclusions regarding orthodox monetary theory – something just isn’t right. There is an official restlessness especially in the US and Europe because time has finally outrun all the past excuses.

Whether one central bank does something and the other nothing, the results are still the same. There is no trace of money printing whether balance sheet expansion happens or it doesn’t. If there was going to be one, a global burst of consumer inflation would have been evident months before September 2017. |

European Inflation, Jan 2007 - Jul 2017 |

Tags: China,China Consumer Price Index,China Producer Price Index,CPI,currencies,ECB,economy,EuroDollar,Europe,European inflation,Federal Reserve,Federal Reserve/Monetary Policy,hicp,inflation,lsap,Markets,money printing,newslettersent,PBOC,pce deflator,PPI,QE